Tax Credit For School Fees In general qualified tuition and related expenses for the education tax credits include tuition and required fees for the enrollment or attendance at eligible post secondary educational

An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition and fees you The Lifetime Learning Credit reduces your tax bill on a dollar for dollar basis for a portion of the tuition fees and other qualifying expenses you pay for yourself a spouse or a

Tax Credit For School Fees

Tax Credit For School Fees

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

https://udwa.org/wp-content/uploads/TaxCredit.png

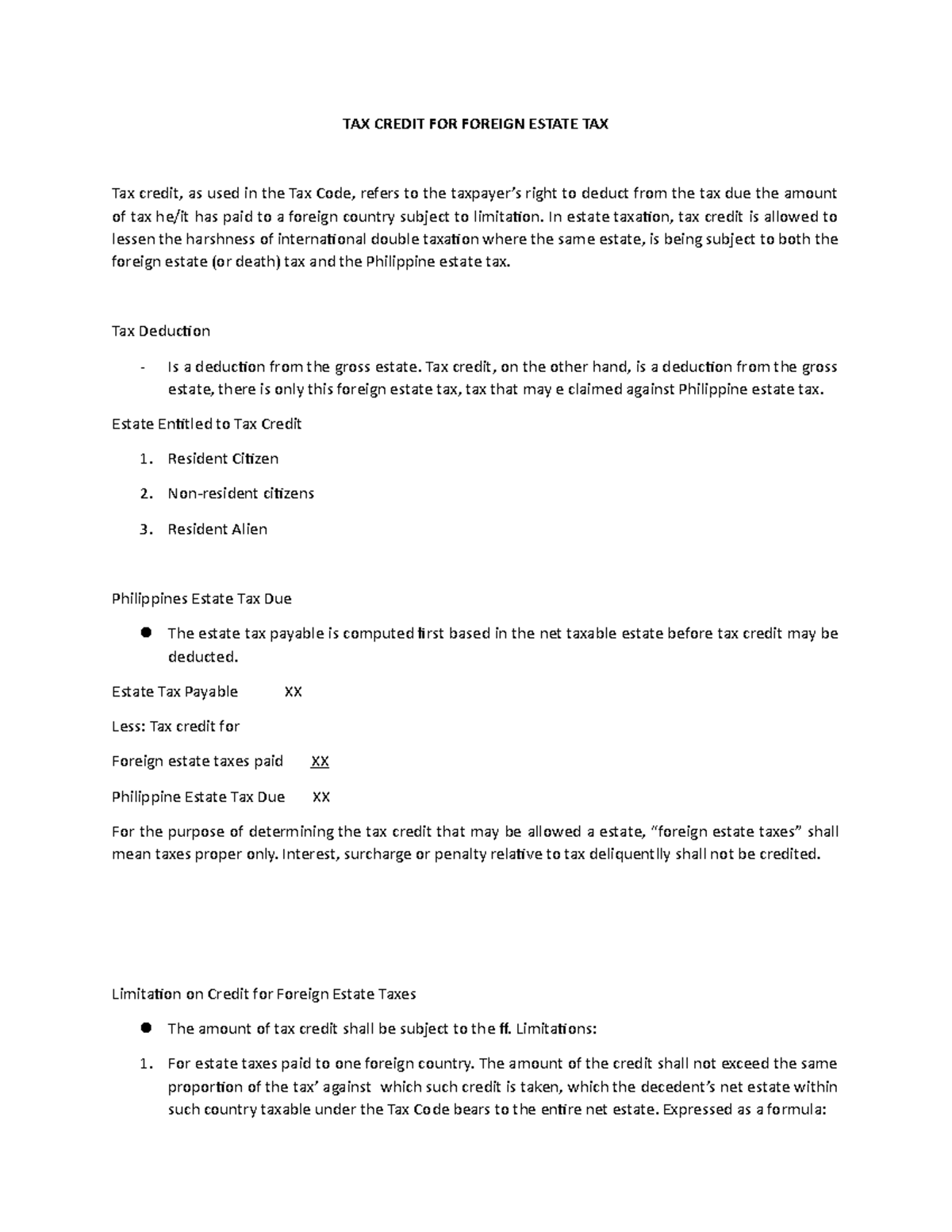

Chapter 9 Tax Credits For Foreign Estate Tax TAX CREDIT FOR FOREIGN

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/13670d83508fce97953b9582fddf4f67/thumb_1200_1553.png

By TurboTax 552 Updated 2 months ago Education expenses can be complex but we ll simplify them for you Here are examples of what you can and can t deduct You can The lifetime learning credit is Worth a maximum benefit of up to 2 000 per tax return per year no matter how many students qualify Available for all years of postsecondary

Individual tax credits and deductions allow parents to receive state income tax relief for approved educational expenses which can include private school tuition books supplies computers tutors and transportation You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses The qualifying fees must be paid for an approved course at

Download Tax Credit For School Fees

More picture related to Tax Credit For School Fees

Tax Credit Bill For Rural Physicians Passes House Committee

https://1.bp.blogspot.com/-A3hfue5TdzI/YCYQAXI0PtI/AAAAAAAARg0/NBzdPnoWGtQyKMN7CrCBjv4WwAt1xY2-gCLcBGAsYHQ/s1628/O%2527Donnell%252C%2BTerry.jpg

Another Way To Save New Tax Credit For Plan Participants

https://insights.rpag.com/hubfs/Imported_Blog_Media/GettyImages-1077235824-1.jpg

California Competes Tax Credit For Business Owners

https://capatacpa.com/wp-content/uploads/2019/02/taxtime.jpg

Eligible tuition fees Generally a course taken in 2023 at an institution in Canada will qualify for a tuition tax credit if it was either taken at a post secondary education institution Learn how the American Opportunity Tax Credit AOTC can help pay up to 2 500 for tuition and other qualifying expenses per student each year on your tax return during the first four years of

Certain tax credits deductions and savings plans can help with the cost of higher education expenses Read below to see which option could work for you and the students in your life OVERVIEW There are two federal education tax credits that can cut your tax bill by thousands of dollars You ll save more with the American Opportunity Credit up to 2 500 per student but it s typically only available

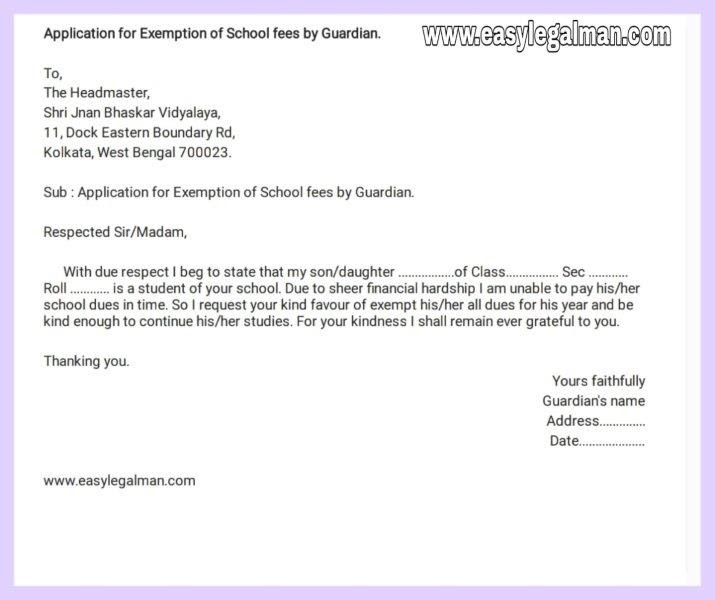

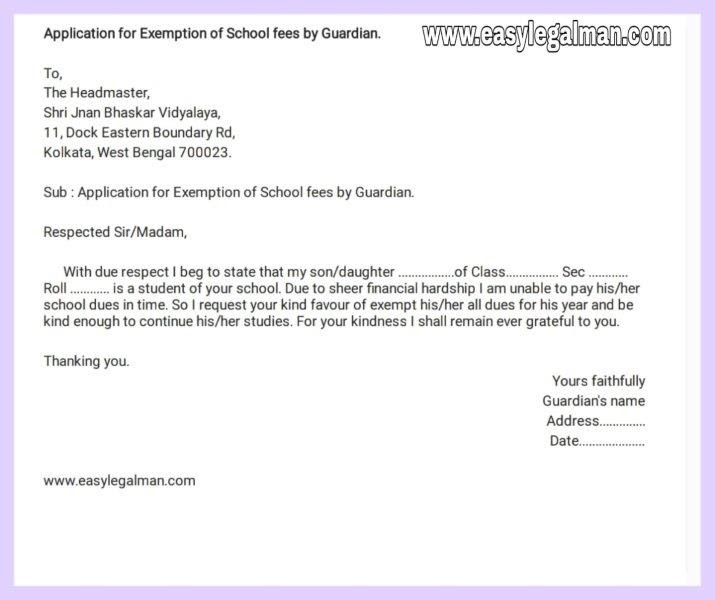

How To Write An Application For Exemption Of School Fees By Guardian

https://1.bp.blogspot.com/-8RfG-cc1VWo/YMzCICv0uLI/AAAAAAAAAR8/sa10CZhX26cl0uISC8PxPsc9vKqLX5WCwCLcBGAsYHQ/w1200-h630-p-k-no-nu/WhatsApp%2BImage%2B2021-06-18%2Bat%2B3.30.29%2BPM.jpg

US Treasury Department Issues Guidelines Around A New Tax Credit For

https://s.hdnux.com/photos/01/35/50/67/24546784/3/rawImage.jpg

https://www.irs.gov/credits-deductions/individuals/...

In general qualified tuition and related expenses for the education tax credits include tuition and required fees for the enrollment or attendance at eligible post secondary educational

https://www.forbes.com/advisor/taxes/t…

An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition and fees you

Approval Of Tax Credit For Union Built EVs Will Face Internal And

How To Write An Application For Exemption Of School Fees By Guardian

How Much Is The Child Tax Credit For 2023 Here s What You Need To Know

Guide To Child Tax Credit GJM Co GJM Co

Georgia Tax Credits For Workers And Families

Information On The 2018 Adoption Tax Credit

Information On The 2018 Adoption Tax Credit

Tax Credit Campaign Campaign

5 000 IRS Tax Credit For Website Accessibility

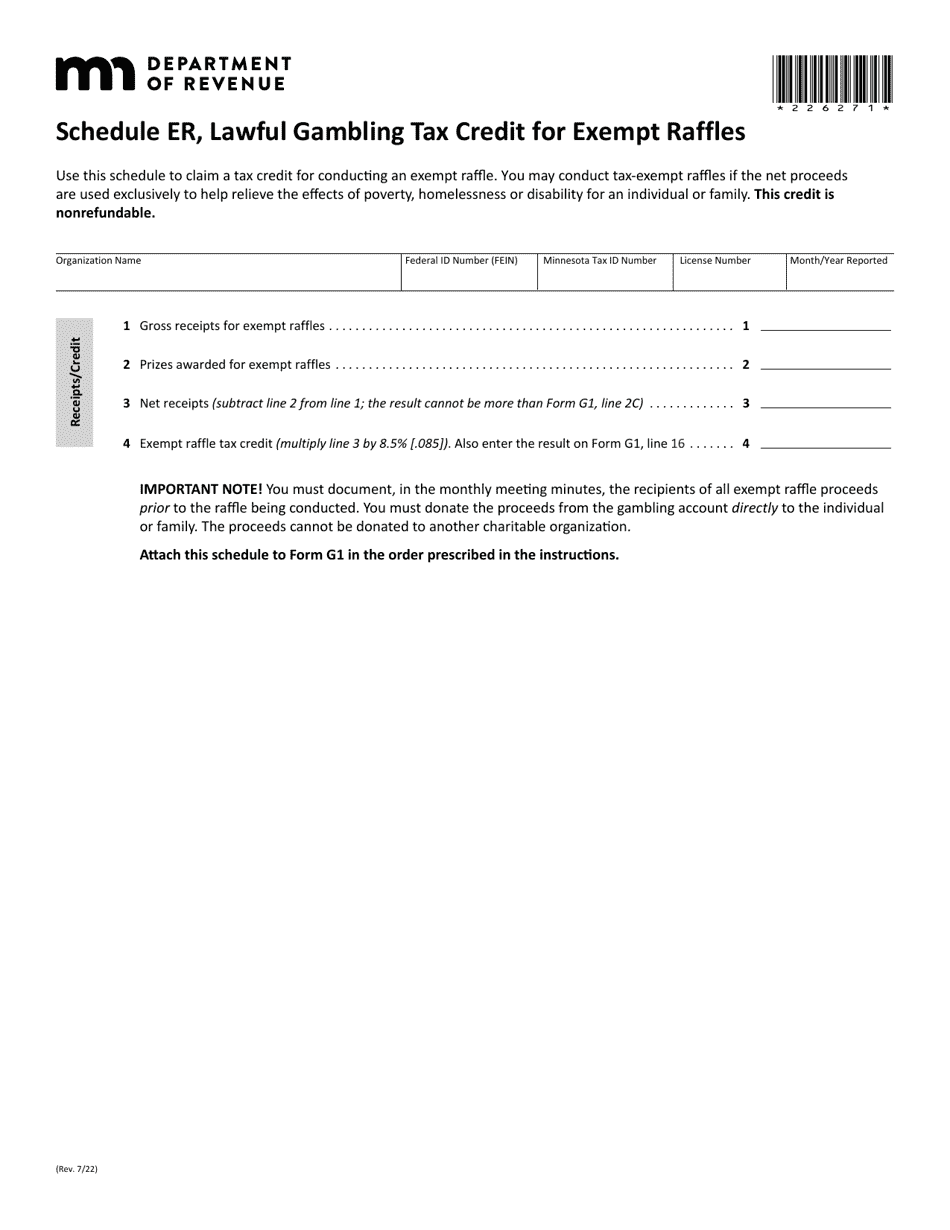

Schedule ER Download Fillable PDF Or Fill Online Lawful Gambling Tax

Tax Credit For School Fees - Individual tax credits and deductions allow parents to receive state income tax relief for approved educational expenses which can include private school tuition books supplies computers tutors and transportation