Tax Credit For Student Loan Payments Verkko 25 tammik 2023 nbsp 0183 32 The student loan interest deduction allows you to deduct up to 2 500 from your taxes Here s how to claim it for 2022

Verkko 25 tammik 2023 nbsp 0183 32 As a student you can claim the credit on your taxes for a maximum of four years as long as no one else like your Verkko 22 lokak 2023 nbsp 0183 32 Up to 2 500 of student loan interest paid each year can be claimed as a deduction on Schedule 1 of the Form 1040 For 2023 the break begins to phase out

Tax Credit For Student Loan Payments

Tax Credit For Student Loan Payments

https://pbs.twimg.com/media/FbNIx03X0AA6GrY?format=jpg&name=large

Five Tax Breaks For Paying Your Student Loan

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1iEIZT.img?w=1920&h=1303&m=4&q=79

7 Ways To Lower Student Loan Payments Credit Debt

https://creditanddebt.org/wp-content/uploads/2023/10/iStock-1301217920-scaled.jpg

Verkko 21 marrask 2023 nbsp 0183 32 You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2022 You re legally obligated to pay Verkko 3 hein 228 k 2023 nbsp 0183 32 Luckily taxpayers who make student loan payments on a qualified student loan may be able to get some relief if the loan they took out solely paid for higher education In many cases the

Verkko 28 maalisk 2023 nbsp 0183 32 Student loan payments can reduce your taxable income by up to 2 500 and if you re still in school give you a tax credit of up to 2 500 How student loans affect your taxes Verkko 10 helmik 2020 nbsp 0183 32 The Top 3 Methods to Manage Student Loans on Your Taxes These are the three major student loan tax credit and deduction options provided by the

Download Tax Credit For Student Loan Payments

More picture related to Tax Credit For Student Loan Payments

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

Student Loan Debt Update How Government Shutdown Affects Payments

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1gMelA.img?w=2500&h=1667&m=4&q=89

How To Prepare For The Return Of Federal Student Loan Payments

https://everythingfinanceblog.com/wp-content/uploads/2021/07/How-to-prepare-for-the-return-of-federal-student-loan-payments-683x1024.png

Verkko The student loan interest deduction is a tax deduction that allows you to write off up to 2 500 in student loan interest payments each year Verkko 6 syysk 2023 nbsp 0183 32 The student loan interest tax deduction is designed to reduce your taxable income based on how much student loan interest you ve paid during the year It s important to note that you don t

Verkko If you have student loans or pay education costs for yourself you may be eligible to claim education deductions and credits on your tax return such as loan interest Verkko 27 lokak 2023 nbsp 0183 32 Key takeaways Tax credits and deductions can help students their parents and educators offset the costs of higher education and classroom supplies

Student Loan Payments Set To Resume What Borrowers Need To Know About

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhttV5cr9pLdp6ZZGVp0PQtmeSnTJq2MJnmy607iTOargmXH1RmjZupSaNklZ5uBPvzUbfzqH9sMYr28h5kI2MT__rLWnkGv7bD_rT7O2TQys_7DDG-k-WyGJJC5oxQYVPzQ95vn464BSRexp3je6ZMmSWyGK_x3ovcYwxTIc-uj_qfuCqFH00z7TVB2nQ/s2000/Student-Loan-Payments.jpg

How To Prepare For Student Loan Payments In January 2021

https://image.cnbcfm.com/api/v1/image/106787947-1604938796210-GettyImages-1186933471.jpg?v=1604938849&w=1920&h=1080

https://www.nerdwallet.com/.../loans/student-loans/8-student-faqs-taxes

Verkko 25 tammik 2023 nbsp 0183 32 The student loan interest deduction allows you to deduct up to 2 500 from your taxes Here s how to claim it for 2022

https://www.nerdwallet.com/.../loans/student …

Verkko 25 tammik 2023 nbsp 0183 32 As a student you can claim the credit on your taxes for a maximum of four years as long as no one else like your

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

Student Loan Payments Set To Resume What Borrowers Need To Know About

Student Loan Payment Breaks What To Expect Business News

Chapter 9 Tax Credits For Foreign Estate Tax TAX CREDIT FOR FOREIGN

Some Student Loan Borrowers Get Inaccurate Bills After Miscalculations

After Student Loan Payments Restart 1 4 Million Americans Risk

After Student Loan Payments Restart 1 4 Million Americans Risk

Another Way To Save New Tax Credit For Plan Participants

Child Tax Credit Expansion In New Bipartisan Deal Has Battle In House

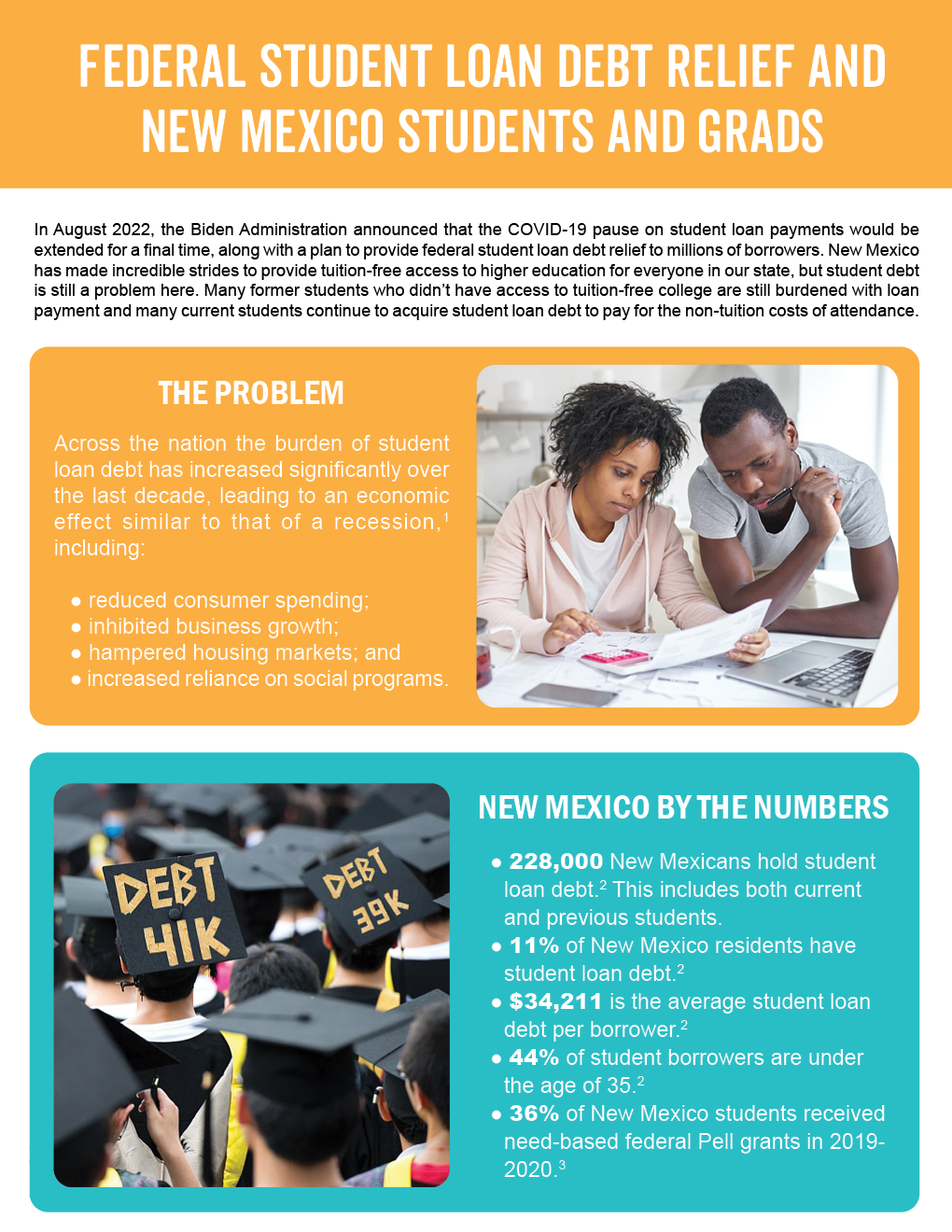

Federal Student Loan Debt Relief And New Mexico Students And Grads

Tax Credit For Student Loan Payments - Verkko You can take a tax deduction for the interest paid on student loans that you took out for yourself your spouse or your dependent This benefit applies to all loans not just