Tax Credits For Hvac Units 2023 Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax

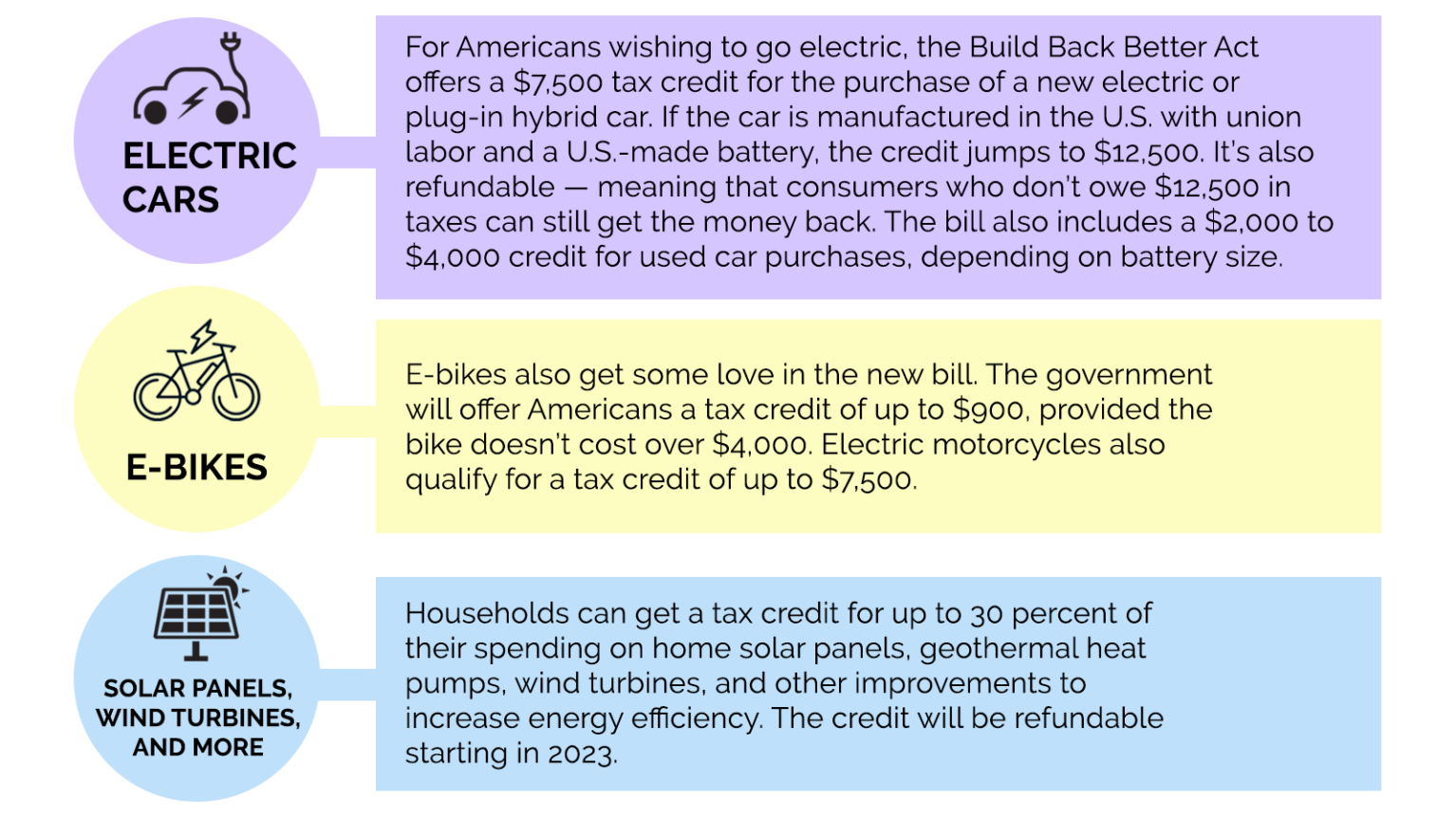

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the improvements are The Renewable Energy tax credits have also been extended and now will be available through the end of 2023 These include incentives for Geothermal Heat Pumps Residential Wind Turbines Solar Energy Systems

Tax Credits For Hvac Units 2023

Tax Credits For Hvac Units 2023

https://octanecdn.com/reliableairnew/reliableairnew_782044049.png

Easy ERTC Application How Businesses Claim Employee Tax Credits For

https://www.dailymoss.com/wp-content/uploads/2022/08/easy-ertc-application-how-businesses-claim-employee-tax-credits-for-2020-amp-202-62f607d891d65.png

Federal Tax Credits For Air Conditioners Heat Pumps 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white-web.png

For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation The dollar limit that this credit maxes out at Determining if your central ACs heat pump or furnace qualifies for a tax credit in 2023 involves understanding specific criteria set by the federal government primarily focusing

2023 HVAC Tax Credit Amendment The 25C federal tax credit was amended for 2023 and will remain effective until Dec 31 2032 Amendments include 30 of cost up to 600 or 2 000 for HPs Gas furnace and air conditioner can Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for

Download Tax Credits For Hvac Units 2023

More picture related to Tax Credits For Hvac Units 2023

HVAC Federal Tax Credits Rebates LennoxPros

https://images.lennoxpros.com/is/image/LennoxIntl/tax-savings?scl=1&fmt=png-alpha

Cool Federal Tax Credits For Energy Efficient Homes GVEC

https://www.gvec.org/wp-content/uploads/2023/08/shutterstock_667165351-scaled.jpg

Get The Power Of Tax Credits For Your Businesses

https://imageio.forbes.com/specials-images/imageserve/6382a9dd088a90f846f35930/0x0.jpg?format=jpg&crop=3207,3207,x0,y0,safe&width=1200

Learn how you may qualify for rebates or tax credits on your HVAC installation thanks to the Inflation Reduction Act IRA Learn about the federal government s tax credit program for high efficiency heating and cooling equipment and review regional programs for qualifying HVAC systems

The Tax Credit Product Lookup Tool can help determine if new heating air conditioning or water heating equipment may be eligible for the Energy Efficient Home The Home Improvement Tax Credit 25C rewards homeowners for switching to these more environmentally friendly HVAC options Learn what equipment qualifies on our

Tax Credits MJA Associates

https://mja-associates.com/wp-content/uploads/2023/12/AdobeStock_124656824.jpg

IRS Announces Tax Credits For New Vehicles In 2023 And Beyond

https://dnd2oi6izkvoi.cloudfront.net/2023/04/18/image/jpeg/DfgIoFMTrCnfustlsJWQCxq9JpM9vn5fNQQxhobd.jpg

https://www.energystar.gov/about/federal-tax...

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax

https://www.irs.gov/newsroom/irs-going-green-could...

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the improvements are

SAVE BIG With HVAC Tax Credits Sun Heating Cooling Inc

Tax Credits MJA Associates

How To Get Tax Credits For Solar And Electric Cars Popular Science In

Federal Solar Tax Credits For Businesses Department Of Energy

Green Incentives Usually Help The Rich Here s How The Build Back

Tax Credits For EU Electric Vehicles To Dominate U S Trade Talks

Tax Credits For EU Electric Vehicles To Dominate U S Trade Talks

When Are Tax Credits Ending How To Apply For Universal Credit

Georgia And Federal Tax Credits For HVAC 2023 Reliable Heating Air

Take Advantage Of Federal Tax Credits For HVAC Systems In 2023

Tax Credits For Hvac Units 2023 - Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be