Tax Credits Travel Costs You cannot get the credit for other costs such as equipment or travel expenses You can only get the credit if the work was done by a third party If you did the work yourself or if

For tax purposes travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job An ordinary expense is one that is Travel expenses are tax deductible only if they were incurred to conduct business related activities Only ordinary and necessary travel expenses are deductible expenses that

Tax Credits Travel Costs

Tax Credits Travel Costs

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Simplifying The Complexities Of R D Tax Credits TriNet

https://images.contentstack.io/v3/assets/blt9ccc5b591c9e2640/blt64bfb078a74eaa48/643963cd9074ca2928c792b6/RD-Tax-Credits-thumbnail.jpg

The Value Of Investment Tax Credits For Your Business

https://torontoaccountant.ca/wp-content/uploads/2014/11/Tax-credits.jpg

TurboTax Help Intuit Can I deduct travel expenses SOLVED by TurboTax 5278 Updated November 30 2023 If you re self employed or own a business you can deduct Tax Tip 2022 104 July 11 2022 Business travel can be costly Hotel bills airfare or train tickets cab fare public transportation it can all add up fast The good news is business

THE GOLDEN RULES FOR TRAVEL EXPENSES There are a lot of ifs to consider when deducting business travel expenses For example A taxpayer may deduct business Tax Deductions for Business Travelers Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 December 14 2023 8 55 AM OVERVIEW

Download Tax Credits Travel Costs

More picture related to Tax Credits Travel Costs

Upcoming Changes To R D Tax Credits Introducing The Additional

https://www.zest.tax/wp-content/uploads/2023/06/pexels-thisisengineering-3912480-scaled.webp

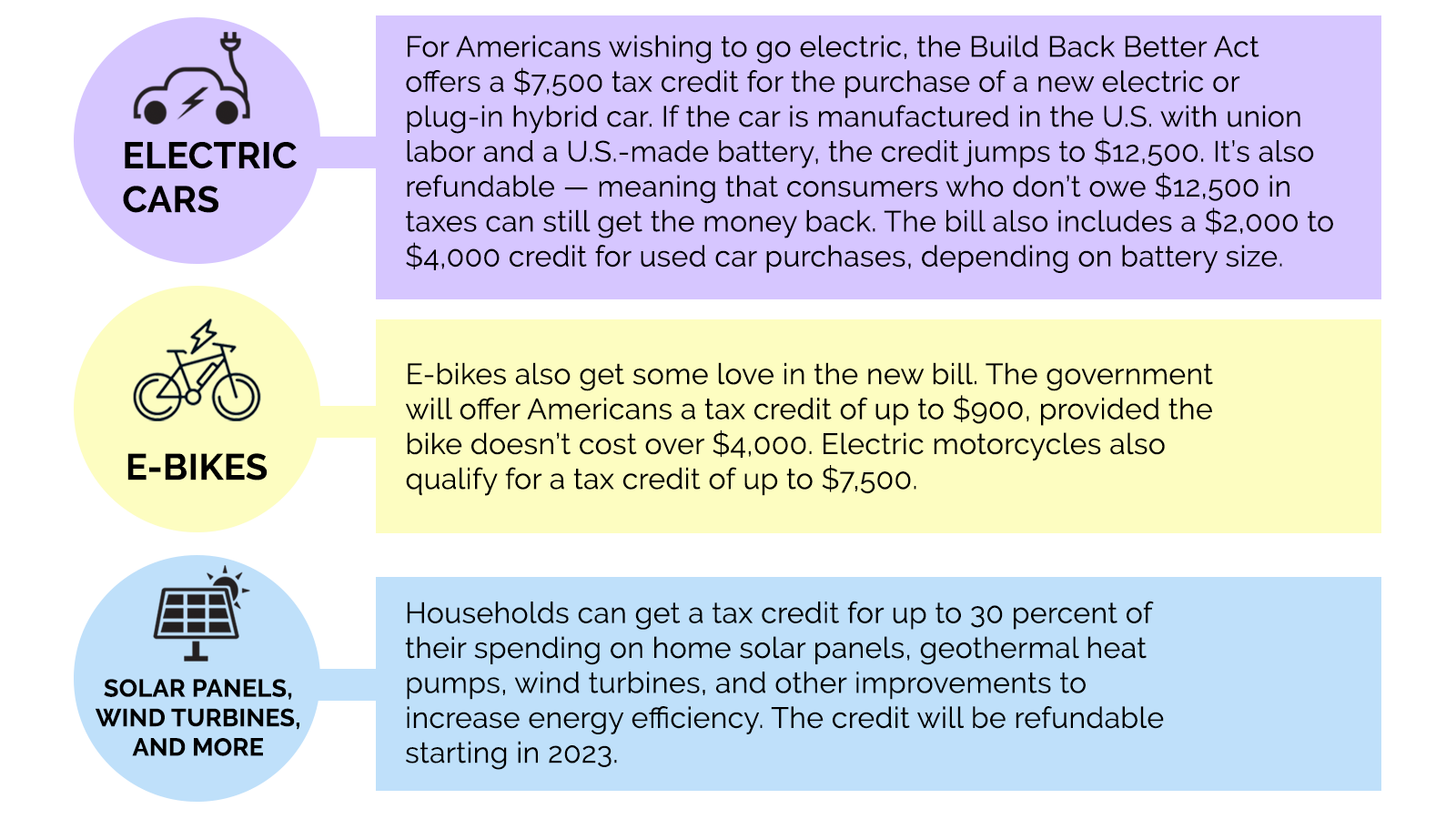

Tax Credits Are Hidden Benefit For Homeowners

https://www.tennessean.com/gcdn/-mm-/c35235dca3494476ea713db1a4eea54b43cda490/c=0-1242-4148-3585/local/-/media/2016/02/08/Nashville/Nashville/635905382793361586-DeniseCreswell.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Details From IRS About Enhanced Child Tax Credits

https://www.gannett-cdn.com/presto/2020/10/09/NETN/6fd18418-b434-4fe3-b42f-55875f385db0-p1DavidBruce070716_1.JPG?crop=2630,1479,x180,y168&width=2630&height=1479&format=pjpg&auto=webp

November 3 2022 Good news most of the regular costs of business travel are tax deductible Even better news as long as the trip is primarily for business you can tack August 18 2023 You don t have to fly first class and stay at a fancy hotel to claim travel expense tax deductions Conferences worksite visits and even a change of scenery

What is a Travel Tax Credit by Toby Mathis Updated October 7 2021 Are travel expenses tax deductible If you are self employed or run your own business they most You re named on or entitled to an NHS tax credit exemption certificate if you do not have a certificate you can show your award notice you qualify if you get child tax credits

Understanding Tax Credits Avenue Tax Service

https://avenuetaxservices.com/wp-content/uploads/2023/04/Untitled-design-1-1024x791.png

Freelance Accounting Personal Tax Services

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100057362743633

https://www.vero.fi/en/individuals/tax-cards-and...

You cannot get the credit for other costs such as equipment or travel expenses You can only get the credit if the work was done by a third party If you did the work yourself or if

https://www.irs.gov/publications/p463

For tax purposes travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job An ordinary expense is one that is

Democratic Plan Would Close Tax Break On Exchange traded Funds

Understanding Tax Credits Avenue Tax Service

Geothermal Tax Credits Incentives

What Are Tax Credits For Health Insurance Smartly Guide

Green Incentives Usually Help The Rich Here s How The Build Back

Potential Claims Arising From The Use and Abuse Of Research And

Potential Claims Arising From The Use and Abuse Of Research And

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

Missing Out On Tax Credits Improve Collaboration With Expense Software

CAPITALIZE ON YOUR WOTC TAX CREDITS

Tax Credits Travel Costs - Tax Tip 2022 104 July 11 2022 Business travel can be costly Hotel bills airfare or train tickets cab fare public transportation it can all add up fast The good news is business