Tax Cut Meaning In Economics Learn what tax cuts are how they work and their impact on the economy Find out the types of tax cuts such as income sales and capital gains and the examples of tax cuts by presidents

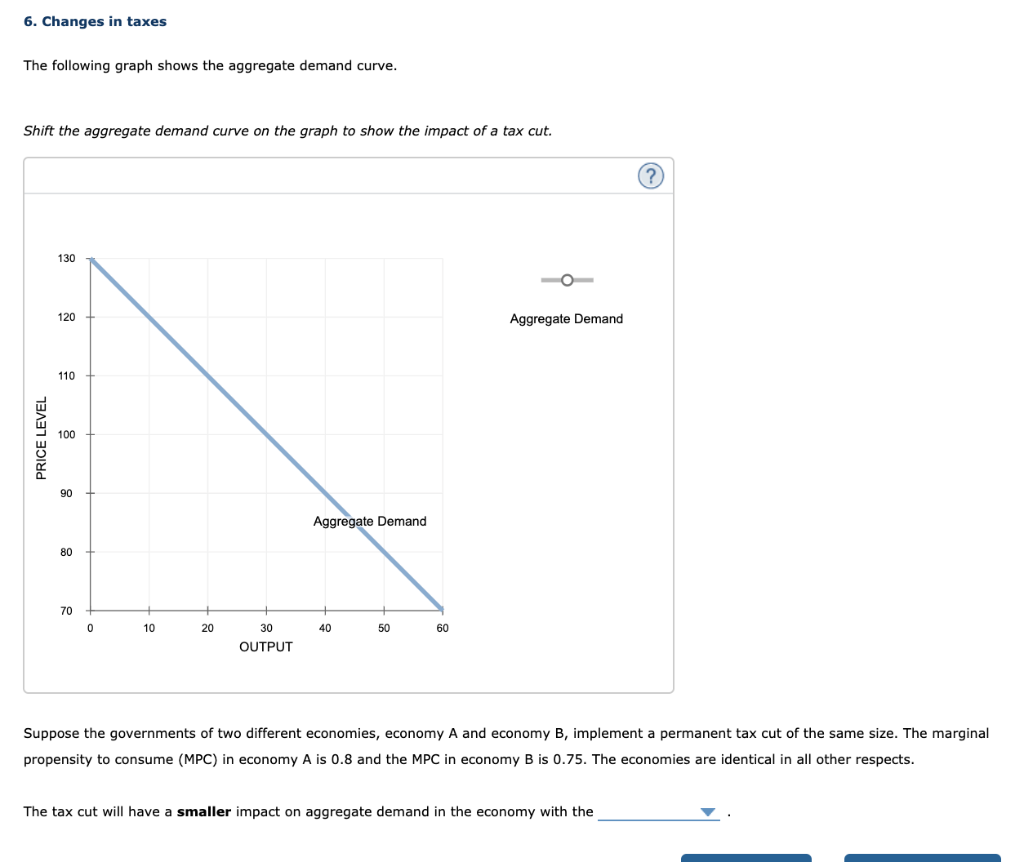

A tax cut is a decrease in the amount of money taken from taxpayers to go towards government revenue Learn about different types of tax cuts such as rate cuts deductions credits and exemptions and how they affect the economy and public finances Tax cuts can increase consumer spending and demand in the short term but may also affect productivity and supply in the long term Learn how tax cuts are financed how they depend on the state of the economy and how they relate

Tax Cut Meaning In Economics

Tax Cut Meaning In Economics

http://blog.getdistributors.com/wp-content/uploads/2014/07/Tax-cut.jpg

Tax Cut Government Policy In Economic Crisis Or Financial Planning For

https://static.vecteezy.com/system/resources/previews/002/167/209/non_2x/tax-cut-government-policy-in-economic-crisis-or-financial-planning-for-tax-reduction-concept-professional-businessman-financial-advisor-or-office-worker-using-sword-to-slash-cut-the-word-tax-vector.jpg

House Republicans Follow Senate s Lead On Tax Cuts For Wealthy The

https://westernnews.media.clients.ellingtoncms.com/img/photos/2021/06/24/Cut_taxes_stock.jpeg

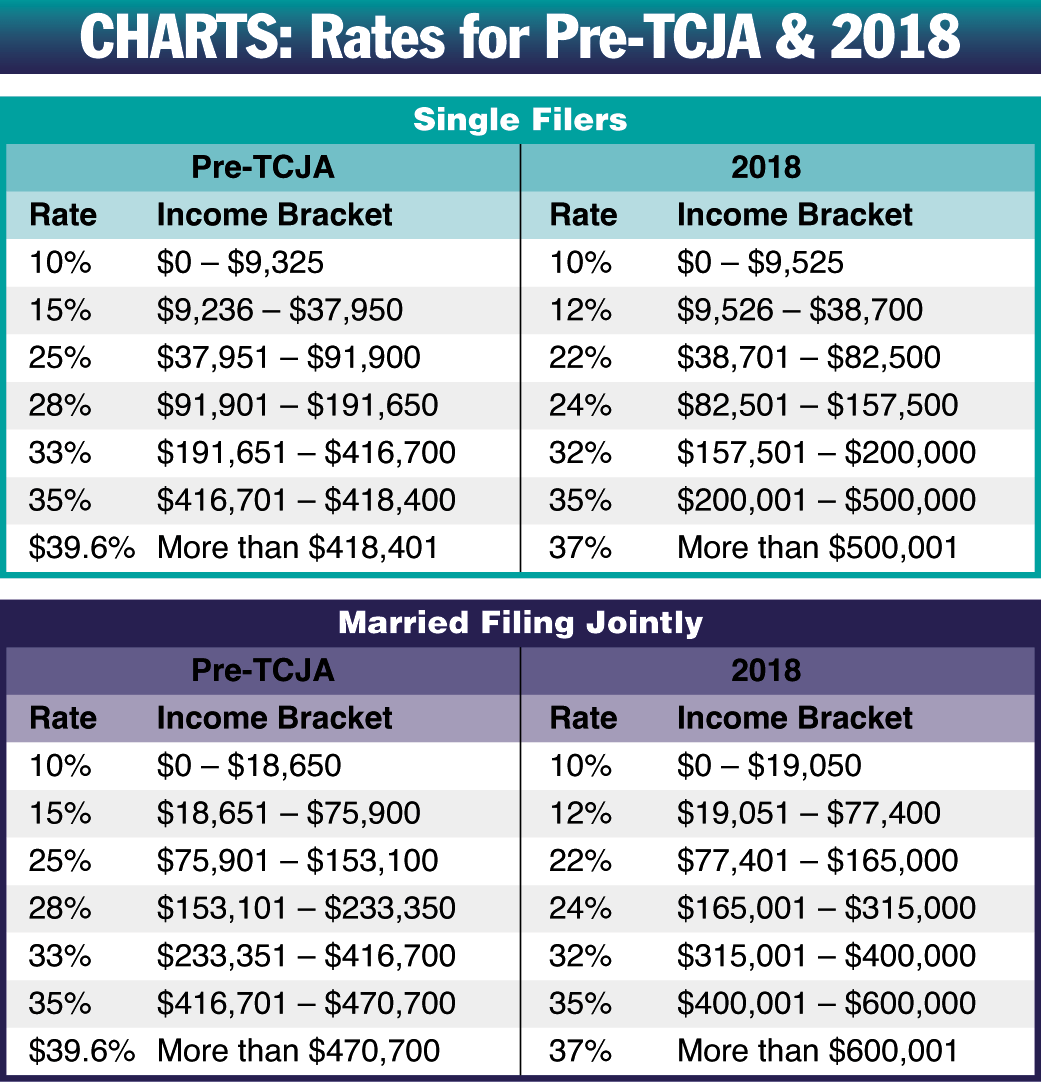

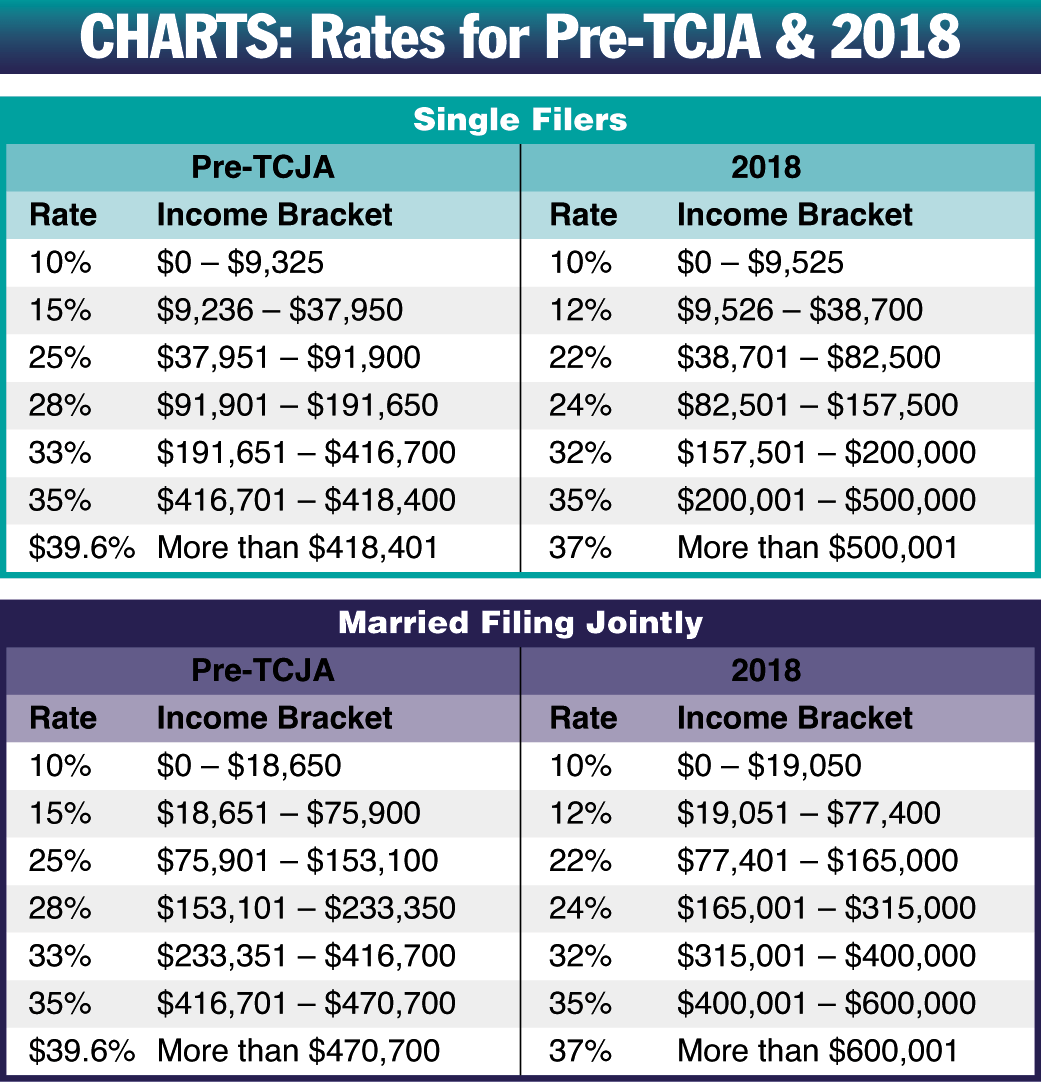

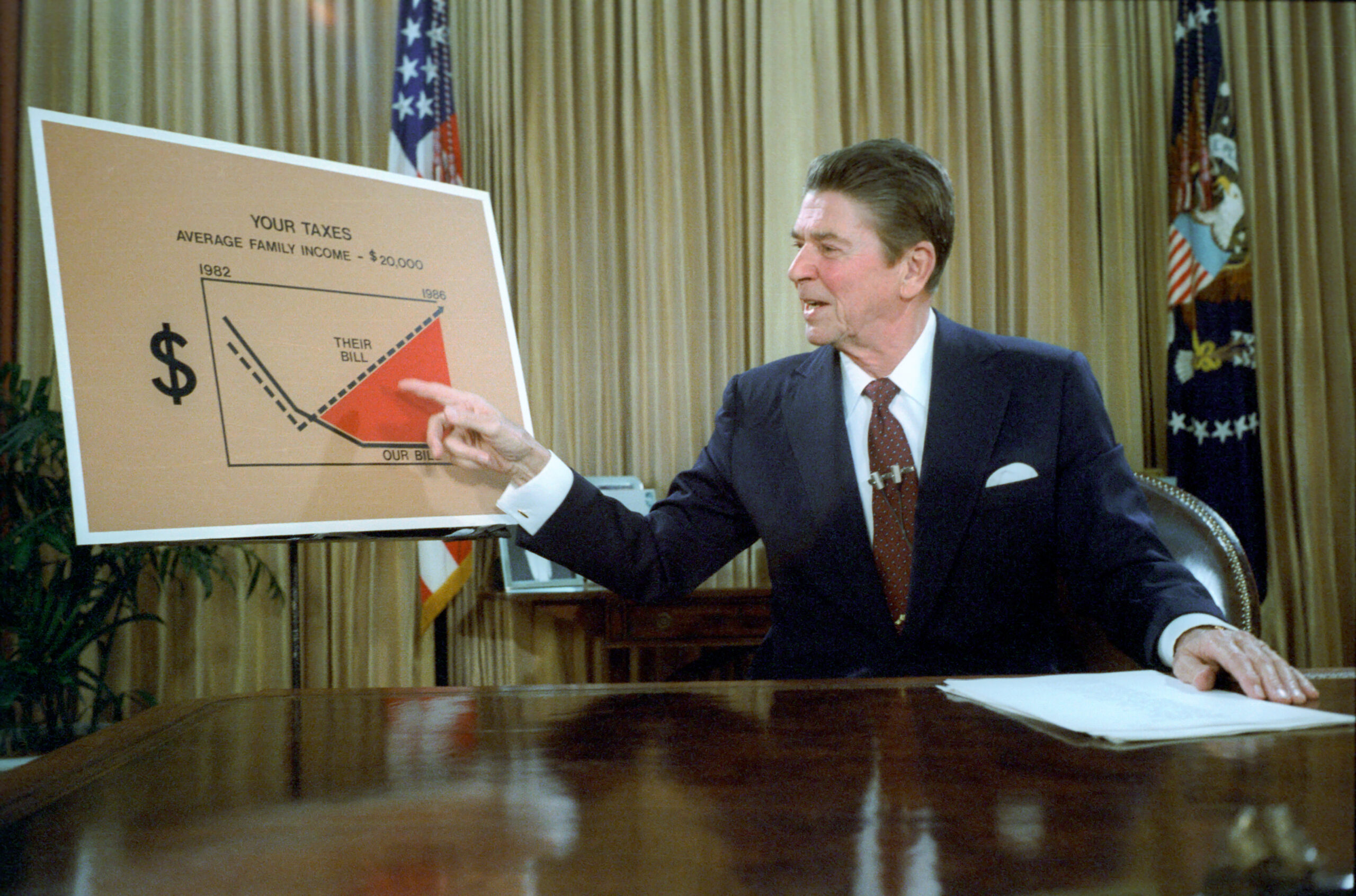

Learn about the Laffer curve a theory by economist Arthur Laffer that shows the relationship between tax rates and revenue Find out how it influenced Reaganomics and the U S tax policy and A tax cut is a change to tax laws that lowers the amount of money you have to pay in taxes Learn about different types of tax cuts such as income inheritance capital gains and business tax cuts and how they benefit taxpayers and the economy

The Long Answer Tax cuts can boost economic growth But the operative word there is can It s by no means an automatic or perfect relationship We know we know No one likes a fact check U S lawmakers getting ready to rewrite the nation s tax code have a fundamental question to answer What are the priorities for tax reform Do you want faster growth Less income inequality A tax cut that doesn t increase the budget deficit

Download Tax Cut Meaning In Economics

More picture related to Tax Cut Meaning In Economics

:max_bytes(150000):strip_icc()/GettyImages-1136346827-3eba69ab996a4abeb0836afe62abfd3c.jpg)

Tax Cuts Definition Types Effect On Economy

https://www.thebalancemoney.com/thmb/XPgnbNc-YCtZ0pXHZ3Xkty-FofQ=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/GettyImages-1136346827-3eba69ab996a4abeb0836afe62abfd3c.jpg

House Approves Bill To Extend Individual Small Business Tax Cuts MCB

https://www.mcb.cpa/wp-content/uploads/2018/10/Tax-Cuts-994x675.jpg

Image Gallery Economics Definition

http://4.bp.blogspot.com/-0onXc0KxbvU/Vi0PooREEDI/AAAAAAAACLM/FLLjL0pJV8o/s1600/ECONOMICS.jpg

High marginal tax rates can discourage work saving investment and innovation while specific tax preferences can affect the allocation of economic resources But tax cuts can also slow long run economic growth by increasing deficits A tax cut may increase economic growth by inducing individuals to work more save more and invest more what economists call a substitution effect However a tax cut also increases an

[desc-10] [desc-11]

Tax Cut Savings Flow To Company Stockholders Trickle To Hourly Workers

https://www.gannett-cdn.com/-mm-/514922ee78c25e2bb90a92cf29ab3e31e5542750/c=0-153-3000-1848/local/-/media/2018/04/11/USATODAY/USATODAY/636590451030391032-CORPORATETAXWINDFALL.JPG?width=3000&height=1695&fit=crop&format=pjpg&auto=webp

/taxes-word-on-wood-block-on-top-of-coins-stack-869670536-efbe1559282e4a5c87945445dd1b32a3.jpg)

Effective Tax Rate Definition

https://www.investopedia.com/thmb/gYbUOCtBpmIpqEmtj5w7ywsO6uI=/5500x3667/filters:fill(auto,1)/taxes-word-on-wood-block-on-top-of-coins-stack-869670536-efbe1559282e4a5c87945445dd1b32a3.jpg

https://www.thebalancemoney.com/tax-cuts...

Learn what tax cuts are how they work and their impact on the economy Find out the types of tax cuts such as income sales and capital gains and the examples of tax cuts by presidents

https://en.wikipedia.org/wiki/Tax_cut

A tax cut is a decrease in the amount of money taken from taxpayers to go towards government revenue Learn about different types of tax cuts such as rate cuts deductions credits and exemptions and how they affect the economy and public finances

Why Do Corporations Get More Tax Cuts Than I Do

Tax Cut Savings Flow To Company Stockholders Trickle To Hourly Workers

New Tax Law Steps Needed To Cut Property Tax Bill Are Worth Time Money

Tax Cut Package Finally Clears Legislature

Solved 6 Changes In Taxes The Following Graph Shows The Chegg

How The Tax Cuts And Jobs Act Of 2017 Affect You Fil Am Voice

How The Tax Cuts And Jobs Act Of 2017 Affect You Fil Am Voice

Study Of 50 Years Of Tax Cuts For Rich Confirms Trickle Down An

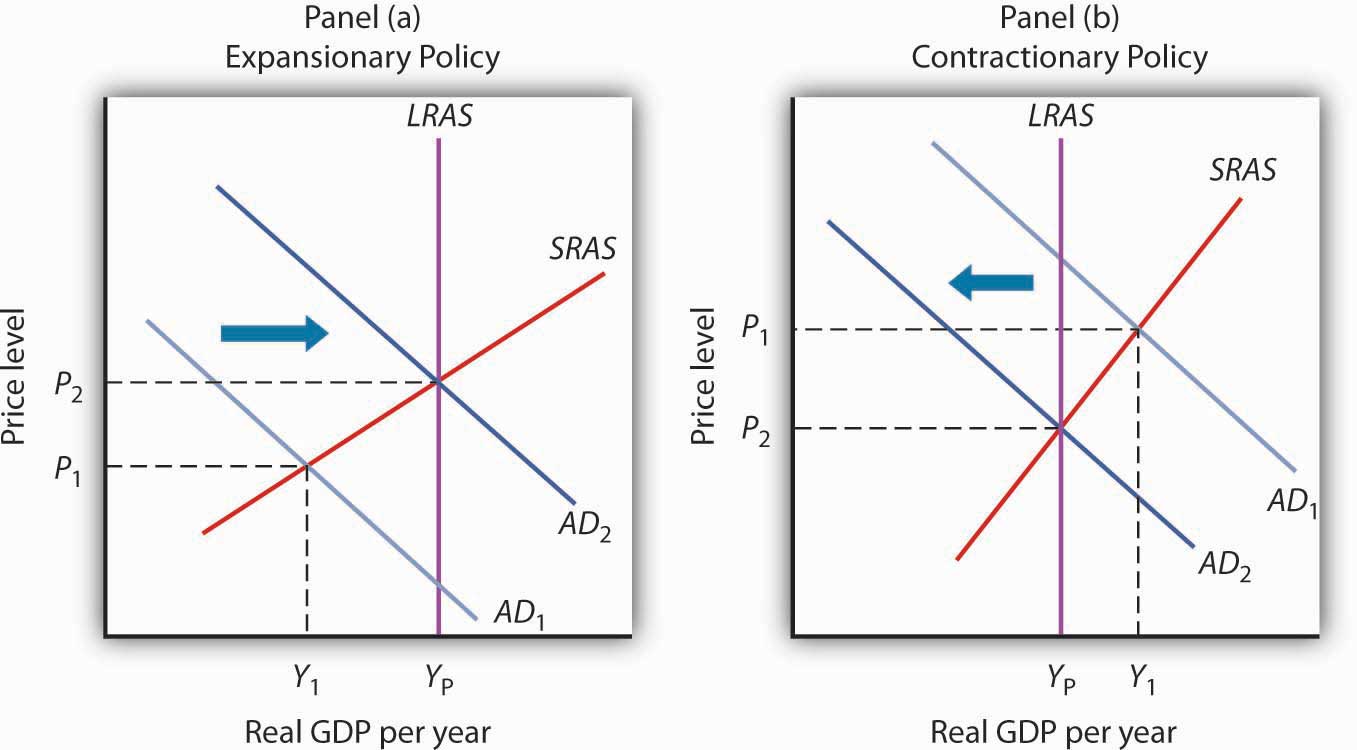

The Use Of Fiscal Policy To Stabilize The Economy

Do Tax Cuts Matter BDF LLC BDF

Tax Cut Meaning In Economics - [desc-14]