Tax Deduction For Car Donation 2021 To deduct a charitable contribution taxpayers must itemize deductions on Schedule A of Form 1040 How the Charitable Contributions Deduction Works

If you donate a qualified vehicle with a claimed value of more than 500 you can t claim a deduction unless you attach to Form 8283 a copy of the CWA you received from the Giving up an old car to charity may qualify you for a tax deduction And charities benefit because even junk cars are more valuable amid high prices for new and

Tax Deduction For Car Donation 2021

Tax Deduction For Car Donation 2021

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

Car Donation And IRS Deductions Explained Kars4Kids Hub

https://www.kars4kids.org/hub/wp-content/uploads/2021/10/Untitled-design-31.png

The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they don t If it is worth more than 500 you ll need to complete section A of IRS Form 8283 when you file your tax return If the vehicle is worth more than 5 000 you will

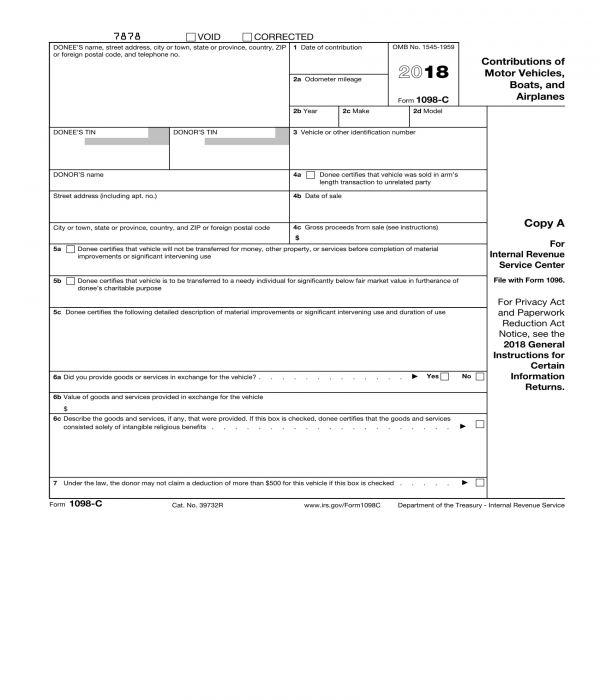

Donating a qualified vehicle to a charity Learn how Form 1098 C is used to report the details of your donation and how it affects your deduction Understanding a few fundamentals before donating your car for tax deductions is important You can claim a deduction if you donate to a qualified charity

Download Tax Deduction For Car Donation 2021

More picture related to Tax Deduction For Car Donation 2021

2018 Car Donation Tax Questions Answered Car Donation Wizard

https://www.cardonationwizard.com/blog/wp-content/uploads/2018/11/tax-1103675_1920-1024x768.jpg

Donate Car For Tax Credit 2016 Car Donation Tax Deduction How To Get

https://3.bp.blogspot.com/-I2ZnysVTsCw/V0MFtS_ztYI/AAAAAAAAAAY/Aq_AEm6A9LE47-HnrHKpziRJSvLjgVpYwCLcB/s1600/tax.jpg

FREE 6 Car Donation Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2018/07/Car-Donation-Tax-Form.jpg

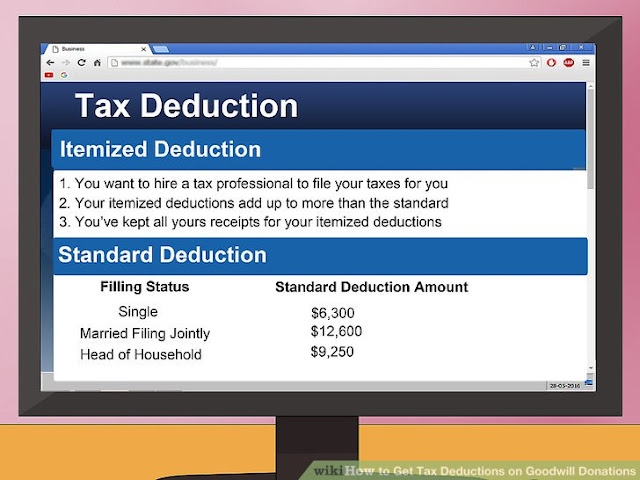

You ll need to report your deduction on Schedule A of your federal income tax return If your car donation is more than 500 you must also fill out IRS Form 8283 If your deduction for the car is between 501 Getting a tax deduction for your car donation is a great way to help out a local non profit and help save money on your taxes If the process seems overwhelming

Donating your vehicle to charity can lead to rewards for everyone involved Not only can it give a deserving individual a fresh start it can give your finances a jump start with a tax Make sure the charity you donate your car to is an IRS tax exempt organization Estimate the fair market value of your car using a used car guide such as the Kelley Blue Book If

The Government Shutdown Won t Hurt Your Tax Deduction

https://www.donateforcharity.com/wp-content/uploads/2013/10/irs-car-donation-tax-deduction-e1381639923844.jpg

Car Donation Tax Deduction Tax Benefits Of Donating A Car

https://www.goodwillcardonation.org/wp-content/uploads/2016/06/Tax-credit-1024x576.jpg

https://www.investopedia.com/terms/c/charitable...

To deduct a charitable contribution taxpayers must itemize deductions on Schedule A of Form 1040 How the Charitable Contributions Deduction Works

https://www.irs.gov/publications/p526

If you donate a qualified vehicle with a claimed value of more than 500 you can t claim a deduction unless you attach to Form 8283 a copy of the CWA you received from the

Bonus Tax Deduction For Investments To Improve Energy Efficiency

The Government Shutdown Won t Hurt Your Tax Deduction

Education Tax Deductions For Charitable Donations How Much Can I

2 Easy Steps To Get Tax Deduction For Your Personal Vehicle Blue Rock

DONATE CAR TO CHARITY CHARITY TAX DEDUCTION Tax Benefits By Donating

Tax Deduction For New Or Used Equipment Learn More About Section 179

Tax Deduction For New Or Used Equipment Learn More About Section 179

How To Claim Tax Deduction For Car Donation In California

Tax Deduction For Car Donations Car Talk Donation Program

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Tax Deduction For Car Donation 2021 - Understanding a few fundamentals before donating your car for tax deductions is important You can claim a deduction if you donate to a qualified charity