Tax Deduction Italy An Italian resident taxpayer has the right to certain deductions and claim a tax deduction or tax credit for certain expenses and charges incurred in the relevant tax return Some but not all of these deductions credits may be claimed by

In Italy the individual is subject to the following income taxes National income tax Regional income tax Municipal income tax The tax liability shall be computed on a progressive rate and the applicable tax rates Easy to use salary calculator for computing your net income in Italy after Income Tax and Social Security contributions have been deducted

Tax Deduction Italy

Tax Deduction Italy

https://i.pinimg.com/originals/c1/fe/77/c1fe77bfd3a19358901fe3dcd052a853.jpg

Section 179 Tax Deduction

https://lifttrucksupplyinc.com/wp-content/uploads/2016/05/12369179_537911586377015_8736271735998525545_n.png

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Individuals who transfer their tax residency see the Residence section for more information to Italy starting from tax period 2024 are subject to a reduction of 50 of the employed earnings on the Italian territory Certain expenses oneri deducibili deductible expenses may reduce total income such as social security and welfare contributions or donations to non profit organisations Gross tax is calculated by applying the rates per bracket to total income net of deductible expenses

Under the scheme for 5 years income from work as an employee or similar category and self employment pursued in Italy is taxed at 30 of the amount or 10 if the worker becomes resident in one of the following regions Abruzzo Molise Campania Apulia Basilicata Calabria Sardinia or Sicily The Italy Tax Calculator below is for the 2024 tax year the calculator allows you to calculate income tax and payroll taxes and deductions in Italy This includes calculations for Employees in Italy to calculate their annual salary after tax Employers to calculate their cost of employment for their employees in Italy Tax in Italy Explained

Download Tax Deduction Italy

More picture related to Tax Deduction Italy

http://5b0988e595225.cdn.sohucs.com/images/20180627/c158e2289d284e93998d4eb2ea54f1b1.jpeg

Example Tax Deduction System For A Single Gluten free GF Item And

https://www.researchgate.net/profile/Julio-Bai/publication/274087526/figure/tbl1/AS:391861509345282@1470438472540/Example-tax-deduction-system-for-a-single-gluten-free-GF-item-and-calculations-for-tax.png

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

If the taxpayer files a Tax return through Form 730 the employer or the National Pension Institute deducts the income tax liability directly from the taxpayer s salary or pension and pays it to the tax office When to pay taxes in Italy Learn all about taxes in Italy including personal and corporate levies VAT inheritance laws and all the latest rates

Written on 13 November 2023 Italian tax residents are subject to a range of taxes on their worldwide income at national regional and municipal levels This is in addition to wealth taxes and passive income taxes which are all taxed at different rates Detailed Breakdown of Taxes and Contributions With a gross annual income of 30 000 our Salary After Tax Calculator for Italy estimates your net monthly income to be around 1 604 This represents approximately 35 84 of your gross monthly income deducted as taxes and contributions

What Are The Top 10 Pre Tax Deduction List For Maximizing Savings In

https://www.horilla.com/wp-content/uploads/2023/08/cropped-pre-tax-deduction-12.jpg

INCOME TAX RATE IN ITALY 2020 GUIDE FOR FOREIGNERS Accounting Bolla

https://accountingbolla.com/wp-content/uploads/2021/03/income-tax-return-deduction-refund-concept-pfnxy9g_orig-1024x683.jpg

https://taxing.it/list-of-deductions-and-deductible-expenses

An Italian resident taxpayer has the right to certain deductions and claim a tax deduction or tax credit for certain expenses and charges incurred in the relevant tax return Some but not all of these deductions credits may be claimed by

https://taxsummaries.pwc.com/italy/individual/taxes-on-personal-income

In Italy the individual is subject to the following income taxes National income tax Regional income tax Municipal income tax The tax liability shall be computed on a progressive rate and the applicable tax rates

/cloudfront-us-east-1.images.arcpublishing.com/tgam/W6JWPGS5MZAINPGV24C65SXD6Q)

Two Tax deduction Strategies For Procrastinators The Globe And Mail

What Are The Top 10 Pre Tax Deduction List For Maximizing Savings In

Tax Deduction 50 E C M Infissi

Premium AI Image Tax Deduction Planning Concept Businessman Calculating

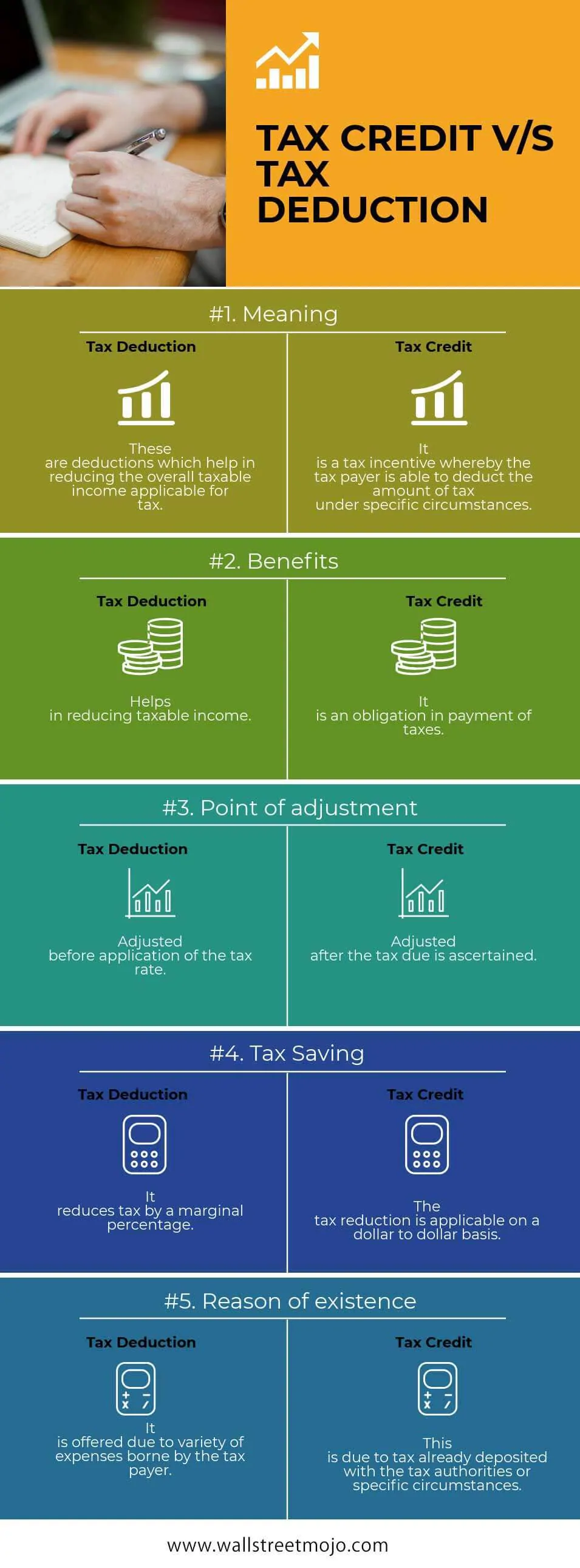

Tax Credits Vs Tax Deductions Top 5 Differences You Must Know

How To Fully Maximize Your 1099 Tax Deductions Steady

How To Fully Maximize Your 1099 Tax Deductions Steady

Maximising Tax Benefits Your Guide To Claiming A Rental Property

New Tax Laws Business Deduction Changes You Need To Know About

Illumination Wealth ManagementSection 199A Tax Reduction Strategies

Tax Deduction Italy - The Italy Tax Calculator below is for the 2024 tax year the calculator allows you to calculate income tax and payroll taxes and deductions in Italy This includes calculations for Employees in Italy to calculate their annual salary after tax Employers to calculate their cost of employment for their employees in Italy Tax in Italy Explained