Withholding Tax Italy In Italy withholding agents employers or principals withhold tax on the amounts they pay to employees and workers who receive an income as employees

Italian source interest paid to a non resident is generally subject to a 26 withholding tax WHT and it is considered as sourced in Italy when paid by an Italian resident Dividends paid to foreign entities are subject to ordinary withholding tax at the rate of 26 percent Dividends paid to EU countries and EEA white listed countries

Withholding Tax Italy

Withholding Tax Italy

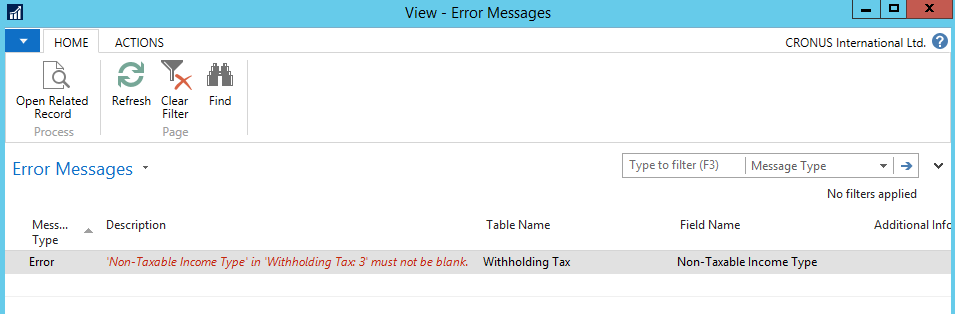

https://learn.microsoft.com/en-us/dynamics/s-e/images/viewerrorsmessagesimage.png

Microsoft Dynamics NAV 2016 Non Taxable Income Type Handling In

https://learn.microsoft.com/en-us/dynamics/s-e/images/editwitholdingtaxcard3image.png

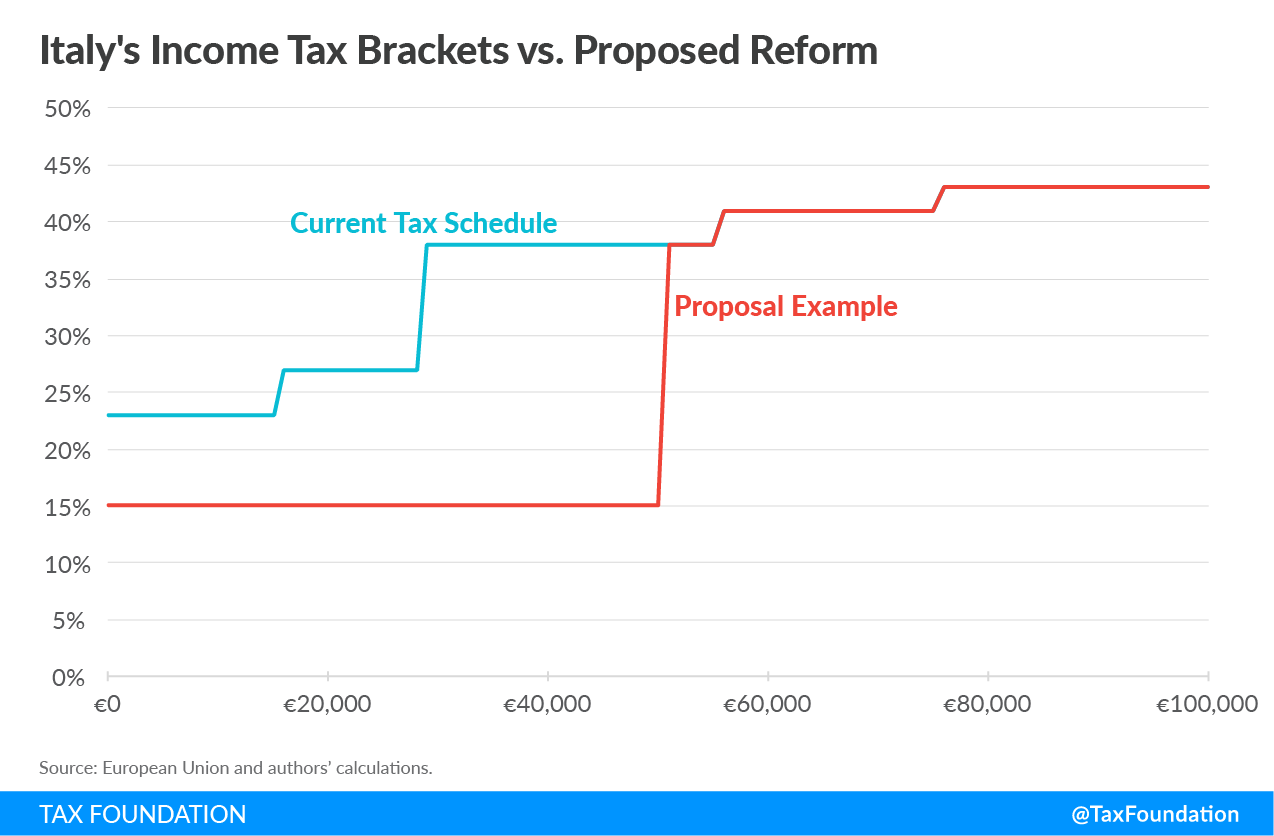

Guide To Flat Tax In Italy For Foreigners

https://www.stresa.biz/uploads/websites/1199/news/6a58a1b31dbfe5b0f9e62bf59cc0dec1.jpeg

The covered areas are corporate income tax indirect tax international tax legal mergers and acquisitions tax accounting tax controversy and dispute resolution transfer pricing Ritenuta d Acconto also known as withholding tax is a mechanism implemented by the Italian government to collect taxes from various sources of income

The Italian tax authorities are entitled to make an assessment in relation to corporate taxes IRES and IRAP VAT and WHT returns up to the end of the fifth The Withholding Tax Rate in Italy stands at 26 percent Withholding Tax Rate in Italy averaged 26 00 percent from 2022 until 2024 reaching an all time high of 26 00 percent

Download Withholding Tax Italy

More picture related to Withholding Tax Italy

What Are FICA Taxes Forbes Advisor

https://www.forbes.com/advisor/wp-content/uploads/2022/07/getty_what_are_fica_taxes.jpeg.jpg

Stock Video Of F24 Italian Tax Forms That Scroll 14834005 Shutterstock

https://ak5.picdn.net/shutterstock/videos/14834005/thumb/1.jpg

Important Tax Benefits To Know Before Renovating In Italy

https://www.italyirl.com/wp-content/uploads/2023/03/TaxBenefits.jpg

Withholding Tax Withholding taxes are imposed at source of income and are often applied to dividends interest royalties rent and similar payments The rates of withholding tax This guide on the Italian Tax Return will give you insights on fulfillments related to your case as well as various types deadlines available and penalties in case of non

Withholding tax WHT on dividend income payments in Italy was and still is a recurrent discussion topic in the asset management sector The acceptance and Royalties paid by a resident company to a non resident company without a permanent establishment in Italy are subject to a final 30 withholding tax However except for

Income Tax Return Filing For AY 2022 23 Know About Deadlines Click

http://blog.freetaxfiler.com/wp-content/uploads/2022/06/logo-dark.png

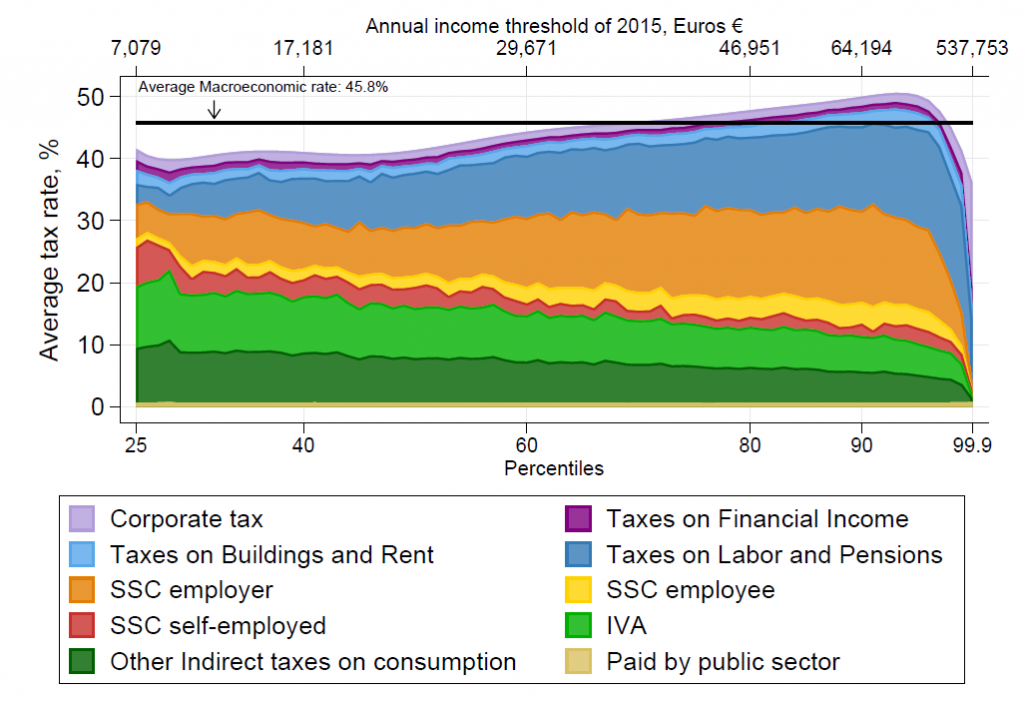

Income Inequality In Italy And Tax Policy Implications WID World

https://wid.world/wp-content/uploads/2022/02/TaxRateIncomePercentile_NT-1024x708.png

https://www.agenziaentrate.gov.it/portale/web/...

In Italy withholding agents employers or principals withhold tax on the amounts they pay to employees and workers who receive an income as employees

https://www.dentons.com/.../italy

Italian source interest paid to a non resident is generally subject to a 26 withholding tax WHT and it is considered as sourced in Italy when paid by an Italian resident

Taxes In Italy Everything You Need To Know About The Italian Tax System

Income Tax Return Filing For AY 2022 23 Know About Deadlines Click

Flat Tax Easy Home Italy

HOW TO GET A TAX REFUND IN ITALY THE ULTIMATE GUIDE Accounting Bolla

Europe Personal Income Tax Rates Birojs BBP

Taxes In Italy 2023 A Complete Guide Clear Finances

Taxes In Italy 2023 A Complete Guide Clear Finances

Withholding Tax HW Co CPAs Advisors

Italy Income Taxes Italy Can Pay For A Flat Tax Italy Taxes

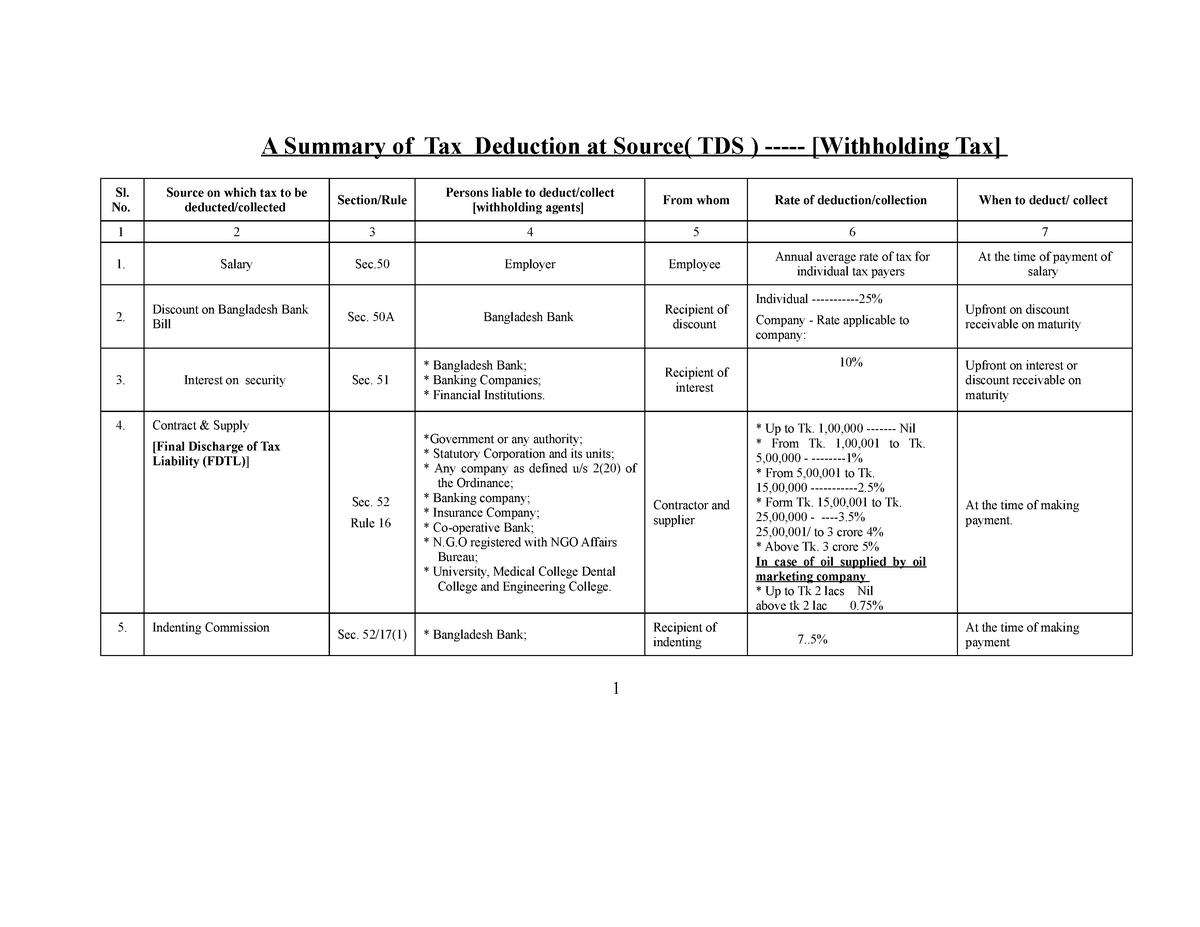

Withholding Tax A Summary Of Tax Deduction At Source TDS

Withholding Tax Italy - Ritenuta d Acconto also known as withholding tax is a mechanism implemented by the Italian government to collect taxes from various sources of income