Tax Deductions For Home Care Workers Web If you pay for at home home care services the IRS may let you deduct the cost from your annual taxes The IRS does allow citizens to deduct certain medical deductions to

Web 23 Dez 2023 nbsp 0183 32 In 2022 the tax deduction amounts to 94 of the actual contributions at a maximum of 94 of EUR 25 639 EUR 51 278 and increases to 100 in 2023 For Web 7 M 228 rz 2022 nbsp 0183 32 These services can include for example cleaning gardening meal prep moving services pet care in your home etc Up to 20 of these costs can be claimed

Tax Deductions For Home Care Workers

Tax Deductions For Home Care Workers

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/file-uploads/blogs/34581/images/8d6d3d2-24e3-41c7-ff4-fa3ce24fa8_Tax_Tips_Blog_Image.png

Assets And Liabilities Worksheet Sample Balance Sheet For Small

https://i.pinimg.com/originals/cc/2e/e6/cc2ee6a61e87bb8f3c9b4ea0ee0c3682.jpg

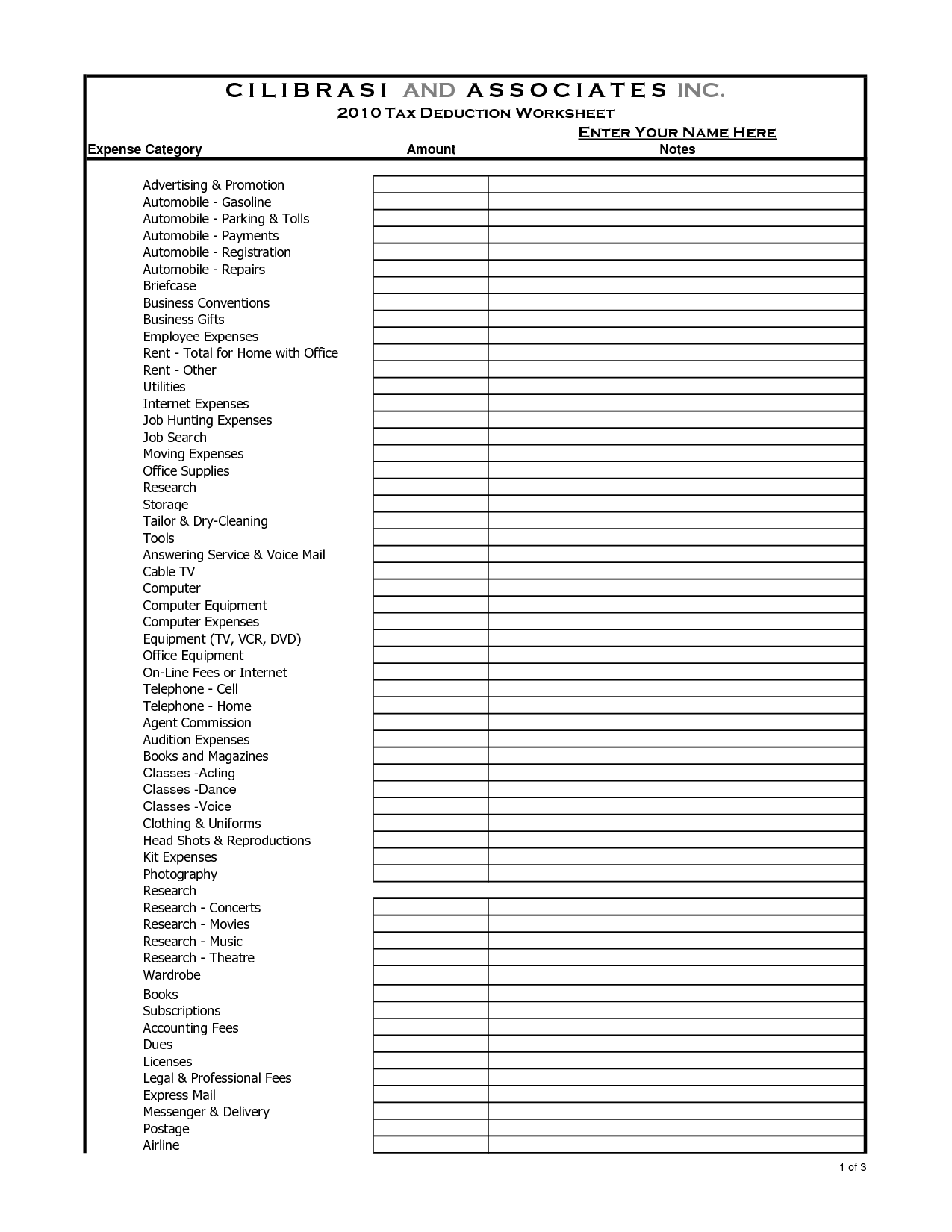

8 Tax Preparation Organizer Worksheet Worksheeto

https://www.worksheeto.com/postpic/2015/05/small-business-tax-deduction-worksheet_449268.png

Web 30 Mai 2023 nbsp 0183 32 Family Caregivers and Self Employment Tax Special rules apply to workers who perform in home services for elderly or disabled individuals caregivers Caregivers Web With the new Home Office Lump Sum credit you can claim 5 for every day you work from home for a maximum of 120 days for the 2022 tax return meaning up to 600

Web Tax deductions for home health care workers Vehicle expenses The chances are that you use your vehicle in important ways in home health care For instance you may Home Web 6 Okt 2021 nbsp 0183 32 With out of pocket expenses totaling 25 000 you d be able to deduct 21 250 25 000 3 750 When filing taxes these deductions must be listed in the

Download Tax Deductions For Home Care Workers

More picture related to Tax Deductions For Home Care Workers

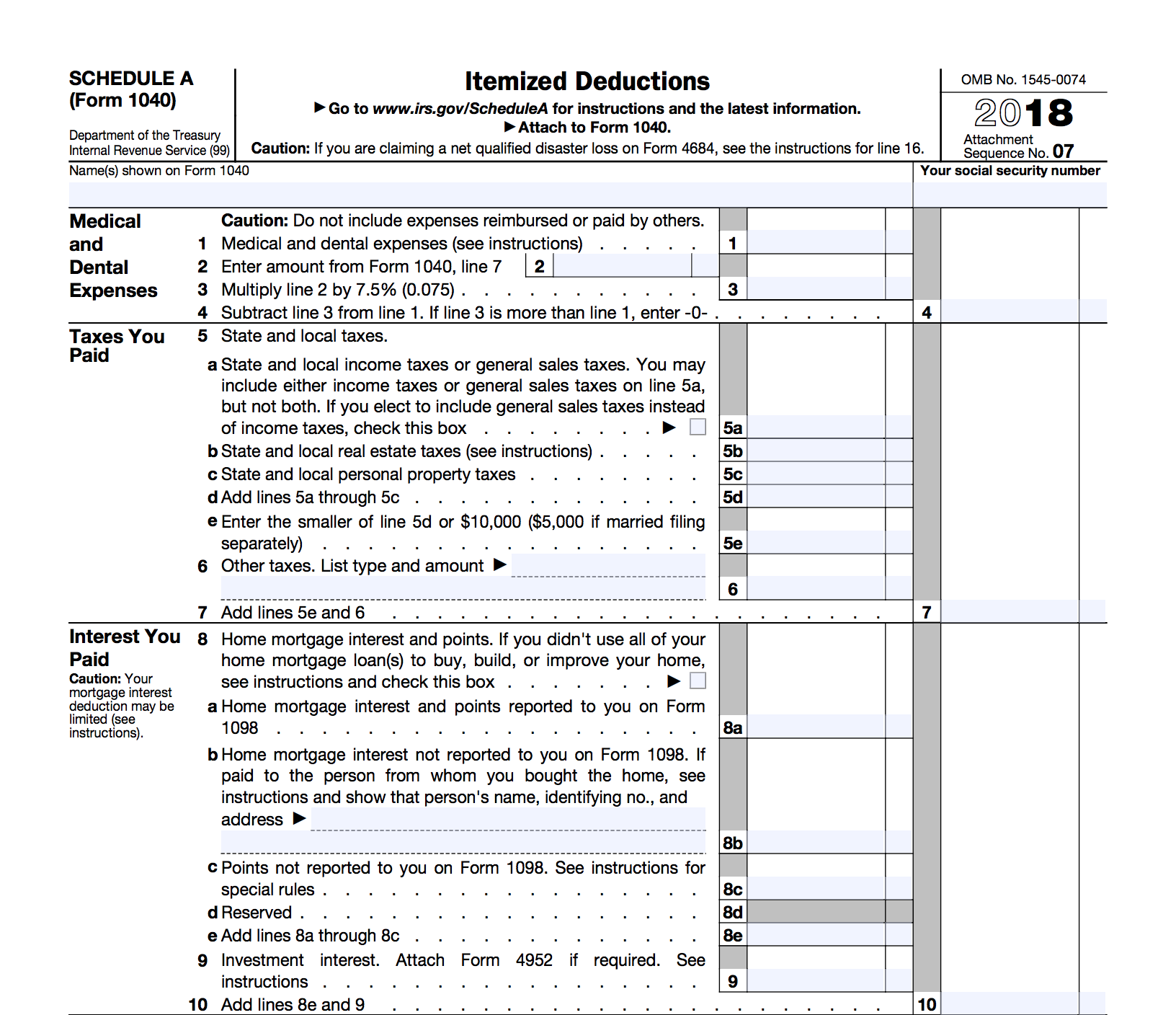

Standard Deduction 2020 Vs Itemized Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/how-to-reduce-your-tax-bill-with-itemized-deductions-bench-1.png

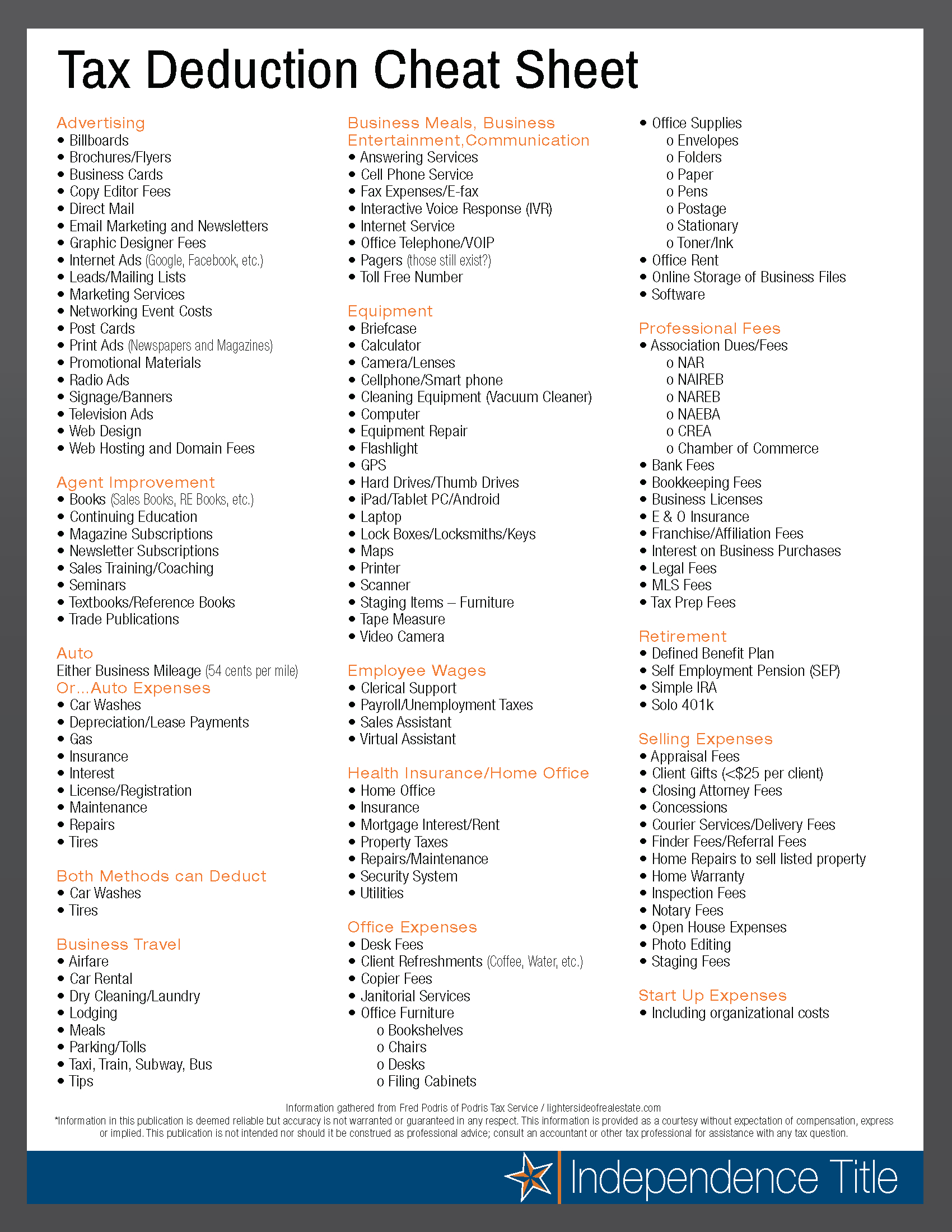

Tax Deduction Cheat Sheet For Real Estate Agents Db excel

https://db-excel.com/wp-content/uploads/2019/09/tax-deduction-cheat-sheet-for-real-estate-agents-1.png

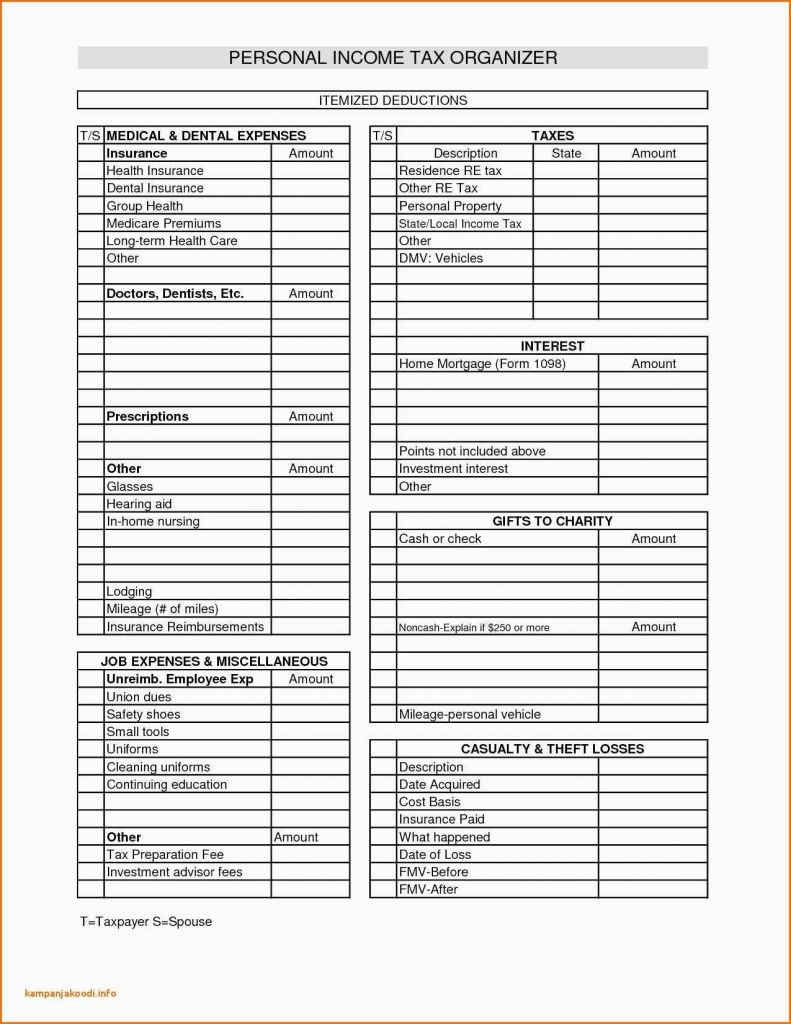

16 Best Images Of Tax Organizer Worksheet Tax Deduction Worksheet

http://www.worksheeto.com/postpic/2011/03/tax-deduction-worksheet_652627.png

Web 1 Feb 2023 nbsp 0183 32 Taxpayers often overlook deductions and credits related to caregiver expenses However these deductions and credits can reduce the financial burden of hiring an in home caregiver Caregiver expenses Web 1 Sept 2016 nbsp 0183 32 In addition to avoiding unpleasant consequences of fines and other criminal punishments the correct reporting of in home caregiver taxes has several tax benefits including the availability of the Sec 21

Web 13 Mai 2022 nbsp 0183 32 As a home care aid you are eligible for a number of tax deductions including vehicle expenses home office deduction and professional association Web Here are some available tax deductions for home health care workers Home Office Deductions Home healthcare employees who use part of their home exclusively and

![]()

Farm Cash Flow Spreadsheet Google Spreadshee Farm Cash Flow Projection

http://db-excel.com/wp-content/uploads/2019/01/farm-cash-flow-spreadsheet-with-budgetrksheet-expense-grass-fedjp-study-site-farm-xls-tracking-sof.png

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

https://www.caringseniorservice.com/blog/how-to-deduct-home-care...

Web If you pay for at home home care services the IRS may let you deduct the cost from your annual taxes The IRS does allow citizens to deduct certain medical deductions to

https://taxsummaries.pwc.com/germany/individual/deductions

Web 23 Dez 2023 nbsp 0183 32 In 2022 the tax deduction amounts to 94 of the actual contributions at a maximum of 94 of EUR 25 639 EUR 51 278 and increases to 100 in 2023 For

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

Farm Cash Flow Spreadsheet Google Spreadshee Farm Cash Flow Projection

Society Of Certified Senior Advisors Tax Deductions For Home Health Care

5 Tax Deductions Small Business Owners Need To Know

Home Based Business Tax Deductions Canada Black Scholes Employee

Qualified Insurance For Self Employed Health Insurance Deductions

Qualified Insurance For Self Employed Health Insurance Deductions

What Is A Tax Deduction Definition Examples Calculation

5 Popular Itemized Deductions 2021 Tax Forms 1040 Printable

Itemized Deductions Spreadsheet Intended For Small Business Tax

Tax Deductions For Home Care Workers - Web 1 Mai 2023 nbsp 0183 32 For long term home care to be tax deductible care needs to be performed by a home healthcare worker and three requirements generally need to be met The