Tax Exemption Redundancy Payments Verkko A statutory redundancy payment made under the Employment Rights Act 1996 or the Employment Rights Northern Ireland Order 1996 is exempt from liability to tax as

Verkko 25 hein 228 k 2023 nbsp 0183 32 Home Life events and personal circumstances Leaving a job and unemployment Redundancy lump sum payments You may receive a lump sum Verkko 6 huhtik 2023 nbsp 0183 32 In the situation where your employer taxes a redundancy payment incorrectly you should contact HMRC or seek some advice from TaxAid Whatever is left over of the 163 30 000

Tax Exemption Redundancy Payments

Tax Exemption Redundancy Payments

https://www.davisgrant.co.uk/wp-content/uploads/2020/06/redundancies-blog-featured-image-880x360.jpg

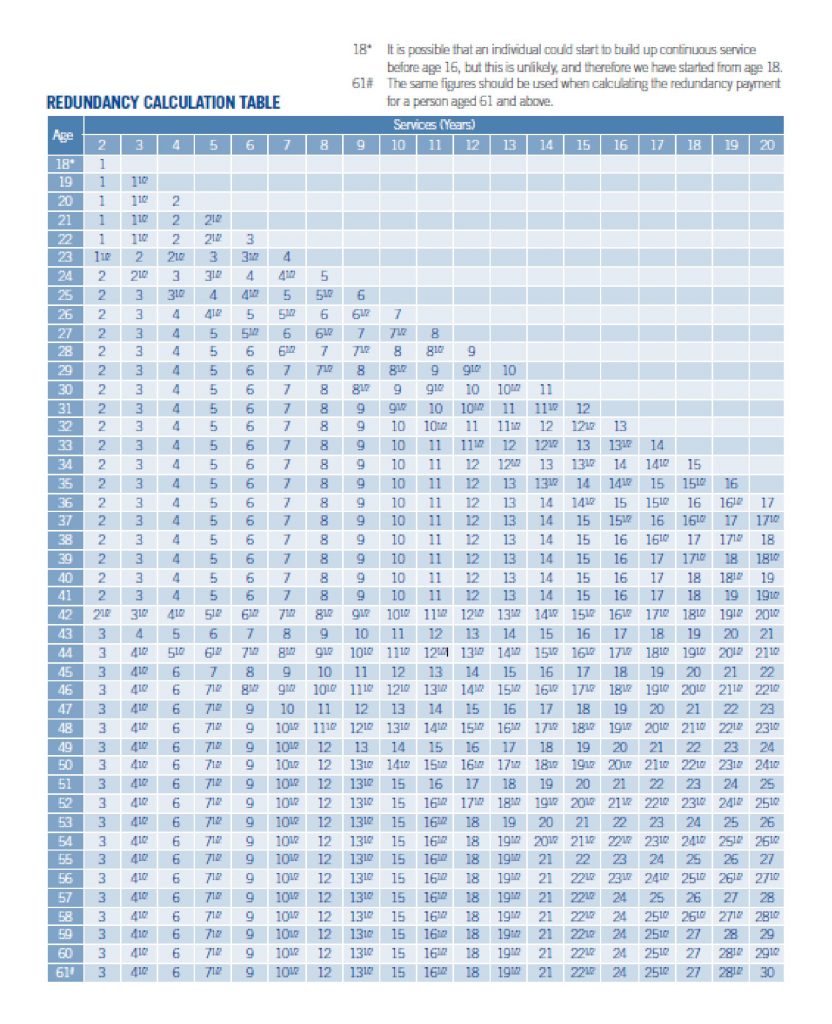

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

HOW REDUNDANCY PAYMENTS ARE TAXED

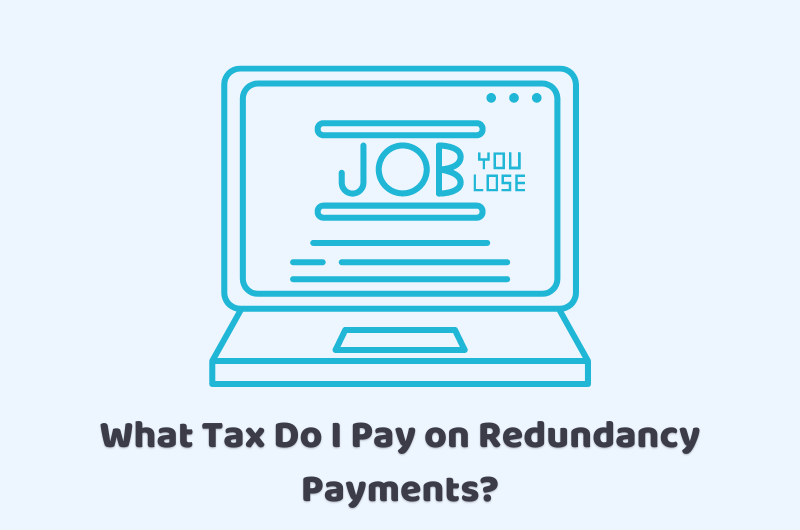

https://s3.studylib.net/store/data/008235229_1-43bc4650635de2de8c53ef7caa1696a0-768x994.png

Verkko The legislation ensures that statutory redundancy payments remain exempt from Income Tax up to the 163 30 000 threshold Foreign service relief is removed through Verkko 4 jouluk 2023 nbsp 0183 32 The statutory redundancy payment itself is tax free but other payments of earnings will not be Different payments of earnings Payments in lieu of notice Some redundancy situations will require

Verkko Tax and National Insurance If you re made redundant you may get a termination payment This could include statutory redundancy pay holiday pay unpaid wages Verkko If all you have is a redundancy payment up to 163 30 000 against which your employer has allowed an exemption and the amount of post employment notice pay is Nil just fill in

Download Tax Exemption Redundancy Payments

More picture related to Tax Exemption Redundancy Payments

What Tax Do I Pay On Redundancy Payments CruseBurke

https://cruseburke.co.uk/wp-content/uploads/2022/12/tax-on-redundancy-payments.png

Redundancy Payments PDF Pension Tax Exemption

https://imgv2-2-f.scribdassets.com/img/document/505429617/original/21c17b2f91/1667578999?v=1

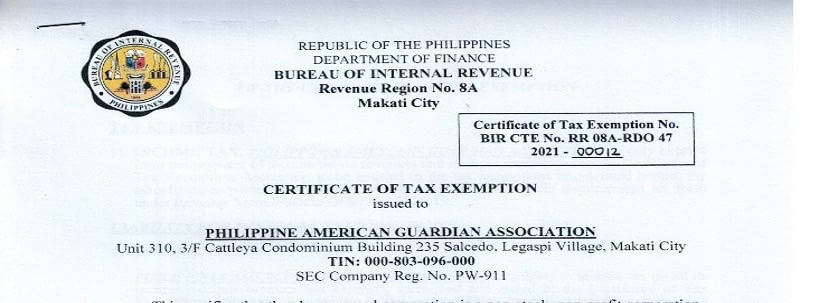

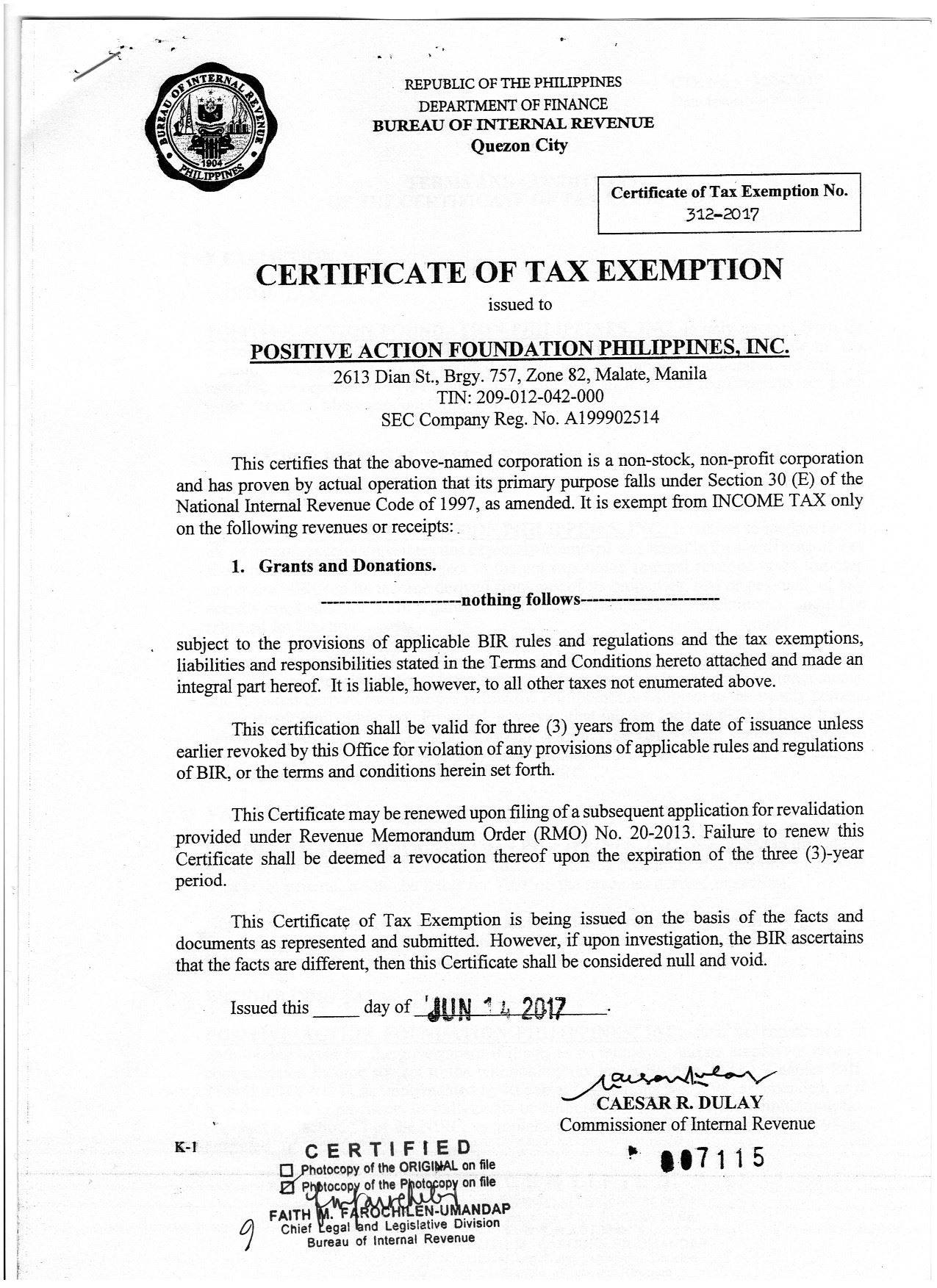

BIR Certificate Of Tax Exemption PAGA

https://mldxg0t9jgcn.i.optimole.com/w:813/h:303/q:auto/https://www.paga.ph/wp-content/uploads/2021/11/bir-tax-exemption.jpg

Verkko 1 lokak 2015 nbsp 0183 32 Increased exemption You may be able to increase your tax free exemption payment to up to 20 160 plus the 765 for each year of service if you Verkko 26 kes 228 k 2018 nbsp 0183 32 Apart from earnings which are always taxable the first 163 30 000 of your redundancy package is likely to be exempt But it is your employer s responsibility to

Verkko 1 jouluk 2023 nbsp 0183 32 Lea D Uradu Fact checked by Suzanne Kvilhaug Severance pay may be given to individuals by their company when their employment is terminated It s taxed Verkko A statutory redundancy payment is exempt from income tax ITEPA 2003 s309 However it reduces the 163 30 000 annual exemption under ITEPA 2003 s403

Invoice Payment Free Stock Photo Public Domain Pictures

https://www.publicdomainpictures.net/pictures/270000/velka/invoice-payment.jpg

Best Instant Personal Loan App In India SmartCoin

https://blog.smartcoin.co.in/wp-content/uploads/2023/03/Tax-Exemption-scaled.jpg

https://www.gov.uk/hmrc-internal-manuals/employment-income-manual/…

Verkko A statutory redundancy payment made under the Employment Rights Act 1996 or the Employment Rights Northern Ireland Order 1996 is exempt from liability to tax as

https://www.revenue.ie/.../redundancy-lump-sum-payments.aspx

Verkko 25 hein 228 k 2023 nbsp 0183 32 Home Life events and personal circumstances Leaving a job and unemployment Redundancy lump sum payments You may receive a lump sum

What Tax Do I Pay On Redundancy Payments Accounting Firms

Invoice Payment Free Stock Photo Public Domain Pictures

Elite Universities Must Purpose Endowments To Subsidize Students

Redundancy Payment What To Do With It

2017 PAFPI Certificate of TAX Exemption Certificate Of

Exemption From Taxation Blingby

Exemption From Taxation Blingby

Tax Exemption Line Icon Vector Illustration 8081251 Vector Art At Vecteezy

Freelance Accounting Personal Tax Services

How Redundancy Payments Will Be Affected By Tax FTAdviser

Tax Exemption Redundancy Payments - Verkko If all you have is a redundancy payment up to 163 30 000 against which your employer has allowed an exemption and the amount of post employment notice pay is Nil just fill in