Tax Incentive For Buying Hybrid Car You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their See more

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs

Tax Incentive For Buying Hybrid Car

Tax Incentive For Buying Hybrid Car

https://cenrep.ncsu.edu/cenrep/wp-content/uploads/2017/10/Not_too_bright._3678784084-e1507044513387.jpg

Getting Electric Vehicle Tax Incentives Right Why Market Power

https://blogs.worldbank.org/sites/default/files/users/user986/figure 01.JPG

Cheapest Electric Car 2022 With Tax Credit Relase Date

https://img.money.com/2022/12/News-Save-buying-electric-car-using-tax-credits.jpg?crop=0px%2C183px%2C2880px%2C1620px&quality=85

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the tax credit

If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in Find out how you can save money through Federal tax incentives on your purchase of a new plug in hybrid or electric vehicle

Download Tax Incentive For Buying Hybrid Car

More picture related to Tax Incentive For Buying Hybrid Car

A Tax Incentive For Innovation Trade Only Today

https://www.tradeonlytoday.com/.image/t_share/MTg2ODYwOTY0MTc0Mzc0Mzky/1_img_0769-1.jpg

Can I Get A Tax Credit For Buying A Used Hybrid Car Juiced Frenzy

https://i0.wp.com/juicedfrenzy.com/wp-content/uploads/2021/11/Depositphotos_131877390_S.jpg?fit=1000%2C751&ssl=1

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

The IRS has given automakers a little more wiggle room around which electric vehicles will qualify for a federal tax credit worth up to 7 500 The change which gives A federal hybrid car tax credit is available to consumers who buy plug in electric vehicles EVs in the United States According to the U S Department of Energy you can receive a tax credit of

We ve compiled every new plug in hybrid that is eligible to receive either the partial 3750 or the full 7500 federal incentive Below is a list of used EVs PHEVs and FCVs eligible for a federal tax credit of up to 4 000 as of April 9 2024 The latest additions to the list include models from GMC and

All About Tax Credit For EV PHEV And Hybrid Cars CarBuzz

https://cdn.carbuzz.com/gallery-images/1600/954000/800/954828.jpg

Toyota C HR Hybrid Is The First Thai Tax Incentive Model Gets 75 Of

http://s3.paultan.org/image/2017/12/Toyota-C-HR-Thailand-11-1200x675.jpeg

https://www.irs.gov › credits-deductions › credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their See more

https://www.cars.com › articles

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids

Aqua Prius Fit Or Vezel Guide For Buying Hybrid Vehicles At

All About Tax Credit For EV PHEV And Hybrid Cars CarBuzz

How Do The Used And Commercial Clean Vehicle Tax Credits Work Blink

11 Types Of Tax Incentives How They Differ In Their Functionality

THE MOST IMPORTANT DISCUSSION WE CAN HAVE IS TAX INCENTIVE FOR

When Is The Official UK Ban On New Petrol Diesel And Hybrid Car Sales

When Is The Official UK Ban On New Petrol Diesel And Hybrid Car Sales

5 Things To Know Before Buying A Hybrid Camera

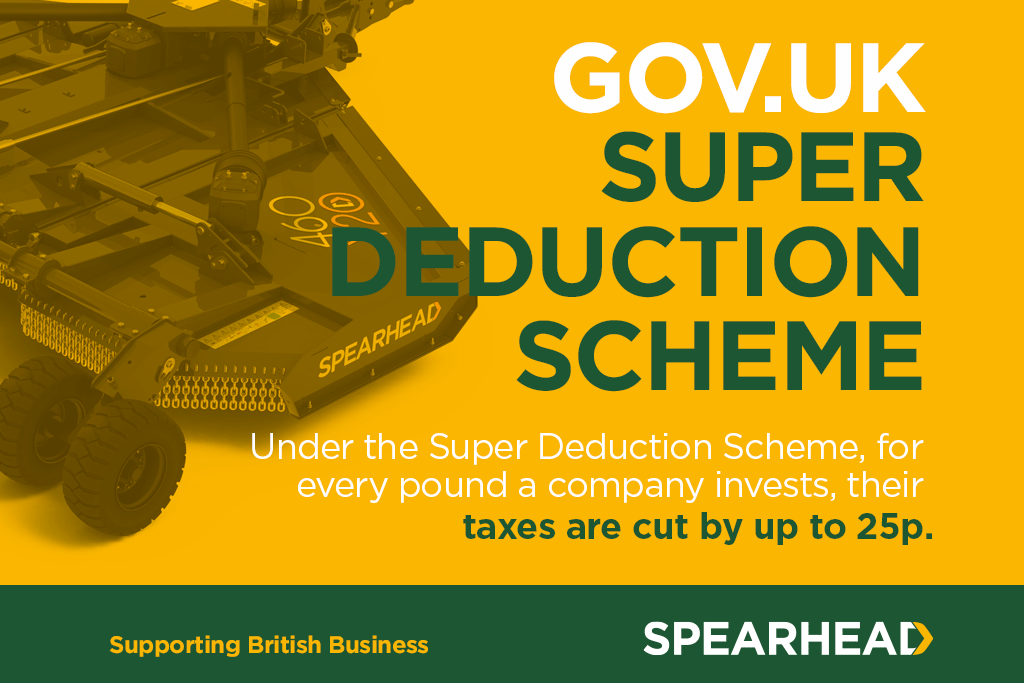

Cut Your Business Tax Bill By Up To 25p In The Pound Spearhead

Review Of Tax Incentive For Automation In Manufacturing And Services Sector

Tax Incentive For Buying Hybrid Car - Find out how you can save money through Federal tax incentives on your purchase of a new plug in hybrid or electric vehicle