Tax Rebate On Joint Housing Loan Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

Web 26 juil 2019 nbsp 0183 32 Income Tax benefits on Housing Loan for Joint Owner of Rs 2 Lakh each Section 24 b of Income Tax Act 1961 amended Conditions for claiming Interest on Web 7 avr 2022 nbsp 0183 32 1 You Must Be One of the Property s Co Owners You should be the property owner to receive tax advantages for a joint home loan According to the property

Tax Rebate On Joint Housing Loan

Tax Rebate On Joint Housing Loan

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/s1600/1644859917358770-0.png

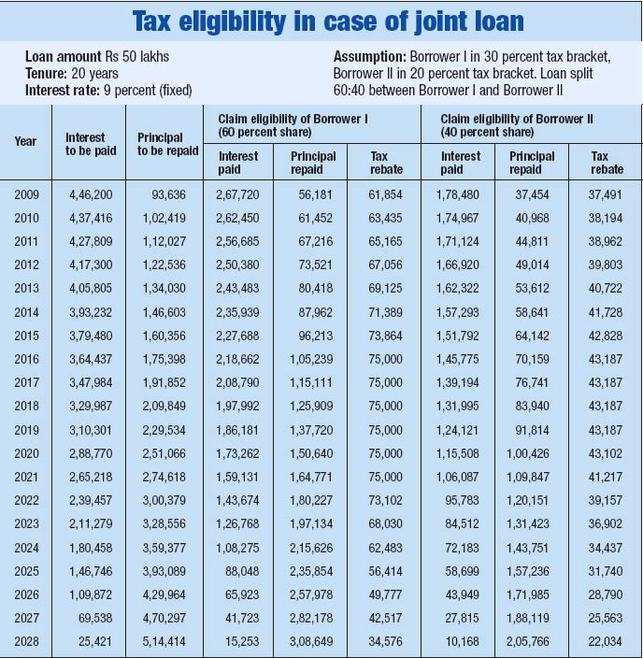

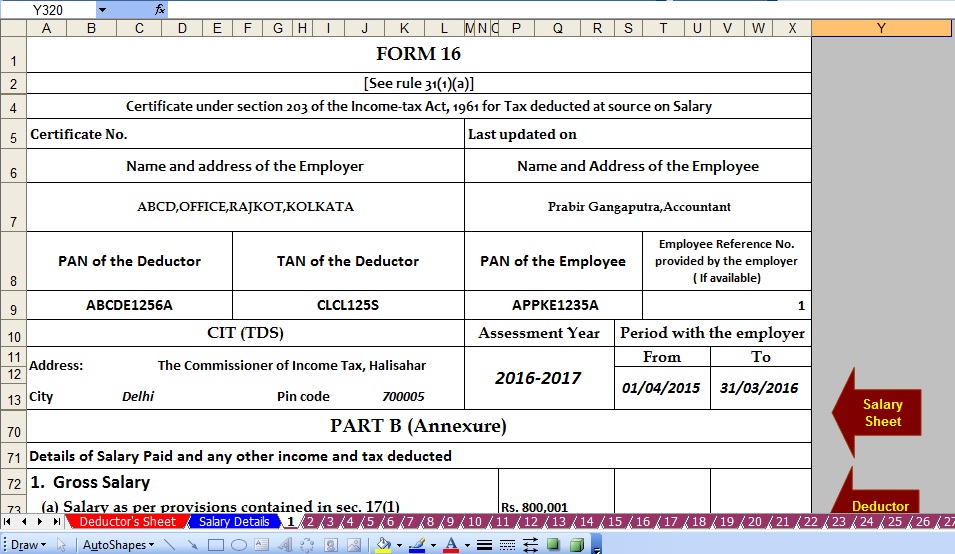

Housing Loans Joint Declaration Form For Housing Loan

https://2.bp.blogspot.com/-sEZi3B4NgBo/VpntlQpZH5I/AAAAAAAAA0Q/gBvZ8XGhTUU/s1600/16%2BPart%2BB.jpg

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-pWSLuq4buU8/YgqSC60pH3I/AAAAAAAAYds/gMCrObm9nqoSd_ngGI_lj0MQT9LaKz7KACNcBGAsYHQ/s1600/1644859913400453-1.png

Web 10 juil 2020 nbsp 0183 32 Both you and your wife will qualify for a rebate on home loan interest rates as well as higher tax benefits with registration fees as lenders offer reduced interest rates to female borrowers If you want to Web 31 mai 2022 nbsp 0183 32 Also borrowers with a joint loan who are also co owners of a property can claim tax rebates on housing credit Property must be fully constructed to claim tax deductions In case the house is not built it

Web 16 oct 2012 nbsp 0183 32 A maximum of 4 to 6 joint applicants are eligible for tax rebate under this clause Thus availing a joint home loan is certainly a lucrative financial option to buy a Web 11 avr 2023 nbsp 0183 32 In the case of a joint home loan both co borrowers can claim a deduction of up to Rs 50 000 each provided they are both first time home buyers and the loan

Download Tax Rebate On Joint Housing Loan

More picture related to Tax Rebate On Joint Housing Loan

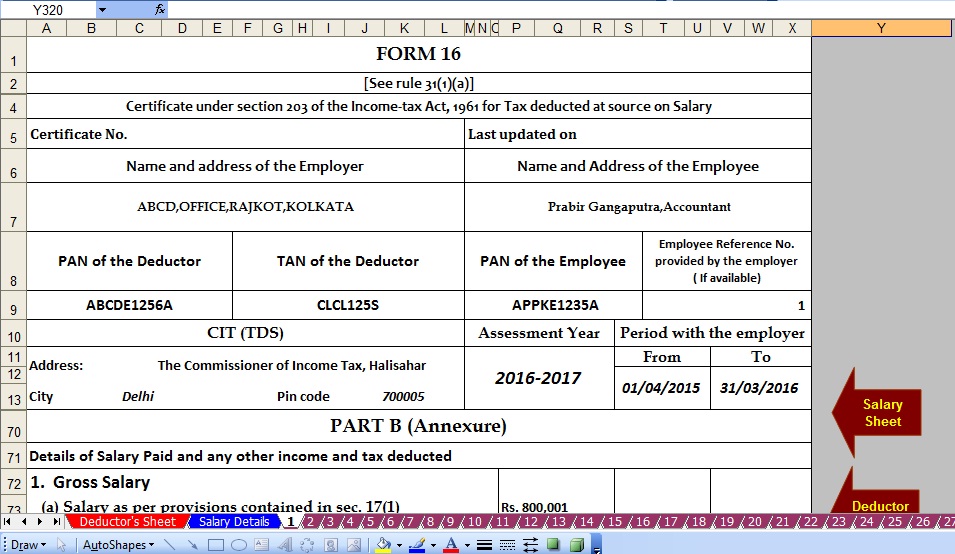

Tax Benefits Of A Joint Home Loan To Co borrowers The Economic Times

https://img.etimg.com/thumb/msid-5256148,width-643,imgsize-108731,resizemode-4/tax-benefits-of-a-joint-home-loan-to-co-borrowers.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Web 5 f 233 vr 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs Web if you have taken a home loan but continue to reside in a rented property you can claim tax benefits against HRA as well in the case of a joint home loan both borrowers can claim

Web 11 janv 2023 nbsp 0183 32 How to maximise tax rebate under Section 80C If a property is jointly owned each co borrower can claim Rs 1 50 lakhs as tax deduction on their respective incomes under Section 80C For spouses Web Getting a tax break for a joint home loan Income tax rebate on home loan Perks of tax advantaged home loans with second homes FAQs If we take out a house loan could

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

https://housing.com/news/claim-tax-benefits-joint-home-loans

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

https://taxguru.in/income-tax/tax-benefits-home-loan-joint-owners.html

Web 26 juil 2019 nbsp 0183 32 Income Tax benefits on Housing Loan for Joint Owner of Rs 2 Lakh each Section 24 b of Income Tax Act 1961 amended Conditions for claiming Interest on

FREE 8 Loan Receipt Templates Examples In MS Word PDF

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

New Home HST Rebate HST Housing Rebate Ontario Canada Home Tax

New Home HST Rebate HST Housing Rebate Ontario Canada Home Tax

GST HST New Housing Rebate Rebates House With Land Home Construction

Save Tax Opt For Joint Home Loan With Indiabulls Home Loa Flickr

Latest Income Tax Rebate On Home Loan 2023

Tax Rebate On Joint Housing Loan - Web 22 janv 2020 nbsp 0183 32 Tax Benefit on Joint Home Loan For claiming tax benefits you should be a co applicant as well as a joint owner of the loan Know how to claim tax benefits on