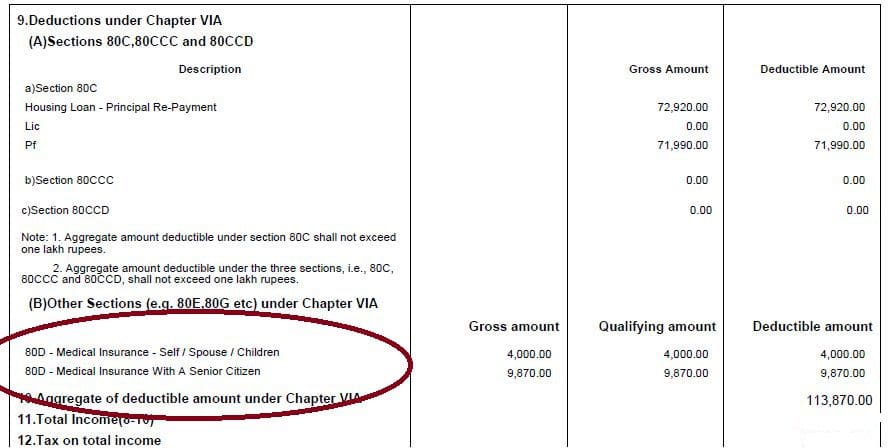

Tax Rebate On Mediclaim Policy Web 26 juin 2018 nbsp 0183 32 ANSWER Considering the above provisions the deduction in case of Mr Raja will be as follows 1 Medical insurance premium on his policy of Rs 15 000 will qualify for deduction 2 Medical insurance

Web 5 nov 2019 nbsp 0183 32 What are the Tax Benefits of Buying a Mediclaim Policy HEALTH INSURANCE Published on 5 Nov 2019 Updated on 7 Aug 2023 Views Method is not Web 18 d 233 c 2022 nbsp 0183 32 How to avail tax rebate on mediclaim policy 1 min read 18 Dec 2022 08 52 PM IST Parizad Sirwalla As per the current provisions of the section an individual taxpayer is eligible for claiming

Tax Rebate On Mediclaim Policy

Tax Rebate On Mediclaim Policy

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

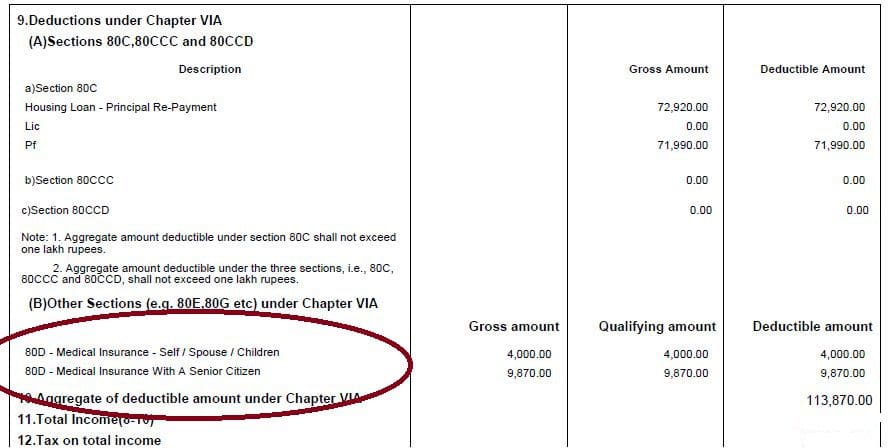

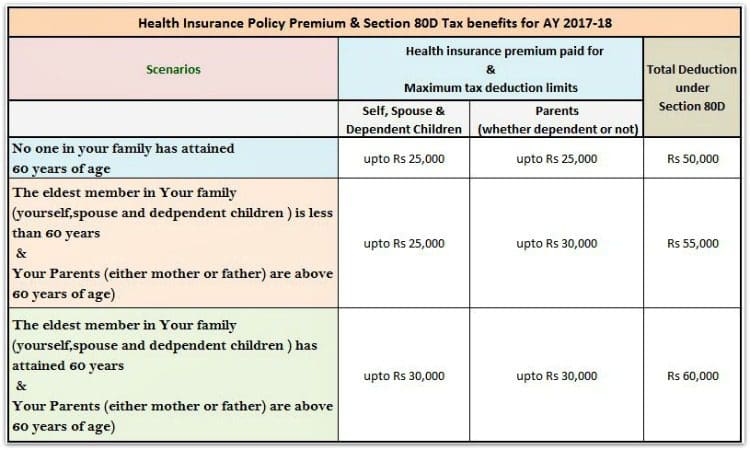

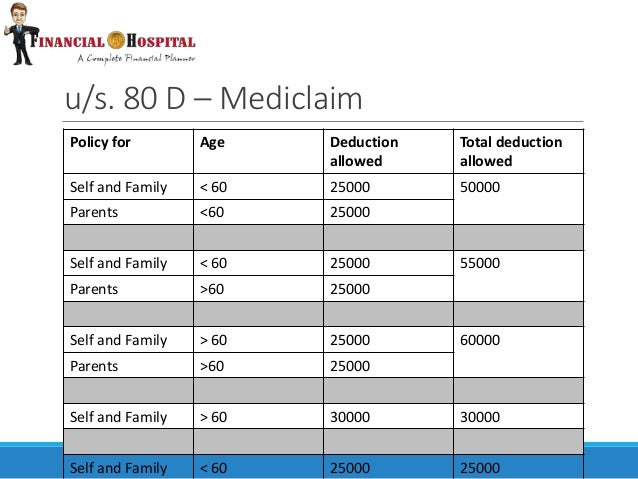

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

https://www.relakhs.com/wp-content/uploads/2014/11/Medical-allowance-form-16.jpg

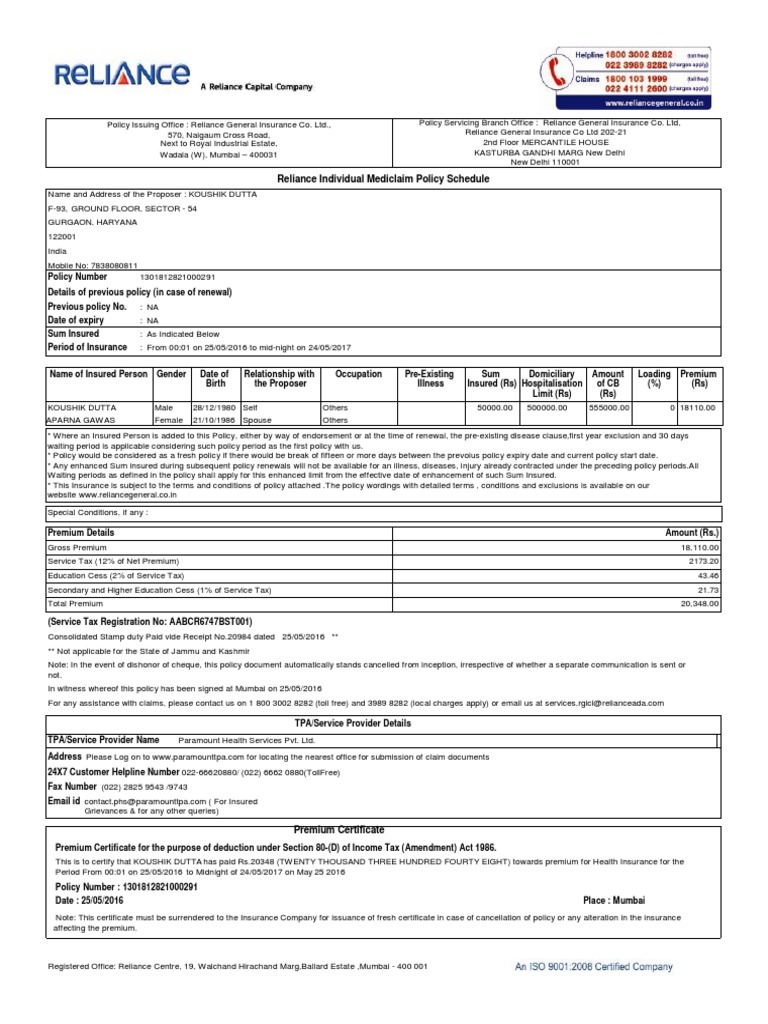

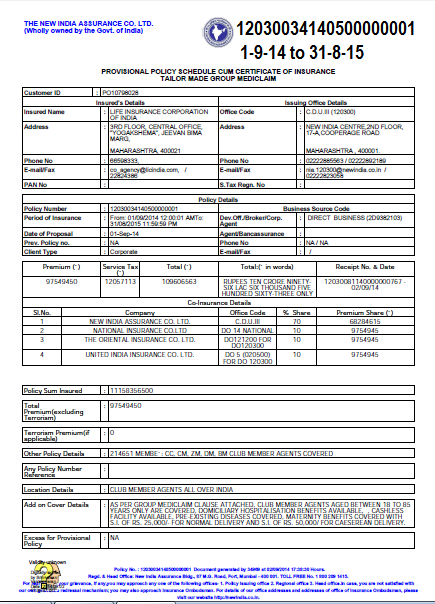

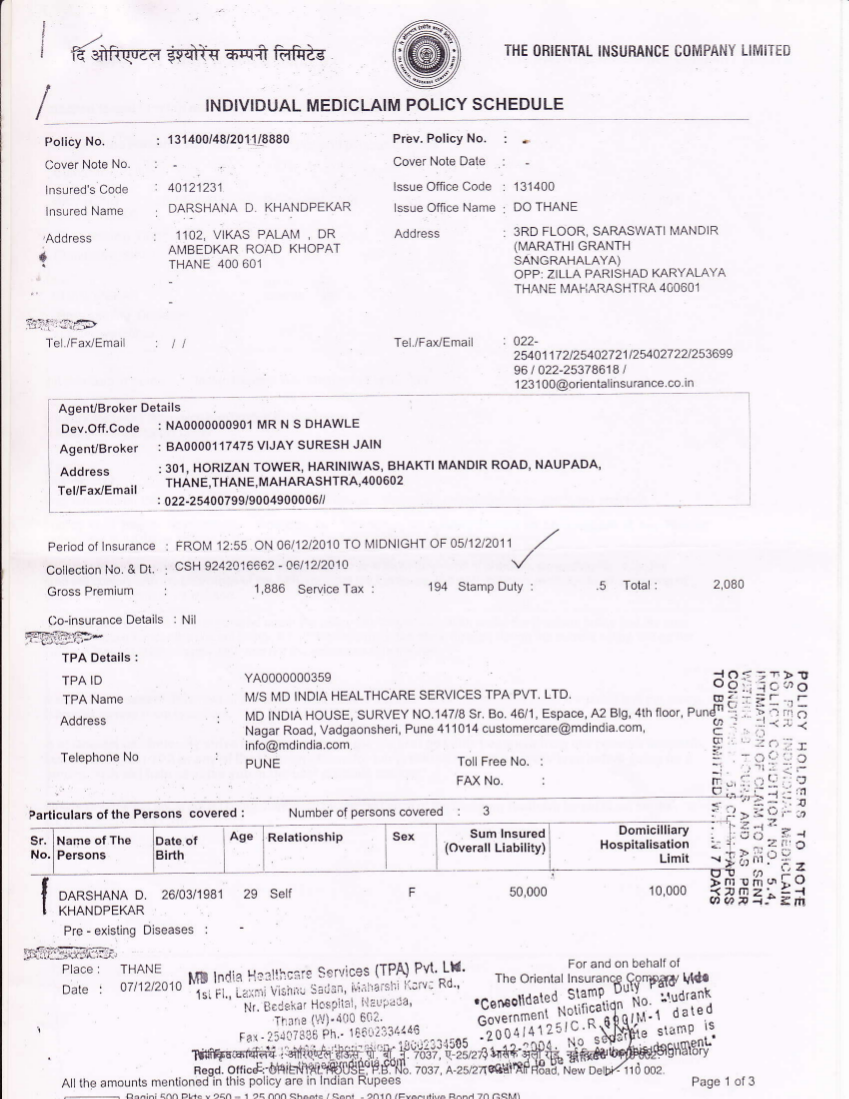

Mediclaim Receipt Insurance Taxes

https://imgv2-2-f.scribdassets.com/img/document/368529097/original/d24413953c/1547041318?v=1

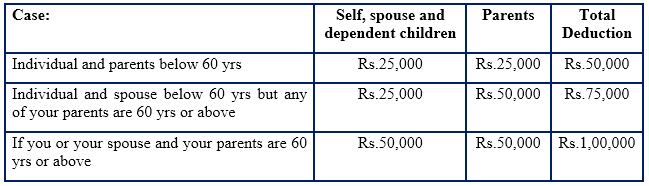

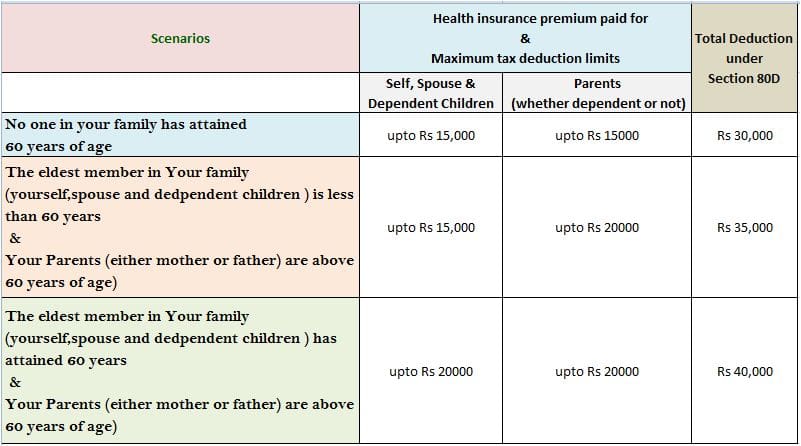

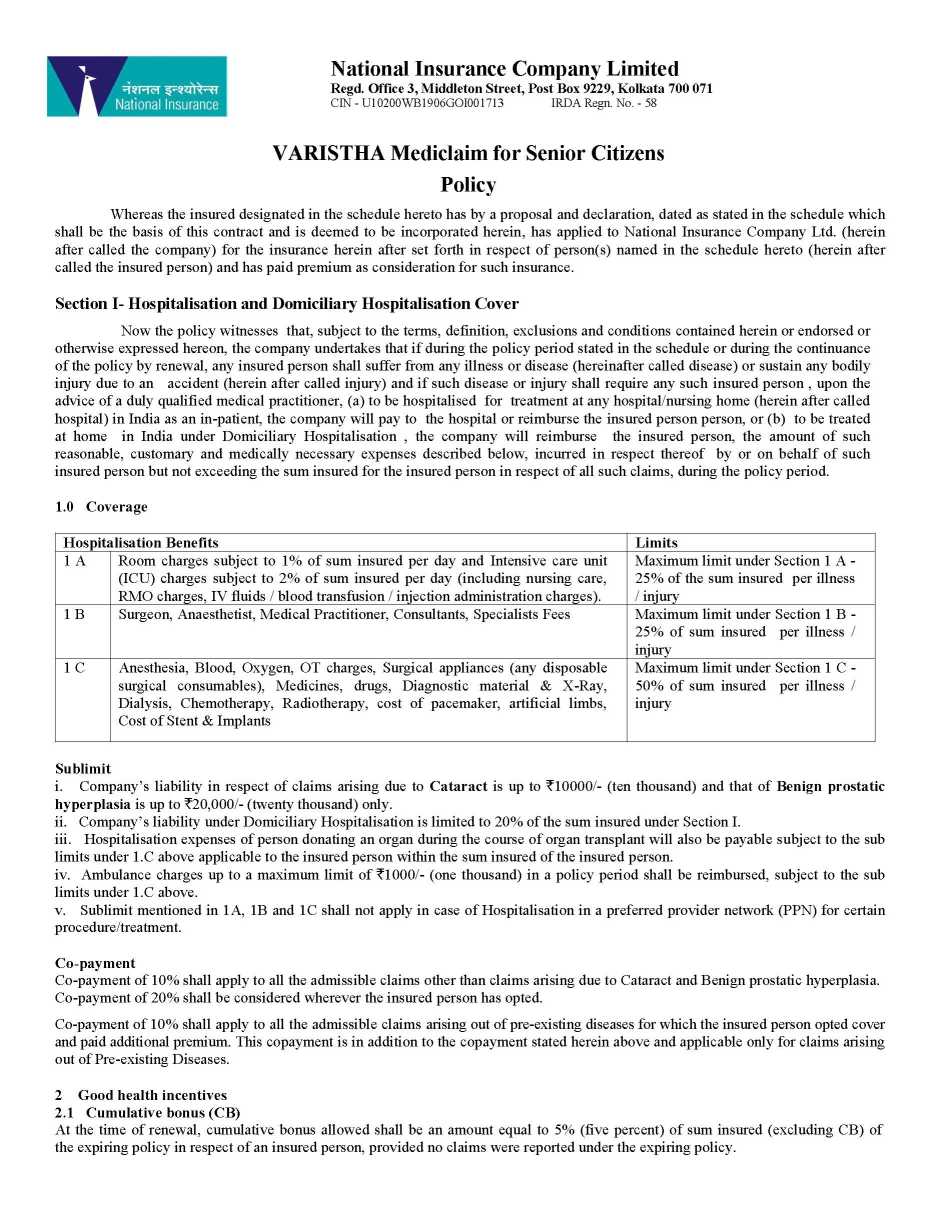

Web 14 juin 2018 nbsp 0183 32 Deduction of Medical Expenses for Senior Citizens Section 80D For the welfare of senior citizens Resident aged 60 or above who don t have health Web Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction for any expenses

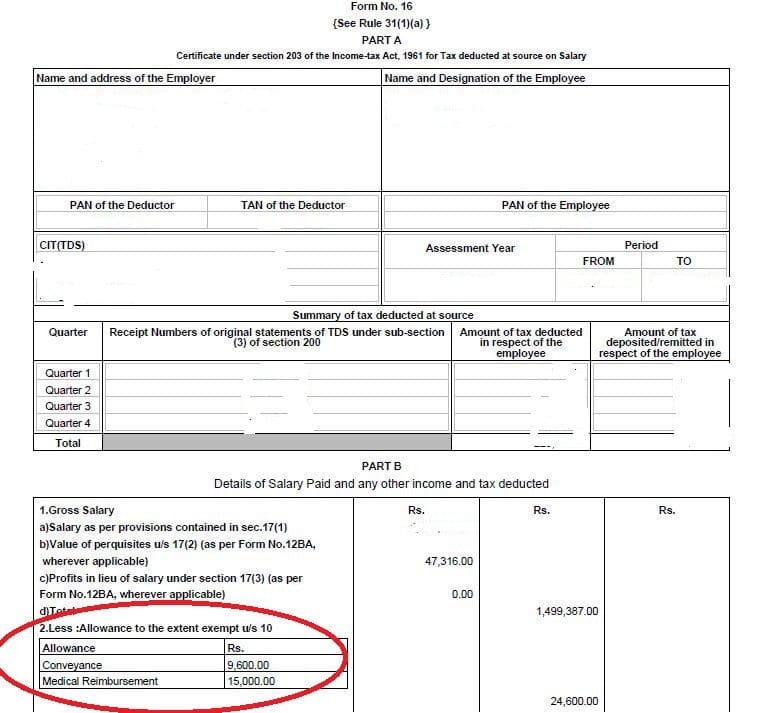

Web 3 ao 251 t 2023 nbsp 0183 32 Secure your health and save on taxes with Section 80D Explore the income tax deductions available for medical insurance premiums Understand the eligibility criteria and the tax benefits you can Web 26 d 233 c 2022 nbsp 0183 32 Taxpayers would be required to pay income tax on expenses that surpass Rs 15 000 if they exceed that amount For reimbursement of medical expenses up to Rs 15 000 the employer will thereafter

Download Tax Rebate On Mediclaim Policy

More picture related to Tax Rebate On Mediclaim Policy

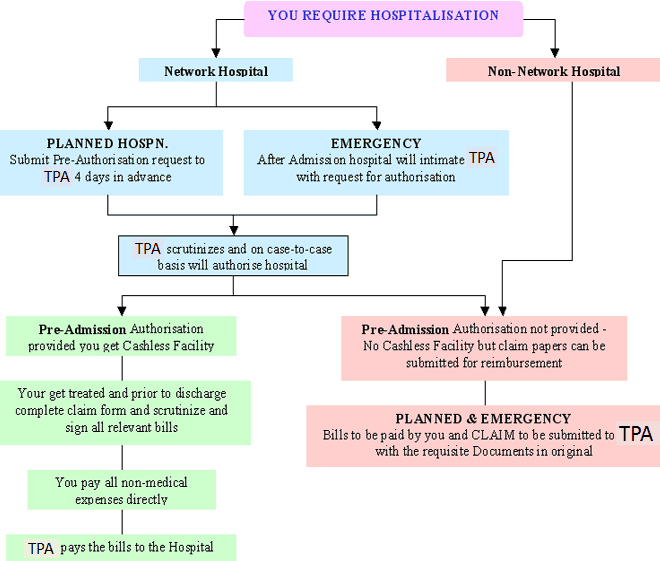

All You Wanted To Know About The Mediclaim Policy In India

https://www.holisticinvestment.in/wp-content/uploads/2020/08/tax-benefits-for-mediclaim-policy.png

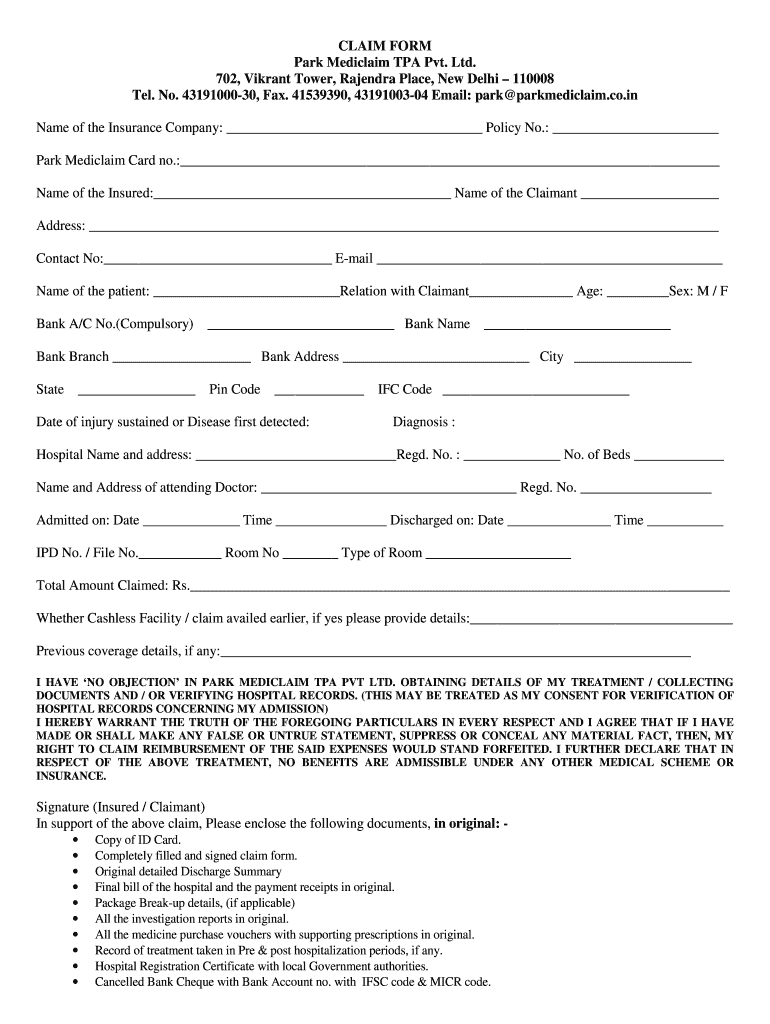

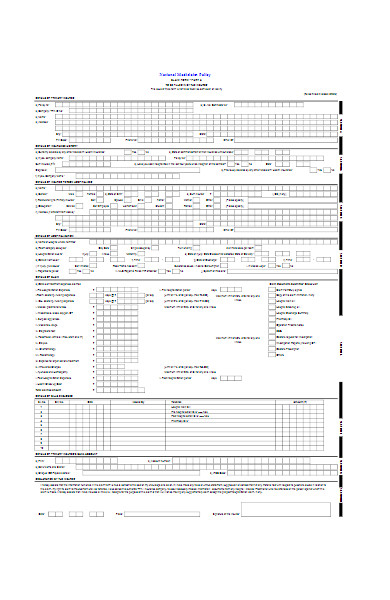

Park Mediclaim Reimbursement Claim Form Fill Online Printable

https://www.pdffiller.com/preview/326/873/326873657/large.png

Section 80D Tax Benefits Health Or Mediclaim Insurance

http://www.relakhs.com/wp-content/uploads/2014/11/health-insurance-premium-section-80d-deductions.jpg

Web The premium you pay towards a mediclaim or health insurance policy qualifies for tax deduction under Section 80D of the Income Tax Act 1961 That is it reduces your tax Web 9 juin 2019 nbsp 0183 32 Under Section 80D a resident individual can claim a tax deduction of up to 25 000 in a year for medical insurance premiums If you were to claim tax benefit proportionately you would get a

Web 18 d 233 c 2022 nbsp 0183 32 As per the current provisions of the section an individual taxpayer is eligible for claiming deduction up to the prescribed limit being 50 000 in your case wherein Web 23 avr 2020 nbsp 0183 32 Speaking about medical reimbursement it is an option available to employees wherein their employers reimburse their medical treatment costs Under the Income Tax

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2014/11/Mediclaim-section-80d-form-16.jpg

InsureRelaxInfo Agents Club Members Group Mediclaime Policy 2014 15

http://4.bp.blogspot.com/-zRFL-W3SRts/VDYK5UuTuoI/AAAAAAAAClo/yqDSUGRLvis/s1600/2014%2Bmediclaime%2Bpolicy.png

https://taxguru.in/income-tax/all-about-deducti…

Web 26 juin 2018 nbsp 0183 32 ANSWER Considering the above provisions the deduction in case of Mr Raja will be as follows 1 Medical insurance premium on his policy of Rs 15 000 will qualify for deduction 2 Medical insurance

https://www.careinsurance.com/blog/mediclaim-insurance-articles/what...

Web 5 nov 2019 nbsp 0183 32 What are the Tax Benefits of Buying a Mediclaim Policy HEALTH INSURANCE Published on 5 Nov 2019 Updated on 7 Aug 2023 Views Method is not

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Rajesh Haldipur s Web Log Oriental Insurance Rejects Mediclaim Claim

Tax Planning For Salaried Individual

National Insurance Company Varistha Mediclaim Policy 2021 2022

80d Medical Insurance Premium Receipt Pdf Fill Online Printable

80d Medical Insurance Premium Receipt Pdf Fill Online Printable

All You Want To Know About Mediclaim Policy

Browse Our Image Of Medical Insurance Receipt Template Invoice

FREE 50 Hospital Forms In PDF MS Word MS Excel

Tax Rebate On Mediclaim Policy - Web 14 juin 2018 nbsp 0183 32 Deduction of Medical Expenses for Senior Citizens Section 80D For the welfare of senior citizens Resident aged 60 or above who don t have health