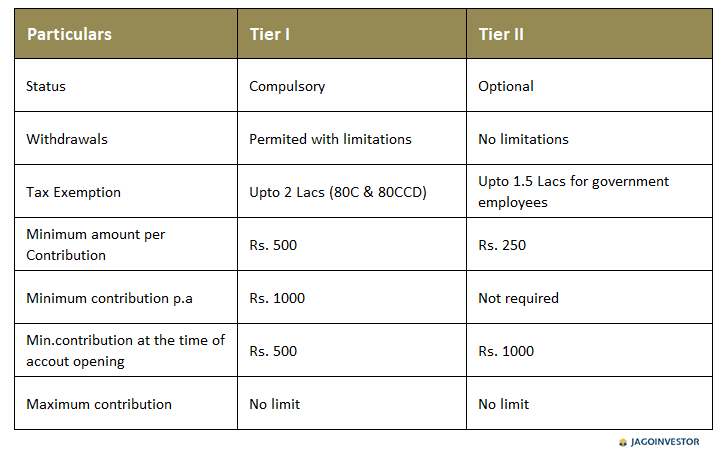

Tax Rebate On Nps Tier 2 Web 21 sept 2022 nbsp 0183 32 Tier I is a mandatory account for all NPS investors while Tier II is voluntary Tier I investments are eligible for NPS deductions or NPS tax saving benefits under Section 80C and Section 80CCD 1B of

Web Unlike a Tier I NPS account Tier II NPS accounts do not qualify for a tax rebate under Section 80C of the Income Tax Act When it comes to NPS tax benefits another point to Web 16 sept 2022 nbsp 0183 32 How the withdrawal from NPS tier 2 is taxed Is any indexation or tax on only capital gain will be available Withdrawals from NPS Tier 2 are taxed at 20 after indexation if held for more than 36

Tax Rebate On Nps Tier 2

Tax Rebate On Nps Tier 2

https://img.etimg.com/photo/53350143/nps3.jpg

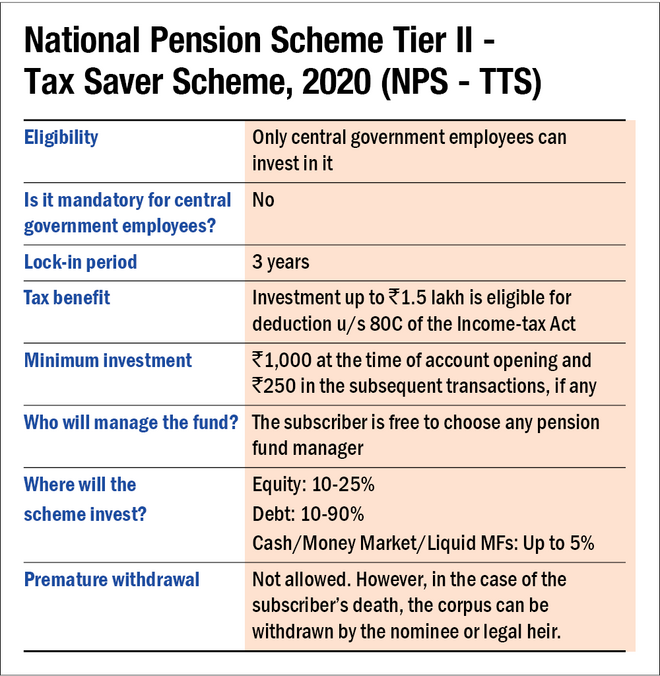

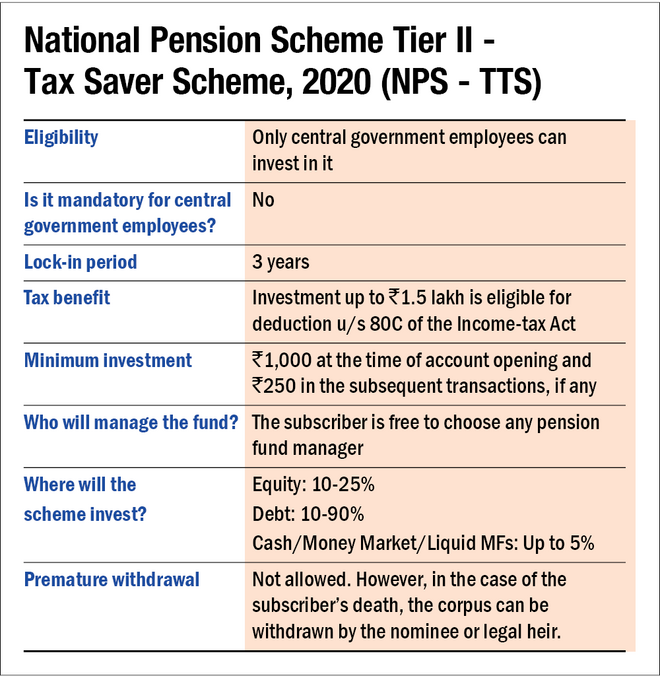

New NPS Tier II Scheme Gives Tax Benefit To Central Government

https://www.valueresearchonline.com/content-assets/images/48432_national_pension_scheme_tier_ii-table1__w660__.png

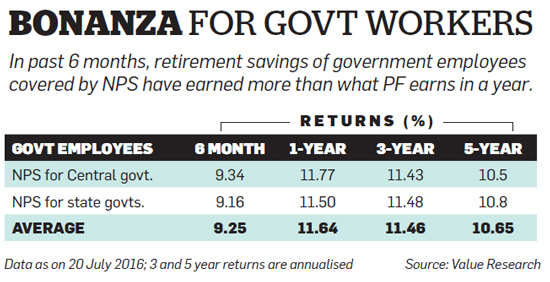

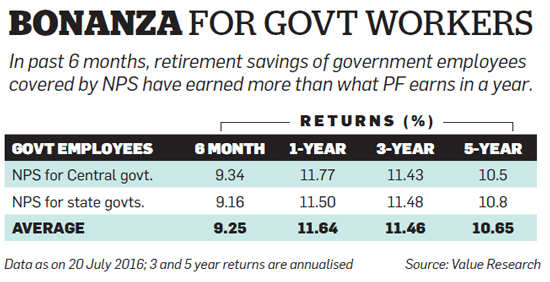

With 11 Returns NPS Tier II Outshines Bank FDs Liquid Funds Mint

https://images.livemint.com/img/2020/09/23/original/Capture_1600850918894.PNG

Web 24 juin 2020 nbsp 0183 32 If a Government employee contributes towards Tier II of NPS the tax benefit of Section 80C for deduction up to Rs 1 50 lakh will be available to them provided that Web Tax implications on NPS Tier 2 Account The deposits that you make towards the Tier 2 Account would not get any tax benefits They would form a part of your taxable income

Web 7 f 233 vr 2020 nbsp 0183 32 Tax Benefit on NPS Tier 1 and or 2 NPS has two Tiers 1 and 2 NPS Tier 1 is the long term investment which has restricted withdrawals and meant primarily for retirement planning On maturity Web 10 juil 2020 nbsp 0183 32 They can claim tax rebate of Rs 1 50 lakh annually under Section 80C of the Income Tax Act However the condition is that the lock in period of three years will now

Download Tax Rebate On Nps Tier 2

More picture related to Tax Rebate On Nps Tier 2

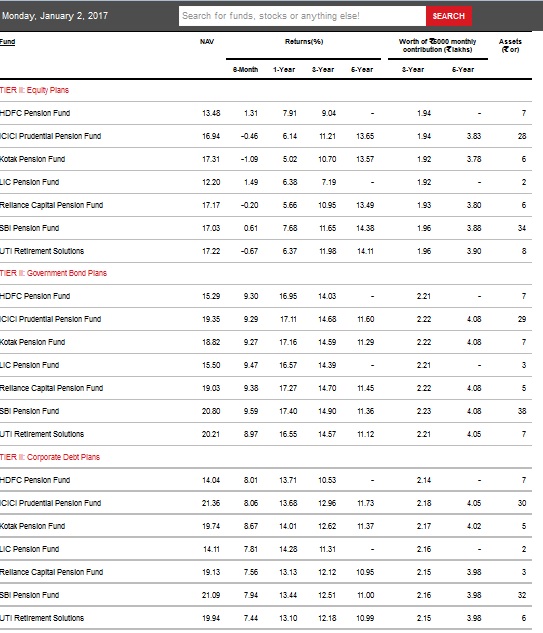

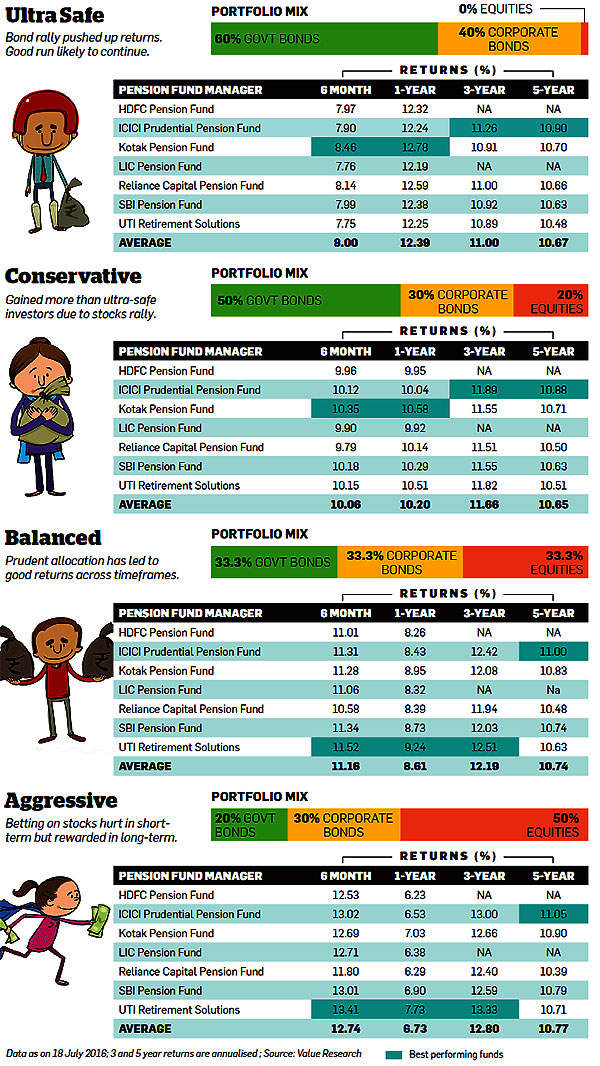

Should You Invest In National Pension System NPS Tier 2 Account

https://3.bp.blogspot.com/-FQhgkPFxA-A/WGuHCNBJdwI/AAAAAAAADew/PodkGYxOzQoBUAhFLTLWo831Yv0Jm7Z0ACLcB/s1600/NPS%2Breturns.jpg

Should You Invest In Tier II NPS Business News

https://smedia2.intoday.in/btmt/images/stories/Newstaffpics/tier-ii_111616013407.jpg

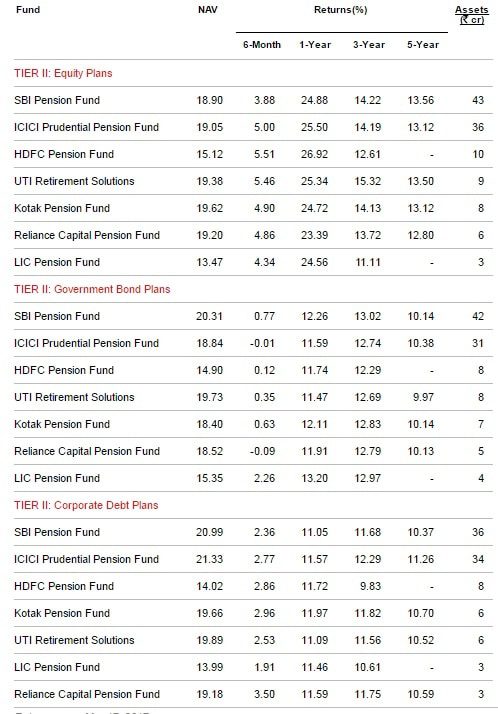

Best NPS Funds 2019 Top Performing NPS Scheme

https://www.relakhs.com/wp-content/uploads/2019/01/Latest-NPS-rules-changes-norms-2019-revised-NPS-scheme-Tier-2-tax-benefits-80c.jpg

Web 2 avr 2019 nbsp 0183 32 NPS Tax Benefit Sec 80C and Additional Tax Rebate Asset Yogi 3 7M subscribers Subscribe 9 3K Share 374K views 4 years ago Income Tax NPS tax benefits are offered under section Web 11 juil 2021 nbsp 0183 32 How your NPS Tier II account withdrawals are taxed 4 min read 11 Jul 2021 09 51 AM IST Balwant Jain There is no specific and direct provision for taxation of withdrawal from NPS Tier

Web Tax Benefits NPS tier 2 Tax benefits on all the contributions made to Tier 2 are only available for government employees NPS tier 2 tax benefits cannot be claimed by Web 6 d 233 c 2022 nbsp 0183 32 December 6 2022 NPS Tier 2 Returns Withdrawal Tax Benefit amp How to Open The Pension Fund Regulatory and Development Authority oversees the central

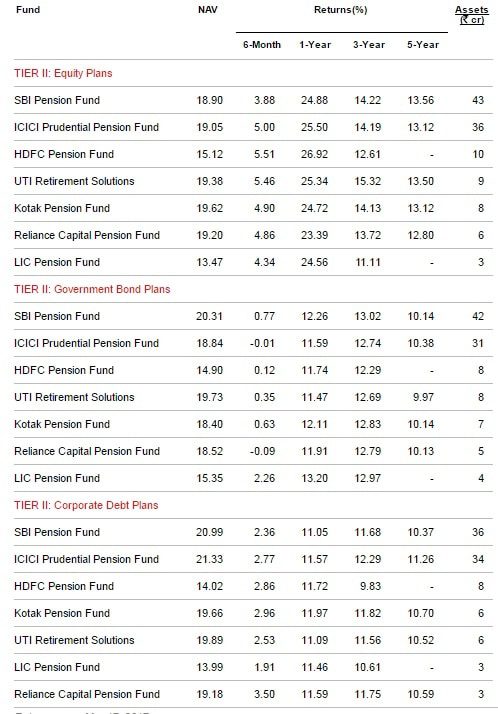

Nps tier2 returns

https://bemoneyaware.com/wp-content/uploads/2017/03/nps-tier2-returns.jpg

Low cost NPS Tier II Has Beaten Direct MFs The Economic Times

https://img.etimg.com/photo/53393680/another-gfx.jpg

https://www.etmoney.com/learn/nps/nps-tax-…

Web 21 sept 2022 nbsp 0183 32 Tier I is a mandatory account for all NPS investors while Tier II is voluntary Tier I investments are eligible for NPS deductions or NPS tax saving benefits under Section 80C and Section 80CCD 1B of

https://www.hdfcbank.com/personal/resources/learning-centre/invest/how...

Web Unlike a Tier I NPS account Tier II NPS accounts do not qualify for a tax rebate under Section 80C of the Income Tax Act When it comes to NPS tax benefits another point to

NPS National Pension Scheme A Beginners Guide For Rules Benefits

Nps tier2 returns

NPS Should You Invest In Its Tier II Account

How To Open An NPS Tier 2 Account

NPS Tier 2 Withdrawal Via Online In 2021 Taxation Time Charges

NPS Tier 2 Alternative To Savings Account FDs Or Debt Mutual Funds

NPS Tier 2 Alternative To Savings Account FDs Or Debt Mutual Funds

How To Open An NPS Tier 2 Account

NPS Calculator Best NPS Fund Manager 2019

Change In Operational Guidelines For NPS Tier II Tax Saver Scheme 2020

Tax Rebate On Nps Tier 2 - Web 6 f 233 vr 2023 nbsp 0183 32 Tier 2 tax benefits are available only for Government Employees Let us discuss one by one as below NPS Tax Benefits under Sec 80CCD 1 The maximum