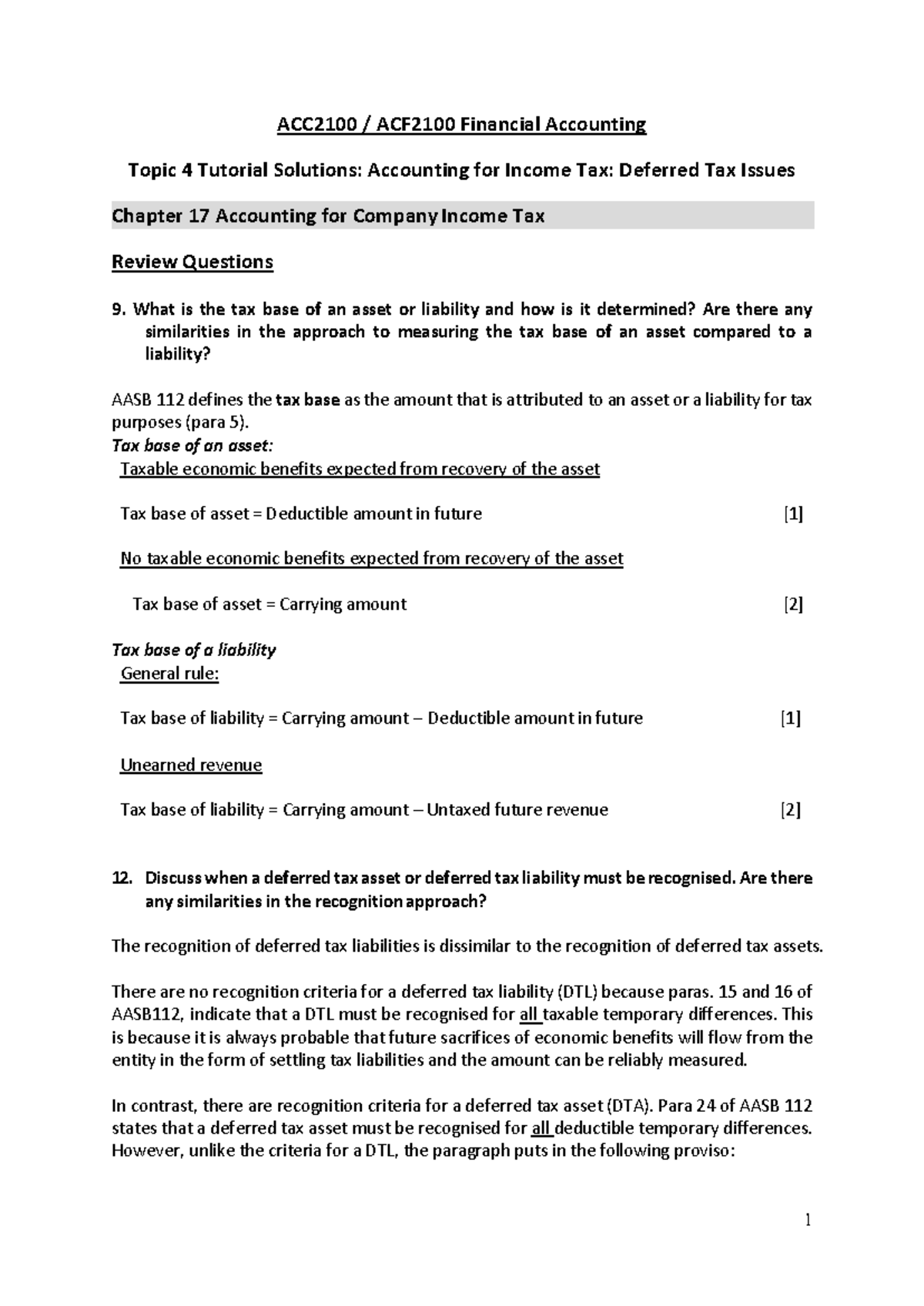

What Is The Tax Benefit On Nps Verkko 20 syysk 2022 nbsp 0183 32 Now there are three sections under which tax benefits can be claimed by individuals First is Section 80CCD 1 where NPS competes with other investments like provident fund PPF life insurance premiums tax saving mutual funds etc The second is Section 80CCD 1B which is an additional tax benefit only given to NPS

Verkko The NPS scheme holds immense value for anyone who works in the private sector and requires a regular pension after retirement The scheme is portable across jobs and locations with tax benefits under Section 80C and Section 80CCD Verkko 26 kes 228 k 2020 nbsp 0183 32 The tax benefit of Section 80CCD 2 is available only to those who are working and earning a salary income and not to a non salaried individual Under the new tax regime the tax benefit on

What Is The Tax Benefit On Nps

What Is The Tax Benefit On Nps

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

Different Types Of National Pension Scheme Accounts And Tax Benefits

https://www.alankit.com/blog/blogimage/different-types-of-nps-accounts-and-tax-benefits.jpg

National Pension Scheme Know About Nps Returns Types Benefits My XXX

https://www.canarahsbclife.com/content/dam/choice/blog-inner/images/nps-returns-meaning-and-benefits-of-nps-returns.jpg

Verkko The main tax benefit on NPS is available when the subscriber is contributing money to their Tier 1 account As explained on this page the NPS tax exemptions are available for both self contribution and employer contribution Verkko 1 What are the tax benefits under NPS Tax Benefit available to Individual Any individual who is Subscriber of NPS can claim tax benefit under Sec 80 CCD 1 with in the overall ceiling of Rs 1 5 lac under Sec 80 CCE Exclusive Tax Benefit to all NPS Subscribers u s 80CCD 1B

Verkko 17 syysk 2019 nbsp 0183 32 What are the Tax Benefits of NPS As of FY 2019 20 any NPS subscriber can claim tax deductions maximum up to 10 of their gross income under Section 80CCD 1 within the overall limit of Rs 1 50 lakh u s Verkko 28 jouluk 2023 nbsp 0183 32 Tax Benefits and Savings for Young Adults Young adults can benefit from the National Pension Scheme NPS in various ways One of those benefits is its tax deduction allowance of up to Rs 1

Download What Is The Tax Benefit On Nps

More picture related to What Is The Tax Benefit On Nps

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

https://www.relakhs.com/wp-content/uploads/2019/08/Latest-NPS-Income-Tax-Benefits-for-FY-2019-2020-AY-2020-2021-pic.jpg

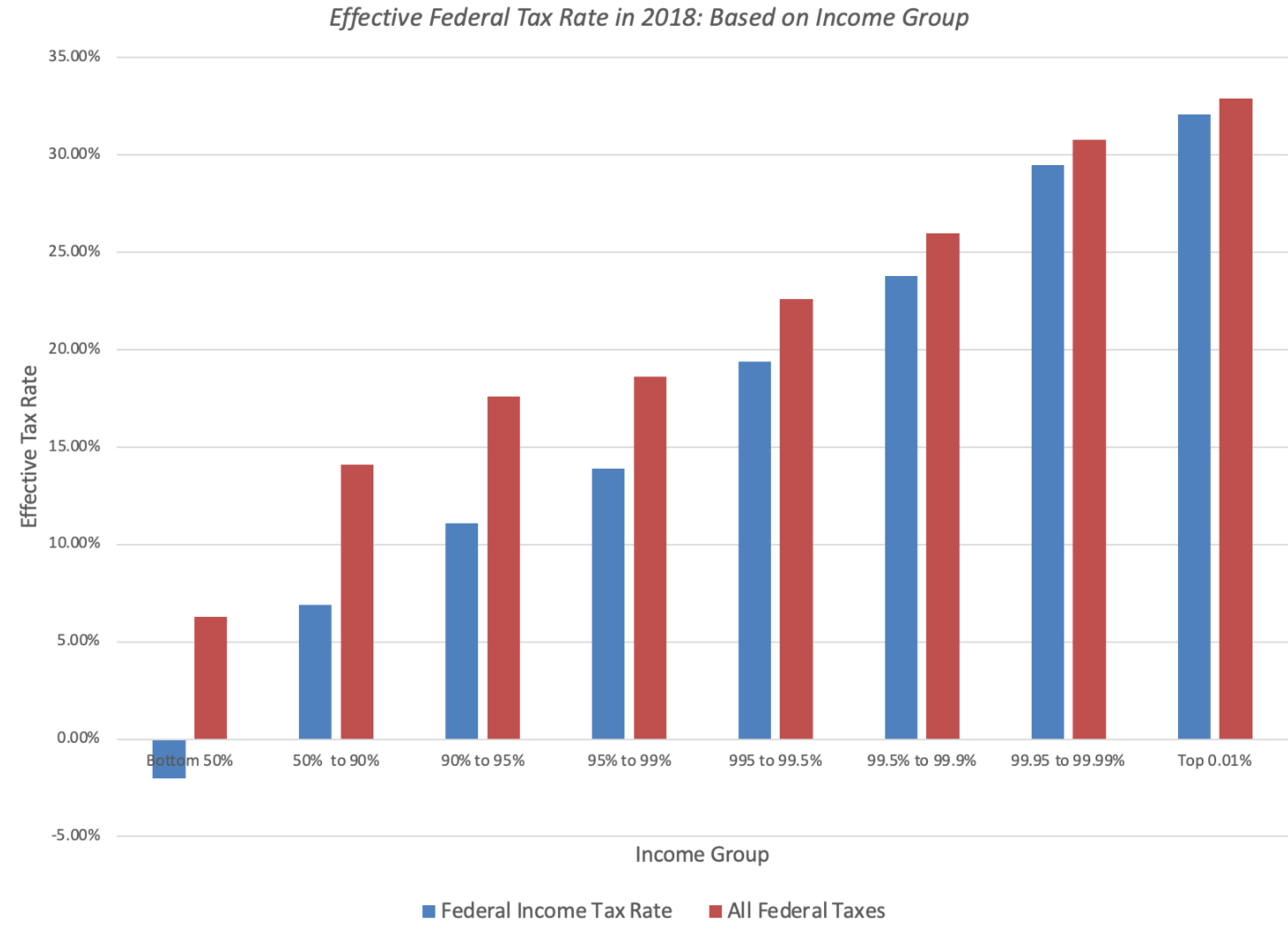

The Billionaire Tax The Worst Tax Idea Ever Actuarial News

https://www.actuarial.news/wp-content/uploads/2021/10/image-41.png

Tax Incentive For Organising Conferences In Malaysia Sep 14 2022

https://cdn1.npcdn.net/image/1663160380f5d0365d74cb0d94c5dfb1e9c5043e7b.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

Verkko The NPS scheme tax benefits for Central Government or State Government employees are that they can claim up to 14 of their salary Basic DA for a tax deduction They can also avail of the 50 000 additional tax deduction if they contribute solely to NPS Verkko 19 syysk 2022 nbsp 0183 32 NPS Tax Benefits For Government Employees The tax benefit under NPS is applicable at three different instances on contribution on partial withdrawal and on maturity 1 Tax Benefits on Contribution Amount Employee s own Contribution towards NPS Tier I account is eligible for tax deduction under section 80 CCD 1 of

Verkko 16 syysk 2022 nbsp 0183 32 NPS offers two account types Tier 1 and Tier 2 Tier 1 is a long term retirement account with tax benefits and limited withdrawals while Tier 2 is a more flexible short term savings option that allows easier access to your funds making it suitable for various financial goals Read this article below to get more information Verkko Tax Benefits of NPS The NPS has its share of income tax benefits both at the time of making contributions and at the time of withdrawal on maturity Individual taxpayers can claim deduction on contributions under Tier I NPS up to Rs 1 5 lakh in a financial year under Section 80C

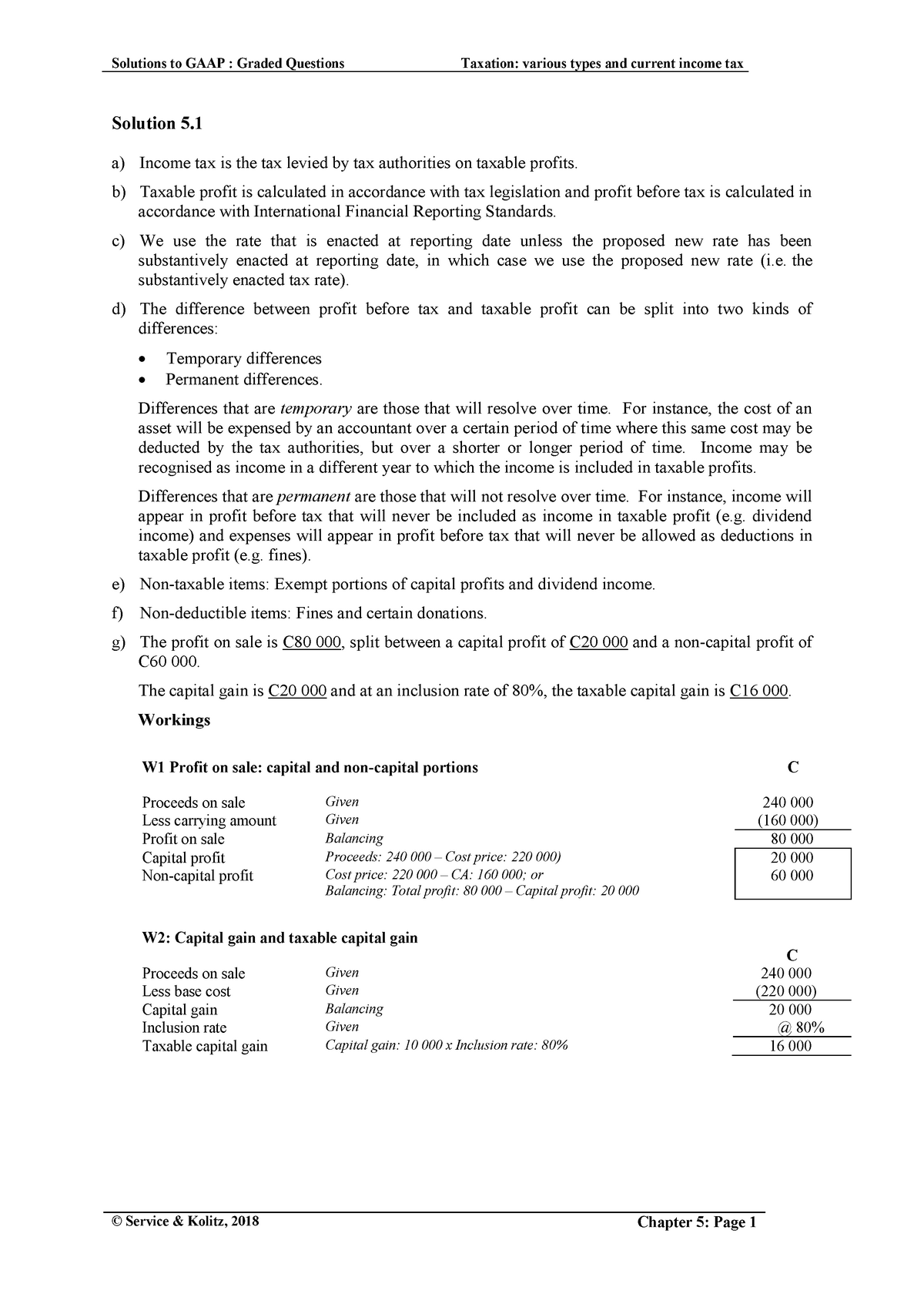

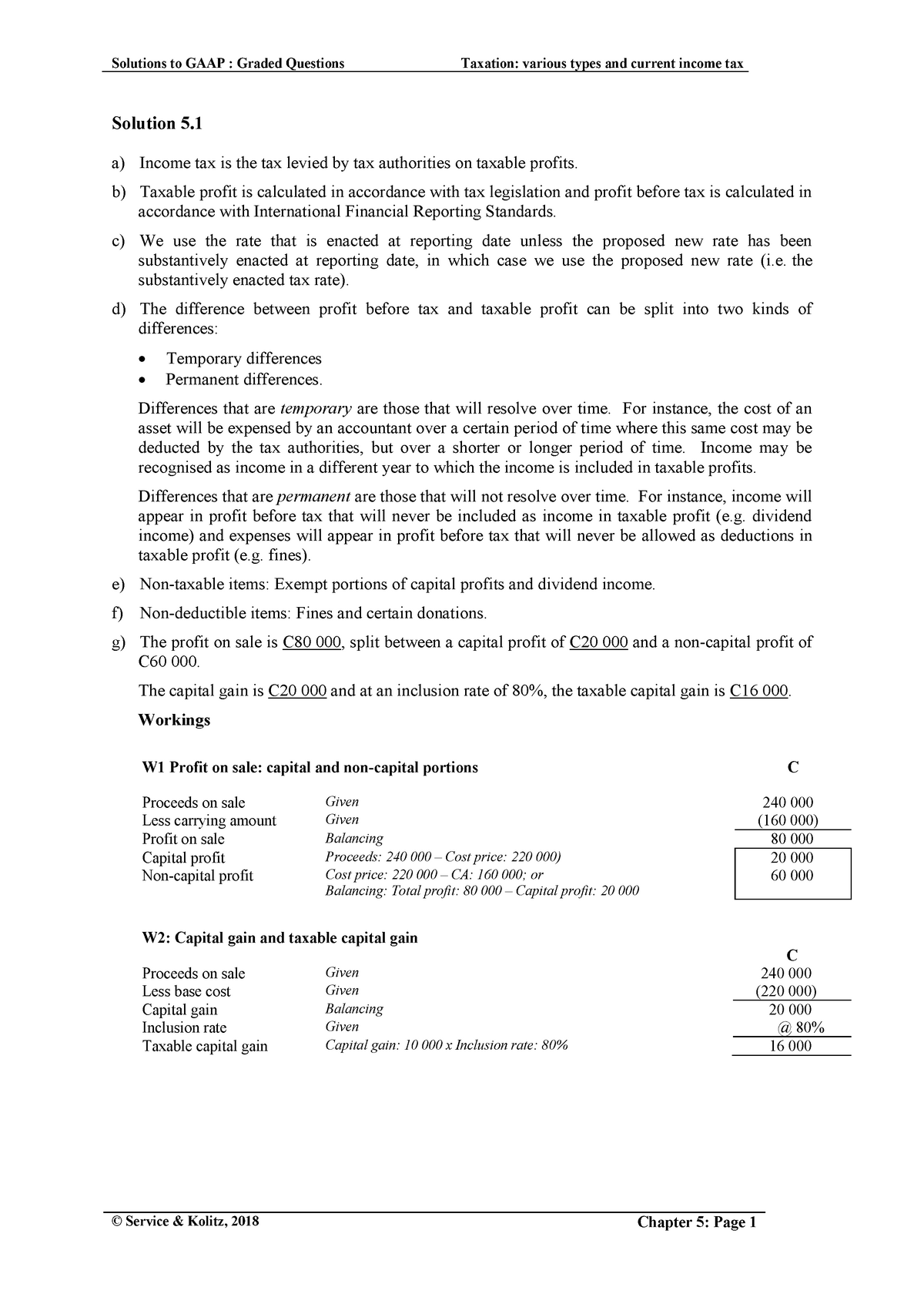

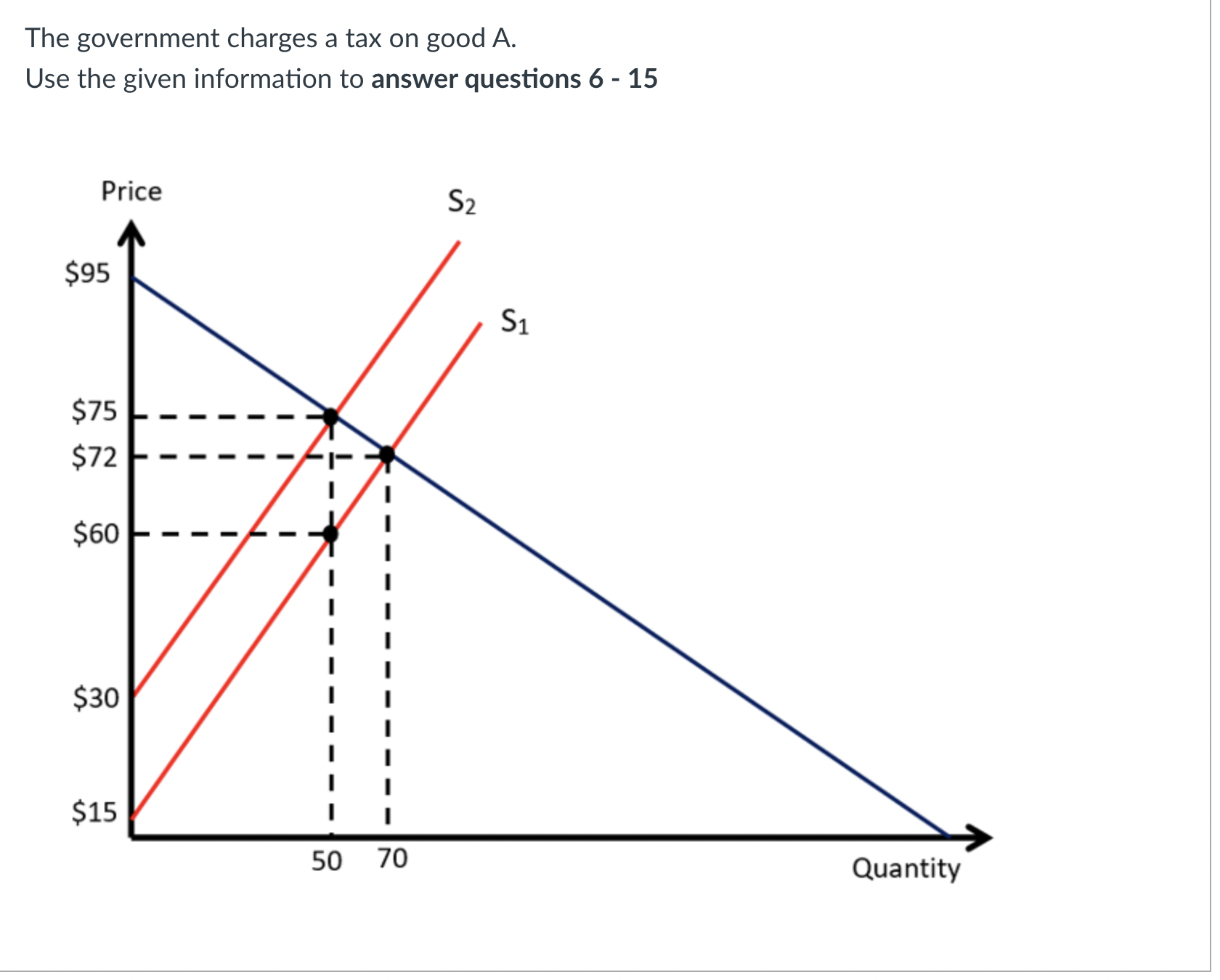

05 Current Taxation S18 Solution 5 A Income Tax Is The Tax Levied

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/bb4d31806efd27c2027ac9db48c13146/thumb_1200_1697.png

Tax Reporting With Trusts Morrison Law Group PLC

https://morrisonlawplc.com/wp-content/uploads/2021/05/Best-Tool-for-Proposed-Tax-Changes-2048x1367.jpg

https://www.etmoney.com/learn/nps/what-are-the-tax-benefits-of-the...

Verkko 20 syysk 2022 nbsp 0183 32 Now there are three sections under which tax benefits can be claimed by individuals First is Section 80CCD 1 where NPS competes with other investments like provident fund PPF life insurance premiums tax saving mutual funds etc The second is Section 80CCD 1B which is an additional tax benefit only given to NPS

https://cleartax.in/s/nps-national-pension-scheme

Verkko The NPS scheme holds immense value for anyone who works in the private sector and requires a regular pension after retirement The scheme is portable across jobs and locations with tax benefits under Section 80C and Section 80CCD

Real Estate Agent Inflation Protection

05 Current Taxation S18 Solution 5 A Income Tax Is The Tax Levied

Tax Benefit On NPS Save More Money

What Is The Tax Life Of HVAC Unit Innovair Corporation United States

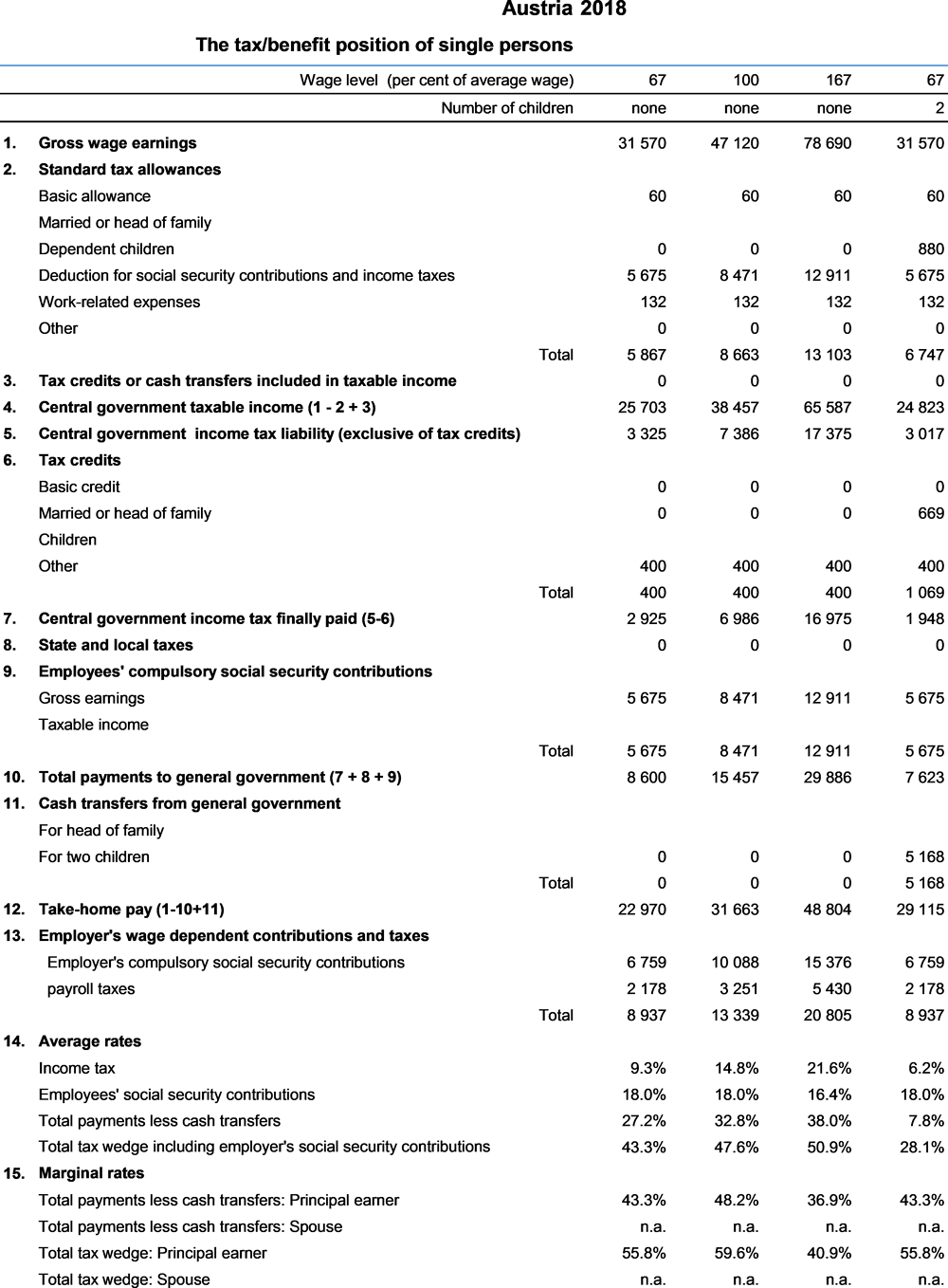

Home OECD ILibrary

Tutorial Solutions 4 What Is The Tax Base Of An Asset Or Liability

Tutorial Solutions 4 What Is The Tax Base Of An Asset Or Liability

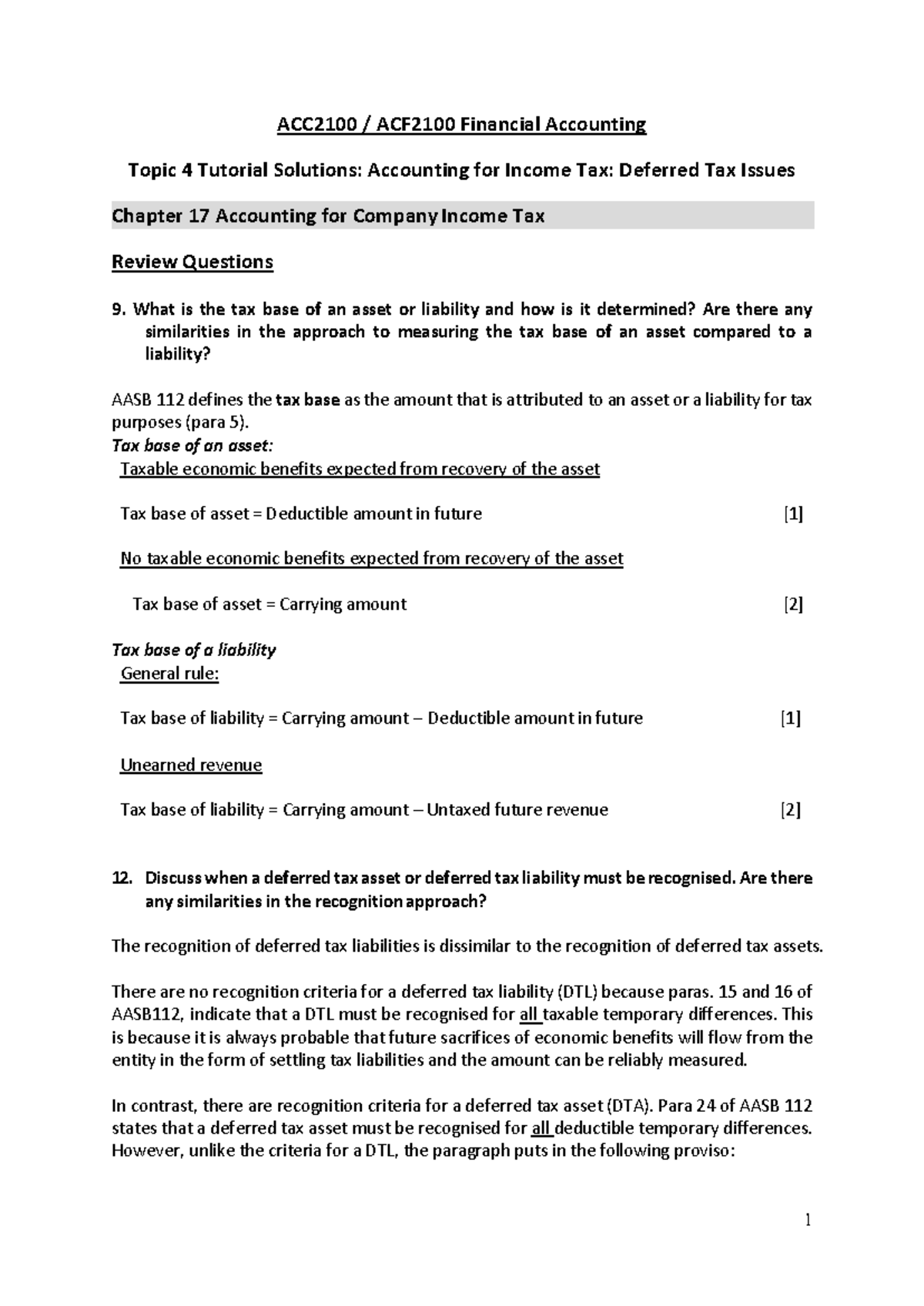

Solved The Government Charges A Tax On Good A Use The Given Chegg

OECD ILibrary Home

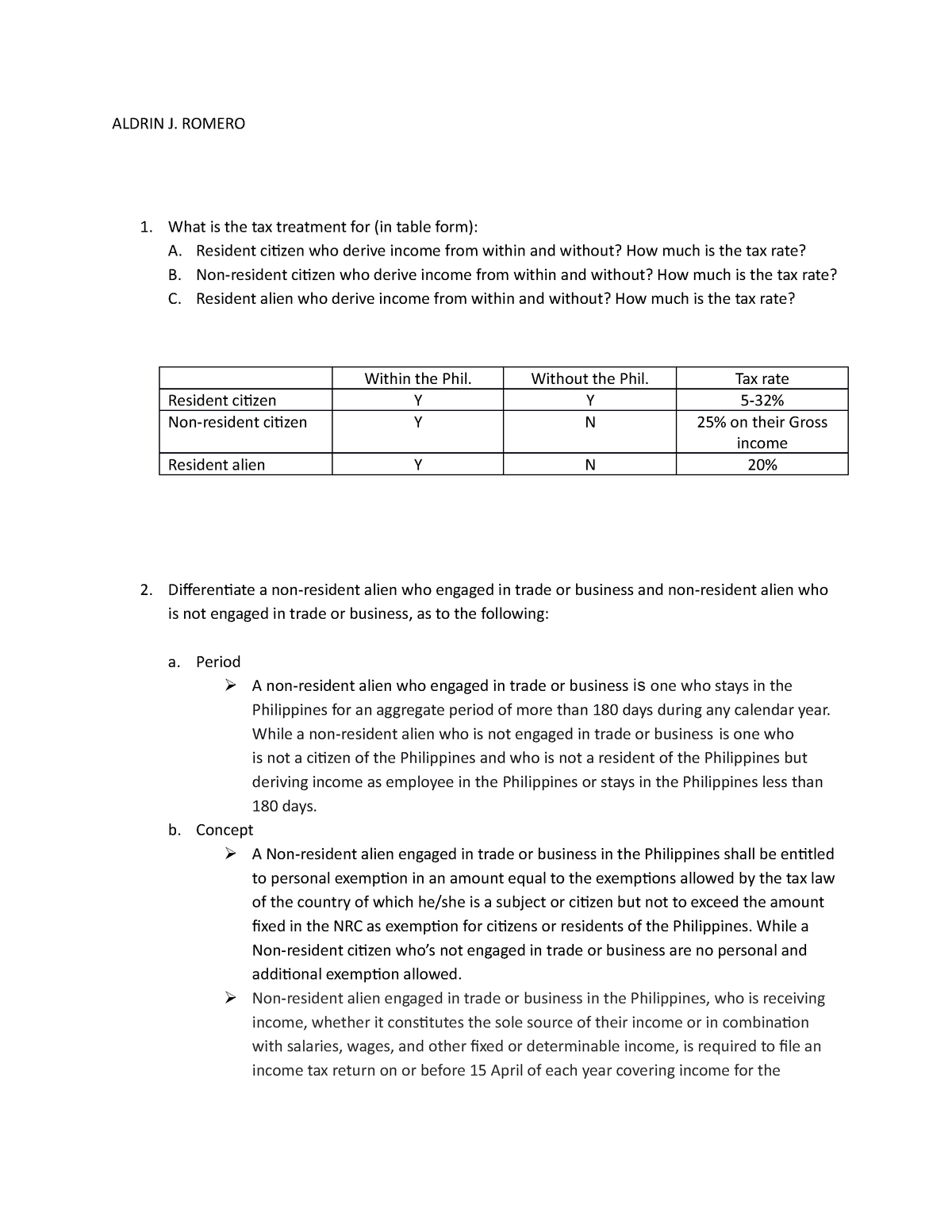

Income Taxation Activity 6 ALDRIN J ROMERO What Is The Tax Treatment

What Is The Tax Benefit On Nps - Verkko 4 Benefits of Opening an NPS Account Returns on investment Investing in NPS offers much higher returns than other traditional tax saving investments like the PPF This scheme has delivered 8 to 10 of annualized returns Change of fund manager Investing in NPS also allows you to change your fund manager if you are not satisfied