Tax Rebate On Student Loan In India Web 4 avr 2017 nbsp 0183 32 An education loan helps you not only finance your higher studies but it can save you a lot of tax as well If you have taken an

Web 28 juin 2019 nbsp 0183 32 Section 80E is the income tax deduction from taxable income which covers the deduction on the interest component paid on higher education loans from the Web 16 f 233 vr 2021 nbsp 0183 32 You are eligible for tax benefits on education loan provisioned by the Income Tax Act of 1961 However certain conditions must be met before claiming any

Tax Rebate On Student Loan In India

Tax Rebate On Student Loan In India

https://mygreatlakes.org/mglstatic/educate/images/knowledge-center/1098e_interest_statement.jpg

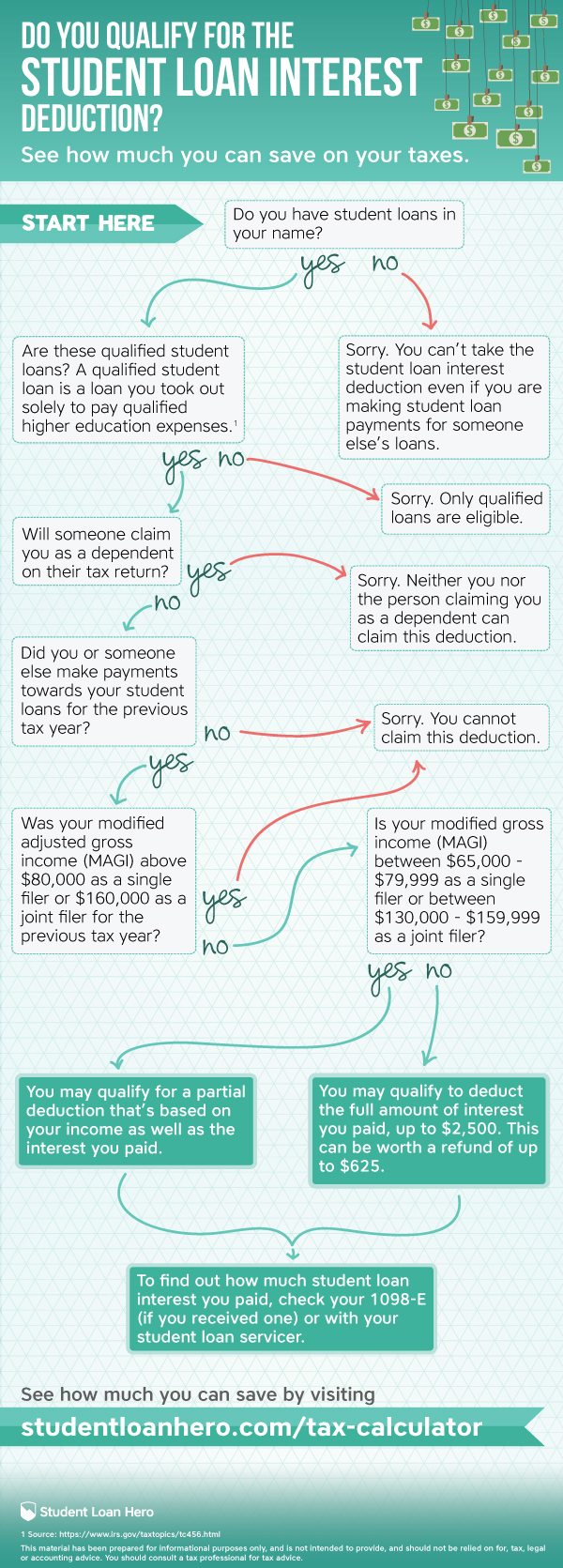

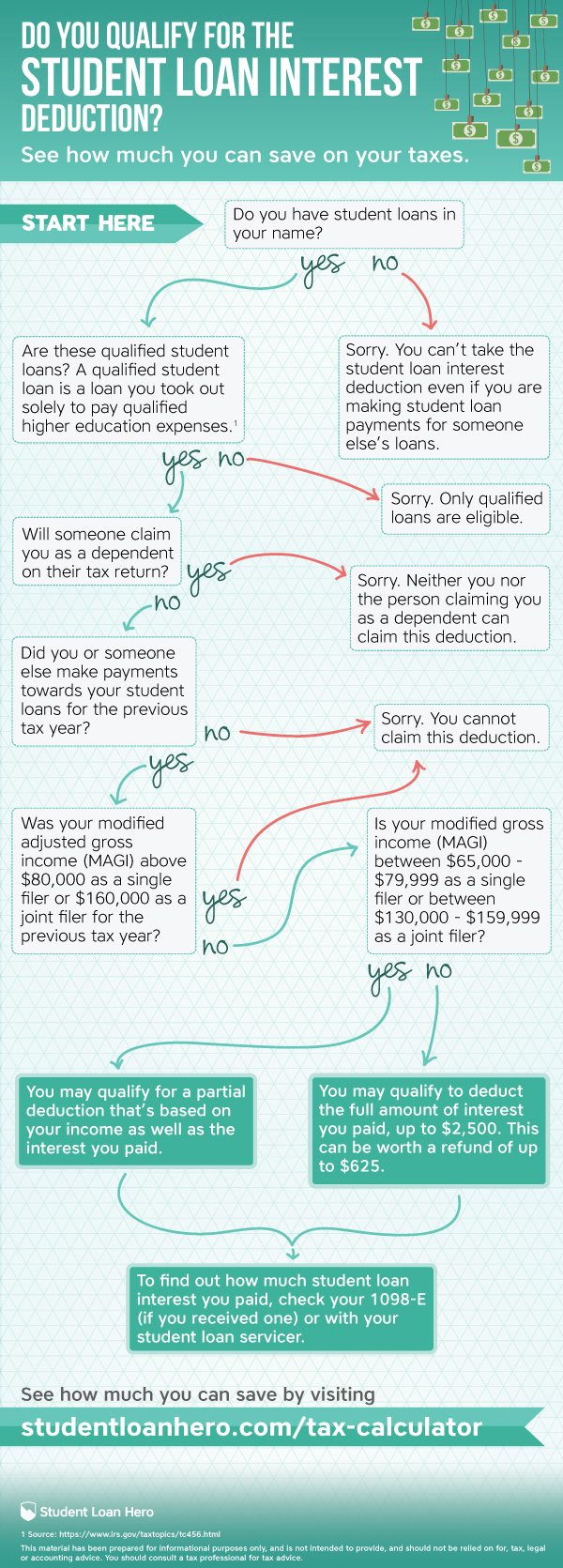

Student Loan Tax Deduction

https://sc.cnbcfm.com/applications/cnbc.com/resources/files/2017/11/02/student-loan-interest-deduction.jpg

The Top 8 Can Student Loans Be Taken Out Of Taxes Best Showbiz Secrets

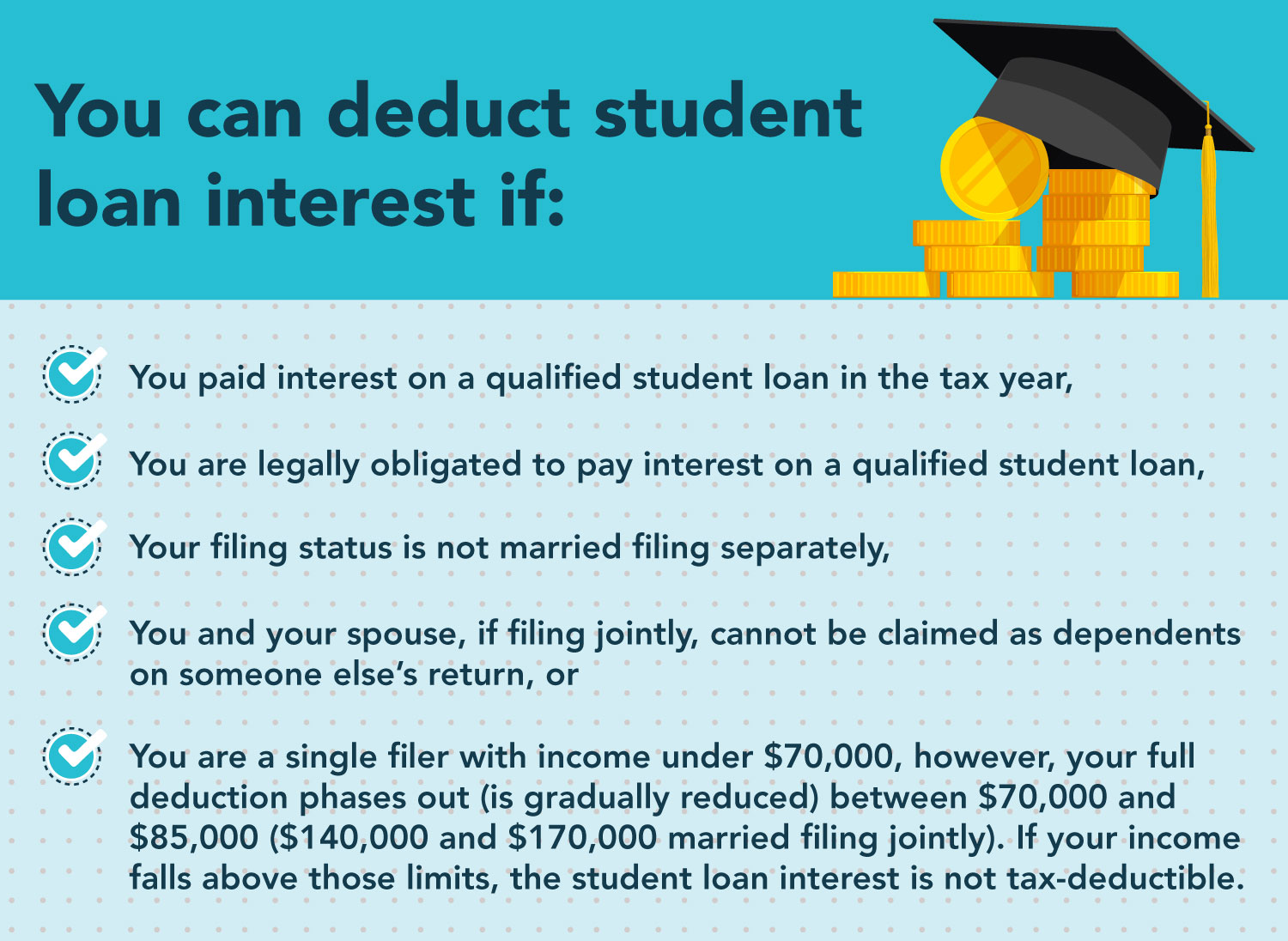

https://blog.turbotax.intuit.com/wp-content/uploads/2020/05/You-can-deduct-student-loan-interest-if-you-meet-the-following-qualifications.jpg

Web Education Loans Tax Benefits Education loans are offered a tax deduction under Section 80e Income Tax Act on the interest of the loan There are other benefits to an education Web Total tax rebate The amount of Income Tax an individual can save by availing of iSMART Education Loan from ICICI Bank The amount of rebate will vary for different tax slabs

Web 16 oct 2020 nbsp 0183 32 For example if the total EMI of your education loan is Rs 12 000 and Rs 8 000 is the principal component and Rs 4 000 is the interest component you can only claim Rs 4 000 per month So for the Web 12 janv 2023 nbsp 0183 32 A maximum deduction of up to Rs 40 000 can be availed under Section 80E While availing deduction under section 80E the taxpayer must obtain a certificate from

Download Tax Rebate On Student Loan In India

More picture related to Tax Rebate On Student Loan In India

Student Loans And Tax Refund 2023

https://cdn.neamb.com/-/media/images/neamb/articles-pages/student_loan_debt/student_loan_debt_repayment_calculator_helps_educators_find_relief/student_loan_debt_repayment_calculator_helps_educators_find_relief_842x474.jpg

How Much Is The Interest On Student Loans Niya Blog

https://www.mercatus.org/sites/default/files/studentloans.jpg

Cares Act Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-recovery-rebates-distributions-rmd-waivers-student-loan.png?fit=840%2C691&ssl=1

Web Section 80E of the Income Tax Act 1961 According to Section 80E of the Income Tax Act 1961 you can claim a tax deduction on the interest paid on your education loans taken Web You can claim a deduction of Interest paid on a loan taken for pursuing higher education from taxable income under Section 80E of the Income Tax Act 1961 According to

Web If you intend to take a loan for pursuing higher studies in India or abroad you can claim a deduction under section 80E of the Income Tax Act 1961 which caters specifically to Web Yes HDFC Credila s Education Loan borrower or co borrower can avail a tax benefit under Section 80E of Income Tax Act 1961 How much Tax can I save Please refer to the

How To Get A Rebate On Consolidated Student Loans 11 Steps

https://i0.wp.com/www.rebateinternational.net/wp-content/uploads/2023/04/how-to-get-a-rebate-on-consolidated-student-loans-11-steps-scaled.jpg

200 Rebate For Refinancing Peanut Butter Student Loan Assistance

https://www.getpeanutbutter.com/wp-content/uploads/2020/11/Copy-of-Untitled-35-980x551.png

https://cleartax.in/s/section-80e-deduction-inte…

Web 4 avr 2017 nbsp 0183 32 An education loan helps you not only finance your higher studies but it can save you a lot of tax as well If you have taken an

https://tax2win.in/guide/sec-80e-deduction-interest-on-education-loan

Web 28 juin 2019 nbsp 0183 32 Section 80E is the income tax deduction from taxable income which covers the deduction on the interest component paid on higher education loans from the

Is Education Loan The Best Method In India MoneyIsle Online Demat

How To Get A Rebate On Consolidated Student Loans 11 Steps

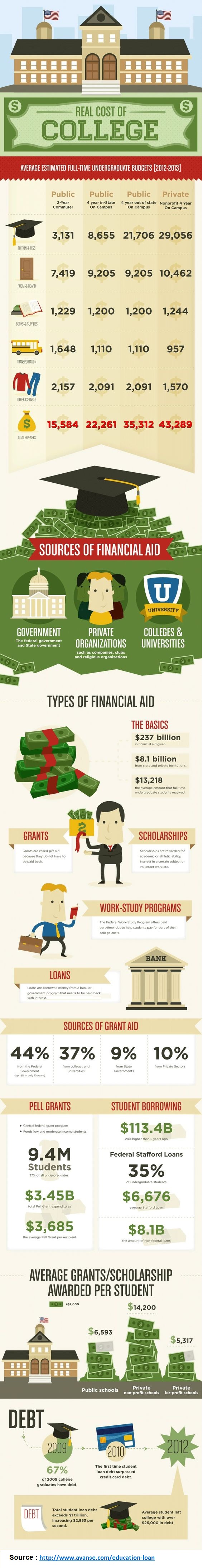

The Real Cost Of College Education Loans In India

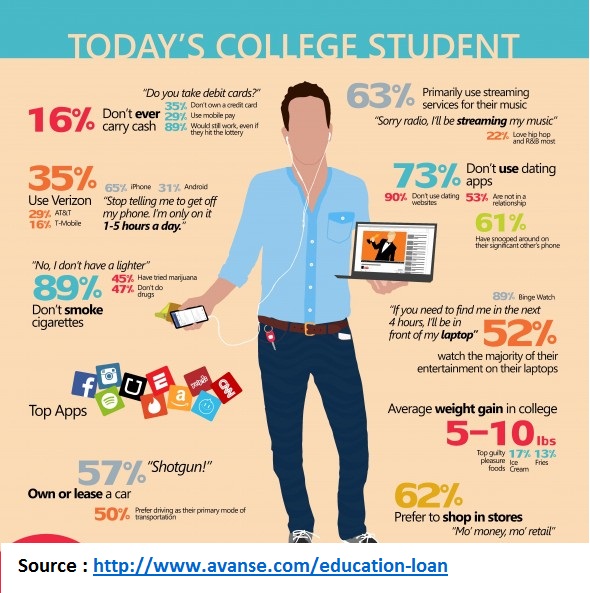

Today s College Student Education Loans In India

Recovery Rebate Income Limits Recovery Rebate

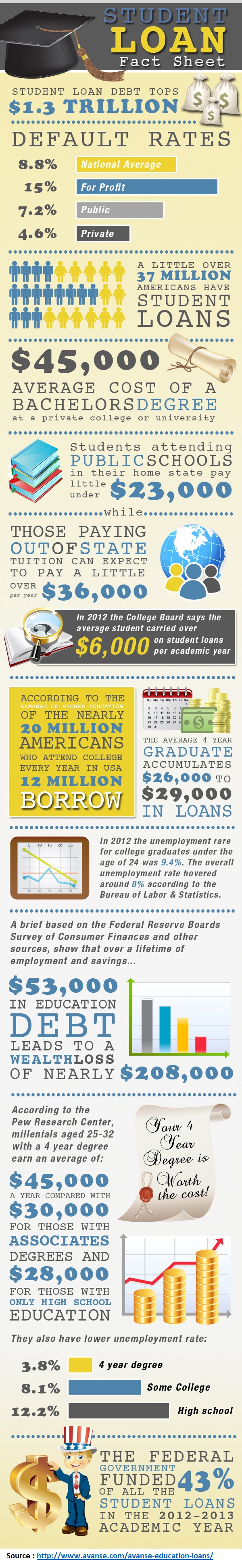

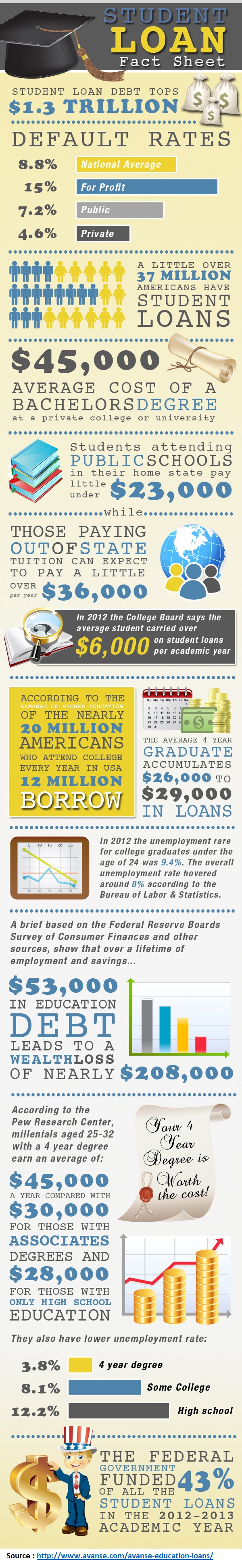

Student Loan Facts Infographic Education Loans In India

Student Loan Facts Infographic Education Loans In India

PPT A Checklist Before You Avail Student Loans In India PowerPoint

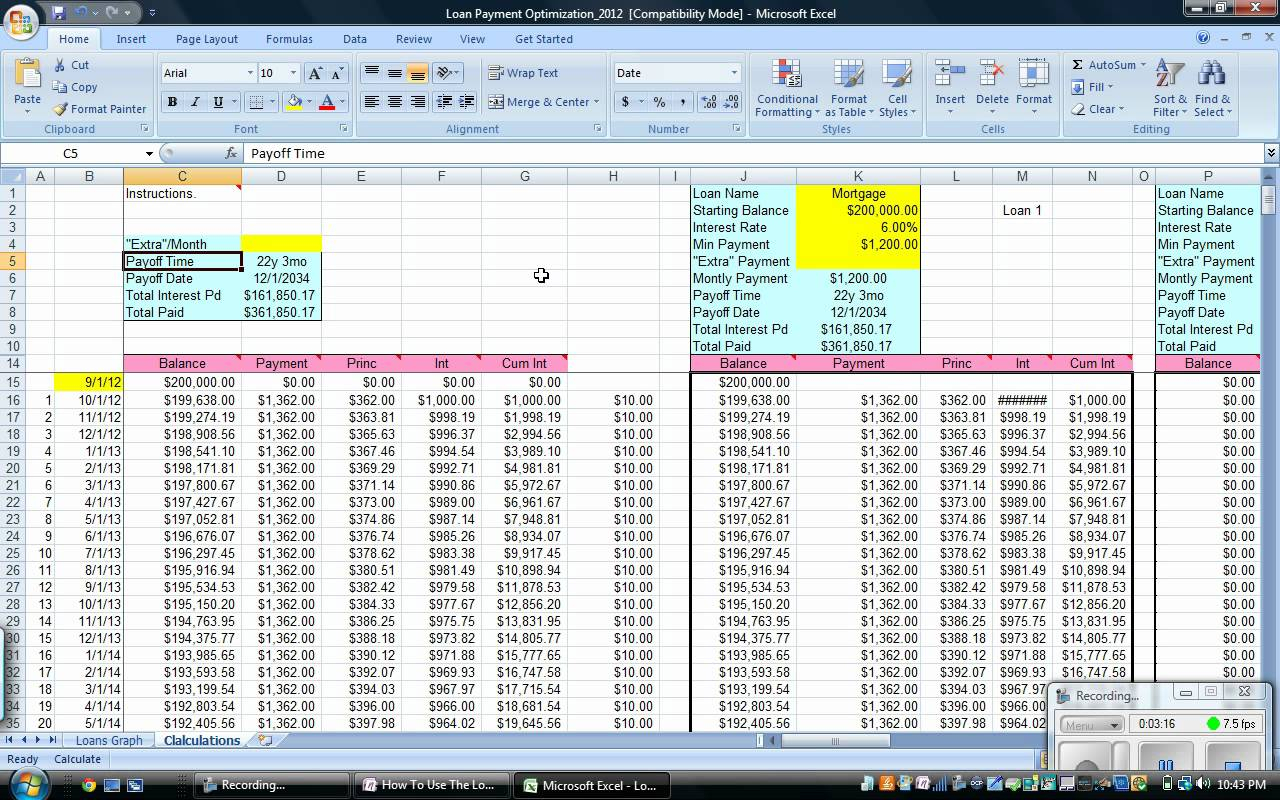

Student Loan Excel Sheet Studentqw

Couponing To Be Debt Free Is It Possible My Worthy Penny Debt

Tax Rebate On Student Loan In India - Web Education Loans Tax Benefits Education loans are offered a tax deduction under Section 80e Income Tax Act on the interest of the loan There are other benefits to an education