Tax Rebates For Home Improvements 2024 Excellent Get Free Estimates

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Click to expand Key Takeaways The easiest way to claim a home office tax break is by using Energy efficiency tax credits get even bigger in 2024 you can get a 10 tax credit for the cost of improvements like adding

Tax Rebates For Home Improvements 2024

Tax Rebates For Home Improvements 2024

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/Tax-Rebates-800x534.jpg

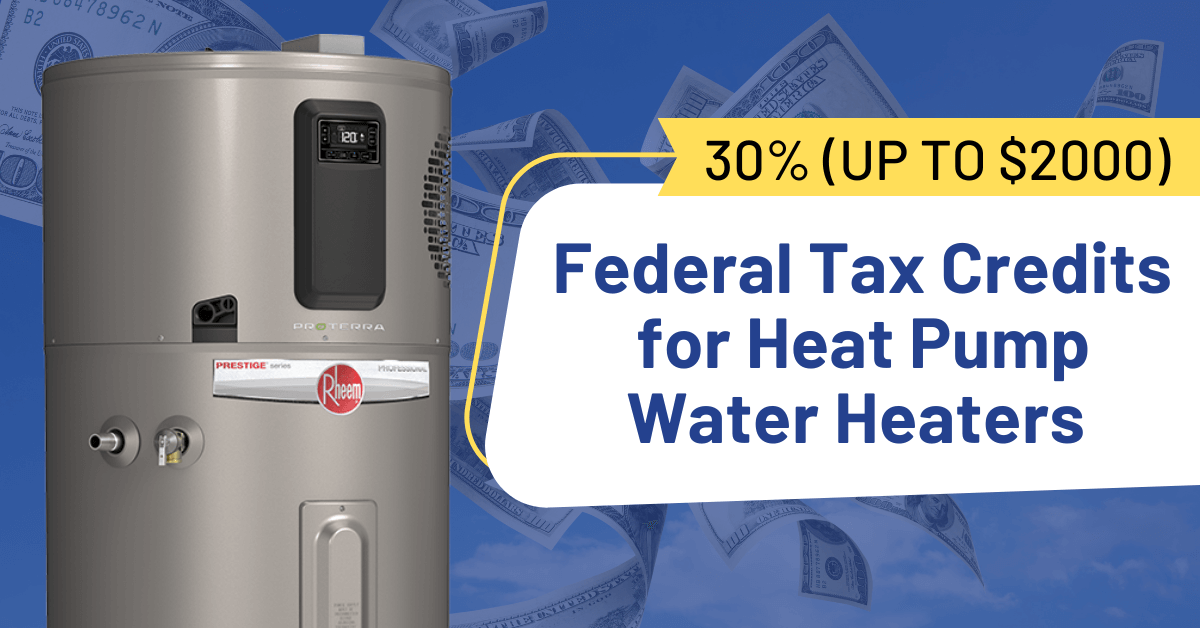

30 Federal Tax Credits For Heat Pump Water Heaters 2023

https://www.raysplumbinginc.com/wp-content/uploads/tax-credits-2023-social.png

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

When you file your tax return you must decide whether to take the standard deduction 13 850 for single tax filers 27 700 for joint filers or 20 800 for heads of household or married Tax Tip 2023 113 Sept 20 2023 Eligible contractors who build or substantially reconstruct qualified new energy efficient homes may be eligible for a tax credit up to 5 000 per home

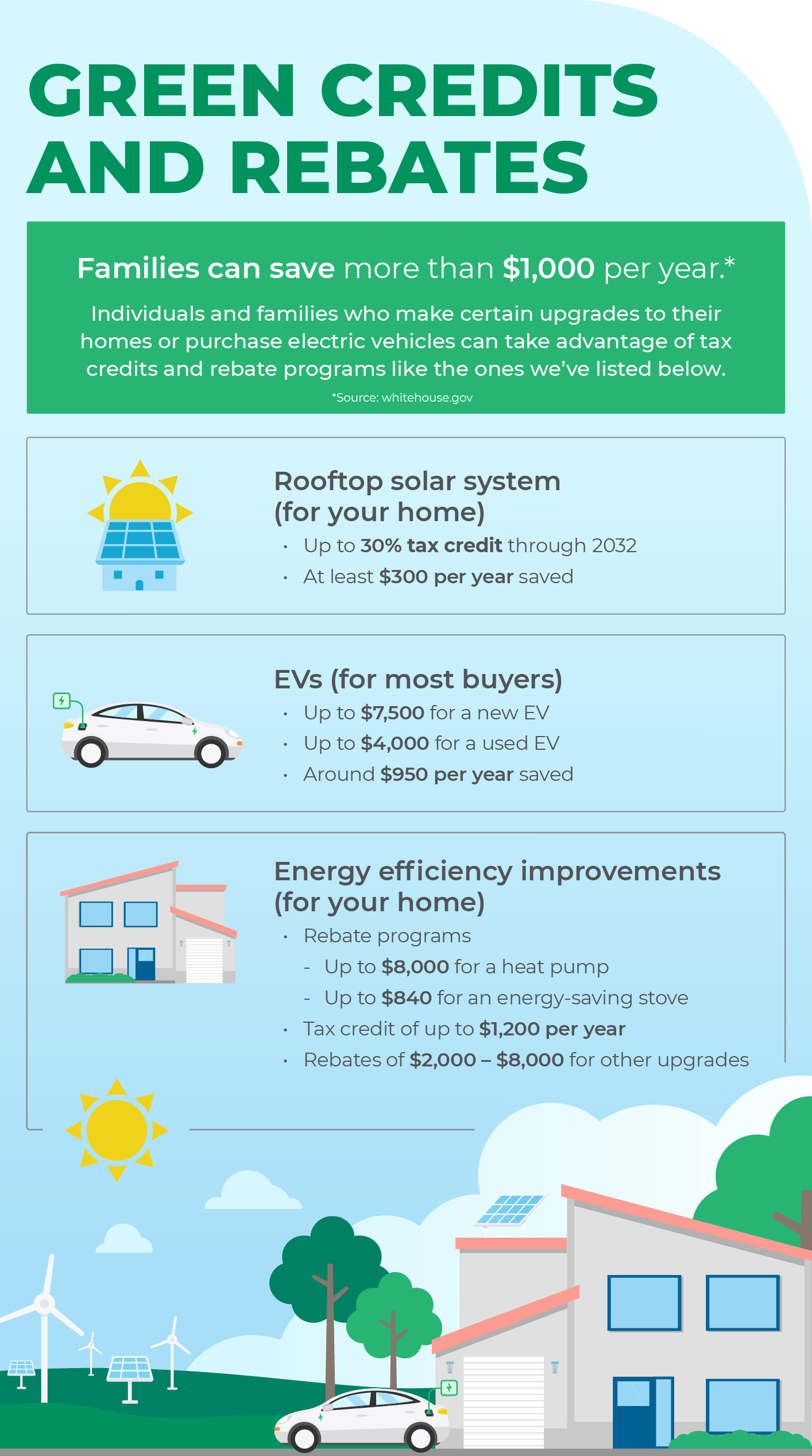

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

Download Tax Rebates For Home Improvements 2024

More picture related to Tax Rebates For Home Improvements 2024

How To Save Money On Home Improvements With Energy Efficiency Tax Credits Rebates

https://mlsjoxwh2dv5.i.optimole.com/cb:fJ2b~7176/w:auto/h:auto/q:90/f:avif/https://finmasters.com/wp-content/uploads/2022/12/How-to-Save-Money-on-Home-Improvements-with-Energy-Efficiency-Tax-Credits-Rebates.jpg

Tax Rebates Worth At Least 75 To Start Going Out To 25 000 People This Week All You Need To

https://www.the-sun.com/wp-content/uploads/sites/6/2022/02/CW-COMP-MONEY-TIME-TO-ACT-US.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

Energy Efficiency Rebates And Tax Credits For Home Improvements In 2023 Wilson Exteriors

https://wilsonexteriors.com/wp-content/uploads/2023/05/Featured-image-223.png

Under the law the HOMES rebate should be available to whole house energy saving retrofits that begin after the Inflation Reduction Act became law on August 16 2022 and completed before Beginning with the 2023 tax year the credit is equal to 30 of the costs for all eligible home improvements made during the year It is also expanded to cover the cost of certain biomass

Back to Inflation Reduction Act Combine IRA Savings with State Incentives to Upgrade Your Home and Ditch Fossil Fuels The Inflation Reduction Act IRA helps New Yorkers get the latest clean energy technologies and equipment that will save energy for years to come What HVAC Tax Incentives Are Available for Homeowners Energy Efficient Home Improvement income tax credits are available for central air conditioning systems boilers furnaces air source heat pumps and biomass stoves that reach benchmarks for high efficiency The credits apply to units purchased and installed between January 1 2023 and December 31 2034

1 000 Tax Rebate Residents In This State May Receive Extra Money This Summer Here s How To Be

https://1075914428.rsc.cdn77.org/data/thumbs/full/270850/820/0/0/0/tax-rebates-2023-eligible-americans-to-receive-up-to-3-000-heres-when-and-how.jpg

Tax Rebates Who Will Start Receiving Checks Of Up To 1 000 From Today Marca

https://phantom-marca.unidadeditorial.es/8477fc2f6004169d9e59851ec62d16d0/resize/1320/f/jpg/assets/multimedia/imagenes/2022/11/01/16673106591434.jpg

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

Excellent Get Free Estimates

https://turbotax.intuit.com/tax-tips/home-ownership/energy-tax-credit-which-home-improvements-qualify/L5rZH56ex

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Click to expand Key Takeaways

Tax Rebates Review Of Tax Credits On The Agenda For Senate GOP

1 000 Tax Rebate Residents In This State May Receive Extra Money This Summer Here s How To Be

Tax Rebates Are On The Way

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits Affect My Refund Fabalabse

TaxHoot TaxHoot

Calam o Get Up To 26 000 Per Employee In Tax Rebates Claim Funding With CPA Help

Calam o Get Up To 26 000 Per Employee In Tax Rebates Claim Funding With CPA Help

2023 Residential Clean Energy Credit Guide ReVision Energy

Tax Accountancy Help Inc Tax Refunds Rebates Returns CIS SMEs

Extra Tax Rebates On Your Website ETRAFFIC

Tax Rebates For Home Improvements 2024 - The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings