Tax Refund On Redundancy Payments Verkko If you have been made redundant it s highly likely you will be eligible for a tax refund Tommy McNally founder of the Tommy s Tax app explains how to claim money owed If like many people right now

Verkko 6 huhtik 2023 nbsp 0183 32 As we explain below if you are made redundant you may be eligible for a tax refund on your pre redundancy earnings If you are claiming jobseeker s allowance JSA or universal credit UC Verkko 27 syysk 2020 nbsp 0183 32 Redundancy Some people who are being made redundant may be able to claim a tax refund Image GETTY How is

Tax Refund On Redundancy Payments

Tax Refund On Redundancy Payments

https://www.simmonslivingstone.com.au/wp-content/uploads/2020/06/JobKeeper-Your-most-asked-Questions-Web-10-1536x977.png

Tax On Redundancy Payments Davis Grant

https://www.davisgrant.co.uk/wp-content/uploads/2020/06/redundancies-blog-featured-image-880x360.jpg

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

Verkko 20 jouluk 2018 nbsp 0183 32 The ETP cap applies to genuine redundancy payments exceeding the tax free limit discussed in the section General Tax Concessions above For non Verkko 16 tammik 2023 nbsp 0183 32 Any overpaid tax will be refunded when you complete your tax return You can choose not to draw this income until later years which could increase the amount when you decide to begin drawing it

Verkko 1 lokak 2015 nbsp 0183 32 If you are made redundant in Ireland you will be entitled to claim tax relief on your redundancy payment under one of the following three exemptions Verkko DSR Tax Refunds can help you get your maximum refund as well as deal with all of that annoying paperwork so give us a call on 0330 122 9972 and let us get you your

Download Tax Refund On Redundancy Payments

More picture related to Tax Refund On Redundancy Payments

Cash App Taxes Review 2023 Pros And Cons How To Get Your Tax Refund

https://i.ytimg.com/vi/gdptLBHnZog/maxresdefault.jpg

What Tax Do I Pay On Redundancy Payments CruseBurke

https://cruseburke.co.uk/wp-content/uploads/2022/12/tax-on-redundancy-payments-768x509.png

Png PNGEgg

https://e7.pngegg.com/pngimages/893/203/png-clipart-form-letter-tax-refund-template-others-template-text.png

Verkko 16 kes 228 k 2023 nbsp 0183 32 1 Overview explaining your redundancy payments If you ve been made redundant and your employer is insolvent you can apply to the Insolvency Verkko 10 lokak 2023 nbsp 0183 32 You may be able to claim back Income Tax now if you ve recently stopped working for example if you have been unemployed for 4 weeks or more and

Verkko Statutory redundancy pay under 163 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment Verkko 2 lokak 2019 nbsp 0183 32 The scale of the refund will also depend on how far through the tax year you were made redundant If your redundancy payment is made after your P45 has

How To Calculate Redundancy Payments Peninsula Ireland

https://www.peninsulagrouplimited.com/media/5628/redundancy-payments-calculation.jpeg

Termination Pay Redundancy CooperAitken Chartered Accountants

http://www.cooperaitken.co.nz/wp-content/webpc-passthru.php?src=https://www.cooperaitken.co.nz/wp-content/uploads/2020/08/Redundancy.png&nocache=1

https://www.themoneypages.com/.../claim-tax …

Verkko If you have been made redundant it s highly likely you will be eligible for a tax refund Tommy McNally founder of the Tommy s Tax app explains how to claim money owed If like many people right now

https://www.litrg.org.uk/.../what-tax-do-i-pay-r…

Verkko 6 huhtik 2023 nbsp 0183 32 As we explain below if you are made redundant you may be eligible for a tax refund on your pre redundancy earnings If you are claiming jobseeker s allowance JSA or universal credit UC

How To Request A New Middle Class Tax Refund Card If You Tossed Yours

How To Calculate Redundancy Payments Peninsula Ireland

What Tax Do I Pay On Redundancy Payments Accounting Firms

California Tax Refund Will You Owe Federal Taxes CalMatters

Complete Guide To Calculating Redundancy Pay Essential Tools Tips

Redundancy Payment What To Do With It

Redundancy Payment What To Do With It

Tax On Redundancy Payments TaxAssist Accountants

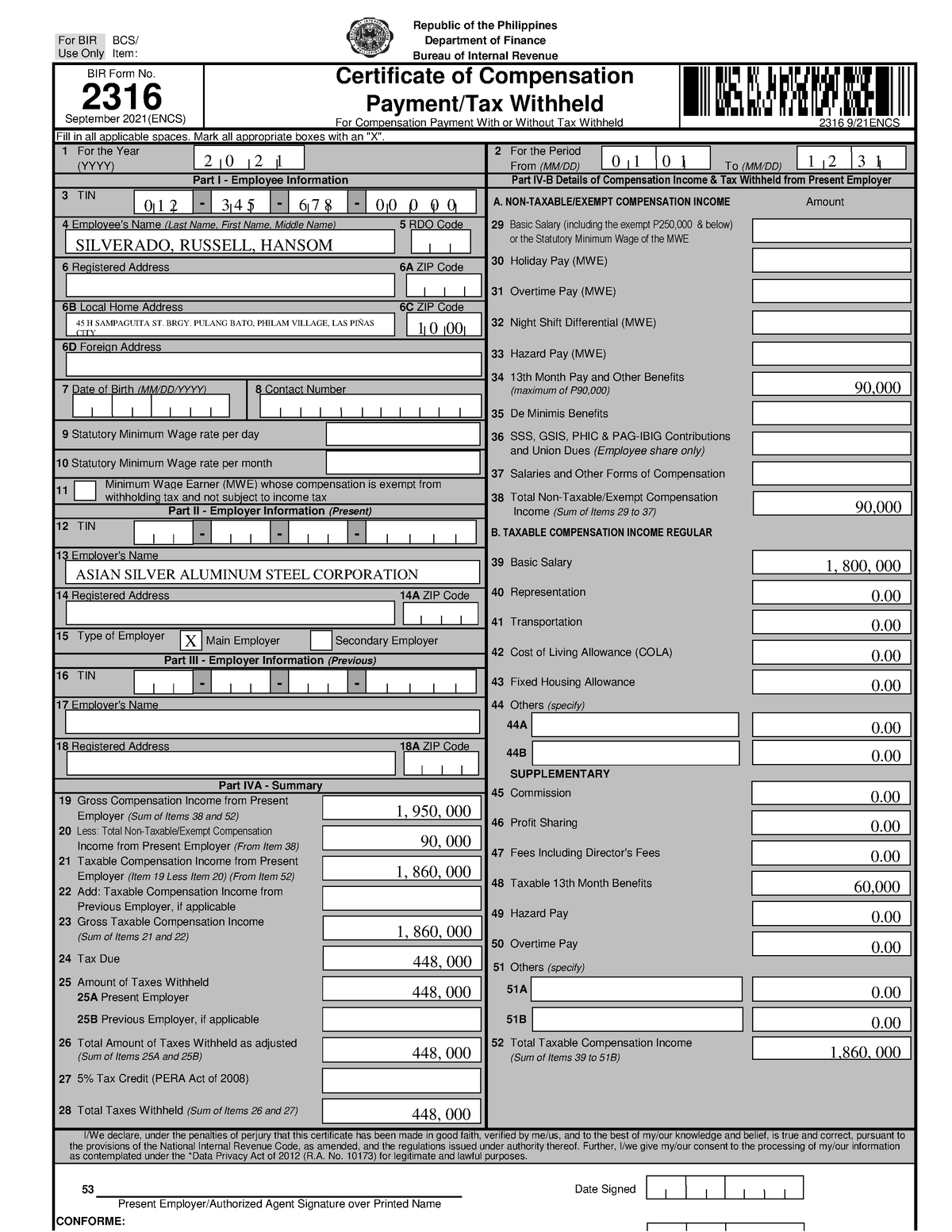

2316 23162316 For Compensation Payment With Or Without Tax Withheld

REDUNDANCY PAYMENTS

Tax Refund On Redundancy Payments - Verkko These payments are always chargeable to income tax as specific employment income and benefit from the 163 30 000 threshold available in section 403 ITEPA 2003 A