Tax Relief For Medical Insurance Premiums Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own

You pay your employee s medical insurance policy of 800 1 000 less tax relief of 200 You must deduct Income Tax PRSI and USC on the gross amount 1 000 from your You might be able to deduct your health insurance premiums and other health care costs from your taxable income which can lower the amount

Tax Relief For Medical Insurance Premiums

Tax Relief For Medical Insurance Premiums

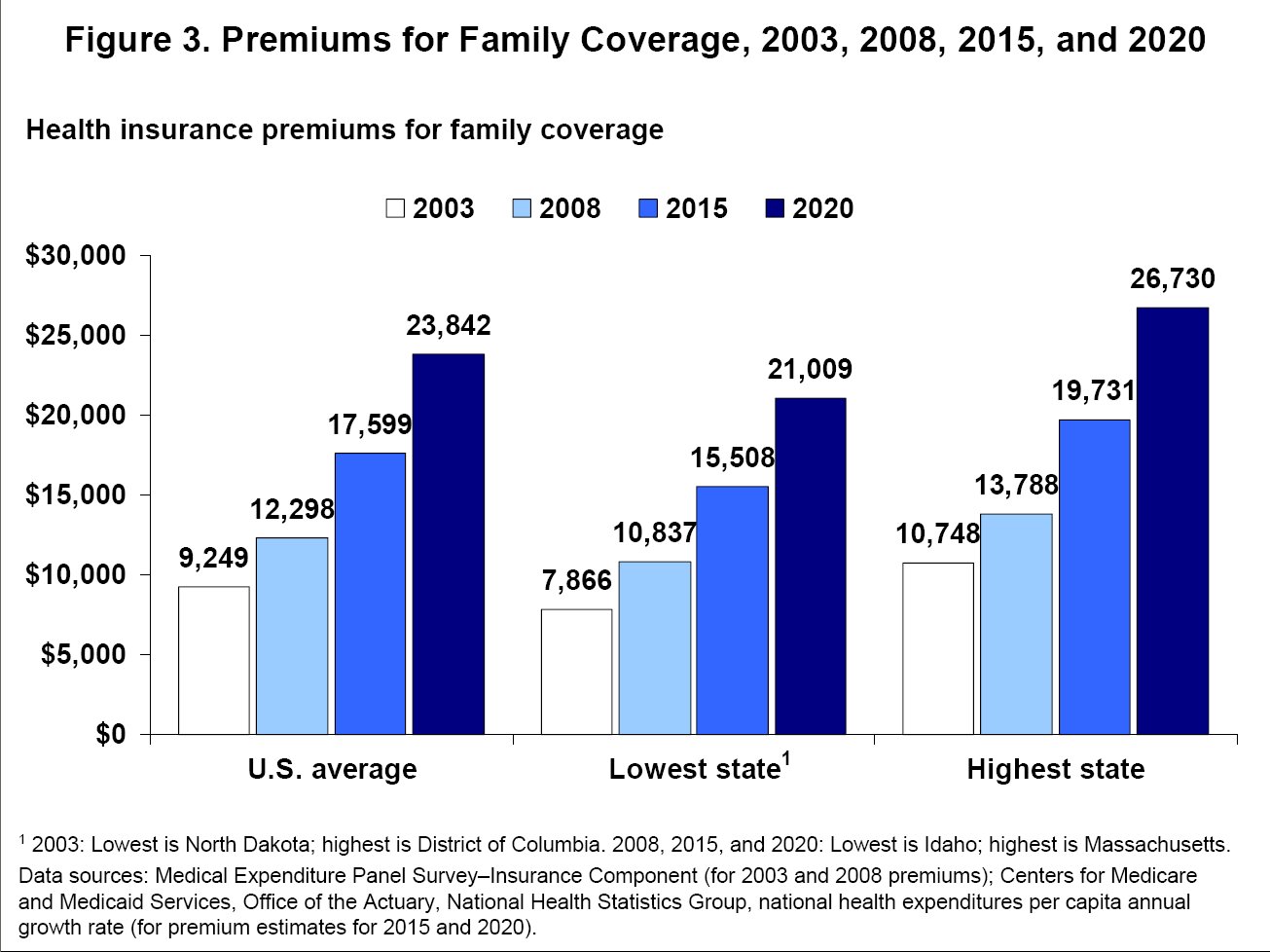

http://www.theglitteringeye.com/images/PremiumsForFamilyCoverage2003-2020.jpg

Tax Advisor For SEIS And EIS Tax Relief Gatwick Accountant

https://www.gatwickaccountant.com/wp-content/uploads/2022/07/accountant-for-tax-return-near-me.png

Claim Tax Relief Of Employing A Carer Home Care Matters

https://homecarematters.ie/wp-content/uploads/2021/01/t2.png

For example employer sponsored premiums paid under a premium conversion plan cafeteria plan or any other medical and dental expenses paid by the plan aren t In this article we will walk you through claiming tax reliefs for your insurance payments More precisely we will help you identify what to look out for in your annual insurance statements as well as how exactly to claim for tax

Income Tax relief in respect of medical and dental insurance is generally granted at source under the Tax Relief at Source TRS system Under the TRS system policy holders pay a reduced Premiums paid by a sole trader or partner to provide life accident or sickness insurance cover for him herself or a partner are not allowable deductions in computing trading profits

Download Tax Relief For Medical Insurance Premiums

More picture related to Tax Relief For Medical Insurance Premiums

Tax Relief For Home Workers

https://www.kateunderwoodhr.co.uk/wp-content/uploads/2022/03/KUHR-Blog-image-template-34-min-1080x675.png

Tax Preparation Specialist Issues Tax Relief Guidance For Employees Who

https://www.wealthandfinance-news.com/wp-content/uploads/2019/03/tax-relief.png

Which Is Better Paying Health Insurance Premiums Pre Tax Or Post Tax

https://i1.wp.com/goneonfire.com/wp-content/uploads/2019/12/014b_Which-is-Better_-Paying-Health-Insurance-Premiums-Pre-Tax-or-Post-Tax_.png?fit=1920%2C1280&ssl=1

The tax relief available is at the standard rate of tax currently 20 If your employer paid 1 000 of Medical Insurance for you and your family Therefore you will be entitled to a tax refund of 200 1 000 x 20 For health insurance premiums the maximum deduction is Rs 25 000 per financial year for individuals below the age of 60 years and Rs 50 000 per financial year for senior citizens

Under Section 80D of the Income Tax Act any individual can claim tax deductions up to 25 000 towards the premiums paid for a health insurance plan s for a given year In the case of Understanding whether health insurance premiums can be deducted on taxes is a valuable consideration for individuals seeking to optimize their tax liabilities As healthcare

Tax Relief For Individuals With Disabilities

https://static.wixstatic.com/media/320966_dbf2a06198424fcb9014226b576480c5~mv2.jpg/v1/fill/w_1000,h_1000,al_c,q_85,usm_0.66_1.00_0.01/320966_dbf2a06198424fcb9014226b576480c5~mv2.jpg

Malaysia Personal Income Tax Relief 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjM81nSzJ2QiCATWboDACN2BpfNmw-0Wf5BApuHi91cjON32r6XUxhruNbA8f0o3K_H_4oIf1B4xQE6D0tInpJ7fFjXuaqCtw3-786N9ouUQ8nKcW7kxtIy0bZOmw2wXtBmRb63A-pQjcxK9mCdSvqTGiUvUxaePn9JkzlCVQKv7Gj0EukB_pdXpC10/s1585/Individual_Tax_Relief_2021.jpg

https://blog.turbotax.intuit.com › health-c…

Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own

https://www.revenue.ie › en › employing-people › benefit...

You pay your employee s medical insurance policy of 800 1 000 less tax relief of 200 You must deduct Income Tax PRSI and USC on the gross amount 1 000 from your

List Of Personal Tax Relief And Incentives In Malaysia 2023

Tax Relief For Individuals With Disabilities

List Of Personal Tax Relief And Incentives In Malaysia 2023

Medical Insurance Tax Relief Claim Tax Back On Your Health Insurance

Alamar Petroleum Company Offers Its Employees The Option Of

Qualified Business Income Deduction And The Self Employed The CPA Journal

Qualified Business Income Deduction And The Self Employed The CPA Journal

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

Compare House Insurance Premiums What Is The Difference Business Blog

No Corporate Tax Relief For Large Companies In Budget India Employer

Reimagining Fundraising Generic Submission Automating Tax Benefits

Tax Relief For Medical Insurance Premiums - For example employer sponsored premiums paid under a premium conversion plan cafeteria plan or any other medical and dental expenses paid by the plan aren t