Tax Relief On Electric Cars Uk 2022 Electric and low emission cars registered on or after 1 April 2025 You will need to pay the lowest first year rate of vehicle tax which applies to vehicles with CO2 emissions 1 to 50g km From

This measure will impact on individuals who own an electric car van or motorcycle These individuals will now need to pay VED on their vehicles Changes will come into effect from 1 April 2025 Yes almost all vehicles need to have been road taxed in order to drive on UK roads including electric vehicles EVs However electric car drivers currently do not need to pay anything to tax their vehicle and the annual VED is

Tax Relief On Electric Cars Uk 2022

Tax Relief On Electric Cars Uk 2022

https://res.cloudinary.com/nimblefins/image/upload/c_limit,dpr_1.0,f_auto,h_1600,q_auto,w_1600/v1/UK/autoinsurance/average_cost_to_charge_electric_car_UK

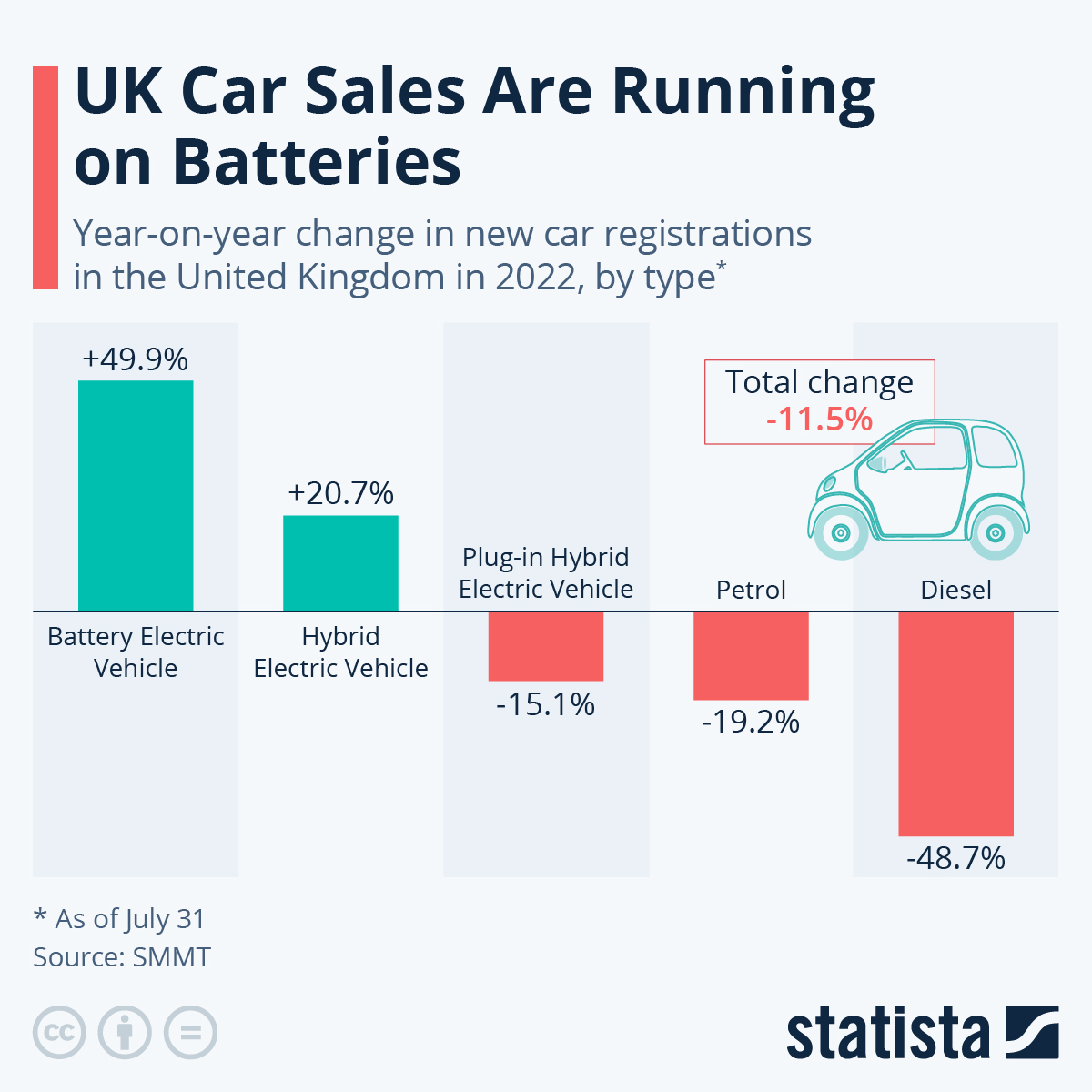

Electric Cars Market Share 2022 Europe Disney Cars 2022

https://www2.deloitte.com/content/dam/insights/us/articles/22869-electric-vehicles/figures/Fig-01.png

Best Small Electric Cars 2022 Uk Top 10 Best Small Electric Cars 2022

https://car-images.bauersecure.com/pagefiles/104127/small_electric_car_2021.jpg

The percentage for fully electric cars 0g km will increase to 4 in 2026 27 and 5 in 2027 28 Electric vans In April 2021 they reduced the taxable benefit for having the private use of a zero emission van to zero If you only use the van for business and commuting there is no taxable benefit at all 17 November 2022 By Noor Nanji Business reporter BBC News Getty Images Electric cars will no longer be exempt from vehicle excise duty from April 2025 the chancellor has said

Thu 17 Nov 2022 10 58 EST Electric car owners will have to pay vehicle excise duty better known as road tax from 2025 the chancellor has announced Industry figures said the The road tax or Vehicle Excise Duty VED rates for all pure electric vehicles have been reduced to 0 until at least 2025 There are reduced VED rates for plug in hybrid electric vehicles PHEVs

Download Tax Relief On Electric Cars Uk 2022

More picture related to Tax Relief On Electric Cars Uk 2022

Is The UK Really Ready For Electric Cars Investors Chronicle

https://www.ft.com/__origami/service/image/v2/images/raw/https://s3-eu-west-1.amazonaws.com/ic-ez-prod/ez/images/1/8/2/9/4179281-1-eng-GB/EV+chart+140220.png?source=invchron

UK Demand For Electric Cars Soars Despite COVID Crisis

https://cdn.statcdn.com/Infographic/images/normal/23119.jpeg

How Much Is Company Car Tax On Electric Cars Auto Express

https://media.autoexpress.co.uk/image/private/s--uUDl7wey--/v1563277546/autoexpress/2019/07/06_8.jpg

Electric Car Tax Benefits Summary of Electric Car Tax Benefits A battery electric vehicle BEV has 2 Benefit in Kind BIK in 2023 2024 and 2024 2025 From 1 April 2020 until 31 March 2025 all zero emission vehicles are exempt from the Vehicle Excise Duty expensive car supplement On a car costing around 40 000 this could amount to a tax relief of 7 600 in the first year Tax benefits on EV charging There are no additional tax reliefs for charging your EV If you charge it at home you pay a standard VAT of 5

In the 2022 Autumn Statement Chancellor Jeremy Hunt announced that from 2025 electric vehicles will not be exempt from paying VED anymore The exemption for electric vehicles from the expensive car supplement will also be abolished For all company cars registered on or since 6th April 2020 the appropriate percentage of Benefit in Kind BiK tax increases by 1 from 6th April 2022 and will be fixed for the next two tax years as well For electric cars which had attracted 1 in 2021 22 they will now attract a 2 BiK rate which means an employee will still pay an

FAQs Electric Cars Green Car

https://content.green.car/wp-content/uploads/2022/04/FAQs-electric-cars-UK-2022.jpeg

Toll Roads Could Be Introduced To UK As Electric Car Ownership Surges

https://e3.365dm.com/21/10/768x432/skynews-electric-car_5566188.jpg?20211031135621

https://www. gov.uk /guidance/vehicle-tax-for...

Electric and low emission cars registered on or after 1 April 2025 You will need to pay the lowest first year rate of vehicle tax which applies to vehicles with CO2 emissions 1 to 50g km From

https://www. gov.uk /government/publications/...

This measure will impact on individuals who own an electric car van or motorcycle These individuals will now need to pay VED on their vehicles Changes will come into effect from 1 April 2025

Electric Cars What You Need To Know About The Future Of Motoring UK

FAQs Electric Cars Green Car

Twizy

Key Questions Answered On Electric Cars Shropshire Star

British Micro EV Maker Launches Compact Two seater For London Autocar

Ford Kuga Plug In Hybrid Drivers Do HALF Their Journeys On ELECTRIC

Ford Kuga Plug In Hybrid Drivers Do HALF Their Journeys On ELECTRIC

China Bets On Electric Cars

Buying An Electric Car For Savings Time Could Be Of The Essence

R D Tax Relief Are You Entitled Bdaily

Tax Relief On Electric Cars Uk 2022 - VED benefit in kind and more Are there still EV tax advantages The UK government has announced plans to make owners of electric cars pay Vehicle Excise Duty VED from 2025 a change