Tax Relief On Life Insurance Premiums Ireland Where the premiums are for an unapproved policy or scheme the premiums paid by the employer are taxable as Benefit in Kind BIK How to claim You can claim the relief during the year by following these steps Sign into myAccount Click on the Manage your tax for the current year link in PAYE Services Select Claim tax credits

This manual outlines the tax implications for employers who take out certain life assurance policies on the lives of their employees 1 General Where an employer takes out in his own favour a policy insuring against death sickness or injury of an employee the premiums paid are normally inadmissible deductions for tax purposes There is no tax relief for life insurance policies However tax relief is available for certain medical related insurance type policies For life assurance it is still possible to obtain tax relief for premiums paid if the cover is part of a pension policy

Tax Relief On Life Insurance Premiums Ireland

Tax Relief On Life Insurance Premiums Ireland

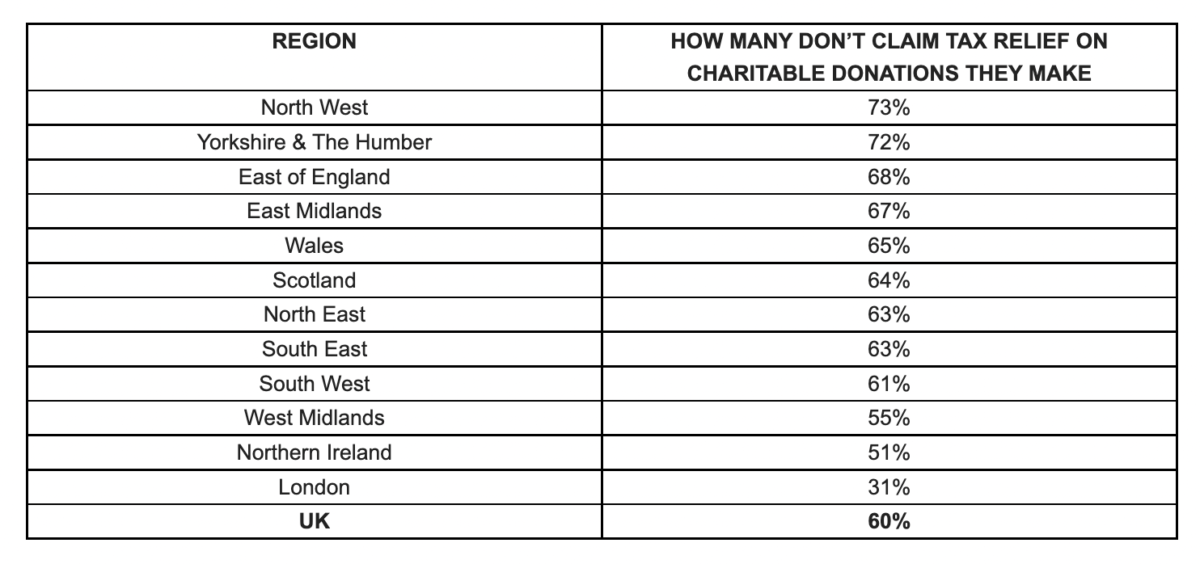

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

https://stedswm.co.uk/wp-content/uploads/2022/05/image001.png

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Premiums on standard term life insurance policies are not tax deductible But you can get tax relief on a special type of life insurance called Pension Term Assurance Also if you re lucky enough to be a company director and your company pays your life insurance premiums the premiums may be a tax deductible expense for the company The taxation of domestic life assurance companies and their policyholders depends on when the life assurance business was written These companies are authorised and regulated by the Central Bank of Ireland

Some types of life insurance offer tax relief on premiums in Ireland Pension Term a type of Life Insurance click here for pension term internal link for self employed is one of them Read more about 1 Is a Life Insurance Claim Taxable 2 How Long Does it Take to Complete the Application Process and Get Cover 3 Can I claim tax relief on my life insurance premiums Income tax relief is not generally available on life insurance premiums However if you re self employed or working for an employer who does not include you in a pension scheme for retirement benefits you can arrange life insurance cover payable to your estate and the premiums may qualify

Download Tax Relief On Life Insurance Premiums Ireland

More picture related to Tax Relief On Life Insurance Premiums Ireland

Finance Loans Finance Tips Business Finance Life Insurance Facts

https://i.pinimg.com/originals/ac/87/b7/ac87b7d99baaaf0291af869f8e228296.jpg

Time To End Pension Tax Relief Inequality Business In The News

https://i1.wp.com/businessinthenews.co.uk/wp-content/uploads/2020/09/Stuart-Price-neutral-002-1.jpg?fit=1200%2C800&ssl=1

Sgli Chart

https://i2.wp.com/www.gavop.com/uploads/blog/Rate_of_life_insurance_1148.png

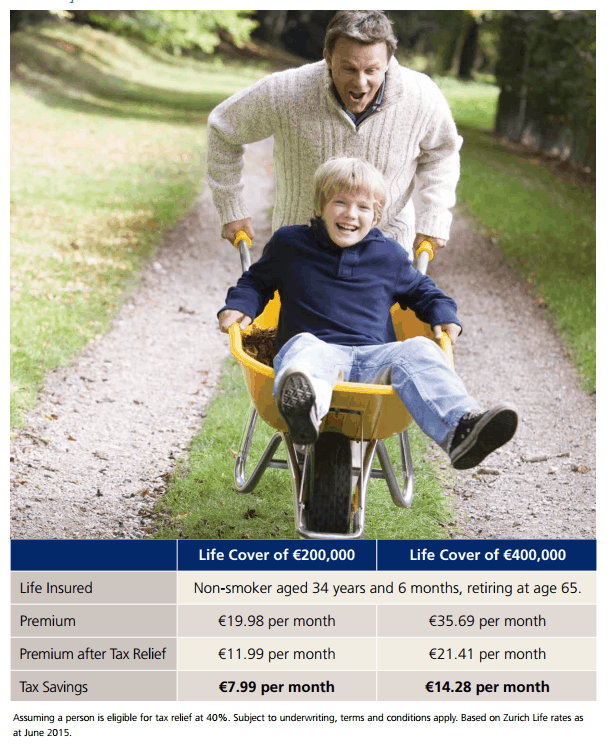

Find out more about taxation and medical expenses and about tax relief on nursing home fees and for dependent relatives Tax relief is also available for premiums paid for health insurance and for long term care insurance The insurance company grants this tax relief at source Tax following a death Tax Savings You can claim tax relief on the premiums you pay making it more affordable The major attraction of Pension Term Assurance is you can claim tax relief on your premiums So it will cost you 40 less than a regular life insurance policy In real terms a 100 per month premium just 60 per month How Tax Relief Works Example

[desc-10] [desc-11]

3 Tips For Massive Savings On Life Insurance Premiums

https://www.vexnews.com/wp-content/uploads/2020/09/Untitled-8.jpg

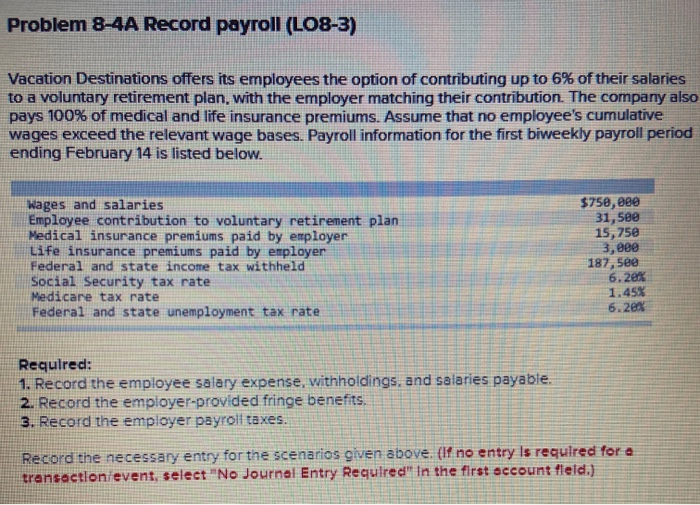

Solved Problem 8 4A Record Payroll LO8 3 Vacation Chegg

https://media.cheggcdn.com/study/b1c/b1c0c513-5d44-4d51-b132-61f5e3bdb736/image.png

https://www.revenue.ie › en › personal-tax-credits...

Where the premiums are for an unapproved policy or scheme the premiums paid by the employer are taxable as Benefit in Kind BIK How to claim You can claim the relief during the year by following these steps Sign into myAccount Click on the Manage your tax for the current year link in PAYE Services Select Claim tax credits

https://www.revenue.ie › en › tax-professionals › tdm › ...

This manual outlines the tax implications for employers who take out certain life assurance policies on the lives of their employees 1 General Where an employer takes out in his own favour a policy insuring against death sickness or injury of an employee the premiums paid are normally inadmissible deductions for tax purposes

How To Claim Higher Rate Tax Relief On Pension Contributions

3 Tips For Massive Savings On Life Insurance Premiums

Tax relief RateMuse

Tax Relief On Life Insurance Premiums OneLife Insurance

Life Insurance Premium Terms You Must Know Mindovermetal English

How To Get Tax Relief On Bad Debt CHW Accounting

How To Get Tax Relief On Bad Debt CHW Accounting

JUST HOW DO The Tax Breaks Work Dug Tech

UK s New Tax Year And The Changes You Need To Know About Financial Times

Claimable Costs What Costs Can Be Included In R D Tax Credit Claims

Tax Relief On Life Insurance Premiums Ireland - Premiums on standard term life insurance policies are not tax deductible But you can get tax relief on a special type of life insurance called Pension Term Assurance Also if you re lucky enough to be a company director and your company pays your life insurance premiums the premiums may be a tax deductible expense for the company