Tax Relief On Life Insurance Premiums The 75 per cent of premiums rule is modified in certain cases an endowment policy defined at IPTM2040 where the insured life exceeds 55 when the policy is taken out the 75 figure is

Life insurance premiums are not usually tax deductible You may however be able to deduct them as a business expense if you are not directly or indirectly a beneficiary of the policy BIM45525 Specific deductions insurance employees and other key persons An employer may take out in their own favour a policy insuring against loss of profits resulting from the death

Tax Relief On Life Insurance Premiums

Tax Relief On Life Insurance Premiums

http://www.rairupinder.com/wp-content/uploads/2020/04/insurance-scaled.jpg

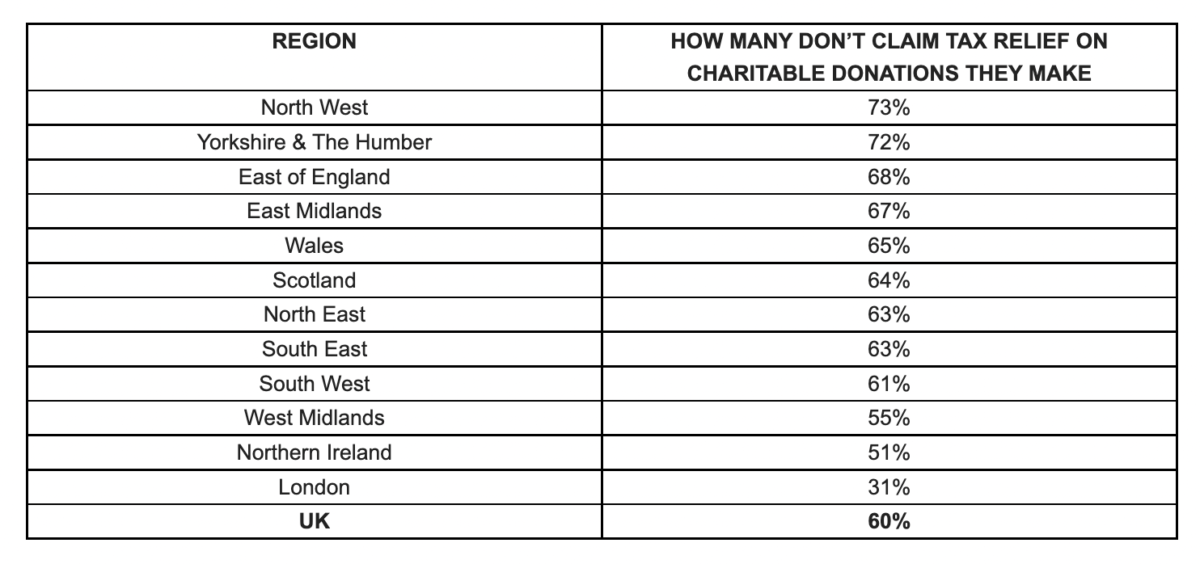

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

https://stedswm.co.uk/wp-content/uploads/2022/05/image001.png

In this article we will walk you through claiming tax reliefs for your insurance payments More precisely we will help you identify what to look out for in your annual insurance statements as well as how exactly to claim for tax reliefs for your insurance in your income tax returns form ITRF This helpsheet deals with chargeable event gains arising from UK life insurance policies It covers the most common circumstances that you re likely to come across when dealing with the

Life insurance payouts are made tax free to beneficiaries But there are times when money from a policy is taxable especially if you re accessing cash value in your own policy Here s Yes you can deduct life insurance premiums if they are for employee benefits and the business is not the beneficiary following the rules on the tax treatment of life insurance premiums paid by the employer

Download Tax Relief On Life Insurance Premiums

More picture related to Tax Relief On Life Insurance Premiums

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/3-3-1024x1024.png

3 Tips For Massive Savings On Life Insurance Premiums

https://www.vexnews.com/wp-content/uploads/2020/09/Untitled-8.jpg

Any taxable elements of a life insurance payout above the IHT threshold will be taxed at 40 or the current IHT rate There are several strategies that you can undertake to avoid saddling your dependents with this cost You could for example Leave it all to a spouse or civil partner Premiums on relevant life insurance are tax deductible for the business and therefore not treated as a benefit in kind to the employee which often come with a significant tax bill Employees also benefit by not having to pay for premiums on a personal life insurance policy from their taxed income

Are life insurance premiums tax deductible Most life insurance policies are excluded from the current UK Income Tax regime The amount you pay for personal life insurance also known as the premium is not tax deductible but in the event of a valid claim the cash sum will not be subject to Income Tax Labour has said it will keep to the existing rules to reduce the debt to GDP ratio in five years with capped annual borrowing at 3pc of GDP Something has to give I have seen little to suggest

Finance Loans Finance Tips Business Finance Life Insurance Facts

https://i.pinimg.com/originals/ac/87/b7/ac87b7d99baaaf0291af869f8e228296.jpg

Can I Claim Tax Relief On Pension Contributions For Previous Years

https://static.wixstatic.com/media/86bc97_3cbaa83e44154d0592e1aed784b07f19~mv2.jpg/v1/fill/w_980,h_653,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/86bc97_3cbaa83e44154d0592e1aed784b07f19~mv2.jpg

https://www.gov.uk/hmrc-internal-manuals/insurance...

The 75 per cent of premiums rule is modified in certain cases an endowment policy defined at IPTM2040 where the insured life exceeds 55 when the policy is taken out the 75 figure is

https://www.investopedia.com/articles/personal...

Life insurance premiums are not usually tax deductible You may however be able to deduct them as a business expense if you are not directly or indirectly a beneficiary of the policy

Malaysia Income Tax Here Are The Tax Reliefs To Claim For YA 2022

Finance Loans Finance Tips Business Finance Life Insurance Facts

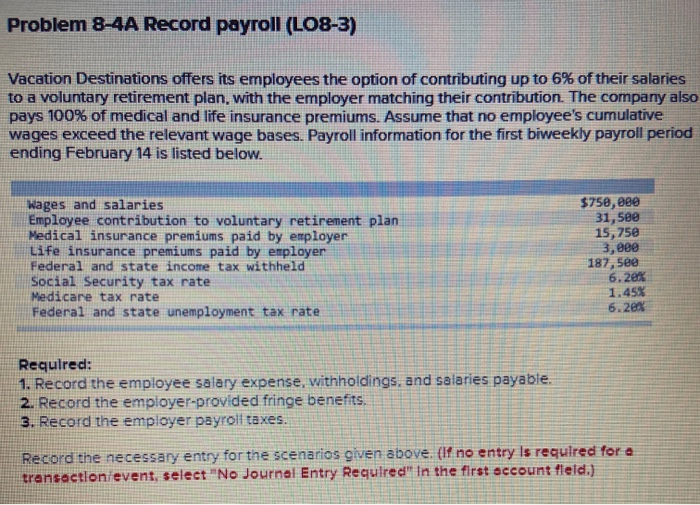

Solved Problem 8 4A Record Payroll LO8 3 Vacation Chegg

Personal Tax Relief 2021 L Co Accountants

How To Claim Higher Rate Tax Relief On Pension Contributions

Tax relief RateMuse

Tax relief RateMuse

Is The Quote Fair How To Calculate An Insurance Premium

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical

Life Insurance Premium Terms You Must Know Mindovermetal English

Tax Relief On Life Insurance Premiums - Yes you can deduct life insurance premiums if they are for employee benefits and the business is not the beneficiary following the rules on the tax treatment of life insurance premiums paid by the employer