Tax Relief On Life Insurance Premiums Uk For policies issued or varied from 21 March 2012 annual premiums payable under all such policies must not exceed 3 600 The 75 per cent of premiums rule is modified in certain cases

Get Started How much is life insurance taxed Any taxable elements of a life insurance payout above the IHT threshold will be taxed at 40 or the current IHT rate Understanding the tax implications of a maturing personal life insurance policy especially as a non UK resident is crucial It involves careful consideration of your residency status allowable expenses and applicable tax rates

Tax Relief On Life Insurance Premiums Uk

Tax Relief On Life Insurance Premiums Uk

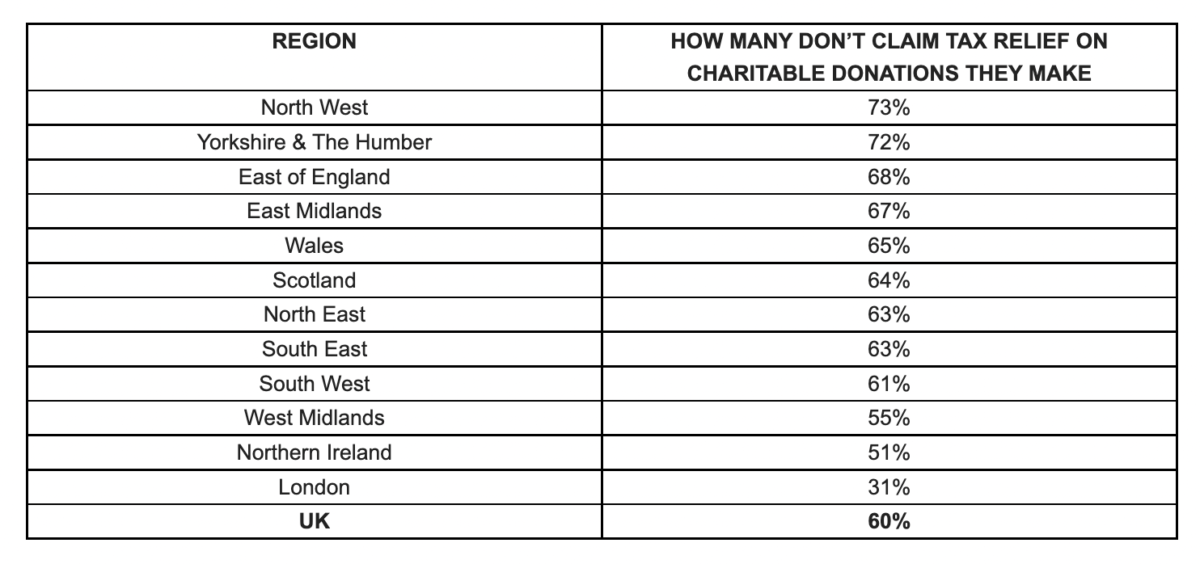

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

https://stedswm.co.uk/wp-content/uploads/2022/05/image001.png

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Guidance The profits from the surrender of certain life insurance policies are treated as savings income rather than capital gains and taxed last after all other income ie top sliced in the income tax computation Most life insurance policies are excluded from the current UK Income Tax regime The amount you pay for personal life insurance also known as the premium is not tax deductible but in the event of a valid claim the

The following Personal Tax guidance note provides comprehensive and up to date tax information on Life insurance policies deficiency relief Can I get tax relief on premiums Yes premiums are paid for by the business and get tax relief since they are treated as a business expense by HMRC What about corporation tax Yes premium costs can be offset against corporation tax

Download Tax Relief On Life Insurance Premiums Uk

More picture related to Tax Relief On Life Insurance Premiums Uk

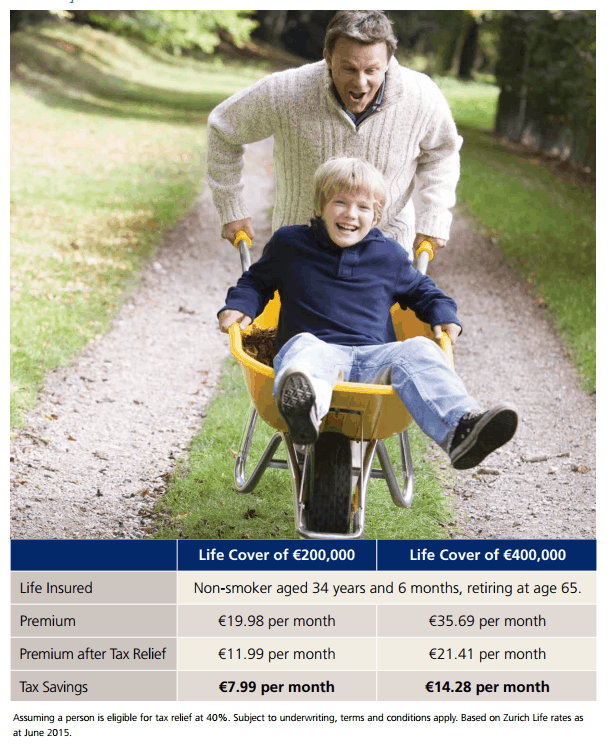

Tax Relief On Life Insurance Premiums OneLife Insurance

https://onelifeinsure.ie/wp-content/uploads/2017/06/Pension-Term-Insurance-photo.png

Finance Loans Finance Tips Business Finance Life Insurance Facts

https://i.pinimg.com/originals/ac/87/b7/ac87b7d99baaaf0291af869f8e228296.jpg

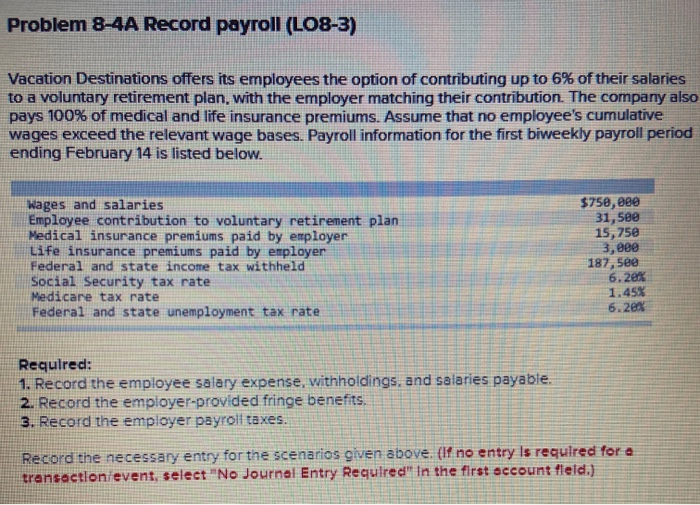

Solved Problem 8 4A Record Payroll LO8 3 Vacation Chegg

https://media.cheggcdn.com/study/b1c/b1c0c513-5d44-4d51-b132-61f5e3bdb736/image.png

Life insurance is not taxed when it pays out in the UK but there are instances where it may become liable for Inheritance Tax IHT so it is important to arrange your life insurance policy in a way that avoids any potential tax implications when you die Deficiency relief reduces the client s liability to tax at the higher rate If a policy has been issued added to or assigned on or after 3 March 2004 corresponding deficiency relief is only available where the claimant was the person chargeable on the earlier gain s Gain is treated as having borne tax

Under the scheme an individual resident in the UK who makes an eligible regular premium payment under a qualifying life insurance policy issued before 14 March 1984 is entitled to income tax Updated 6 April 2024 This helpsheet deals with chargeable event gains arising from UK life insurance policies It covers the most common circumstances that you re likely to come across when

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical

https://www.ibanding.my/wp-content/uploads/2017/09/Green-Tax-Jar-min.jpg

Personal Tax Relief 2021 L Co Accountants

https://landco.my/wp-content/uploads/2021/11/Personal-Tax-Relief-2021-724x1024.png

https://www. gov.uk /hmrc-internal-manuals/insurance...

For policies issued or varied from 21 March 2012 annual premiums payable under all such policies must not exceed 3 600 The 75 per cent of premiums rule is modified in certain cases

https://www. onlinemoneyadvisor.co.uk /insurance/...

Get Started How much is life insurance taxed Any taxable elements of a life insurance payout above the IHT threshold will be taxed at 40 or the current IHT rate

How To Claim Higher Rate Tax Relief On Pension Contributions

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical

Tax relief RateMuse

Life Insurance Premium Terms You Must Know Mindovermetal English

Claimable Costs What Costs Can Be Included In R D Tax Credit Claims

Half Of Brits Have No Idea What Affects Their Life Insurance Premiums

Half Of Brits Have No Idea What Affects Their Life Insurance Premiums

Which Is Better Paying Health Insurance Premiums Pre Tax Or Post Tax

Life Insurance And Taxes Everything You Need To Know About It

Tax Advisor For SEIS And EIS Tax Relief Gatwick Accountant

Tax Relief On Life Insurance Premiums Uk - There is no tax relief for employees and individuals when premims are paid and there is usually no tax liability when the policy is cashed in A different type of life insurance policy contains investment it is often cashed in during a person s life and any gain would in that case be taxable