Tax Return Donations To Charity How to claim relief on a Self Assessment tax return if you donate to charity through Gift Aid Payroll Giving or gifts of shares securities land or buildings

In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the taxpayer s Charitable contribution tax information search exempt organizations eligible for tax deductible contributions learn what records to keep and how to report contributions find tips on making

Tax Return Donations To Charity

Tax Return Donations To Charity

https://i.pinimg.com/originals/b7/35/34/b73534202de2f142a8d417f5211bfae0.jpg

Here s How To Get This Year s Special Charitable Tax Deduction

https://kubrick.htvapps.com/htv-prod-media.s3.amazonaws.com/images/donations-1609343326.jpg?crop=1.00xw:1.00xh;0,0&resize=900:*

How To Legally Claim A Tax Deduction For Charitable Giving From Your

http://www.wealthsafe.com.au/wp-content/uploads/2015/02/charity-hand.jpg

These taxpayers including married individuals filing separate returns can claim a deduction of up to 300 for cash contributions to qualifying charities during 2021 The You can only claim a tax deduction for a gift or donation to an organisation that has the status of a deductible gift recipient DGR To claim a deduction you must be the

For tax year 2024 and most tax years you are required to itemize your deductions to claim your charitable gifts and contributions Itemizing your tax return to include charitable donations and contributions means filing With a qualified charitable distribution QCD you can transfer up to 100 000 to charity tax free The money would have to go directly from your IRA to an eligible charitable organization

Download Tax Return Donations To Charity

More picture related to Tax Return Donations To Charity

Bunching Up Charitable Donations Could Help Tax Savings

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

Charitable Deductions For 2020

https://hbkcpa.com/wp-content/uploads/2020/10/GivingtoChairty.jpg

How To Find The Value Of Donations For Tax Purposes ToughNickel

https://usercontent1.hubstatic.com/4527128_f520.jpg

Charitable donations of cash investments and physical property may be tax deductible But you must itemize to deduct your donations If the standard deduction is larger Giving to charity can be life affirming and as a bonus it can help with your tax bill If donating to a charity is part of your tax plan here are a couple of tips so you can

In the United States ever changing tax laws can make it difficult for donors to know which gifts are tax deductible and how charitable giving can benefit your tax situation We recommend Are charitable contributions tax deductible Here s what you need to know when filing your 2024 tax return

4 Things To Know About Charitable Donations And Taxes The Motley Fool

https://g.foolcdn.com/editorial/images/463728/donations-jar_gettyimages-639389876.jpg

Tips On Tax Deductions For Donations

http://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

https://www.gov.uk › government › publications

How to claim relief on a Self Assessment tax return if you donate to charity through Gift Aid Payroll Giving or gifts of shares securities land or buildings

https://www.irs.gov › charities-non-profits › ...

In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the taxpayer s

Charitable Contributions Guide

4 Things To Know About Charitable Donations And Taxes The Motley Fool

Charitable Giving What You Can And Can t Deduct Greater Iowa Credit

6 Tax Changes To Know To Avoid A Surprise In 2019 UseMyPro Part 5

High State Income Tax Rates Discourage Philanthropists Fuel Bureaucrats

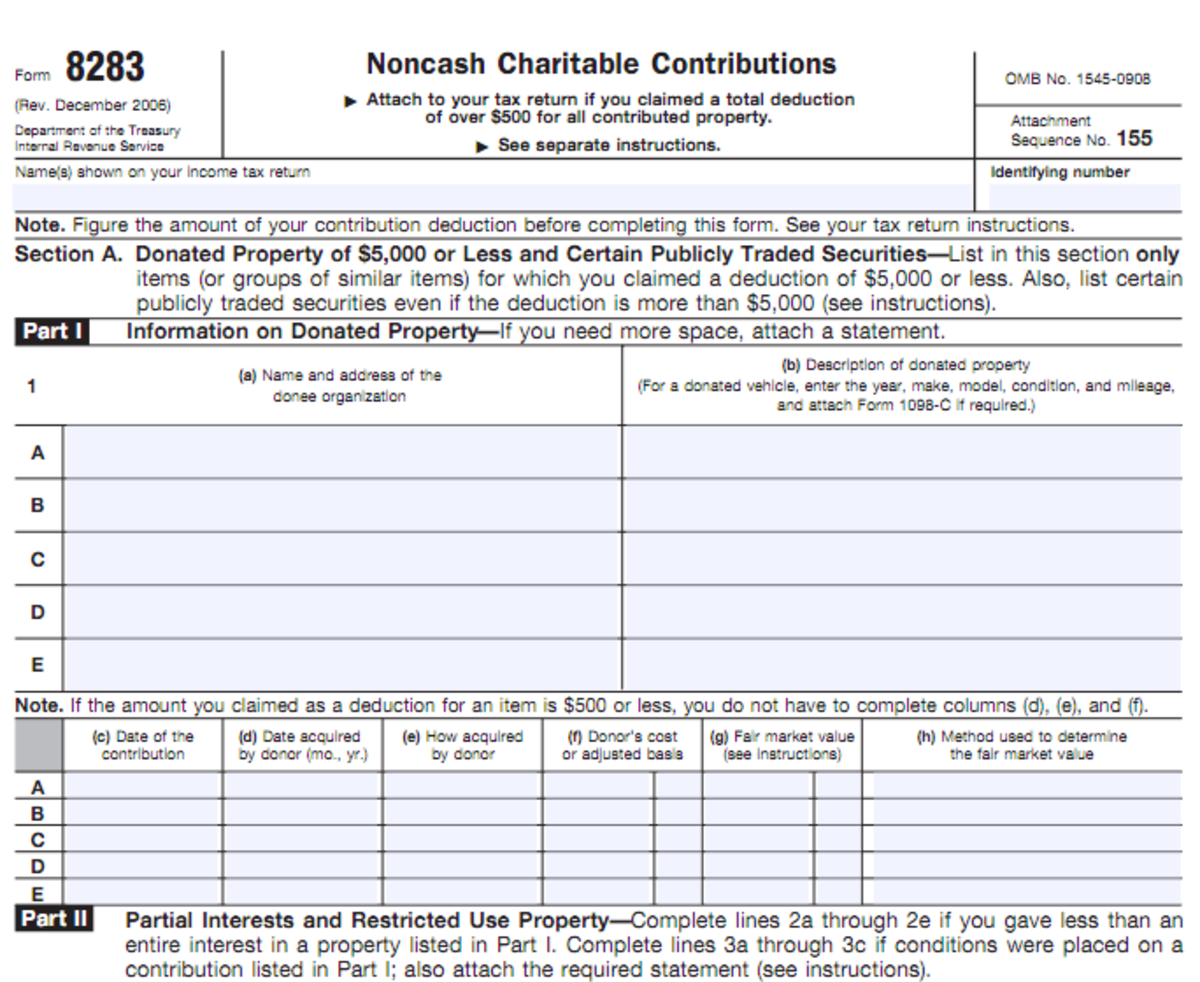

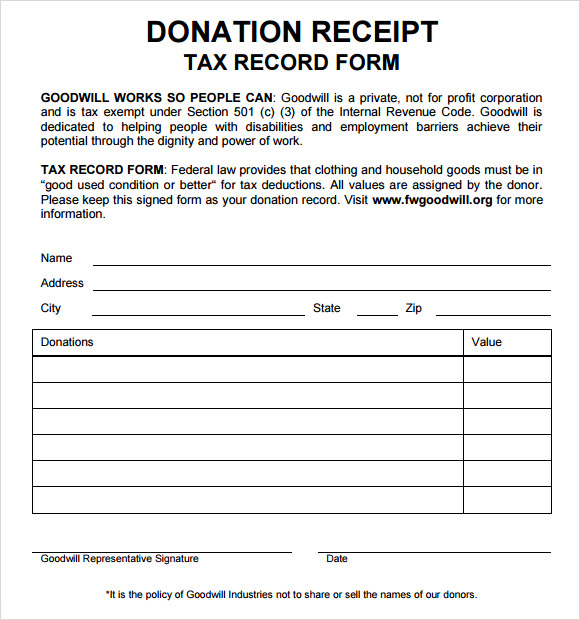

Tax Deductible Donation Receipt Printable Addictionary

Tax Deductible Donation Receipt Printable Addictionary

10 Donation Receipt Templates Free Samples Examples Format

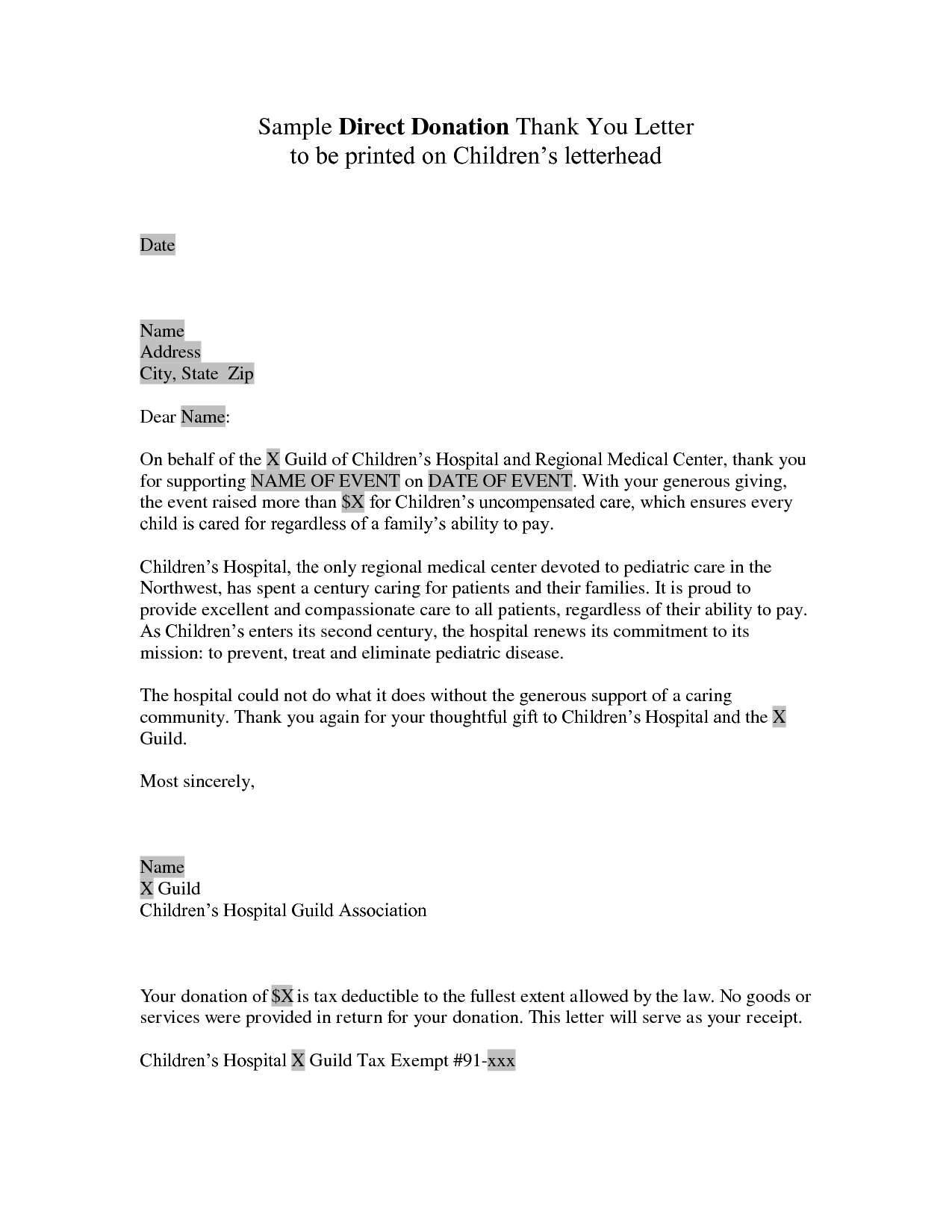

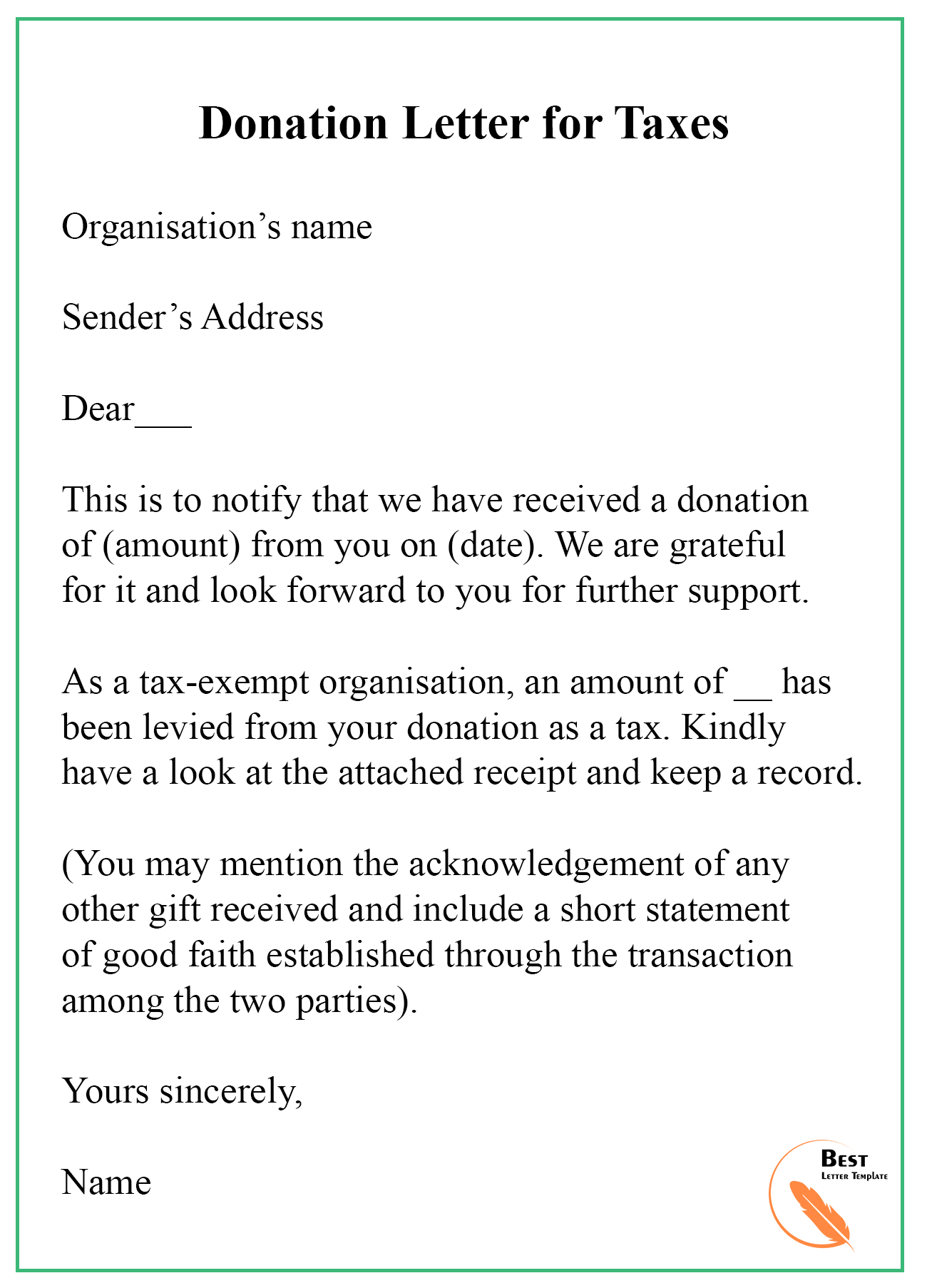

Tax Write Off Donation Letter Template Samples Letter Template Collection

13 Free Donation Letter Template Format Sample Example

Tax Return Donations To Charity - You can only claim a tax deduction for a gift or donation to an organisation that has the status of a deductible gift recipient DGR To claim a deduction you must be the