Tax Return For Salary Person You can use the tax rate calculator to estimate whether the tax rate indicated in your tax card needs to be changed This may be necessary if you have started or stopped working for

Finnish income tax rates for your salary range determine how much money you ll pay in taxes These rates apply to each individual person s income so your spouse s or partner s income In case of eligible taxpayers having income from business and profession new tax regime is default regime If assessee wants to opt out of new tax regime they can furnish Form 10 IEA

Tax Return For Salary Person

Tax Return For Salary Person

https://medtax.ca/wp-content/uploads/2021/07/income-tax-return-words-in-3d-wooden-letters-in-cr-HR89U2N-scaled.jpg

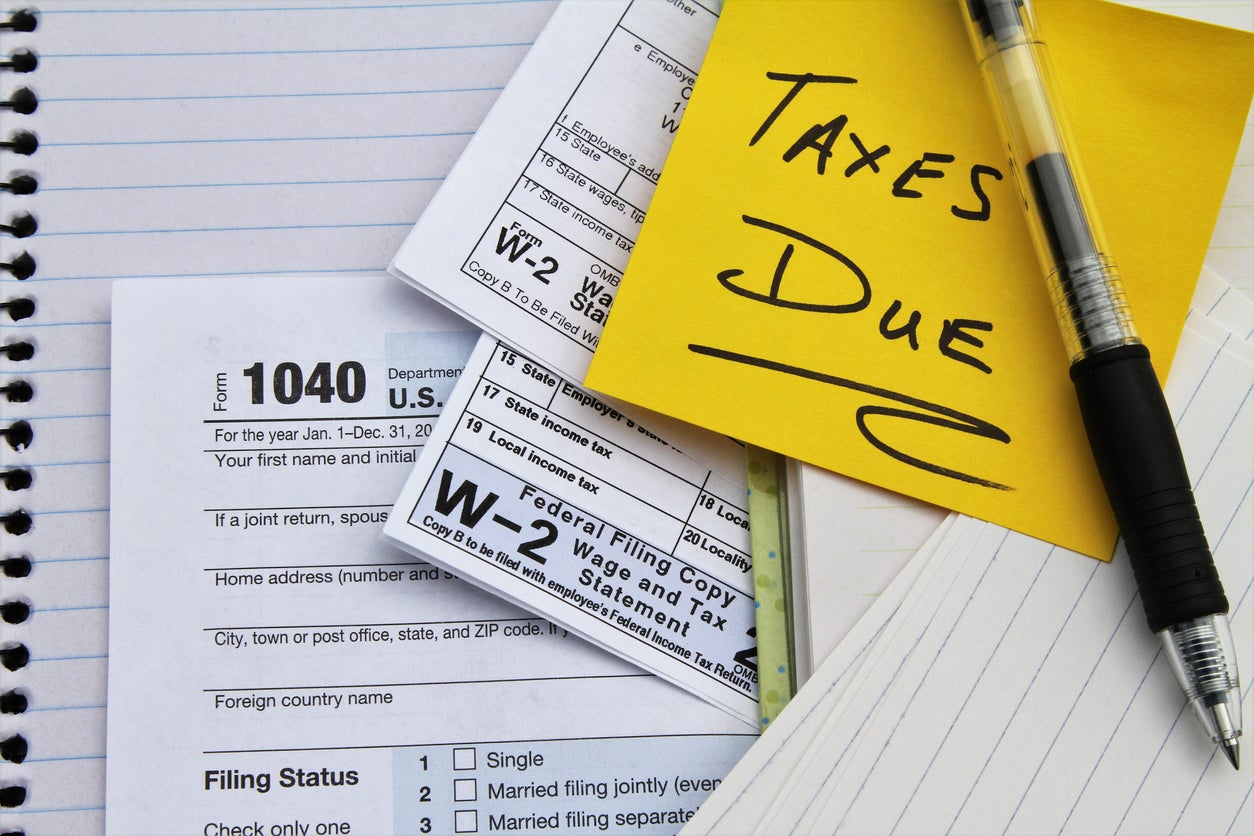

How To File Tax Extension Self Employed

https://img.money.com/2023/02/News-2023-How-To-File-Taxes-Free.jpg

Tax Return Preparation Complete Guide 2022 Jasim Uddin Rasel

https://taxpertbd.com/wp-content/uploads/2021/09/Tax-Return-Preparation-Cover-1324x2048.jpg

When it comes to taxation and financial responsibility one of the essential obligations for a salaried employee is to file their Income Tax Return ITR diligently It s a There is no need to declare the income received as a key employee on a Finnish tax return unless you are receiving some other earned income simultaneously A key person s tax

Salaried individuals can file Income Tax returns online File Photo Here we give step wise detail on how can a salaried individual taxpayer file ITR 1 using Form 16 online through the e Filing Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number online You can efile income tax return on your income from salary

Download Tax Return For Salary Person

More picture related to Tax Return For Salary Person

How To Calculate Income Tax On Salary With Payslip Example Income Tax

https://i.ytimg.com/vi/USW68EaURfg/maxresdefault.jpg

Income Tax Return Filing ITR For FY 2022 23 Important Tips Form 16

https://static.toiimg.com/thumb/msid-100690943,width-1070,height-580,imgsize-23082,resizemode-75,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

Tax Return 2021 File Tax Return 2021 For Salary Govt Teacher And

https://i.ytimg.com/vi/X55nCV_qUd4/maxresdefault.jpg

Salaried individuals can file income tax returns ITR using the forms ITR 1 or ITR 2 ITR 1 applies to individual resident taxpayers with a total income of up to Rs 50 lakhs For an employee their main source of income is via salary Such employees need to file their Income tax return in the FORM ITR 1 SAHAJ This article explains how salaried person should prepare their income tax return in

Understanding the nuances of income tax returns is vital for salaried employees to navigate the complexities of tax obligations This comprehensive guide explores the various types of income tax returns available to them Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number online You can efile income tax

Breakdown Of Tax Return Filers Revealed By HMRC As This Year s January

https://www.ross-shirejournal.co.uk/_media/img/KZSI4R39WOJ1F3DHGGZU.jpg

Can A Spouse Sign A Tax Return For The Other Spouse Mind The Tax

https://mindthetax.com/wp-content/uploads/2021/08/Logo.png

https://www.vero.fi › en › individuals › tax-cards-and...

You can use the tax rate calculator to estimate whether the tax rate indicated in your tax card needs to be changed This may be necessary if you have started or stopped working for

https://www.workinfinland.com › en › get-started › ...

Finnish income tax rates for your salary range determine how much money you ll pay in taxes These rates apply to each individual person s income so your spouse s or partner s income

How To Calculate Income Tax On Salary With Example

Breakdown Of Tax Return Filers Revealed By HMRC As This Year s January

ITR Income Tax Return E verification To Complete Filing Process All

How Much Does An Employer Pay In Payroll Taxes Tax Rate

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Income Tax Return For Salary Employees Myonlineauditor

Income Tax Return For Salary Employees Myonlineauditor

100 OFF US Income Tax Preparation IRS Tutorial Bar

How Can I Get The Most Out Of My Tax Return Education Loan Finance

4 Ways To File Your Taxes This Year Get It Back Tax Credits For

Tax Return For Salary Person - When it comes to taxation and financial responsibility one of the essential obligations for a salaried employee is to file their Income Tax Return ITR diligently It s a