Us Tax Refund Date 2022 See your personalized refund date as soon as the IRS processes your tax return and approves your refund See your status starting around 24 hours after you e

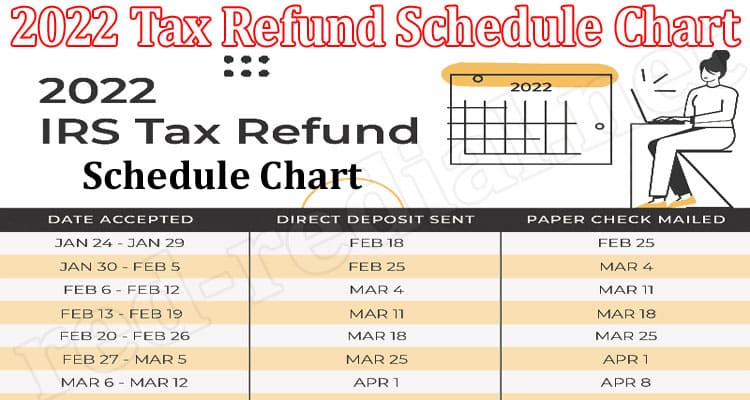

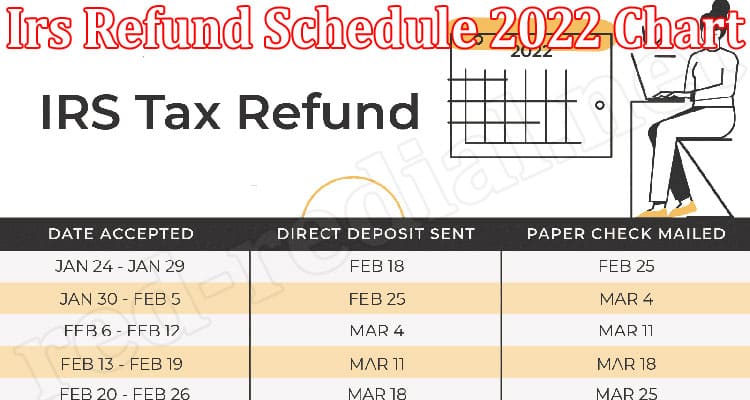

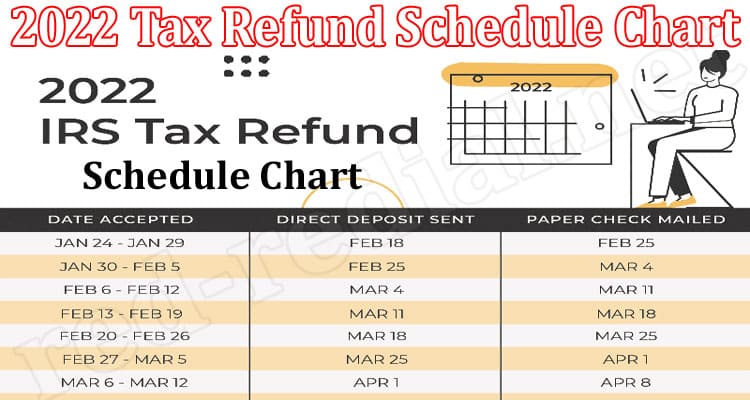

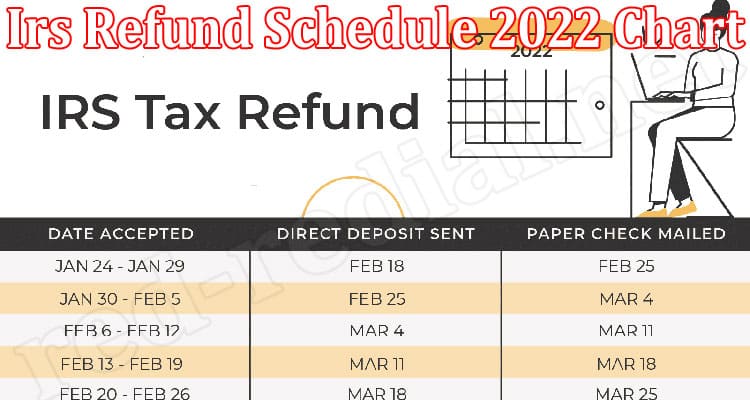

IRS will start accepting income tax returns on Jan 24 2022 IRS may delay start of tax season by a week or so Returns with EITC or CTC may have refunds delayed until March to Explore options for getting your federal tax refund how to check your refund status how to adjust next year s refund and how to resolve refund problems

Us Tax Refund Date 2022

Us Tax Refund Date 2022

https://www.red-redial.net/wp-content/uploads/2022/02/Latest-News-2022-Tax-Refund-Schedule-Chart.jpg

Irs Refund Schedule 2022 Chart Feb Track Progress Help

https://www.red-redial.net/wp-content/uploads/2022/02/Latest-News-Irs-Refund-Schedule-2022-Chart.jpg

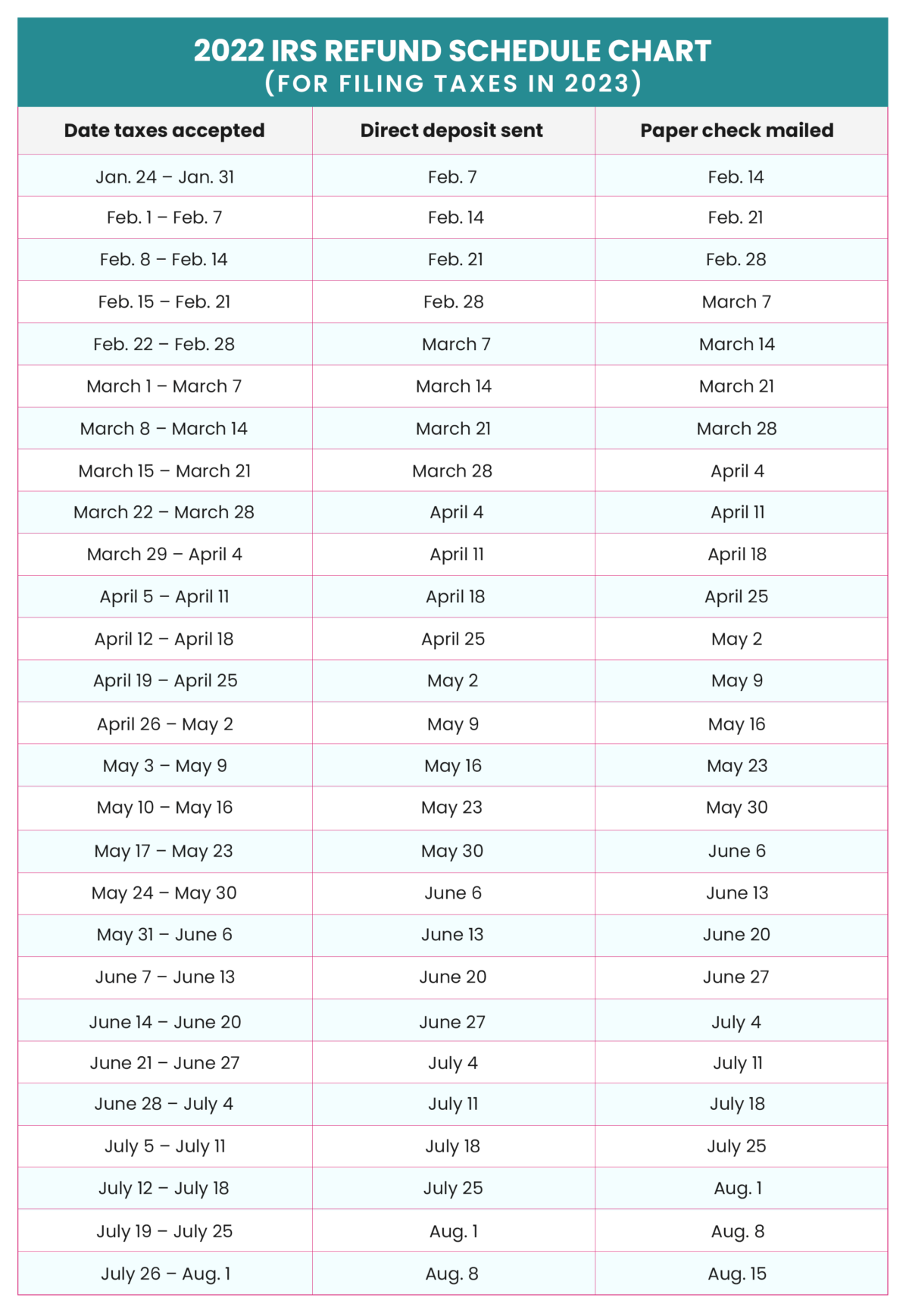

Tax Refund Schedule 2022 Chart Feb Complete Insight

https://www.red-redial.net/wp-content/uploads/2022/02/Latest-News-Tax-Refund-Schedule-2022-Chart.jpg

That may make taxpayers nervous about delays in 2022 but most Americans should get their refunds within 21 days of filing according to the IRS And Although the IRS will start accepting returns on Jan 24 you may not get a refund until mid February especially if you got child tax credit money

When is the tax filing deadline in 2022 The deadline to file 2021 income tax returns is Monday April 18 for most people three days later than the normal April 15 Yep nearly 81 4 million federal income tax returns were done as of March 25 slightly more than three weeks before this year s April 18 filing deadline for most of

Download Us Tax Refund Date 2022

More picture related to Us Tax Refund Date 2022

The IRS Refund Schedule 2021 Tax Deadline Tax Return Deadline Tax

https://i.pinimg.com/originals/7d/b0/9e/7db09ee47275620c9c16a4628885c0c1.jpg

2022 Tax Refund Schedule Chart Sad Kings

https://i0.wp.com/themilitarywallet.com/wp-content/uploads/2022/01/tax-refund-schedule.png

2022 Tax Refund Schedule Chart May Read About It

http://wnews24x7.com/wp-content/uploads/2022/05/2022-Tax-Refund-Schedule-Chart-1.jpg

For most taxpayers the due date to file and pay is Monday April 18 2022 not the typical April 15 because that s Emancipation Day Taxpayers in Maine or Massachusetts have until April Check your federal tax refund status Before checking on your refund have the following ready Social Security number or Individual Taxpayer Identification Number

Tax Return Filing due dates April 18 2022 For most taxpayers the tax filing deadline is April 18 2022 April 19 2022 For residents of Maine and Massachusetts only the deadline is April 19 2024 Tax Deadline Monday April 15 2024 The IRS does not release a calendar but continues to issue guidance that most filers should receive their refund

2022 Estimated Income Tax Refund Date Chart When Will You Get Your

https://i.ytimg.com/vi/SNnMLx2aDAo/maxresdefault.jpg

Tax Extension 2022 KereenAimen

https://i.pinimg.com/736x/5f/5e/0f/5f5e0f1c9fdd61fa87df5215e135f24d.jpg

https://www.irs.gov › wheres-my-refund

See your personalized refund date as soon as the IRS processes your tax return and approves your refund See your status starting around 24 hours after you e

https://www.cpapracticeadvisor.com

IRS will start accepting income tax returns on Jan 24 2022 IRS may delay start of tax season by a week or so Returns with EITC or CTC may have refunds delayed until March to

The Best Irs Refund Calendar 2022 Ideas Blank November 2022 Calendar

2022 Estimated Income Tax Refund Date Chart When Will You Get Your

How To Find Out If You Owe State Taxes Rowwhole3

Estimated Income Tax Refund Date Chart For 2022 CPA Practice Advisor

2023 Tax Refund Date Chart Printable Forms Free Online

11 How To Check My State Refund Status Trending Hutomo

11 How To Check My State Refund Status Trending Hutomo

2022 Tax Refund Estimator CeiranAhsun

2022 Tax Refund Schedule Chart Caf Group 2024 Calendar Printable

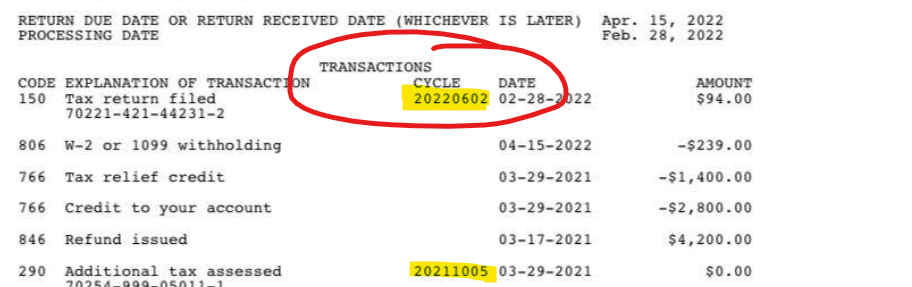

2022 IRS Cycle Code Using Your Free IRS Transcript To Get Tax Return

Us Tax Refund Date 2022 - Expect the IRS to acknowledge your return within 24 to 48 hours IRS Refund Timetable Post acceptance the processing time typically unfolds on an IRS