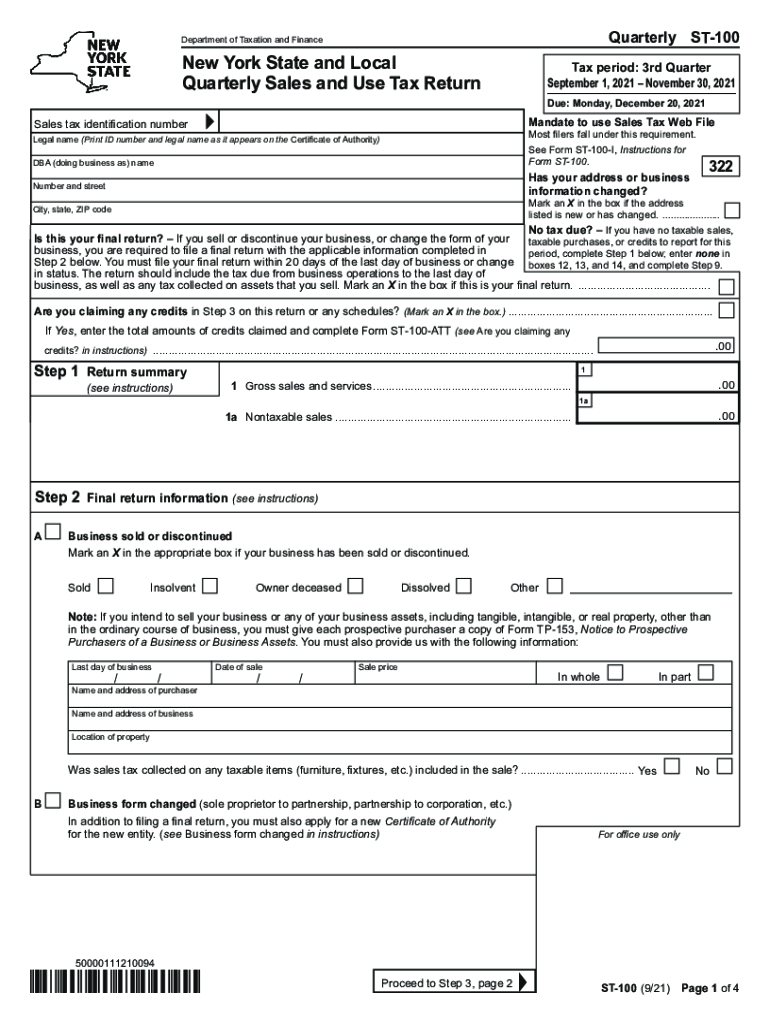

Virginia Quarterly Sales Tax Return Due Dates View account history and schedule payments in advance up to the due date Business Account FAQs Available for Retail Sales and Use Tax Form ST 9 for in state dealers

Excise Tax Full page on this site CDT Cannabis Dispensary Tax File through MyTaxes The tax shall be due and payable on the 20th day of January April For Periods Beginning On and After April 1 2022 All Form ST 9 filers are required to file and pay electronically at www tax virginia gov See ST 9A Worksheet

Virginia Quarterly Sales Tax Return Due Dates

Virginia Quarterly Sales Tax Return Due Dates

https://www.signnow.com/preview/577/778/577778985/large.png

How To File And Pay Sales Tax In Florida TaxValet Tax Refund Sales

https://i.pinimg.com/originals/02/24/44/022444d55827d477e72b45d7d2503666.png

There s Still Time To Contribute To An IRA For 2021 Taylor Company

https://taylorcpas.net/wp-content/uploads/2022/03/taxtime-1.jpg

For Periods Beginning On and After July 1 2021 All Form ST 9 filers are required to file and pay electronically at www tax virginia gov See ST 9A Worksheet for Typically most people must file their tax return by May 1 Fiscal year filers Returns are due the 15th day of the 4th month after the close of your fiscal year If the due date falls on a

The due dates for filing sales tax returns in Virginia are Monthly 20th of the following month Quarterly April 20 July 20 October 20 January 20 I didn t collect View our complete guide to Virginia sales tax with information about Virginia sales tax rates registration filing and deadlines

Download Virginia Quarterly Sales Tax Return Due Dates

More picture related to Virginia Quarterly Sales Tax Return Due Dates

.png)

Income Tax Return Who Is Required Which Form Due Dates Fy 2022 23 Ay

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjgH5E3CzzJ-EczNDbw-wI_pL5VZC0SNmhsDQowAPaGKZ6vduNsvxSJgeHlrZQtukMAJ5XecqFbniw9tA-_vkdXcMzNSddLdSt_vXTyfHJpqrXqGUqYaoF0gOS4P268HUqM2FEsnkUirI00ycY1vH7KW4JJO-KNdRmEld1-DcyaNNeA0HqXHo7AIBxH-w/w1200-h630-p-k-no-nu/income tax return due date 2023-24 (1).png

Tax Return Date Estimate 2024 Dael Casandra

https://checkersaga.com/wp-content/uploads/2024/01/hero_-_2024_self-employed_tax_deadlines-1024x576.png

When Are 2019 Tax Returns Due Every Date You Need To File Business

https://www.indinero.com/wp-content/uploads/2019/09/TaxDeadlineCalendar-2.png

In Virginia you will be required to file and remit sales tax either monthly or quarterly Virginia sales tax returns are always due the 20th of the month following the reporting In Virginia sales tax returns can be due on a monthly quarterly or annual basis The frequency at which you file depends on the amount of sales tax you collect from customers in Virginia The filing

Your Virginia Sales Tax Filing Frequency Due Dates Your business s sales tax return must be filed by the 20th of the month following reporting period For a list of this year s VA 15 8th Monthly Within 3 working days after any federal payroll period in which 500 or more is withheld VA 16 Quarterly On or before 4 30 7 31 10 31 and 1 31 NOTE If

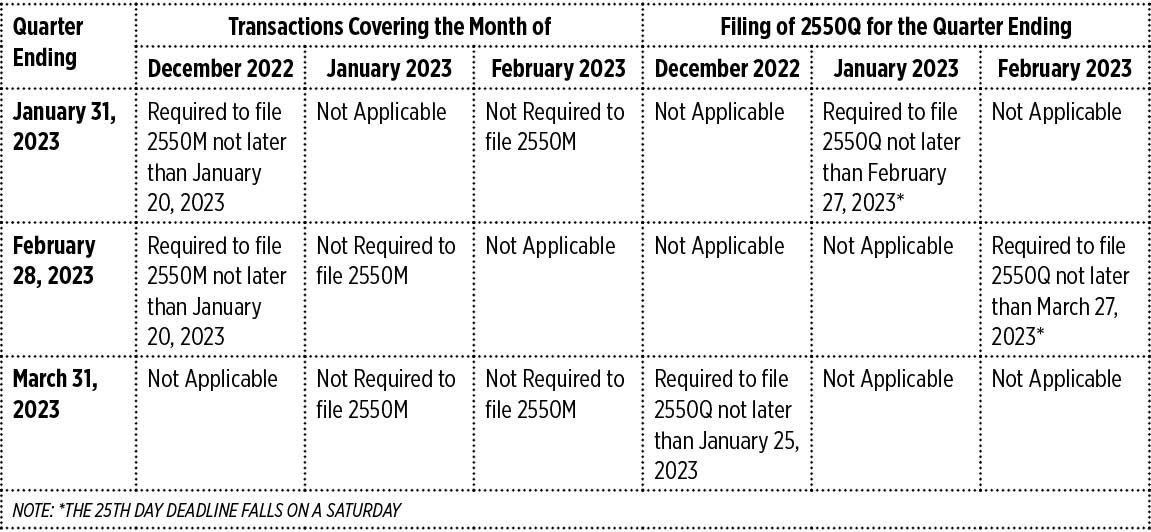

Ask The Tax Whiz How Can I File For The Quarterly VAT Starting

https://www.rappler.com/tachyon/2023/01/Transitory-Provisions.jpg

Nys Sales Tax Due Dates 2023 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/577/700/577700638/large.png

https://www.tax.virginia.gov/how-file-and-pay-sales-and-use-tax

View account history and schedule payments in advance up to the due date Business Account FAQs Available for Retail Sales and Use Tax Form ST 9 for in state dealers

https://tax.wv.gov/TaxCalendar

Excise Tax Full page on this site CDT Cannabis Dispensary Tax File through MyTaxes The tax shall be due and payable on the 20th day of January April

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg?strip=all)

Emancipation Day Dc 2023 Day 2023

Ask The Tax Whiz How Can I File For The Quarterly VAT Starting

Income Tax Return Filing Fy 2021 22 Ay 2022 23 Gambaran

2023 Deposit Requirements For Form 941 Printable Forms Free Online

A Closer Look At Quarterly VAT Filing BusinessWorld Online

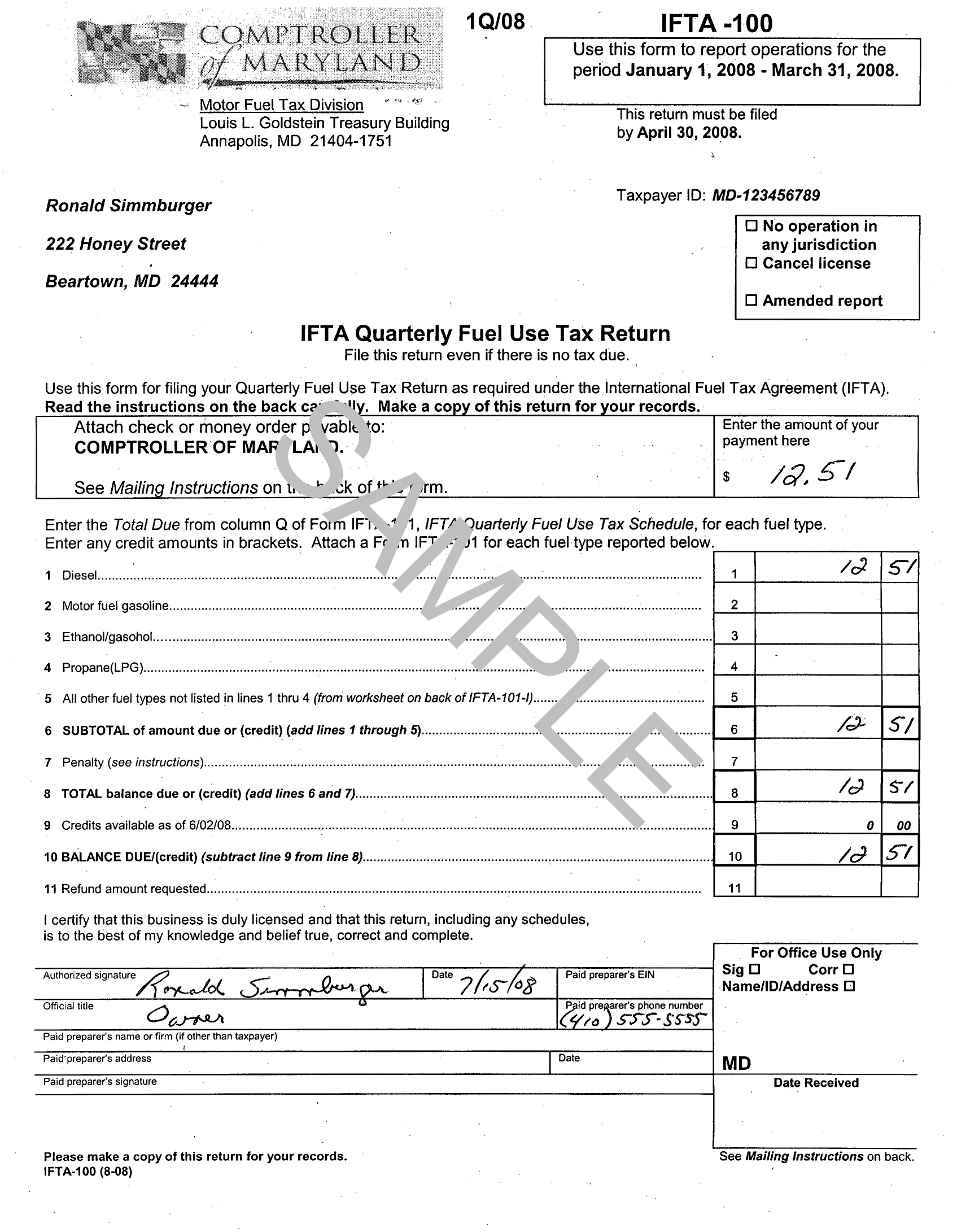

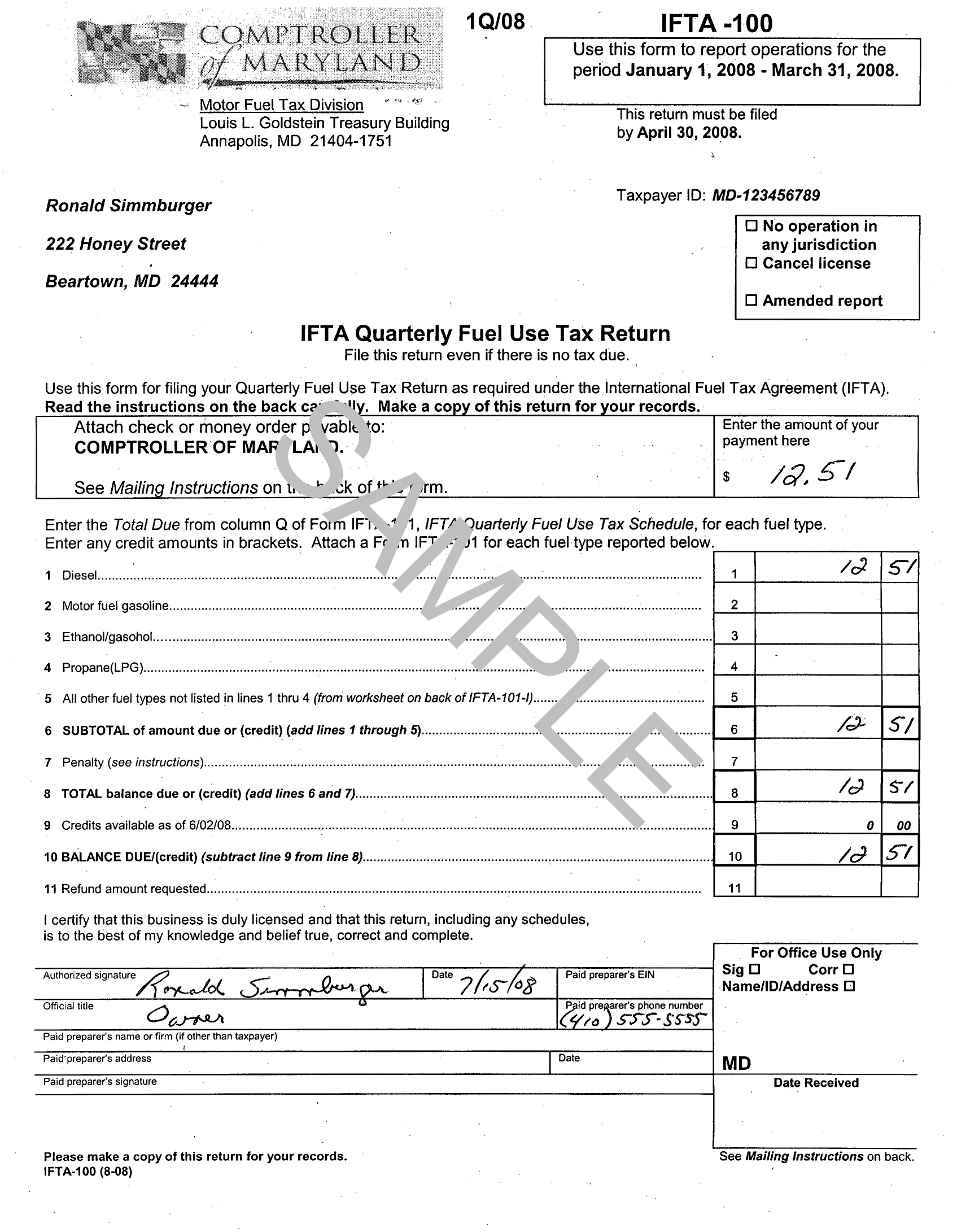

Ifta Report Sample Form Fill Out Printable PDF Forms Online

Ifta Report Sample Form Fill Out Printable PDF Forms Online

TDS Return Due Dates June 31 Due Date July 31

How To Make Quarterly Estimated Tax Payments For Ministers The Pastor

Nevada Monthly Sales Tax Return Due Date IUCN Water

Virginia Quarterly Sales Tax Return Due Dates - View our complete guide to Virginia sales tax with information about Virginia sales tax rates registration filing and deadlines