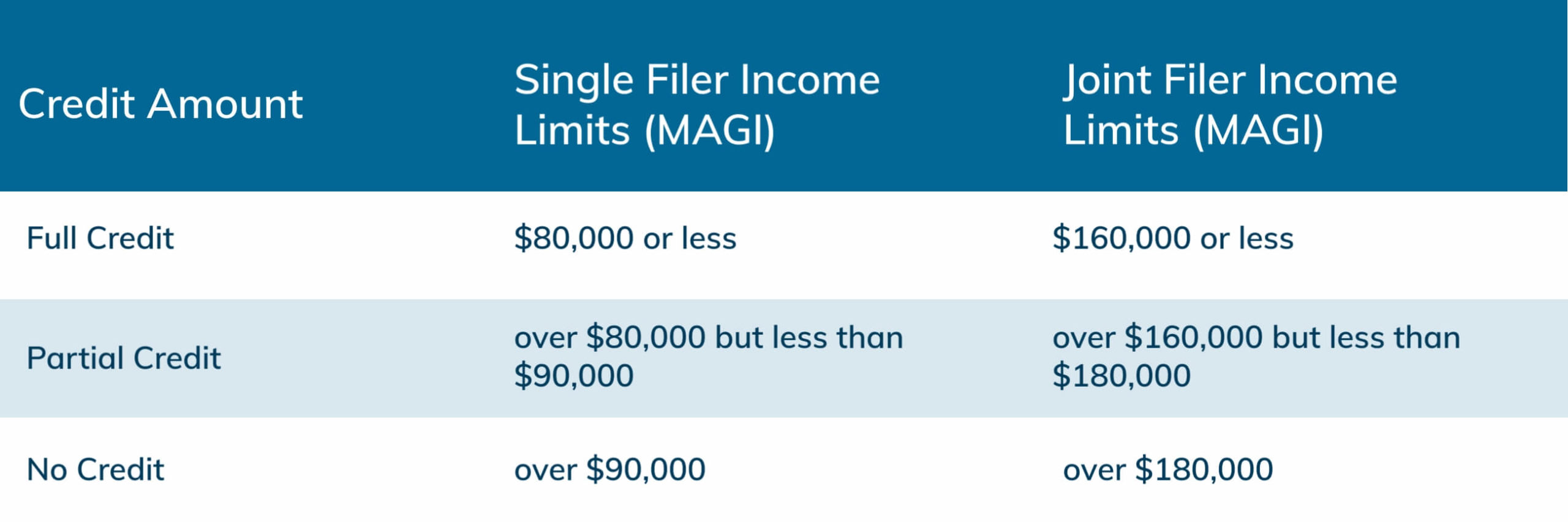

Washington State Tax Credit Income Limits A tax credit for Washington workers Individuals and families may receive up to 1 255 back if they meet certain eligibility requirements See if you qualify Apply now Already applied

The Washington Working Families Tax Credit is a refund of retail sales or use tax for low to moderate income Washington residents who meet certain eligibility requirements Do I have to How much will individuals and families get back It depends on the number of qualifying children and income level See table for estimates based on the 2022 income eligibility thresholds

Washington State Tax Credit Income Limits

Washington State Tax Credit Income Limits

https://foreignusa.com/wp-content/uploads/washington-state-income-tax-rate-from-Canva-768x432.png

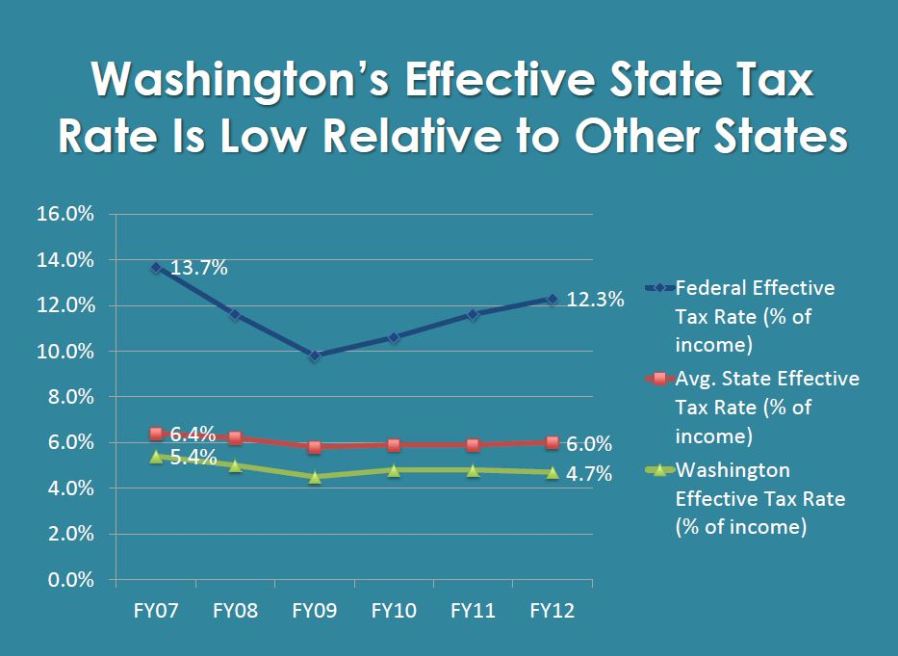

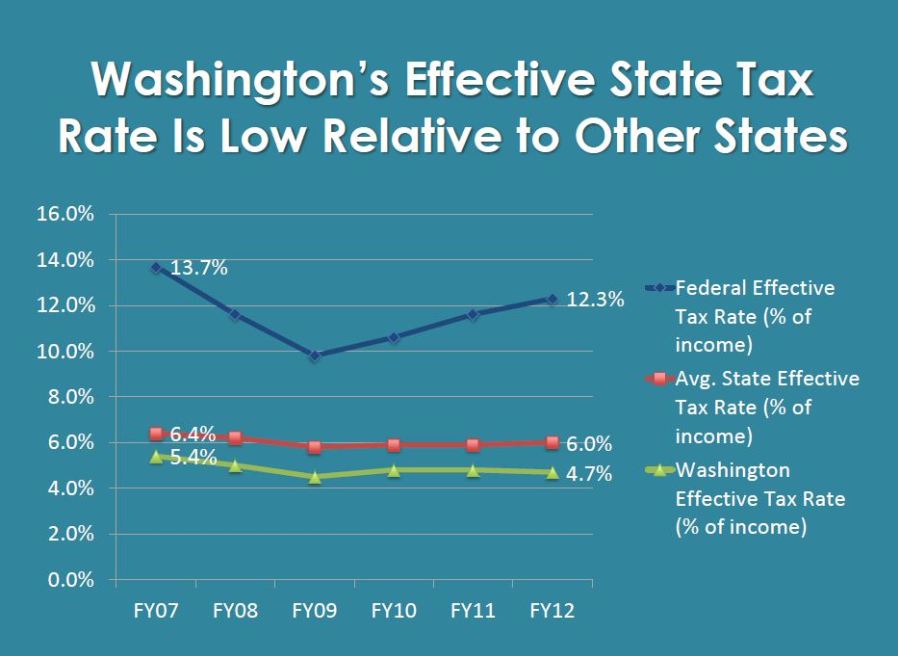

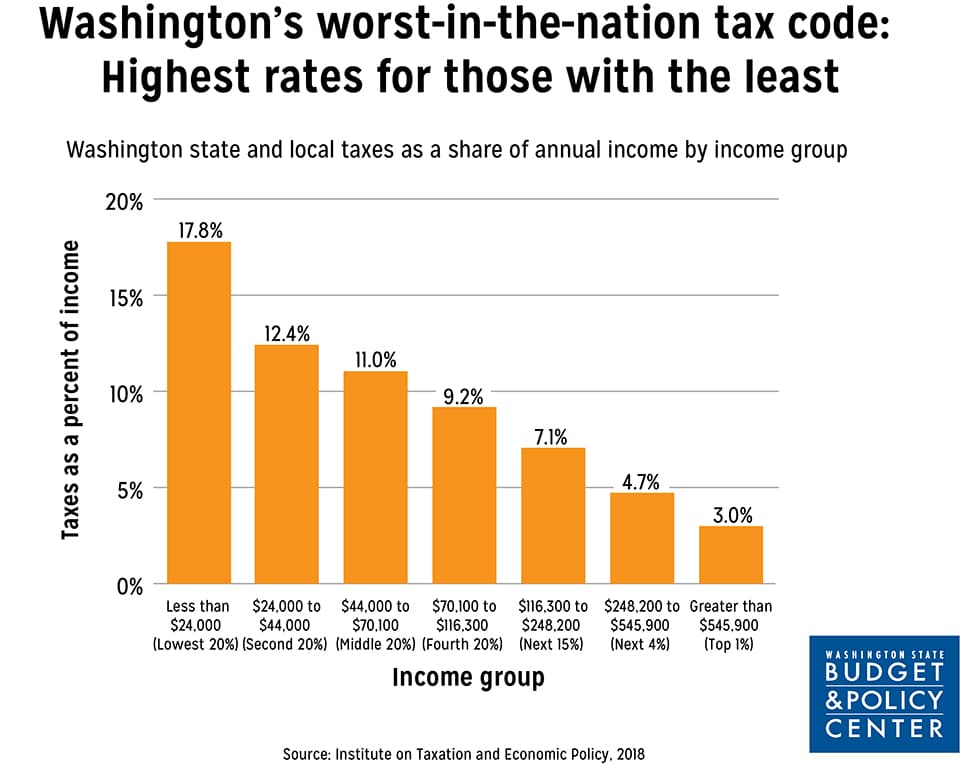

Washington State House Democrats The Truth About Taxes In Washington

http://housedemocrats.wa.gov/tmp/2013/04/WA-State-Effective-Tax-Rate-2013.jpg

Printable Handouts Washington State Working Families Tax Credit

https://workingfamiliescredit.wa.gov/sites/default/files/2022-06/English_WFTC General Info Flyer.jpg

The income limits for the WFTC are the same as the income limits for the federal Earned Income Tax Credit The income limits increase slightly each year You can check the current limits on the Department of Revenue website under Tax Year 2023 income thresholds and credit amount Eligibility for the WFTC is based on income and family size The maximum credit amount for a single person is 315 with an increase of

What is the Washington Working Families Tax Credit The Working Families Tax Credit is a new annual tax refund for Washington residents worth 50 1 255 depending on your income level and how many qualifying children you have in For a family or household of four persons the poverty level for 2021 is 26 500 Eligible taxpayers may apply to the program via the Department of Revenue DOR beginning

Download Washington State Tax Credit Income Limits

More picture related to Washington State Tax Credit Income Limits

At 1 436 Washington Ranks 24th In Property Taxes Per Capita Again

https://opportunitywa.org/wp-content/uploads/2019/03/1PTPCTF.png

Washington State Business Taxes

https://1businessworld.com/wp-content/uploads/2019/10/p6ptd-states-with-estate-or-inheritance-taxes-2018-.1571664757432-1.png

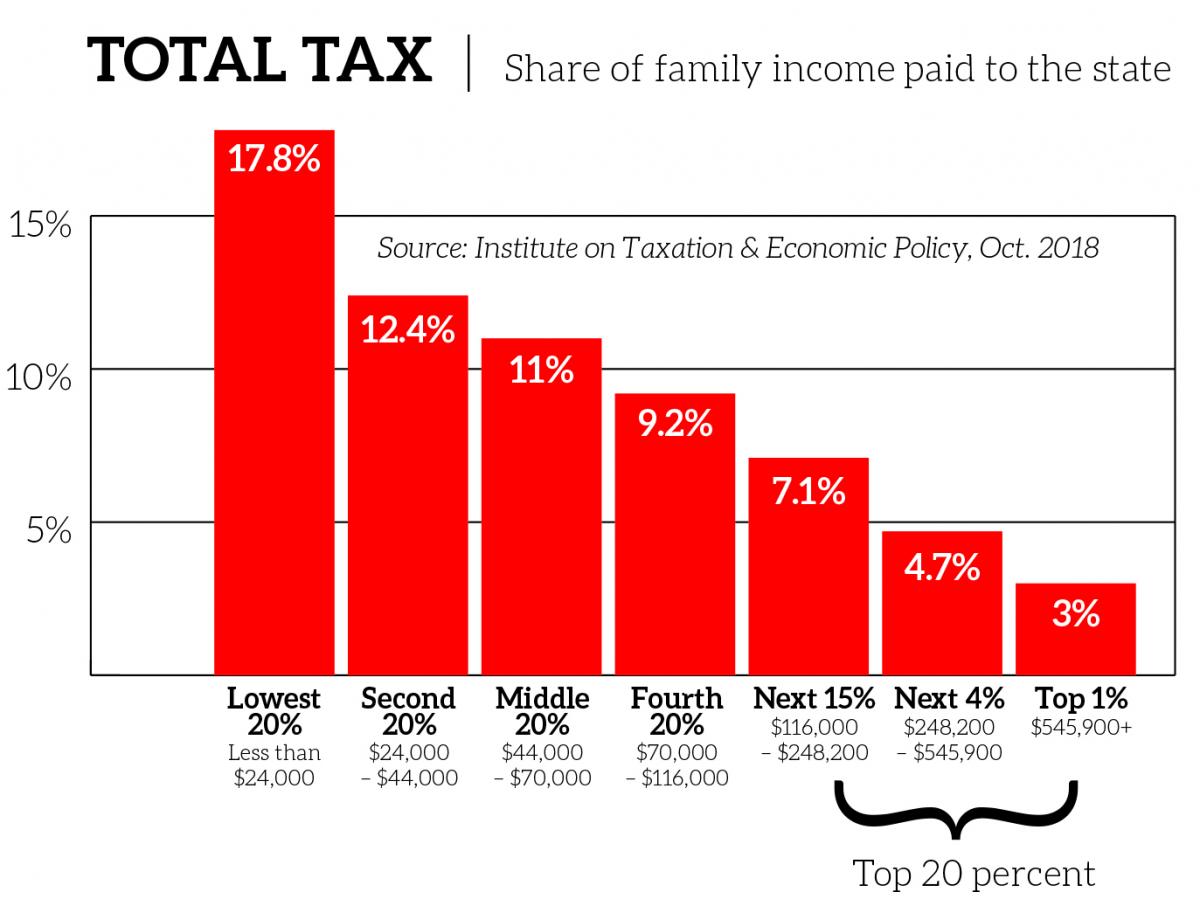

Study Washington Bottoms Out On US Tax Assessment October 24 2018

https://www.realchangenews.org/sites/default/files/styles/article_image_full/public/Tax Chart 10.24.18 issue.jpg?itok=ydBdTWTz

As a result of efforts by advocates the Washington state legislature approved and funded the Working Families Tax Credit an annual payment of up to 1 200 for more than 400 000 In 2023 Washington s Working Families Tax Credit was made officially available to state residents with applications open for the 2022 tax year Notes Washington is the only state

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break Many people in Washington state are eligible for EITC and this credit The income limits are based on the federal Earned Income Tax Credit ETIC View the current income limits Note These thresholds change each year and will be updated on the IRS s

Average Tax Refund In Every U S State Vivid Maps

https://vividmaps.com/wp-content/uploads/2019/02/Taxes.jpg

Payroll Taxes Filing Deadlines Rates And Employer Responsibilities

https://assets-blog.fundera.com/assets/wp-content/uploads/2019/04/07095606/state-income-tax-rates.png

https://workingfamiliescredit.wa.gov

A tax credit for Washington workers Individuals and families may receive up to 1 255 back if they meet certain eligibility requirements See if you qualify Apply now Already applied

https://workingfamiliescredit.wa.gov/get-help/...

The Washington Working Families Tax Credit is a refund of retail sales or use tax for low to moderate income Washington residents who meet certain eligibility requirements Do I have to

2023 Tax Brackets The Best Income To Live A Great Life

Average Tax Refund In Every U S State Vivid Maps

2022 Education Tax Credits Are You Eligible

Washington Ranks Highest In Nation For Reliance On Sales Tax 1170 KPUG AM

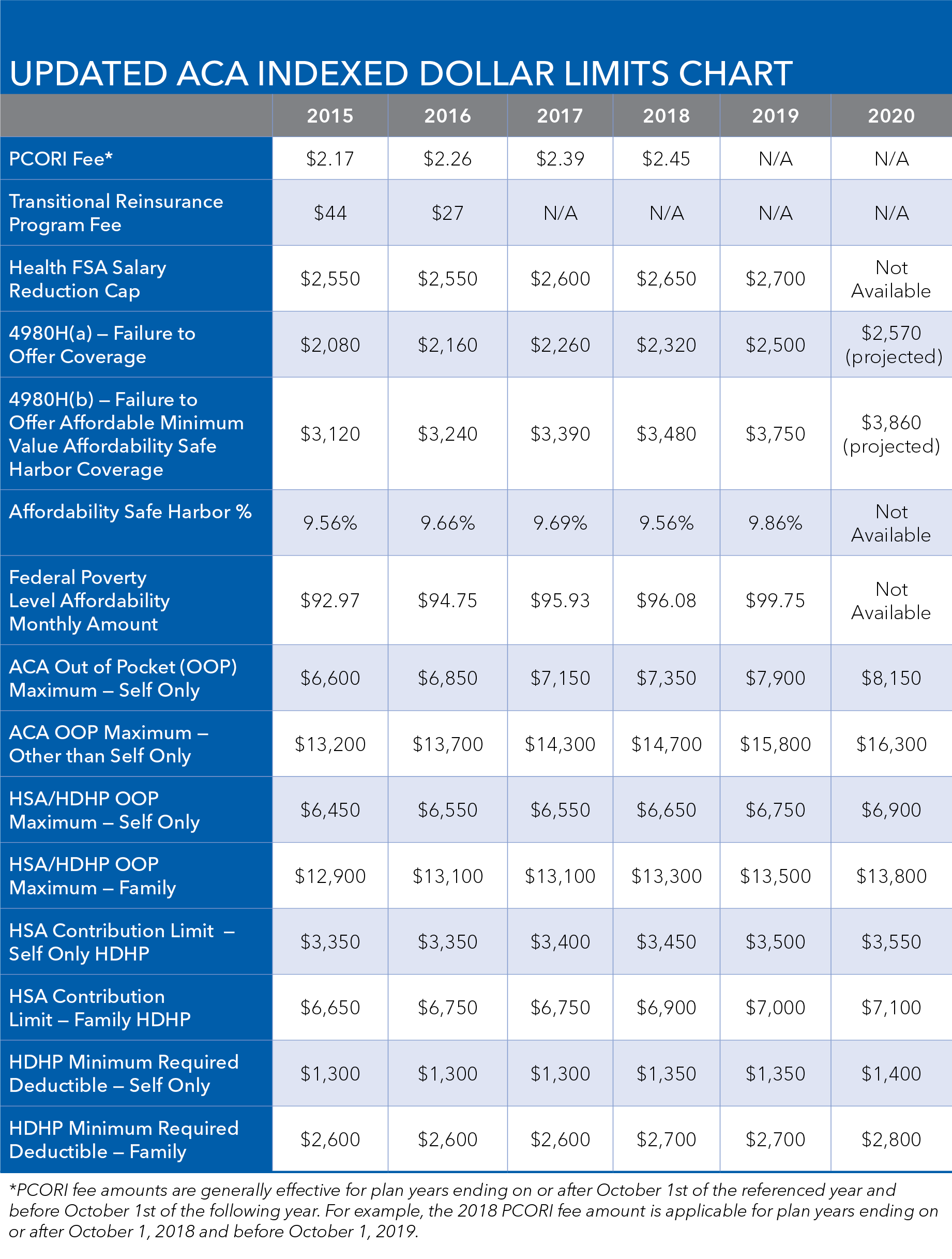

Updated ACA Indexed Dollar Limits Chart Conner Strong

The United States Of Sales Tax In One Map The Washington Post

The United States Of Sales Tax In One Map The Washington Post

Federal Poverty Level Guidelines Chart

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Unacceptable Washington Still Has The Nation s Most Inequitable State

Washington State Tax Credit Income Limits - Tax Year 2023 income thresholds and credit amount Eligibility for the WFTC is based on income and family size The maximum credit amount for a single person is 315 with an increase of