What Can I Deduct For Airbnb Web What expenses are deductible from my Airbnb income as a host of a stay If you re hosting a stay it s possible that not all of your Airbnb income is taxable Deductible items may

Web If you pay taxes for subletting you can deduct the expenses incurred in connection with the rental as income related expenses No Taxes Till the Exemption Limit The exemption Web What expenses are deductible from my Airbnb income as a host of a stay If you re hosting a stay it s possible that not all of your Airbnb income is taxable Deductible items may

What Can I Deduct For Airbnb

What Can I Deduct For Airbnb

https://assets.website-files.com/5f1f2d2413cb3a4770a1fb38/625dcd796eb13cadcb832176_Jordan-Marshall-p-800.jpeg

What Expenses Can I Deduct For A Side Business NJMoneyHelp

https://njmoneyhelp.com/wp-content/uploads/2014/12/tax-6-401kcalculator.org_-968x726.jpg

WHAT CAN I DEDUCT FOR SURPLUS INCOME IN BANKRUPTCY

https://i0.wp.com/www.irasmithinc.com/blog/wp-content/uploads/2014/07/WHAT-CAN-I-DEDUCT-FOR-SURPLUS-INCOME-IN-BANKRUPTCY.jpg

Web 22 Nov 2023 nbsp 0183 32 You can deduct all ordinary and necessary expenses to operate your rental business including guest service fees unless you Web 4 Aug 2021 nbsp 0183 32 You can take deductions for expenses for the use of a home or apartment used for rental purposes Note If you rent out your home for fewer than 15 days a year

Web Include advance rent in your rental income in the year you receive it regardless of the period covered or if you are a cash or accrual basis taxpayer For example if you receive rent in Web Read on for a list of even more write offs for rental property hosts Property promotion Write it off using Schedule C Box 8 Marketing materials like postcards property signs

Download What Can I Deduct For Airbnb

More picture related to What Can I Deduct For Airbnb

Can I Deduct Health Insurance Premiums HealthQuoteInfo

https://healthquoteinfo.com/wp-content/uploads/2018/10/Can-I-Deduct-Health-Insurance-Premiums.jpg

Ebay Reseller Taxes HELP What Can I Deduct For My Reselling Business

https://i.ytimg.com/vi/xWHgnjKg93U/maxresdefault.jpg

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

Web 18 Juli 2019 nbsp 0183 32 1 A new bonus depreciation deduction Instead of letting property owners deduct only 50 percent of your furniture and equipment the new tax law now allows owners to deduct 100 percent of Web Deductible items may include rent mortgage cleaning fees rental commissions insurance and other expenses How to Are Airbnb stays tax deductible It is not possible for us

Web Rules What expenses are deductible from my Airbnb income as a host of a stay Deductible items may include rent mortgage cleaning fees rental commissions Web Mortgage Interest Insurance and Taxes Mortgage interest taxes and homeowners or rental insurance are all potentially deductible depending on how you use your Airbnb

What Can I Deduct On My Business Taxes Due Business Tax Online

https://i.pinimg.com/originals/96/45/03/9645038b679e6e0ab1c162aca5d830fe.jpg

What Can I Deduct From My Taxes Bookkeeping Accounting Tax

https://hylencpa.com/wp-content/uploads/2018/01/Hylen_Blog_TaxDeductions.jpg

https://www.airbnb.com/help/article/182

Web What expenses are deductible from my Airbnb income as a host of a stay If you re hosting a stay it s possible that not all of your Airbnb income is taxable Deductible items may

https://taxfix.de/en/guide-german-taxes/mistakes/airbnb-revenue-on-my...

Web If you pay taxes for subletting you can deduct the expenses incurred in connection with the rental as income related expenses No Taxes Till the Exemption Limit The exemption

What Tax Can I Deduct For Medical Expenses Smith Rossi

What Can I Deduct On My Business Taxes Due Business Tax Online

Deducting Donations To Sports Teams NJMoneyHelp

How To Deduct Home Improvements For Airbnb Property Storables

Airbnb Tax Deductions Short Term Rental Tax Deductions

What Can I Deduct As A Business Expense

What Can I Deduct As A Business Expense

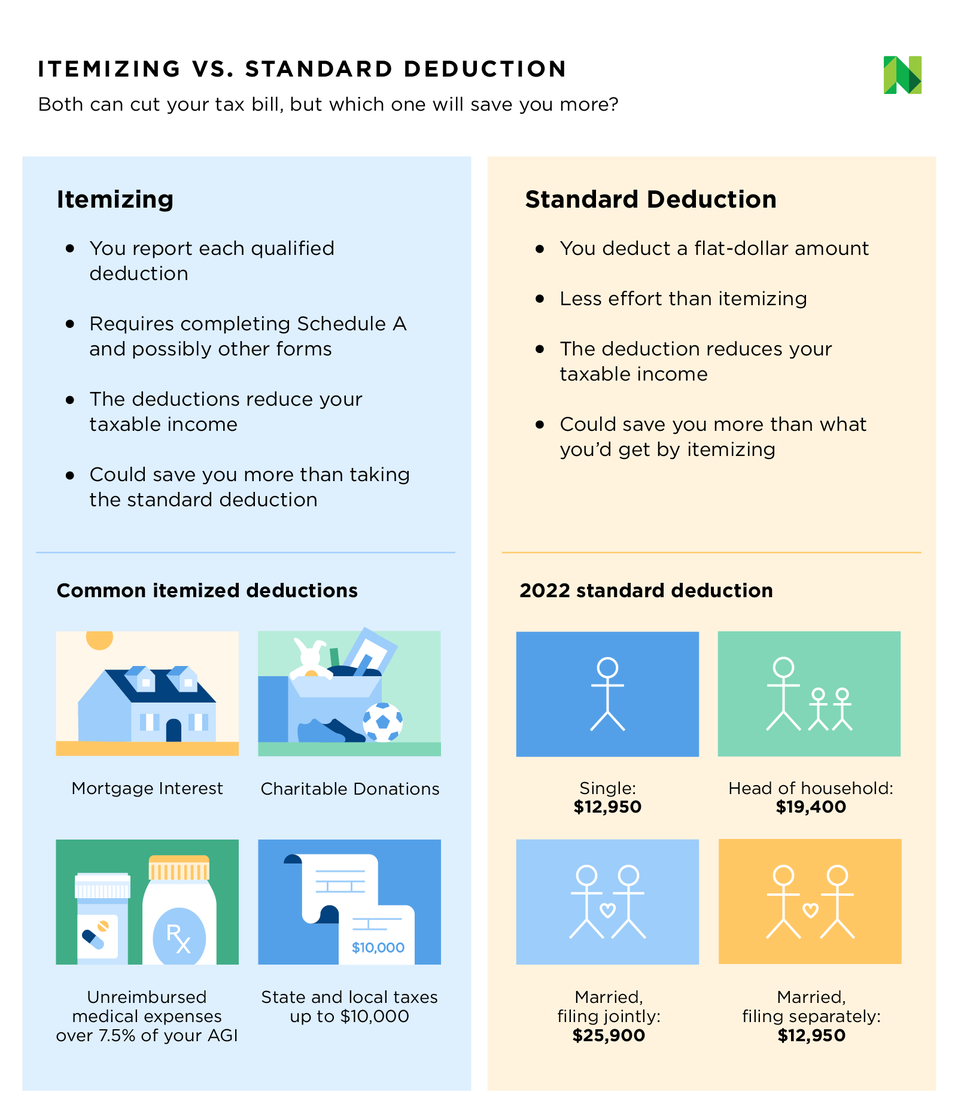

Itemized Deductions Definition Who Should Itemize NerdWallet 2023

List Of Tax Deductions Here s What You Can Deduct

Tax Deduction Cheat Sheet 2024 Allyn Giacinta

What Can I Deduct For Airbnb - Web 22 Nov 2023 nbsp 0183 32 You can deduct all ordinary and necessary expenses to operate your rental business including guest service fees unless you