What Expenses Can I Claim For Airbnb Australia If you re hosting a stay it s possible that not all of your Airbnb income is taxable Deductible items may include rent mortgage cleaning fees rental commissions insurance and other expenses

As an Airbnb host you can claim tax deductions for various expenses related to your rental property These deductions can help lower your taxable rental income reducing the amount of tax you owe Let s dive deeper into each type of What are the tax deductions Airbnb hosts can claim Airbnb hosts are eligible for the same tax deductions that other landlords can claim All expenses involved in running the property will be deductible

What Expenses Can I Claim For Airbnb Australia

What Expenses Can I Claim For Airbnb Australia

https://wp-assets.stessa.com/wp-content/uploads/2022/09/17155837/plumber-going-over-plans-with-home-owners.jpg

AirBnB Taxes Everything You Need To Know For 2020 Tax Season

https://www.picnictax.com/wp-content/uploads/2020/01/alex-block-bb7YrenUr3o-unsplash-1377x2048-1.jpg

What Expenses Can I Claim With My Novated Lease Maxxia

https://www.maxxia.com.au/sites/default/files/styles/infographic/public/2021-11/MAX_Blog_Article_WhatExpensesCanIClaim_800x392.jpg?itok=FgEoQAM_

Airbnb Tax Deductions What Can You Claim The good news is that you can claim various tax deductions related to your Airbnb rental activity However it s important to note that if you re only renting out part of your home Advertising Costs You can claim the costs of advertising your property for rent including online AirBnB listing fees Cleaning and Maintenance Expenses related to cleaning

What Tax Deductions Can Airbnb Hosts in Australia Claim Airbnb hosts are eligible for the same tax deductions that other landlords in Australia can claim Some expenses are fully deductible while others depend on how you use the Don t hide or under claim your Airbnb income the ATO can spot your Airbnb income from a mile away save your expense receipts and notes and talk to your tax agent like etax au about how to properly claim all of your expenses

Download What Expenses Can I Claim For Airbnb Australia

More picture related to What Expenses Can I Claim For Airbnb Australia

What Expenses Can I Claim For The Accountancy Partnership

https://www.theaccountancy.co.uk/wp-content/uploads/2014/02/manage-your-expenses-1110x511.jpg

What Expenses Can I Claim As A Limited Company 2024 Updated

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/what-expenses-can-i-claim-as-a-limited-company_447189-1.jpg

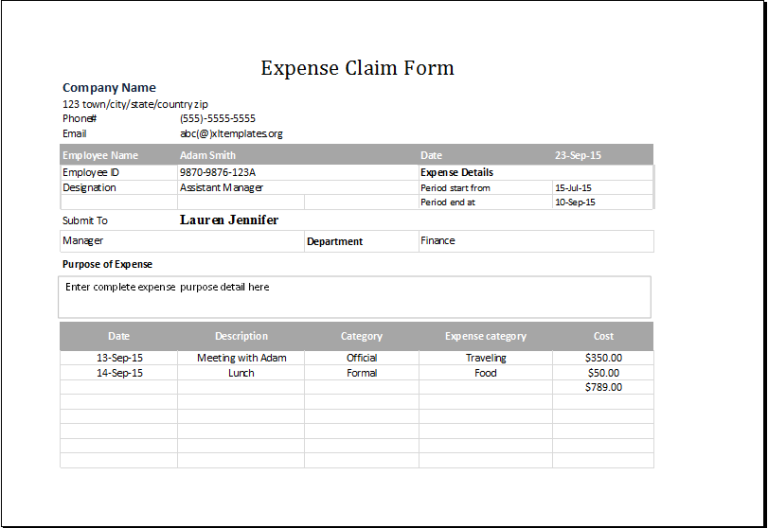

Expense Claim Form Template Excel

https://www.xltemplates.org/wp-content/uploads/2016/02/expense-claim-form-1-768x528.png

There are plenty of ways to make deductions from your income tax on Airbnb rentals Some of these are deductible in full while others may be partly deductible depending on how you use the property The Australian Taxation Additionally you can claim various deductible expenses such as mortgage interest and maintenance costs which are essential to support your claims to the Australian

How much of your expenses you can claim come tax time depends on the proportion of the year you rent your property You can t claim 52 weeks of the year if you ve What can I claim as rental expenses on my tax return Airbnb expenses that can be either fully or partially deducted include It s important to note that the amount that you can claim from your

What Expenses Can I Claim As An Employee Growthwise

https://www.growthwise.com.au/uploads/partners/_868xAUTO_fit_center-center_85/2_230604_100320.png

What Expenses Can I Claim As A Limited Company Countplus

https://www.countplus.co.uk/wp-content/uploads/2022/11/fb-expenses.png

https://www.airbnb.com.au › help › article

If you re hosting a stay it s possible that not all of your Airbnb income is taxable Deductible items may include rent mortgage cleaning fees rental commissions insurance and other expenses

https://www.kpgtaxation.com.au › blog › tax-deductions...

As an Airbnb host you can claim tax deductions for various expenses related to your rental property These deductions can help lower your taxable rental income reducing the amount of tax you owe Let s dive deeper into each type of

What Expenses Can I Claim CIS EEBS

What Expenses Can I Claim As An Employee Growthwise

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

What Expenses Can I Claim After An Accident

Self Employed Allowable Expenses Accounting Basics Best Accounting

Simple Personal Monthly Income And Expenses Statement In Excel Easy

Simple Personal Monthly Income And Expenses Statement In Excel Easy

5 IRS Rules For Renting Out Your Vacation Home Kiplinger

Expense Claim Form Template Excel Printable Word Searches

Expense Claim Form Template Excel 2023 Template Print Vrogue co

What Expenses Can I Claim For Airbnb Australia - Advertising Costs You can claim the costs of advertising your property for rent including online AirBnB listing fees Cleaning and Maintenance Expenses related to cleaning