What Expenses Can I Deduct As An Independent Contractor There are a number of business deductions you can take as an independent contractor including health insurance home office deductions mileage and deductions for your phone

What Expenses Can I Deduct on My Taxes as a 1099 Contractor A free tool by If you re a freelancer 1099 contractor or small business owner you get tax write offs that W 2 employees can t claim Here s a list of the most common taxes independent contractors can deduct There s a good chance that several of these will pertain to you 1 Self employment tax deduction You can claim 50 percent of what you pay in self employment tax as an income tax deduction For example a 5 000 self employment tax payment reduces taxable

What Expenses Can I Deduct As An Independent Contractor

What Expenses Can I Deduct As An Independent Contractor

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/8654/images/dGtNNfyFRc2jd72ieCJV_Blog_graphics_10.png

As An Author What Expenses Can I Deduct

https://i0.wp.com/www.themotivationaleditor.com/wp-content/uploads/2018/09/taxes-cloud.png?resize=640%2C475&ssl=1

Hair Salon Monthly Expenses Google Search Tax Deductions Tax

https://i.pinimg.com/originals/59/a8/f5/59a8f5c21289277936f1e4c5ed2b0d42.png

As an independent contractor you can deduct reasonable and necessary expenses related to running your business Tax deductions reduce net income lowering your business tax bill What Tax Deductions Can Independent Contractors Claim The key to lowering your tax bill is through tax deductions and there are a bunch of them for independent contractors One of the largest

What Expenses Can I Deduct As an Independent Contractor You can deduct the typical business expenses that you ve paid You must have excellent records made at the time of the expense As an independent contractor you can also deduct personal expenses such as mortgage interest paid interest paid to student loans and real estate taxes You can also get a tax break for

Download What Expenses Can I Deduct As An Independent Contractor

More picture related to What Expenses Can I Deduct As An Independent Contractor

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

There s Good News What Expenses Can I Deduct As A 1099 Contractor

https://bookkeepingad.com/wp-content/uploads/2021/11/contractor.bookkeeping.jpg

What Expenses Can I Deduct As A 1099 Contractor Lendio

https://www.lendio.com/wp-content/uploads/2016/03/SBA-Loan-Calculator-800x433.jpg

The good news is that if you re an independent contractor sole proprietor or another form of self employed worker many of your business expenses are tax deductible These deductions also known as write offs are subtracted from your taxable income which lowers your tax bill All independent contractors are classified as self employed by the IRS meaning they can deduct relevant business expenses from their income taxes You ve seen 21 of those expenses in this article and there may be more besides based on the ordinary and necessary guidelines the IRS provides

What taxes can independent contractors deduct As an independent contractor you can write off certain expenses in order to lower your tax liability Independent contractor tax write offs mainly include costs you have to absorb that you wouldn t if you were working in an office A write off is when you claim tax deductions on the money spent as an independent contractor on eligible expenses For example the truck driver example from earlier can write off expenses related to their truck while the photographer can write off expenses related to their camera equipment

Possible Expenses You Can Deduct As An Independent Education Advisor

https://globalbridge-edu.com/wp-content/uploads/2023/09/Possible-Expenses-You-Can-Deduct-as-an-Independent-Education-Advisor-with-GBE.jpg

What Can I Deduct As A Business Expense

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/2147486381/images/9ktBEMokQQaQxFIwbbaB_What_Can_I_Deduct_As_A_Business_Expense.jpeg

https://www.nerdwallet.com/article/small-bus…

There are a number of business deductions you can take as an independent contractor including health insurance home office deductions mileage and deductions for your phone

https://www.keepertax.com/freelancer-tax-deductions

What Expenses Can I Deduct on My Taxes as a 1099 Contractor A free tool by If you re a freelancer 1099 contractor or small business owner you get tax write offs that W 2 employees can t claim

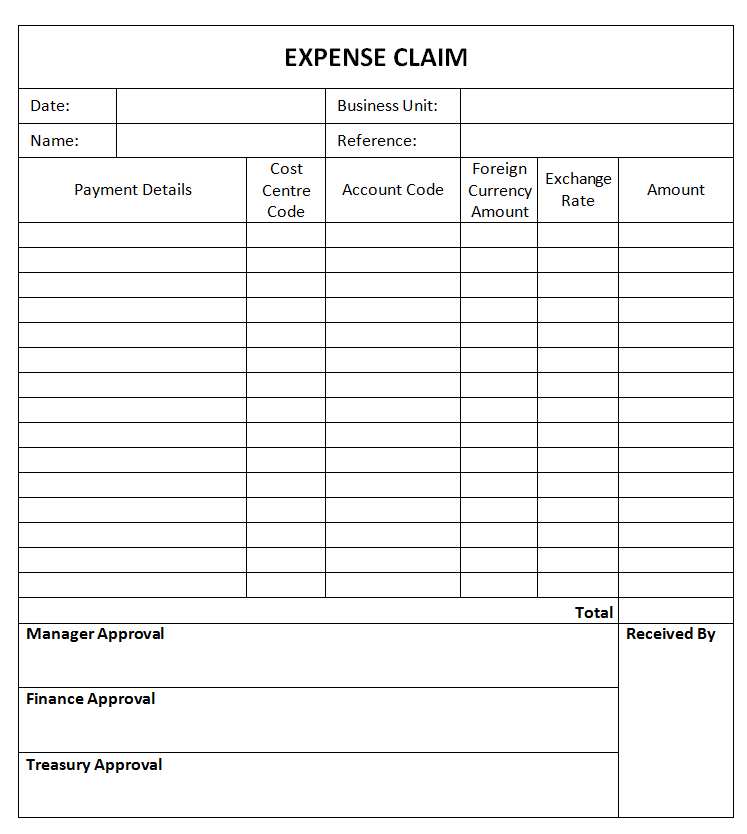

Free Expenses Claim Form Template Uk Printable Templates

Possible Expenses You Can Deduct As An Independent Education Advisor

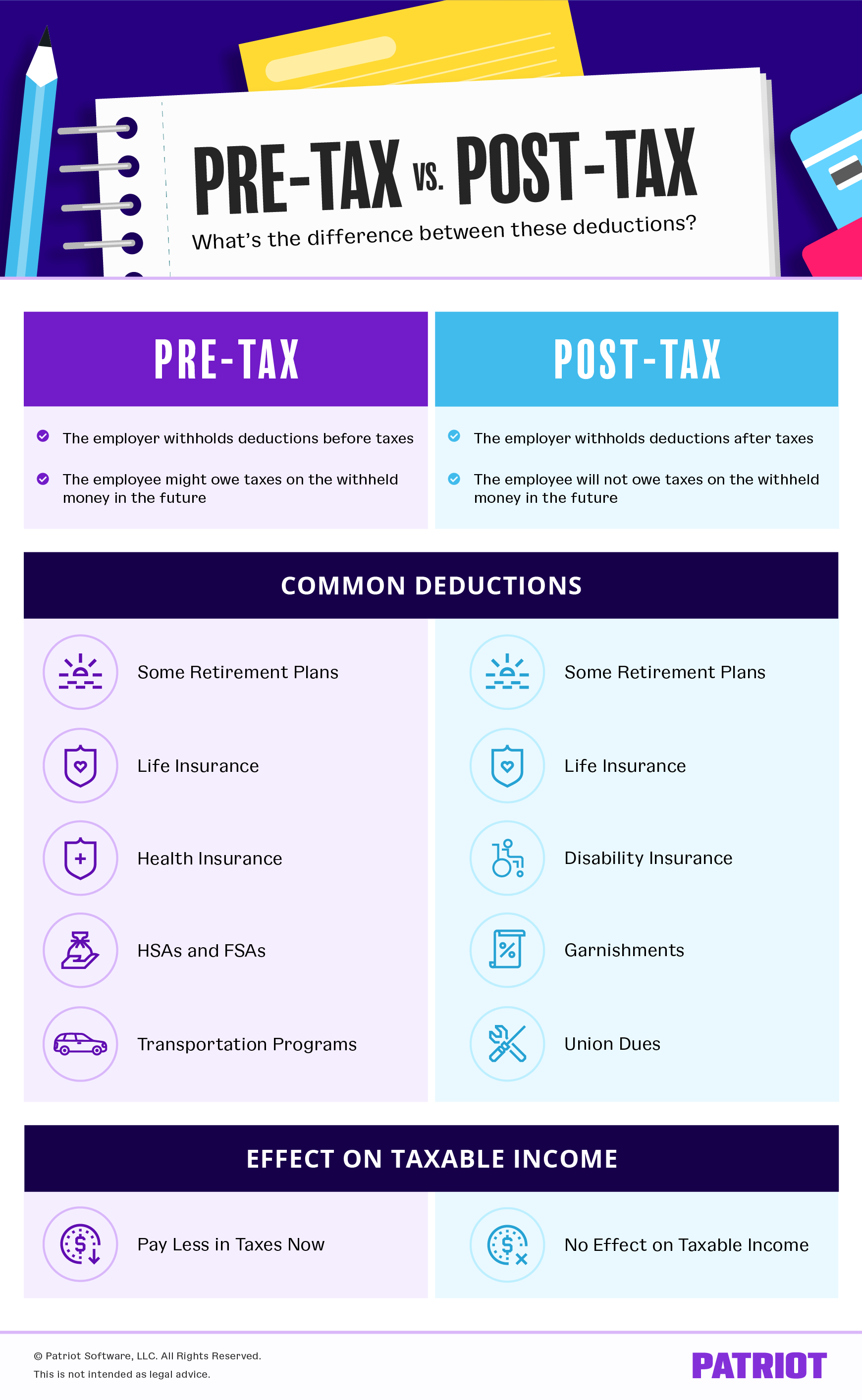

Pre tax Vs Post tax Deductions What s The Difference

What Expenses Can I Deduct As A Landlord HendersonTax

When Is Rent Tax Deductible

What Expenses Can I Deduct As A 1099 Contractor Lendio

What Expenses Can I Deduct As A 1099 Contractor Lendio

Which Expenses Are Qualified Under College 529 Funds WTOP News

Are You Unsure What Expenses Are Deductible For You Business This

Can I Deduct Meals As An Independent Contractor

What Expenses Can I Deduct As An Independent Contractor - What Expenses Can I Deduct As an Independent Contractor You can deduct the typical business expenses that you ve paid You must have excellent records made at the time of the expense