What Happens If You Pay Too Much Social Security Tax To identify excess Social Security tax withholding review your pay stubs and W 2 forms from each employer Compare the cumulative total against the 2024 wage base limit of

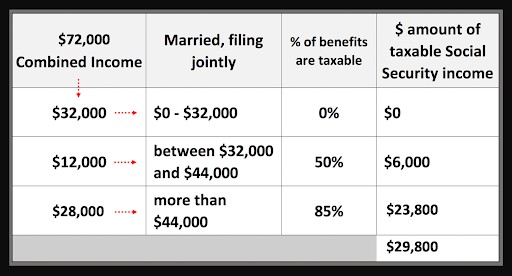

Each employer will pay their share and not get a refund but at tax time you ll get back any excess as if you worked one job On the tax forms the data from each W2 is loaded You May Be Paying Too Much in Taxes on Your Social Security Benefits Here s How to Lower Them Social Security benefits are taxed but they have some special tax benefits that allow retirees to reduce their overall tax burden

What Happens If You Pay Too Much Social Security Tax

What Happens If You Pay Too Much Social Security Tax

https://static.twentyoverten.com/5a4515738296d37425053dec/tsPS7G1J0_T/MoneyTaxes.jpg

How Do Railroad Retirement And Social Security Payroll Taxes Compare

https://static.twentyoverten.com/5b74784bd10c860c99acdebb/LhJkWff_0X/RRR-vs-SS-taxes-compare.png

What Happens If You Can t Pay Medical Bills Banks

https://www.banks.com/wp-content/uploads/2022/03/what-happens-if-you-cant-pay-medical-bills.jpg

12 rowsIf you are working there is a limit on the amount of your earnings that is taxable by Social Security This amount is known as the maximum taxable earnings and changes each Delaying Social Security claims and reducing withdrawals from traditional IRAs are two popular ways Social Security recipients can lower their tax bills Some others may also work depending on

Overpayments can occur in two main ways either by working multiple jobs that together exceed the tax cap or through a payroll error where a single employer withholds too much For 2024 any If you overpaid Social Security tax there are steps you can take to get the excess amount back in your bank How you proceed however is determined by your specific

Download What Happens If You Pay Too Much Social Security Tax

More picture related to What Happens If You Pay Too Much Social Security Tax

Understanding How Social Security Benefits Are Taxed

https://www.wealthenhancement.com/cms/delivery/media/MCFMWPXDOK6JBF7BTOD5IE2GD5JY

Working And Taking Social Security At The Same Time Watch Out For This

https://i.pinimg.com/originals/37/e6/aa/37e6aac0fb6ae19a1e2fc59f6657981d.jpg

What Happens If I Pay My Payroll Taxes Late Banks

https://www.banks.com/wp-content/uploads/2022/06/what-happens-if-i-pay-my-payroll-taxes-late.jpg

In 202 3 income taxes on benefits added 50 7 billion to the Social Security trust funds accounting for about 3 8 percent of Social Security s revenue the vast majority of Switching jobs during a single calendar year as many workers did during the Great Resignation could mean you end up paying more in Social Security payroll taxes than

If one employer withheld too much Social Security tax you won t be able to take a credit for the excess on your tax return You will only see a refund on Schedule 3 Line 11 if Excess Social Security tax should be reported if you or your spouse if filing a joint return had more than one employer for the tax year and individually you or your spouse had total

What Happens If You Cash In Your Savings JustMoney

https://www.justmoney.co.za/uploads/4b38b18c-f7f0-48d8-b75d-a3a6a9853b1c.webp

Marilyn DeRooy Pearson Influence Publishing

https://www.influencepublishing.com/wp-content/uploads/2021/04/paying-too-much-tax.jpeg

https://accountinginsights.org › can-i-get-a-refund...

To identify excess Social Security tax withholding review your pay stubs and W 2 forms from each employer Compare the cumulative total against the 2024 wage base limit of

https://money.stackexchange.com › questions › ...

Each employer will pay their share and not get a refund but at tax time you ll get back any excess as if you worked one job On the tax forms the data from each W2 is loaded

What Happens If An Individual Can t Pay Taxes Milliken Perkins

What Happens If You Cash In Your Savings JustMoney

How Much Social Security Is Taxable Social Security Intelligence

Here s What Happens When You Pay The Wrong Amount Of Estimated Tax

What Happens If You Don t Pay Taxes On The Sale Of An Investment Condo

First File Your Tax Return File Your Past Due Tax Returns Even If

First File Your Tax Return File Your Past Due Tax Returns Even If

What To Do If You Can t Afford To Pay Your Taxes

Do You Pay Taxes On Social Security Terrence Karamchandani

How Much Your Social Security Benefits Will Be If You Make 30 000

What Happens If You Pay Too Much Social Security Tax - Overpayments can occur in two main ways either by working multiple jobs that together exceed the tax cap or through a payroll error where a single employer withholds too much For 2024 any