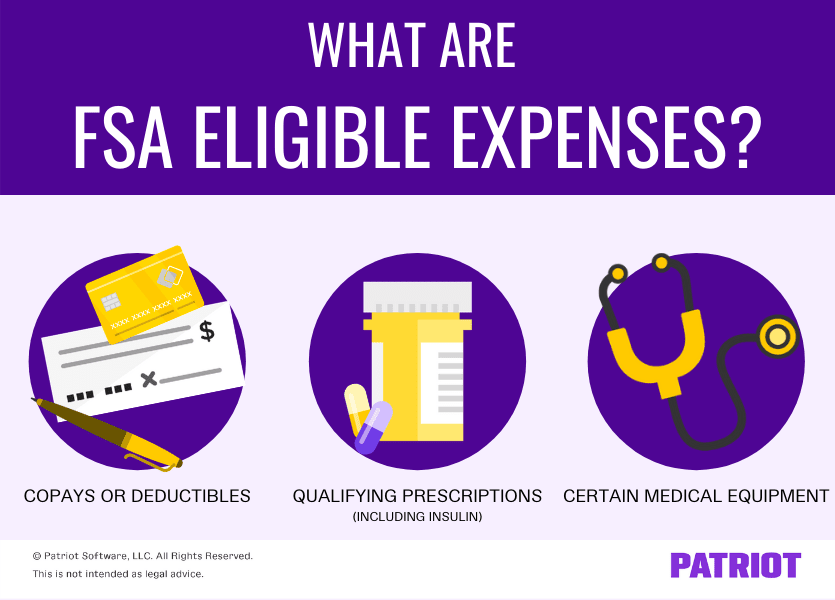

What Is Considered Medical Expenses For Taxes Web When can I deduct medical expenses for tax purposes Medical expenses are considered an extraordinary burden This means that you can claim your special expenses in your

Web 25 Okt 2022 nbsp 0183 32 Medical expenses are the costs to treat or prevent an injury or disease such as health insurance premiums hospital visits and prescriptions These Web 29 Apr 2023 nbsp 0183 32 Tax law defines medical expenses as costs for the diagnosis cure mitigation treatment or prevention of disease and for treatments affecting any part or function of the body

What Is Considered Medical Expenses For Taxes

What Is Considered Medical Expenses For Taxes

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

What Is An FSA Definition Eligible Expenses More Finansdirekt24 se

https://www.patriotsoftware.com/wp-content/uploads/2017/06/FSA-eligible-expenses-compressed.png

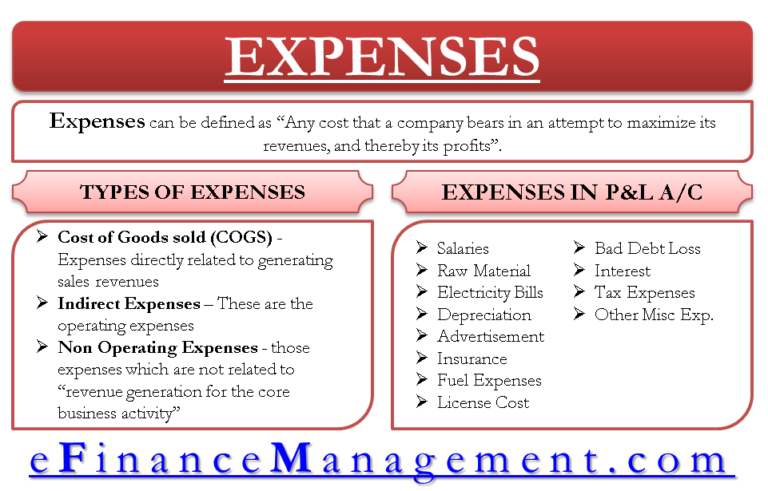

What Are Expenses Its Types And Examples TutorsTips

https://tutorstips.com/wp-content/uploads/2020/02/What-are-Expenses-1.png

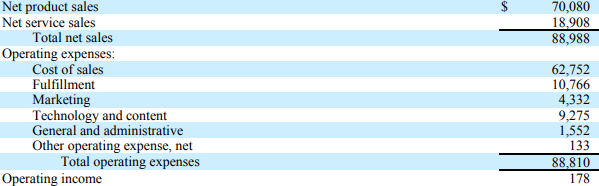

Web May 9 2023 If you itemize deductions on your tax return you may wonder What medical expenses can I include The IRS recently issued some frequently asked questions addressing when certain costs are qualified Web Medical expenses include dental expenses and in this publication the term medical expenses is often used to refer to medical and dental expenses You can deduct on Schedule A Form 1040 only the part of your

Web 20 Okt 2023 nbsp 0183 32 Key Takeaways You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2023 Web 16 Nov 2023 nbsp 0183 32 Medical care expenses include payments for the diagnosis cure mitigation treatment or prevention of disease or payments for treatments

Download What Is Considered Medical Expenses For Taxes

More picture related to What Is Considered Medical Expenses For Taxes

What Is Expense Definition And Meaning

https://efinancemanagement.com/wp-content/uploads/2014/11/Expenses-768x491.png

KadenceatWest

https://fundsnetservices.com/wp-content/uploads/cost-of-goods-sold.png

Medical Expenses Islamicmyte

https://db-excel.com/wp-content/uploads/2019/09/schedule-c-expenses-worksheet-home-design-ideas-home.jpg

Web 31 M 228 rz 2023 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is Web 12 Jan 2023 nbsp 0183 32 The IRS defines qualifying medical expenses as those related to the quot diagnosis cure mitigation treatment or prevention of a disease or condition affecting any part or function of the body quot To

Web 31 Jan 2017 nbsp 0183 32 And as we all know if you ve paid any medical bills been to the dentist spent any time in the hospital or had any sort of doctor patient interactions there is potentially a treasure trove of tax deductions Web Tax guide Deducting Medical Expenses Updated for filing 2021 tax returns Can I get a tax break for medical expenses Yes the medical expense deduction lets you recoup

How To Claim Medical Expenses On Your Tax Return

https://www.searche.co.za/wp-content/uploads/Claim-Medical-Expenses.webp

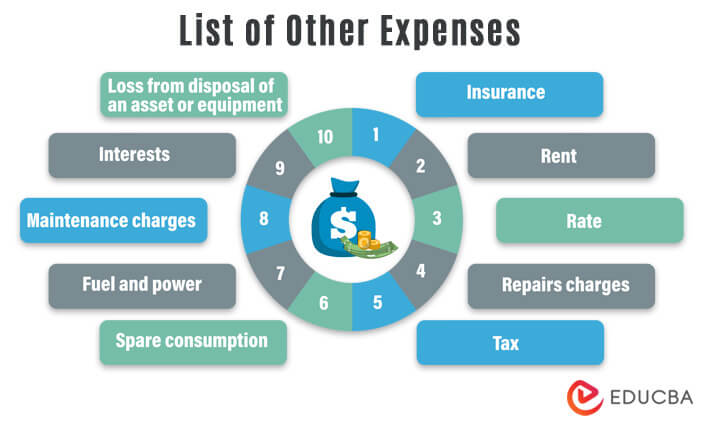

Other Expenses What Are Other Expenses In The Balance Sheet

https://cdn.educba.com/academy/wp-content/uploads/2022/07/List-of-Other-Expenses.jpg

https://www.ottonova.de/en/expat-guide/deduct-medical-expenses-f…

Web When can I deduct medical expenses for tax purposes Medical expenses are considered an extraordinary burden This means that you can claim your special expenses in your

https://www.investopedia.com/terms/m/medical-expenses.asp

Web 25 Okt 2022 nbsp 0183 32 Medical expenses are the costs to treat or prevent an injury or disease such as health insurance premiums hospital visits and prescriptions These

Expenses Financial Edge

How To Claim Medical Expenses On Your Tax Return

:max_bytes(150000):strip_icc()/GettyImages-918315214-d2ced2bbb03c48b1b05e52445005d2ad.jpg)

Medical Expenses Definition Examples Tax Implications

Account For Taxes On Business Expenses

Business Expenses What Can You Claim

Quick Guide Who Should Claim Medical Expenses On Taxes Canada

Quick Guide Who Should Claim Medical Expenses On Taxes Canada

Crazy Little Thing Called Life Can I Deduct IVF Expenses On My Taxes

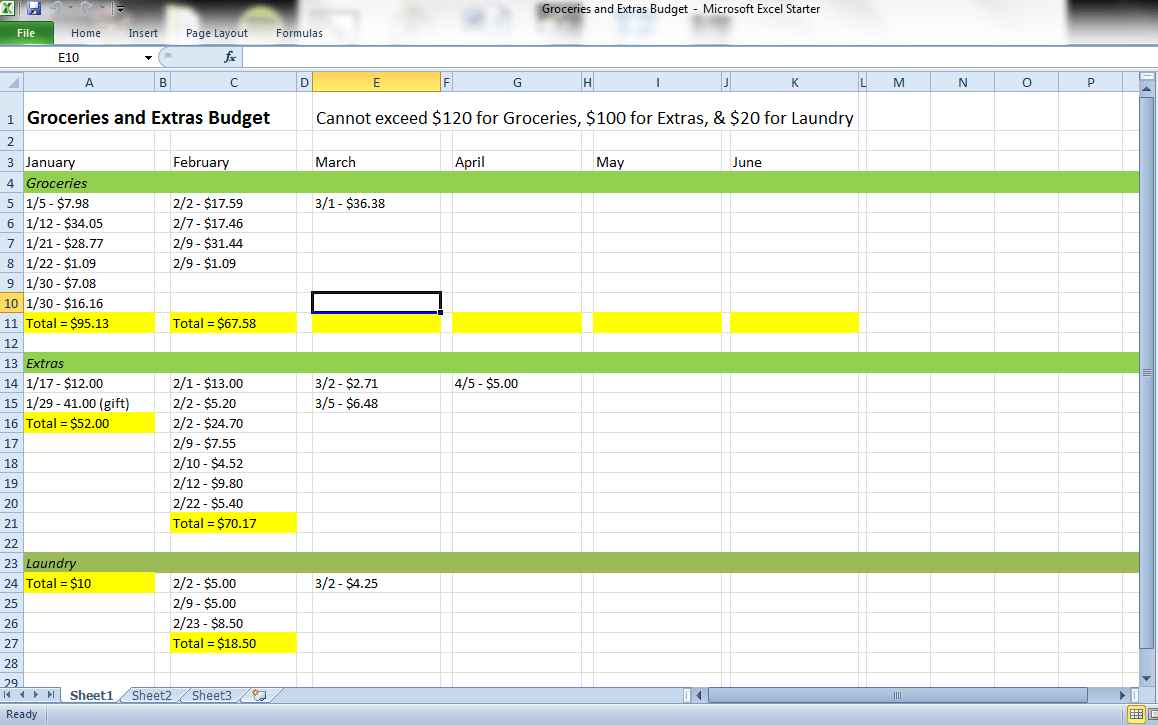

How To Keep A Spreadsheet Of Expenses With Regard To Track Expenses And

Medical Expenses You Can Deduct From Your Taxes Money Saving Tips

What Is Considered Medical Expenses For Taxes - Web May 9 2023 If you itemize deductions on your tax return you may wonder What medical expenses can I include The IRS recently issued some frequently asked questions addressing when certain costs are qualified