What Is Loan Principal Deduction 80c The principal paid on the home loan EMI for the year is allowed as a deduction under section 80C The maximum amount that can be claimed under this

The repayment of the principal of a loan taken to buy or construct a residential property is eligible for tax deductions under Section 80C This deduction is also applicable on stamp duty registration fees Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional tax benefits are also offered to first

What Is Loan Principal Deduction 80c

What Is Loan Principal Deduction 80c

https://i.ytimg.com/vi/6rRt5MHAKSM/maxresdefault.jpg

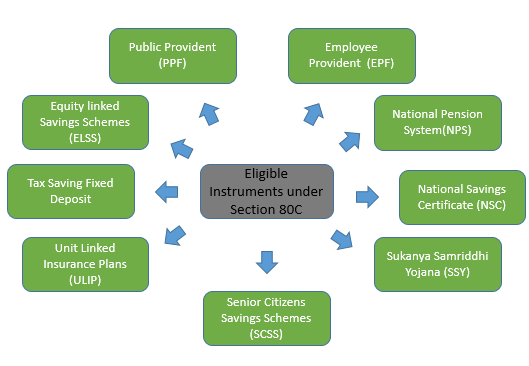

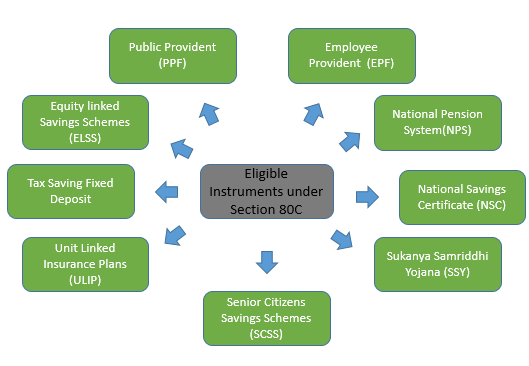

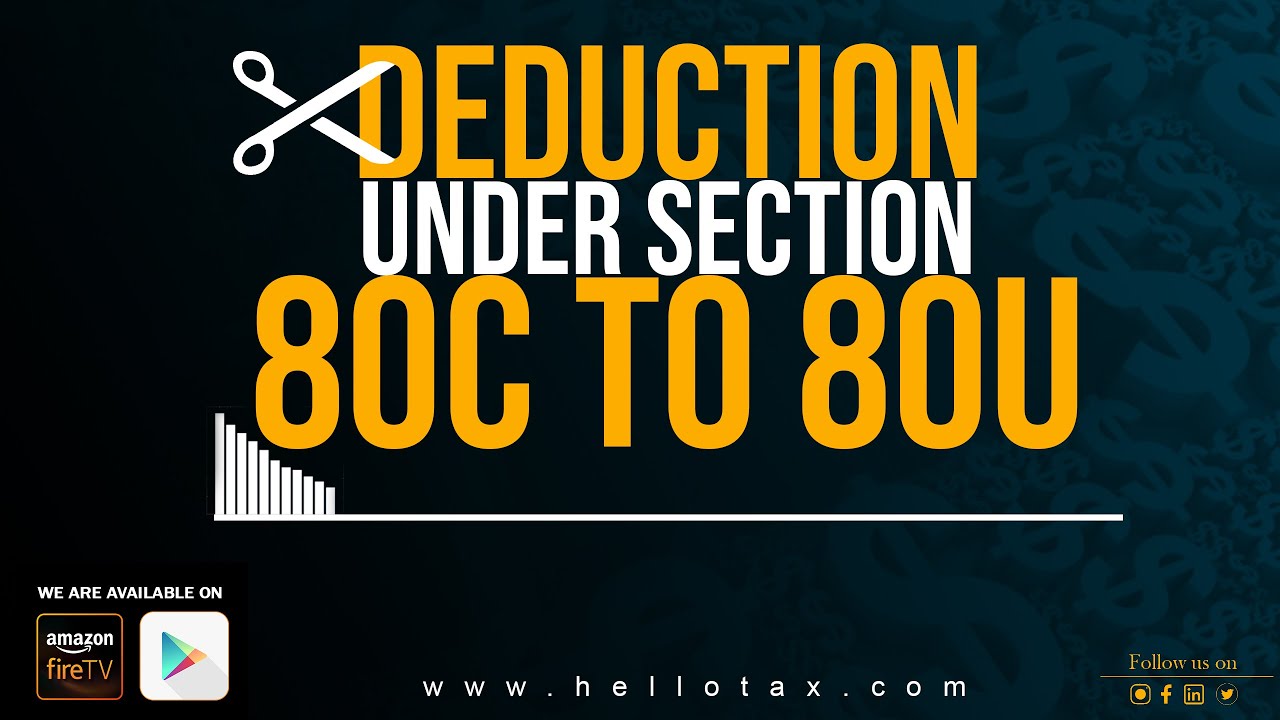

Deduction Under Section 80C A Complete List BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2016/07/Section-80C-Options.jpg

Section 80C Deduction For Tax Saving Investments Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2019/03/28165725/25-September-Deduction-80C-01-01-scaled.jpg

Yes the principal repayment of a home loan is eligible for deduction under Section 80C subject to the overall limit of 1 50 000 However the property should not What is 80C in Income Tax and its Sub sections Section 80C permits certain investments and expenses to be tax exempted By well planning the 80C investments that are

Section 80C of the IT Act provides a deduction of up to INR 1 5 lakh from the total taxable income of individuals and HUFs Here s all you need to know Section 80C deduction is capped at Rs 1 5 Lakhs per financial year reducing your taxable income and thus tax liability This deduction is only available to

Download What Is Loan Principal Deduction 80c

More picture related to What Is Loan Principal Deduction 80c

Section 80C Deductions List Save Income Tax With Section 80C Options

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

Complete Guide On Income Tax Deduction U s 80C 80CCD 80CCC 80CCG

https://financialcontrol.in/wp-content/uploads/2018/08/section-80C-660x186.jpg

Deduction Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Deductions-under-Section-80C-its-allied-sections.png

Repayment of principal amount with respect to any home loan from bank national housing bank approved housing finance companies or eligible employers can Home Loan Tax Benefits under Section 80C Principal Deductions Section 80C deals with the principal amount deductions For both self occupied and let out properties you can

Section 80C allows the deduction for the amount paid towards the principal repayment of the home loan taken from the specified financial institutions This If you have bought a house under the instalment finance scheme from a development authority such as the Delhi Development Authority DDA and are paying

TAX DEDUCTION UNDER SECTION 80C

https://1.bp.blogspot.com/-y7QODHgwf2w/XSb2v478AII/AAAAAAAAANM/3QtXS1n2C2wFgKrONw3Y-Iuu-kThJdC7gCLcBGAs/s1600/cdeductionspng-1512457321752.png

Deduction Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

https://cleartax.in/s/home-loan-tax-benefit

The principal paid on the home loan EMI for the year is allowed as a deduction under section 80C The maximum amount that can be claimed under this

https://cleartax.in/s/80C-Deductions

The repayment of the principal of a loan taken to buy or construct a residential property is eligible for tax deductions under Section 80C This deduction is also applicable on stamp duty registration fees

DEDUCTION UNDER SECTION 80C TO 80U PDF

TAX DEDUCTION UNDER SECTION 80C

Section 80c Everything You Should Know Deduction Under 80c Tax

Section 80C Deduction Under Section 80C In India Paisabazaar

Deduction Of 80C 80CCC 80CCD Under Income Tax

How To Claim Business Loan Tax Deductions Under Section 80C IIFL Finance

How To Claim Business Loan Tax Deductions Under Section 80C IIFL Finance

Home Loan EMI And Tax Deduction On It EMI Calculator

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Deduction Under Section 80C To 80U YouTube

What Is Loan Principal Deduction 80c - Repayments towards the principal component of home loan EMIs are eligible for deduction under Section 80C This benefit is available If the property s