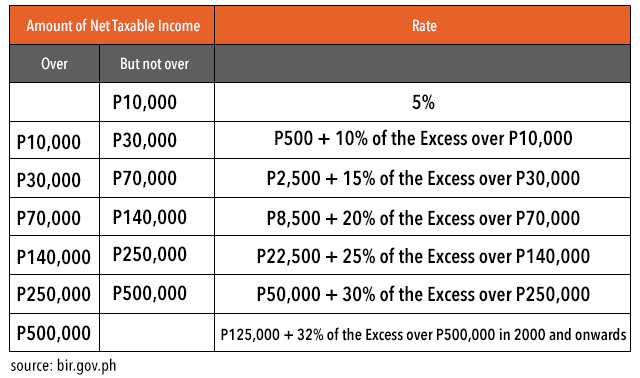

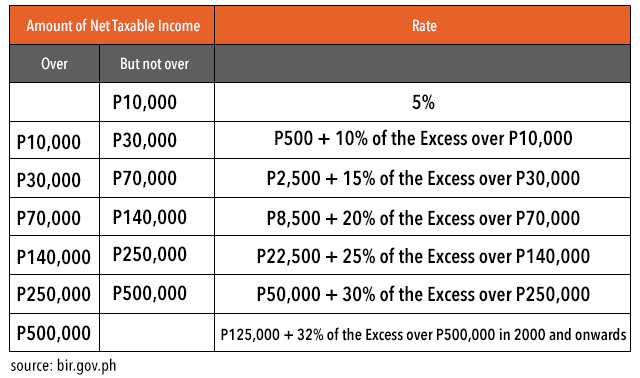

What Is Tax Exemption In The Philippines According to the Bureau of Internal Revenue TRAIN law Tax Reform for Acceleration and Inclusion those with annual taxable income below PHP 250 000 are now exempt from paying personal income tax in the

To cover the personal family and living expenses of individual taxpayers personal exemptions are put in place and come up with a reasonable taxable base for income taxation in the Certain income sources and services are exempt from taxation such as insurance proceeds in most cases riders for disability and critical illness employer provided insurance life health municipal bonds with tax

What Is Tax Exemption In The Philippines

What Is Tax Exemption In The Philippines

https://filipiknow.net/wp-content/uploads/2020/02/tax-exemption-philippines.jpg

2017 PAFPI Certificate of TAX Exemption Certificate Of

https://www.certificateof.com/wp-content/uploads/2018/06/2017-PAFPI-Certificate-of-TAX-Exemption.jpg

How To Use Exemptions When Filing For Chapter 13 Bankruptcy

https://rosenblumlaw.com/wp-content/uploads/2020/04/exemptions-1024x1024.png

Understanding the benefits of tax exemption in the Philippines can help you maximize your tax benefits and reduce the amount of taxes you have to pay Here s what According to the Tax Reform for Acceleration and Inclusion TRAIN Law you are exempt from personal income tax if you are a compensation income earner self employed and professional taxpayer whose

Tax exemptions in the Philippines are guided by specific laws and require documentation for both individuals and businesses Personal income tax relief includes Tax exemptions are special exclusions in the tax code that enable certain taxpayers to reduce their tax liability In the Philippines various tax exemptions exist under

Download What Is Tax Exemption In The Philippines

More picture related to What Is Tax Exemption In The Philippines

Income Tax Rate Ph 2023 Printable Forms Free Online

https://i2.wp.com/www.pinoymoneytalk.com/wp-content/uploads/2020/06/income-tax-rates-bir-train-law-2023.png

Application Letter For Tax Exemption PDF

https://imgv2-1-f.scribdassets.com/img/document/326384257/original/11b6a58523/1627289253?v=1

How To Apply For A Sales Tax Exemption Certificate Tax Walls

https://s2.studylib.net/store/data/011798821_1-abb31c562ff5b7addbf73216c854e1b0.png

What is a Tax Exemption A tax exemption in the Philippines is an exclusion from the payment of taxes on certain types of income property or transactions Tax exemptions are typically granted to individuals businesses The tax base of the 10 percent IAET is the taxable income of the current year plus income exempt from tax income excluded from gross income income subject to final tax and

In this article we ll discuss what is an income tax return why it s important to file and pay your taxes on time who are required and who are exempted from filing an ITR and paying taxes Persons with Disabilities in the Philippines are entitled to significant tax exemptions and benefits aimed at alleviating their financial burdens and fostering an environment of

Why PH Has 2nd Highest Income Tax In ASEAN

https://assets.rappler.com/612F469A6EA84F6BAE882D2B94A4B421/img/8FCED49A66F646BE850500D3D269A63E/table-01.jpg

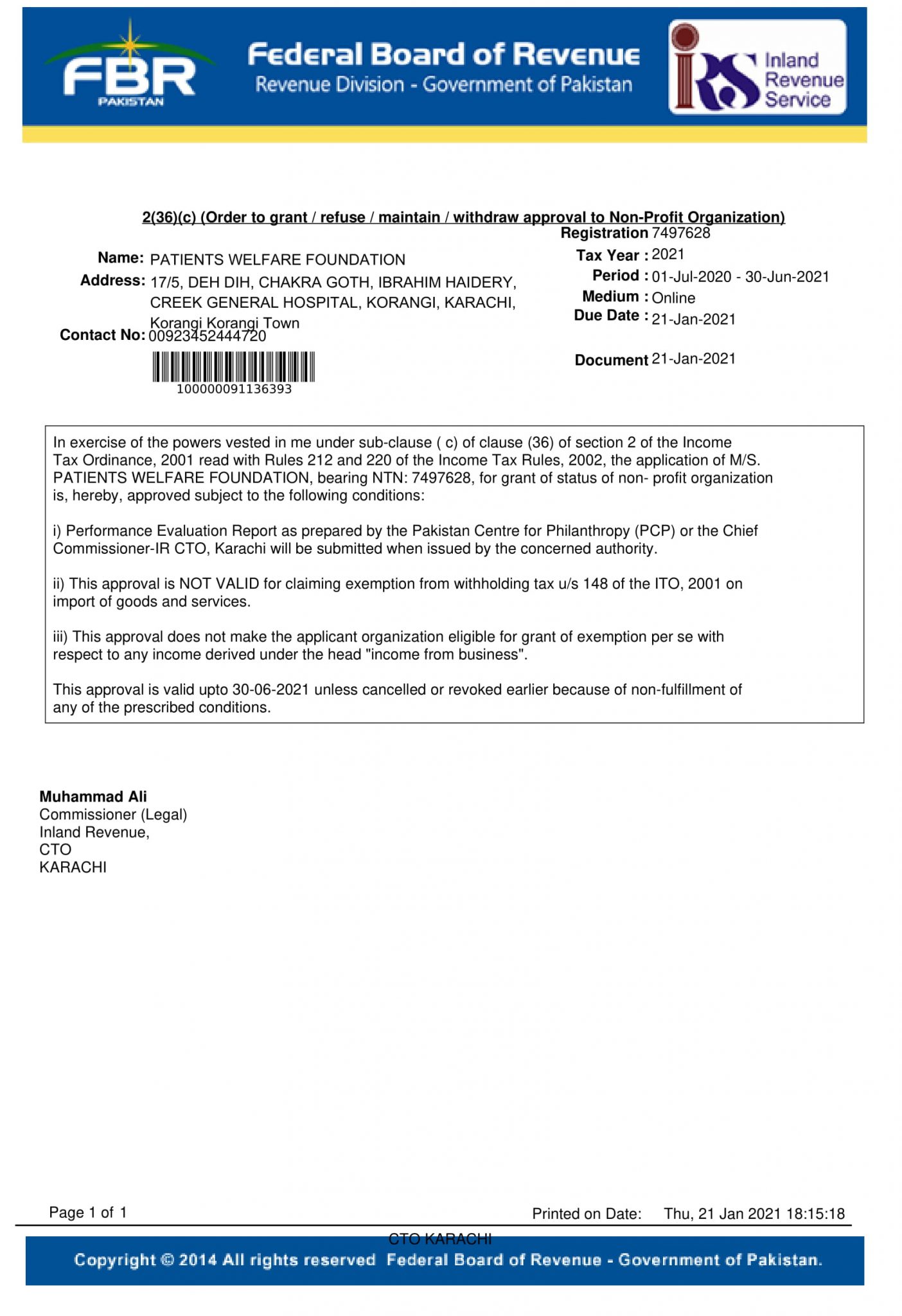

Tax Exemption Certificate PWF Pakistan

https://pwfpakistan.org/wp-content/uploads/2021/01/EXEMPTION-2021-30-06-2021-1404x2048.jpg

https://philpad.com › tax-exemptions-i…

According to the Bureau of Internal Revenue TRAIN law Tax Reform for Acceleration and Inclusion those with annual taxable income below PHP 250 000 are now exempt from paying personal income tax in the

https://taxacctgcenter.ph › personal-exemptions-for...

To cover the personal family and living expenses of individual taxpayers personal exemptions are put in place and come up with a reasonable taxable base for income taxation in the

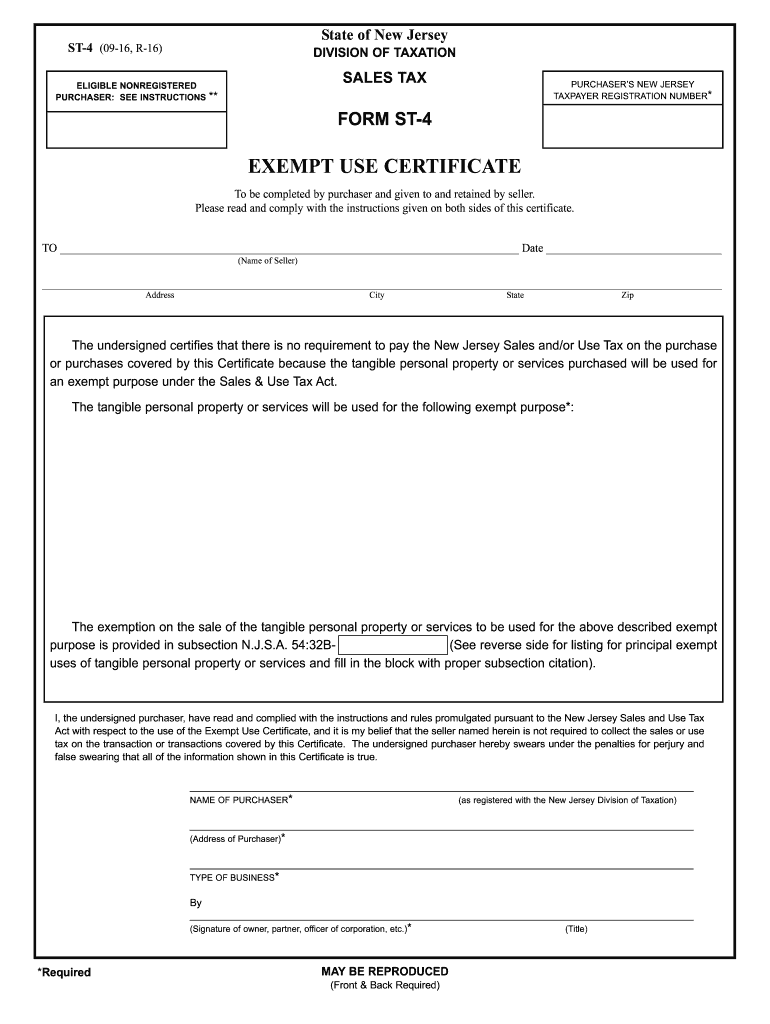

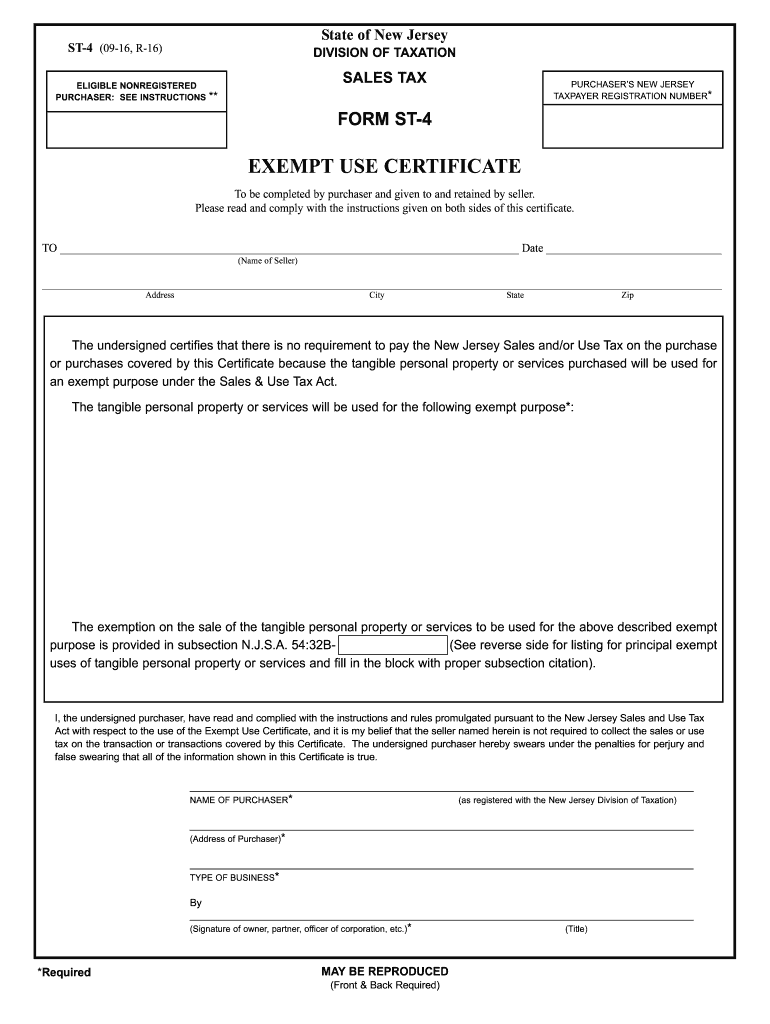

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

Why PH Has 2nd Highest Income Tax In ASEAN

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

Writing Religious Exemption Letters

Sales Certificate Template

St 4 Fill Out Sign Online DocHub

St 4 Fill Out Sign Online DocHub

Exemption Letter Fill Out Sign Online DocHub

Tax Exemption In The Philippines

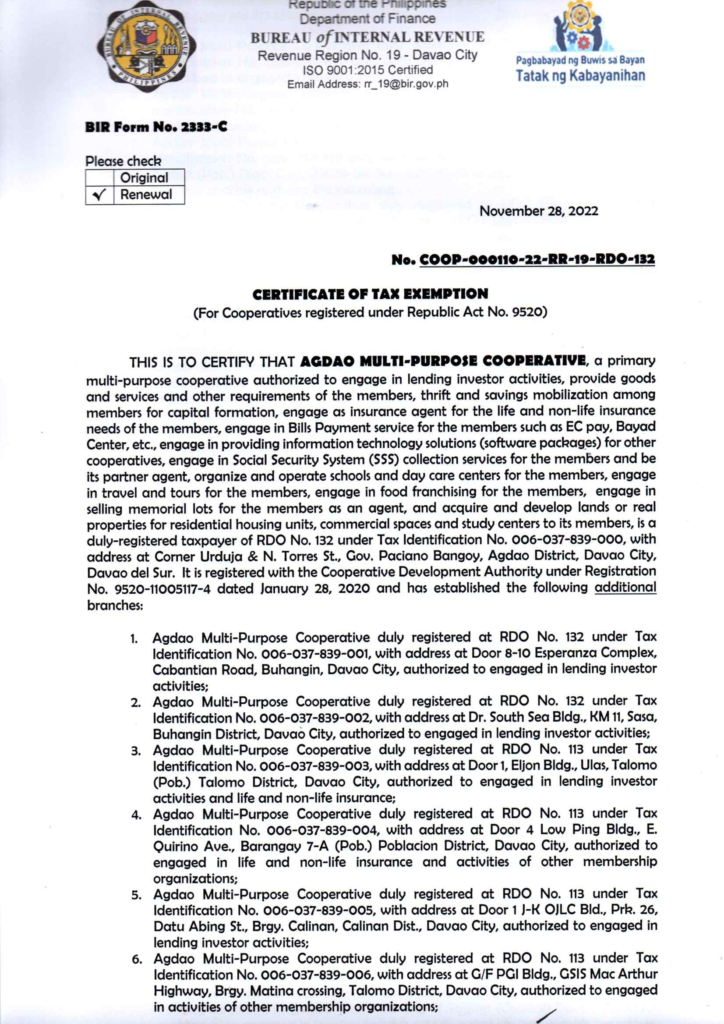

BIR Certificate Of Tax Exemption AMPC

What Is Tax Exemption In The Philippines - Under the TRAIN law salaried individuals earning annual gross compensation of P250 000 or below are now exempted from paying income taxes This is a drastic change from