What Is The Federal Fuel Tax Credit The Inflation Reduction Act of 2022 retroactively extended several fuel tax credits

The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types of fuel costs Using Form 4136 businesses can claim a tax credit for federal excise taxes paid on fuel effectively reducing their overall tax liability This can be a substantial saving particularly

What Is The Federal Fuel Tax Credit

What Is The Federal Fuel Tax Credit

https://stnonline.com/wp-content/uploads/2022/10/fuel-pump-money-back-1536x1024.jpg

Pump Up Savings With The Fuel Tax Credit James Moore

https://www.jmco.com/wp-content/uploads/2022/09/fuel-tax-credit-featured-image-1100-x-800-20.png

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

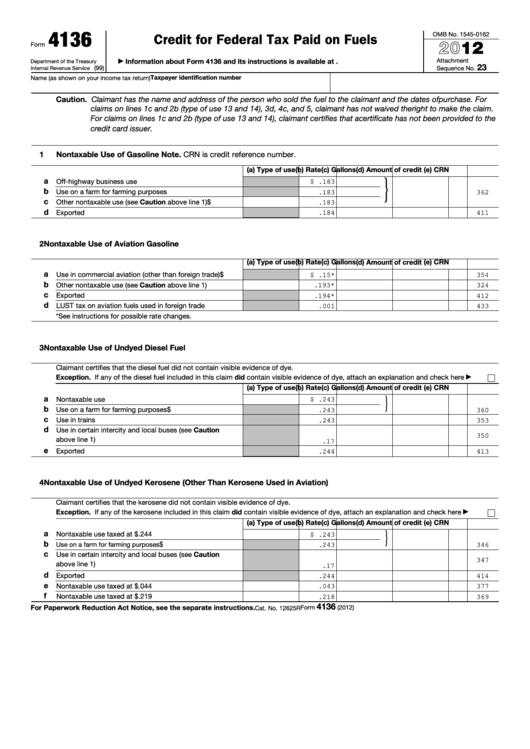

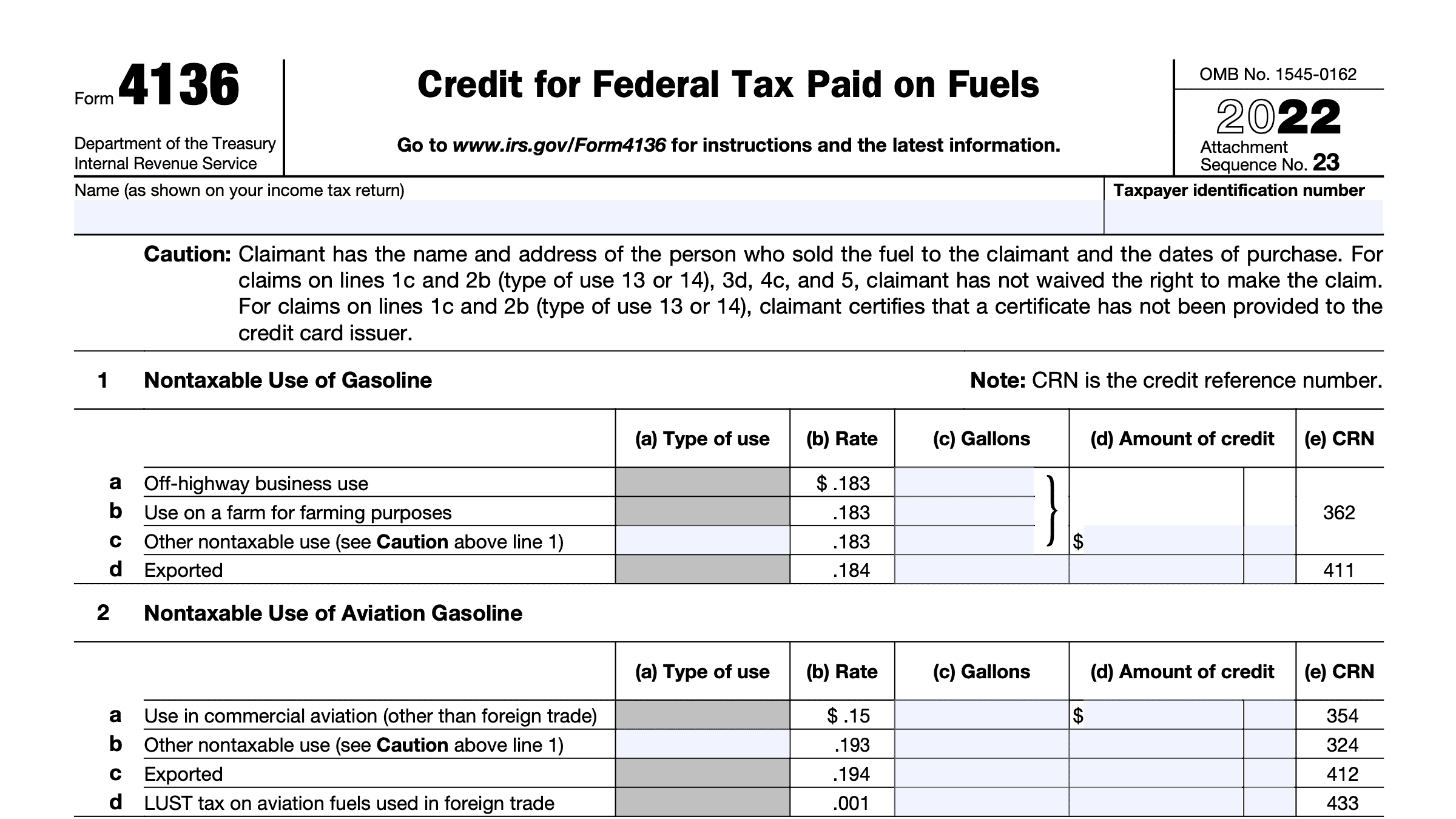

A credit for certain nontaxable uses or sales of fuel during your income tax year A credit for blending a diesel water fuel emulsion A credit for exporting dyed fuels or gasoline The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses of fuels are

WASHINGTON D C The U S Department of Energy DOE the U S Department of Treasury and the Internal Revenue Service IRS today announced 4 billion in tax The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities Many

Download What Is The Federal Fuel Tax Credit

More picture related to What Is The Federal Fuel Tax Credit

Increase Tax Savings With The Fuel Tax Credit Landmark CPAs

https://www.landmarkcpas.com/wp-content/uploads/2022/12/Fuel-Tax-Credit-1024x640.jpg

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

https://theicct.org/wp-content/uploads/2022/06/epv-us-tax-credit-fig-jun22.png

Fuel Tax Credit Calculation Worksheet

https://i2.wp.com/data.formsbank.com/pdf_docs_html/128/1280/128053/page_1_thumb_big.png

You can now claim refundable alternative fuel credits for the first three quarters of 2022 by filing Form 8849 Schedule 3 before April 11 2023 Learn how to claim fuel tax credits on Form 4136 and maximize tax savings Understand eligibility criteria clean fuels tax credit alternative fuel vehicle credit and more

Form 4136 allows taxpayers to claim a credit for certain federal excise taxes paid on fuels including gasoline diesel fuel and alternative fuels like liquefied petroleum gas LPG IRS Form 4136 Credit for Federal Tax Paid on Fuels enables certain taxpayers to claim a fuel credit depending on the type of fuels used and the type of business use the credit

![]()

Fuel Tax Credits Fleet Management Solutions Connect Fleet

https://connectfleet.com.au/wp-content/uploads/sites/2/2018/12/Asset-tracking-img-2-min.jpg

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

https://www.irs.gov/.../fuel-tax-credits

The Inflation Reduction Act of 2022 retroactively extended several fuel tax credits

https://www.investopedia.com/terms/f/f…

The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a program that lets some businesses reduce their taxable income dollar for dollar based on specific types of fuel costs

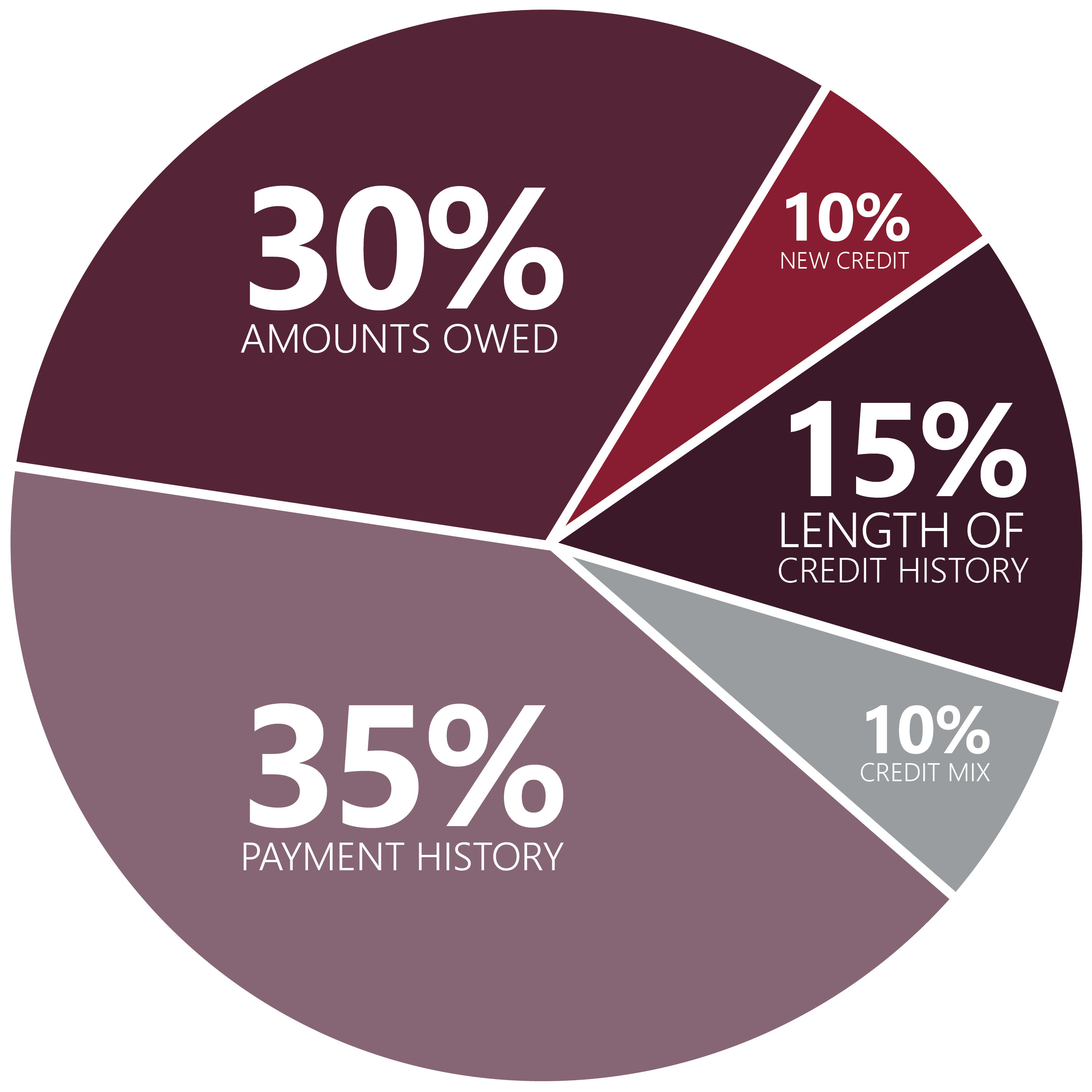

What Is The Credit Mix And How Does It Affect Your Credit Score

Fuel Tax Credits Fleet Management Solutions Connect Fleet

Taxation Notes 1 Income Tax Act And Regulations The Income Tax Act

Fuel Tax Credit 2023 2024

Fuel Tax Credit Rates Have Increased Business Wise

How High Are Gas Taxes In Your State Laura Strashny

How High Are Gas Taxes In Your State Laura Strashny

Form 4136 Fillable Printable Forms Free Online

IRS Form 4136 A Guide To Federal Taxes Paid On Fuels

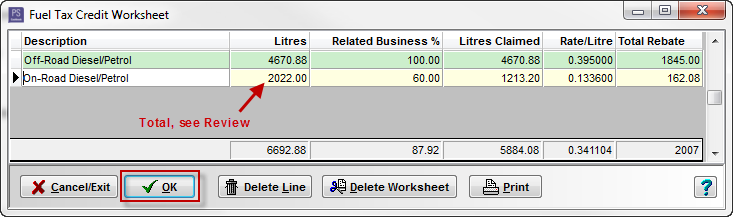

Calculating Fuel Tax Credit Manually PS Support

What Is The Federal Fuel Tax Credit - Whether you run delivery management operations or are in charge of fleet management costs it s best to know who qualifies for the fuel tax credit The federal fuel tax credit is a