What Is The Maximum Household Income For Child Tax Credit To get the maximum amount of child tax credit your annual income will need to be less than 19 995 in the 2024 25 tax year up from 18 725 in 2023 24 Child tax credit is gradually being replaced by Universal Credit

A7 The Child Tax Credit is reduced phased out in two different steps which are based on your modified adjusted gross income AGI in 2021 The first The CTC currently provides up to 2 000 per child under 17 under the 2017 Tax Cuts and Jobs Act TCJA If the CTC exceeds taxes owed families may receive up

What Is The Maximum Household Income For Child Tax Credit

What Is The Maximum Household Income For Child Tax Credit

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/child-tax-credit-1080x675.jpg

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

Two Child Limit To Tax Credits Set To Drive Child Poverty Up By 10 By

https://i2.wp.com/policyinpractice.co.uk/wp-content/uploads/2017/04/Two-Child-Tax-Credit-table.png?resize=940%2C205

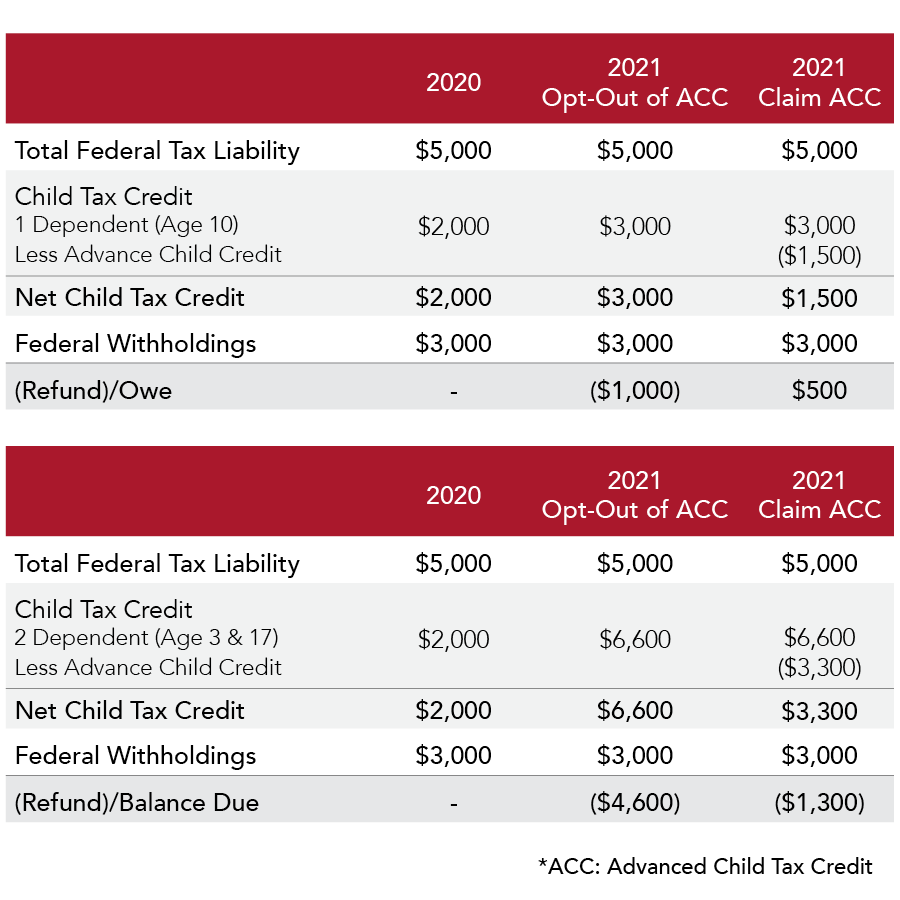

For tax year 2021 the Child Tax Credit increased from 2 000 per qualifying child to 3 600 for children ages 5 and under at the end of 2021 and 3 000 for children The 2024 Child Tax Credit can reduce your tax liability on your annual taxes Here s a breakdown of the CTC s income limits and rules

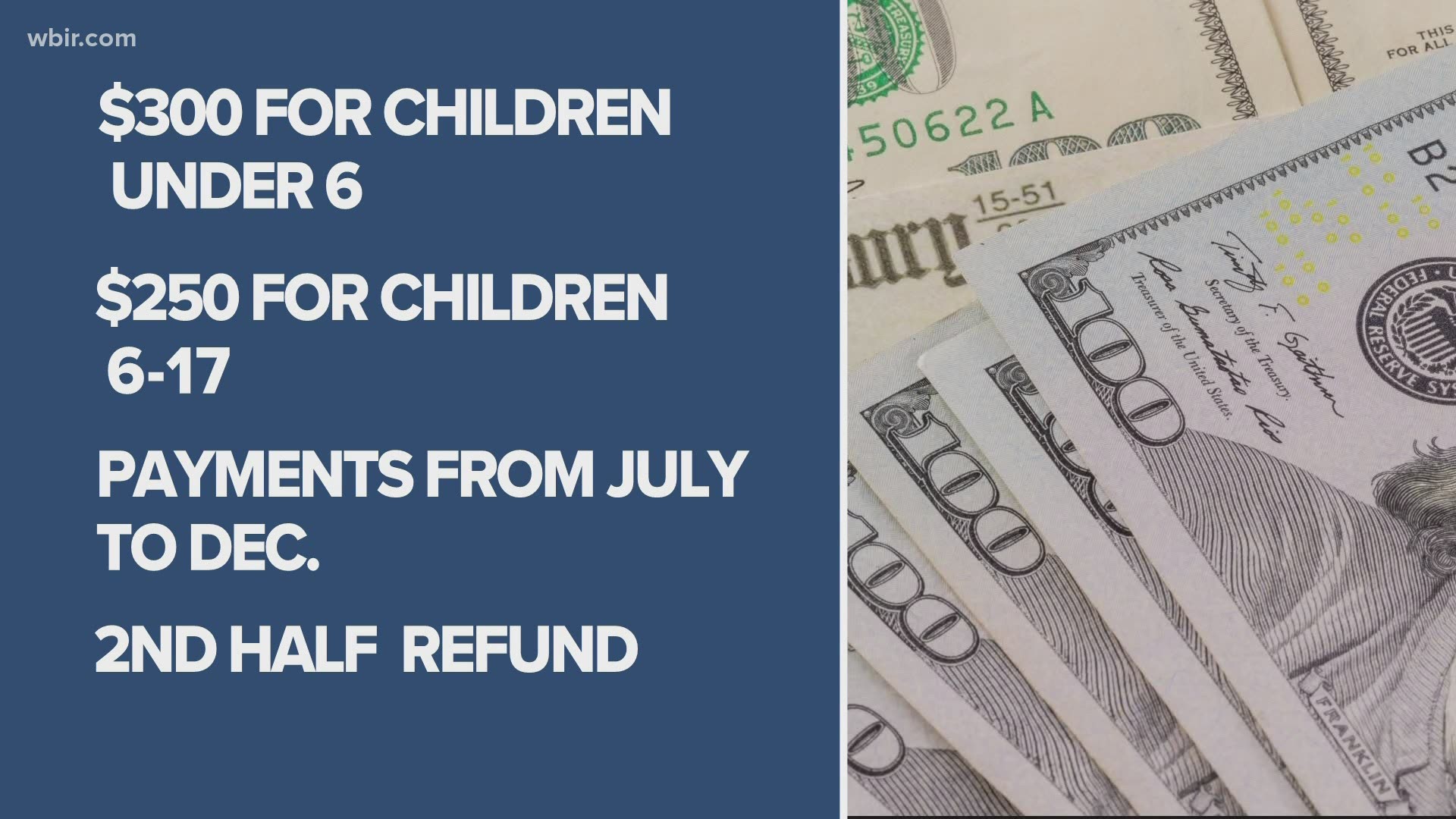

Beginning in July 2021 payments were made monthly up to 300 for children under the age of 6 and up to 250 for children between 6 and 17 beginning in July 2021 to 39 million households Tax Year 2023 Income Limits and Range of EITC Number of Qualifying Children For Single Head of Household or Qualifying Surviving Spouse or Married Filing Separately

Download What Is The Maximum Household Income For Child Tax Credit

More picture related to What Is The Maximum Household Income For Child Tax Credit

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

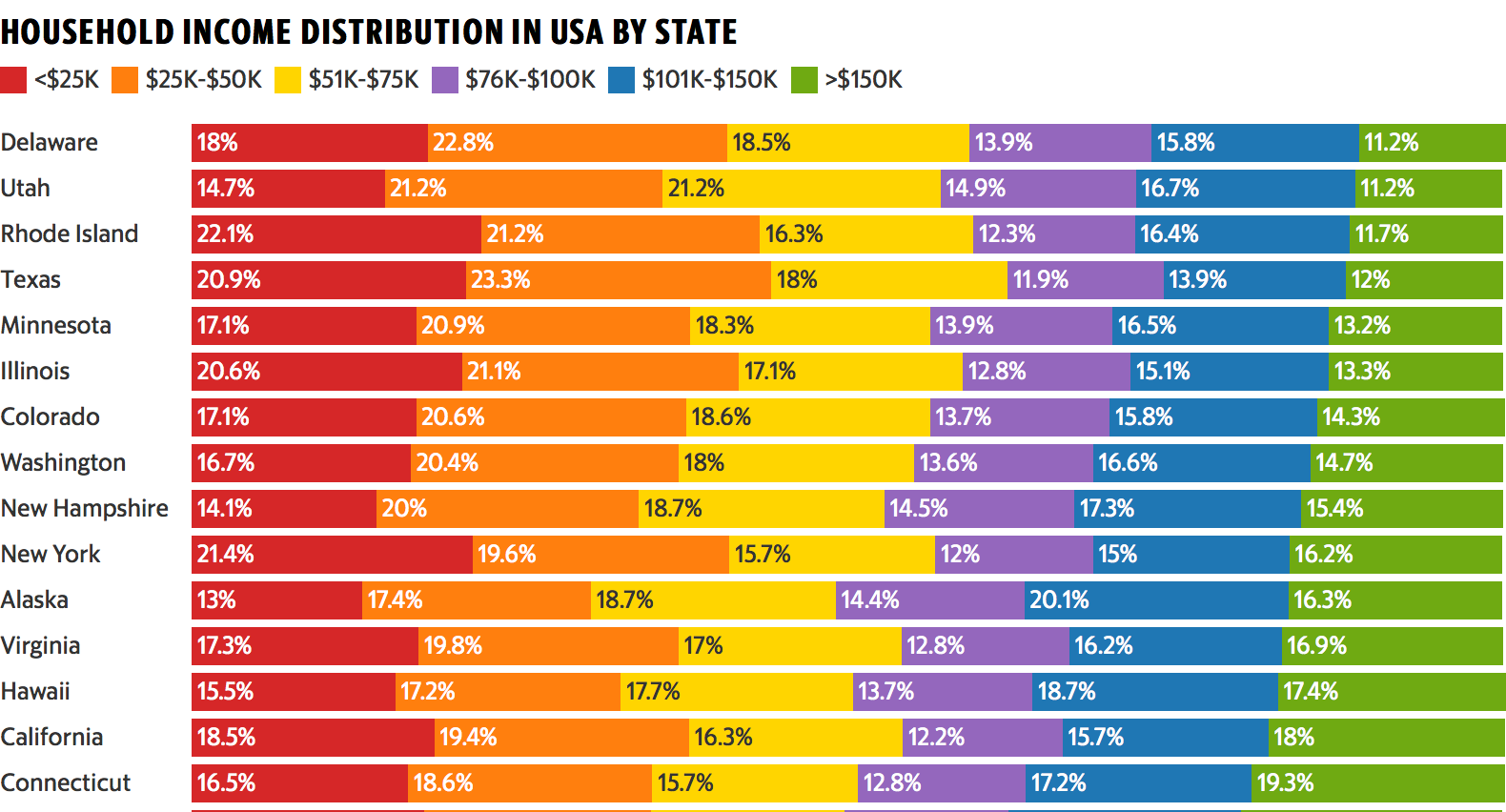

Visualizing Household Income Distribution In The U S By State

https://www.visualcapitalist.com/wp-content/uploads/2017/11/household-income-share.png

Child Tax Credit 2022 Income Limit Phase Out TAX

https://indianapublicmedia.org/images/news-images/child-tax-credit.jpg

For the 2023 tax year you can get a maximum tax credit of 2 000 for each qualifying child under age 17 although there is an income limit of 400 000 for married couples and 200 000 for individuals 1 For 2024 taxes filed in 2025 the child tax credit will be worth 2 000 per qualifying dependent child if your MAGI is 400 000 or below married filing jointly or 200 000 or below all other

The Tax Policy Center estimates that 90 percent of families with children received an average CTC of 2 390 in 2022 the average credit can exceed the maximum per child Child Tax Credit income limit To get the maximum 2 000 Child Tax Credit your 2023 MAGI must be under 200 000 If you file taxes jointly with your spouse your

Child Tax Credit

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

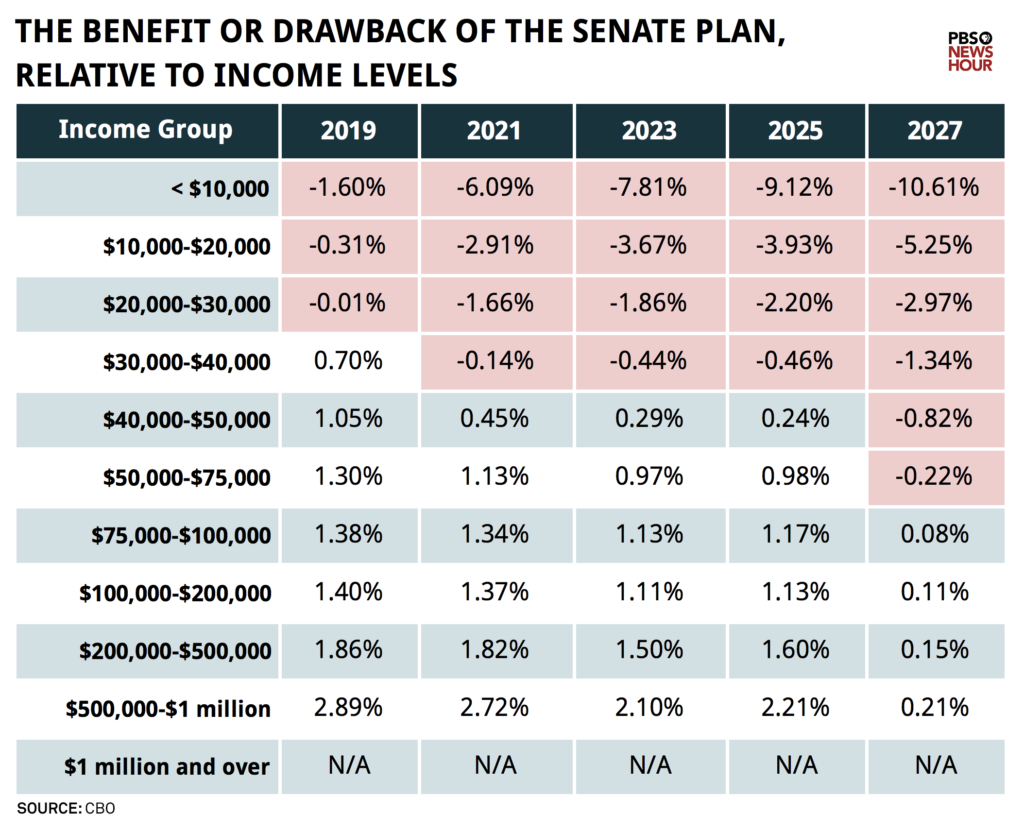

The Rural Blog Charts Show Tax Bill s Impact By Income Groups

https://3.bp.blogspot.com/-nLbvp6YGgRM/WiA0e8R8k6I/AAAAAAAACC8/BvTQnCAhCj0pCxT5ph3IHwETb9i7pxynwCLcBGAs/s1600/PBS%2BCBO%2Bchart%2B2.png

https://www.which.co.uk/money/tax/tax-cre…

To get the maximum amount of child tax credit your annual income will need to be less than 19 995 in the 2024 25 tax year up from 18 725 in 2023 24 Child tax credit is gradually being replaced by Universal Credit

https://www.irs.gov/credits-deductions/tax-year...

A7 The Child Tax Credit is reduced phased out in two different steps which are based on your modified adjusted gross income AGI in 2021 The first

Care Credit Printable Application Printable Word Searches

Child Tax Credit

What Is The Maximum Income To Qualify ForFinancial Aid Insurance Noon

Ironman Blog August 2017 Median Household Income Talkmarkets

Child Tax Credit How Will It Work And When Will Parents Begin To See

Political Calculations Median Household Income In April 2019

Political Calculations Median Household Income In April 2019

Child Tax Credit You Can Opt out Of Monthly Payment Soon Fox61

2021 Child Tax Credit What Should I Know Collins Consulting

Earned Income Tax Credit City Of Detroit

What Is The Maximum Household Income For Child Tax Credit - Here is what the child tax credit means for you what the income limits are for 2020 and how it might change under President Biden