What Is The Sale Tax In Hawaii 4 00 2024 Hawaii state sales tax Exact tax amount may vary for different items The Hawaii state sales tax rate is 4 and the average HI sales tax after local surtaxes is 4 35 Counties and cities can charge an additional local sales tax of up to 0 5 for a maximum possible combined sales tax of 4 5

Get a quick rate range Hawaii state sales tax rate range 4 4 5 Base state sales tax rate 4 Local rate range 0 0 5 Total rate range 4 4 5 Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates Hawaii has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 0 5 There are a total of 4 local tax jurisdictions across the state collecting an average local tax of 0 5 Click here for a larger sales tax map or here for a sales tax table

What Is The Sale Tax In Hawaii

What Is The Sale Tax In Hawaii

https://creditkarma-cms.imgix.net/wp-content/uploads/2018/11/GettyImages-545185575-TXSTHI-e1542728093402.jpg

What Is 65 000 After Tax In Hawaii YouTube

https://i.ytimg.com/vi/mqTFk2FseHc/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLCwiFsDQmMZBgKfiNeFBAHW2YICpA

What Is 70 000 After Tax In Hawaii YouTube

https://i.ytimg.com/vi/mvEAOB6e-hw/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYYSBhKGEwDw==&rs=AOn4CLAQ2IPH3UAU1Em-4ljDdJYXbuKW_A

Hawaii has a 4 statewide sales tax rate but also has four local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0 5 on top of the state tax What transactions are generally subject to sales tax in Hawaii In the state of Hawaii general excise tax is legally required to be collected from most tangible physical products being sold to a consumer Several examples of exceptions to this tax are liquor and some things specifically intended for resale

Hawaii has a lower than average sales tax including when local sales taxes from Hawaii s 4 local tax jurisdictions are taken into account While technically Hawaii does not have a sales tax there is a 4 percent general excise tax GET On top of the state tax rate there may be one or more local taxes as well as one or more special district taxes each of which can range between 0 percent and 5 percent

Download What Is The Sale Tax In Hawaii

More picture related to What Is The Sale Tax In Hawaii

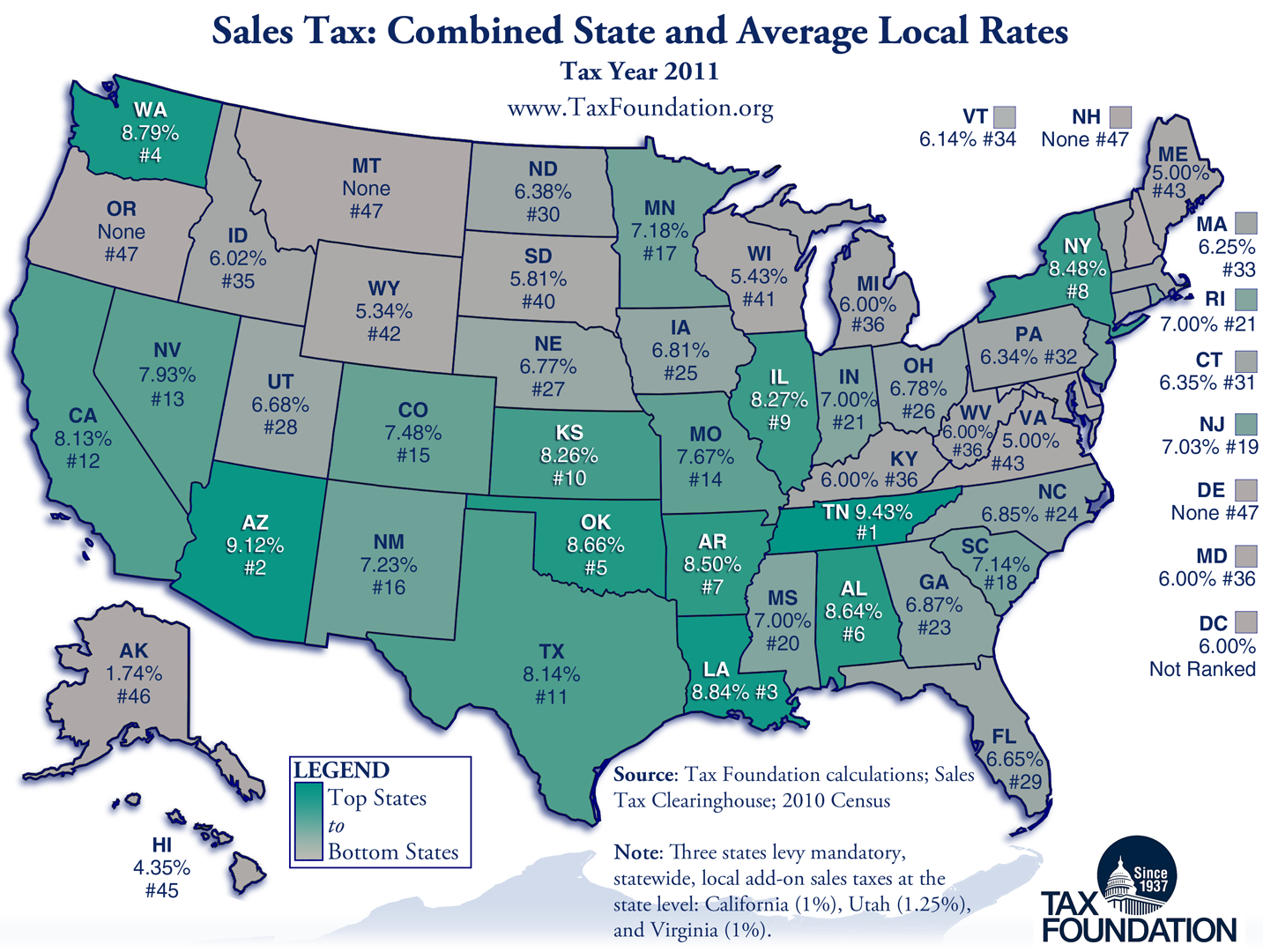

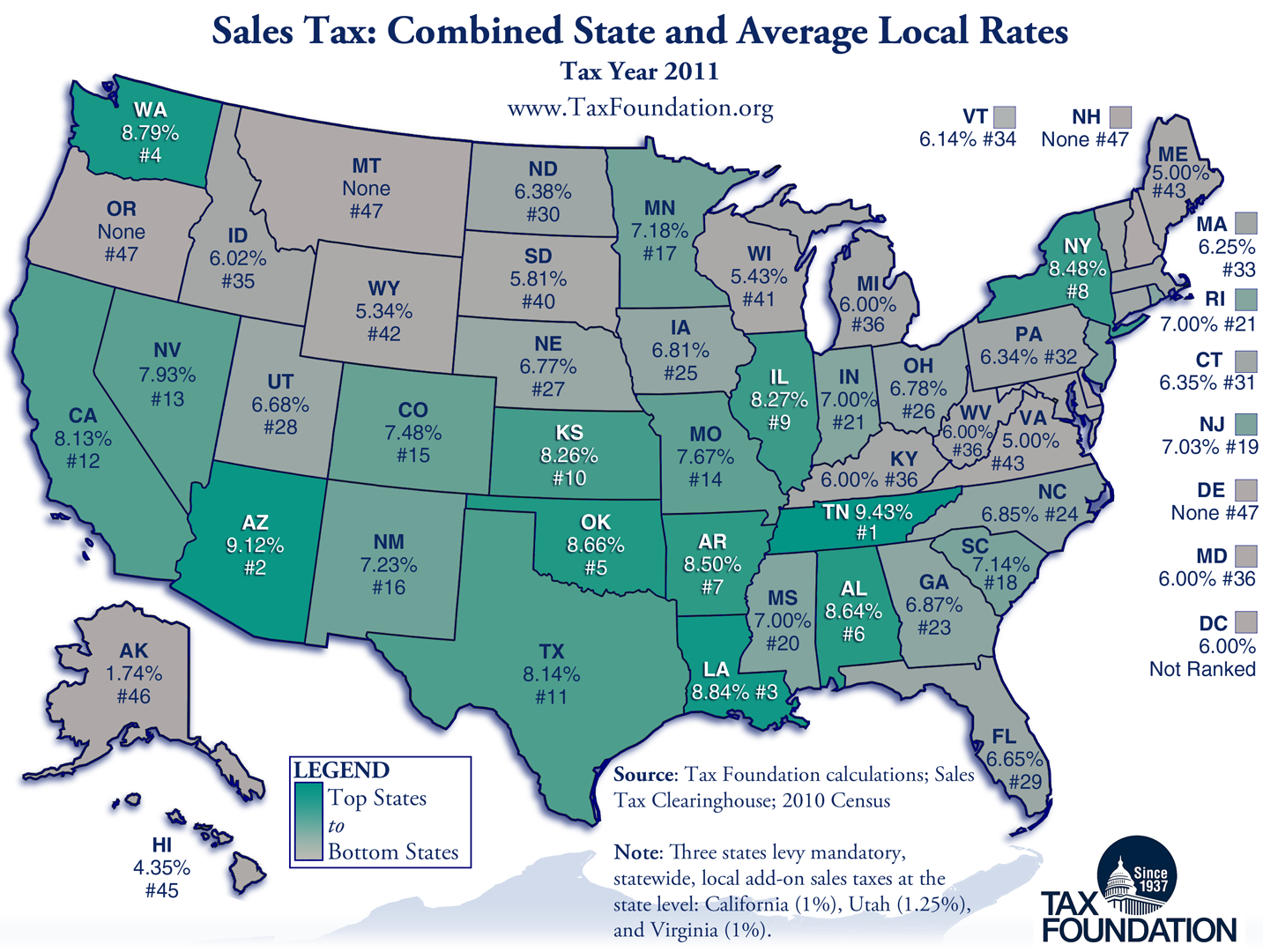

State And Local Sales Tax Rates Midyear 2021 Laura Strashny

https://files.taxfoundation.org/20210707180628/2021-sales-taxes-by-state-2021-sales-tax-rates-by-state-2021-state-and-local-sales-tax-rates-July-2021-1200x1033.png

Hawaii Sales Tax Guide

https://blog.accountingprose.com/hs-fs/hubfs/1-1.png?width=800&name=1-1.png

Hawaii Sales Taxes Highest Per Capita In USA Hawaii Free Press

https://files.taxfoundation.org/20180912152946/SalesTaxesPerCapita-2018.png

State of Hawaii Department of Taxation Issued May 2022 TAX FACTS 2022 1 General Excise and Use Tax Information for Manufacturers and Producers This Tax Facts answers basic questions about how the general excise tax GET and use tax applies to manufacturers and producers 1 What is the general excise tax GET The GET is a privilege tax imposed on business activity in the State of Hawaii The tax is imposed on the gross income received by the person engaging in the business activity Your gross income is the total of all your business income before you deduct your business expenses

Hawaii State Sales Tax 3 50 Maximum Local Sales Tax 0 50 Maximum Possible Sales Tax 4 35 Average Local State Sales Tax The Tax Rates Hawaii Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Hawaii Just enter the five digit zip code of the location in which What is the sales tax rate in Honolulu Hawaii The minimum combined 2024 sales tax rate for Honolulu Hawaii is This is the total of state county and city sales tax rates

Sales Tax I Hawaii Hawaiibloggen

http://1.bp.blogspot.com/-zvoiCorCKzI/UWLgeNaijNI/AAAAAAAD_gM/gNo17e3nt8s/s1600/local_sales_tax_map-o-20110922.png

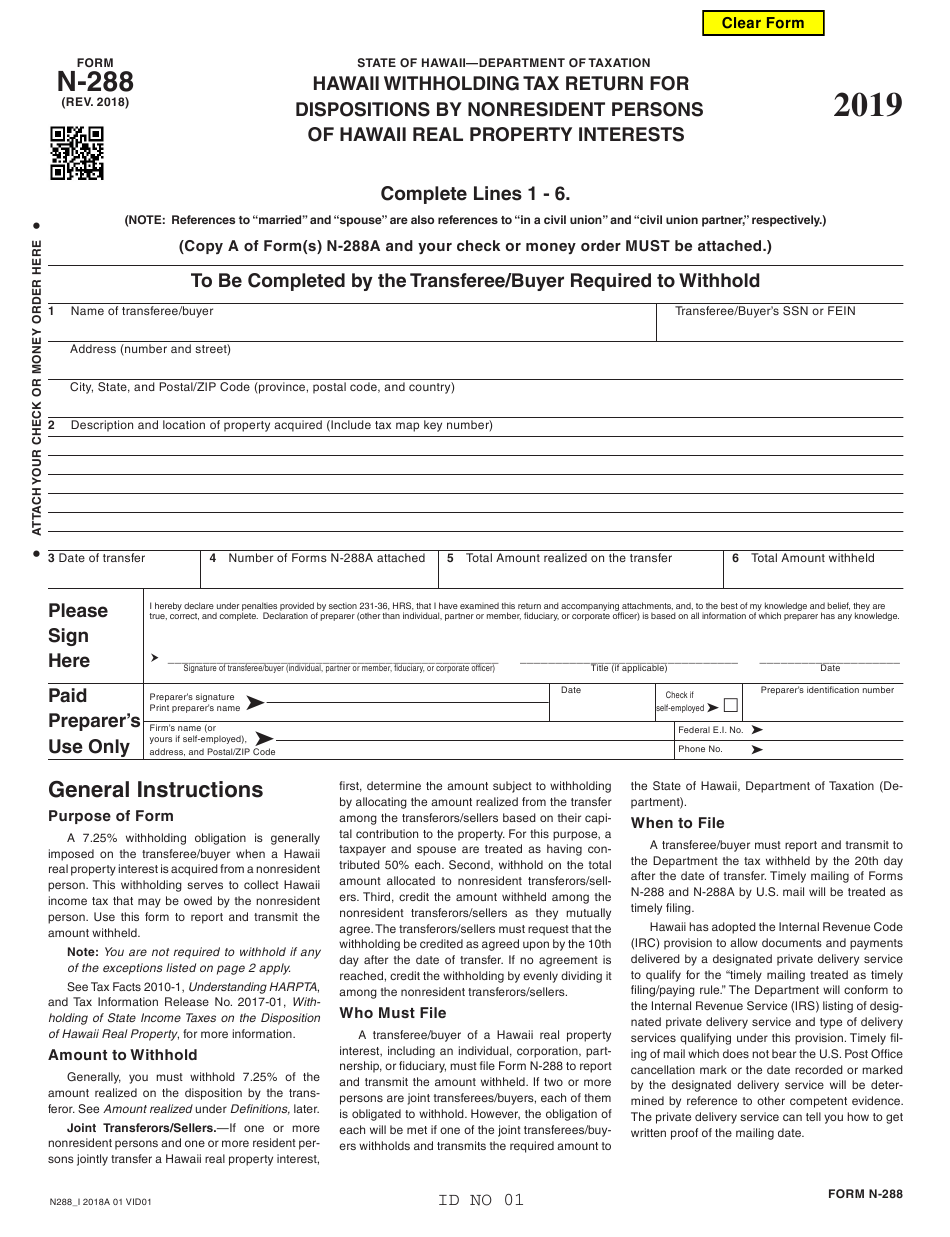

Hawaii State Tax Withholding Form 2022 WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/08/form-n-288-download-fillable-pdf-or-fill-online-hawaii-withholding-tax-1.png

https://www.tax-rates.org/hawaii/sales-tax

4 00 2024 Hawaii state sales tax Exact tax amount may vary for different items The Hawaii state sales tax rate is 4 and the average HI sales tax after local surtaxes is 4 35 Counties and cities can charge an additional local sales tax of up to 0 5 for a maximum possible combined sales tax of 4 5

https://www.avalara.com/taxrates/en/state-rates/hawaii.html

Get a quick rate range Hawaii state sales tax rate range 4 4 5 Base state sales tax rate 4 Local rate range 0 0 5 Total rate range 4 4 5 Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Sales Tax I Hawaii Hawaiibloggen

Trump Tax In Hawaii Tax Foundation Of Hawaii

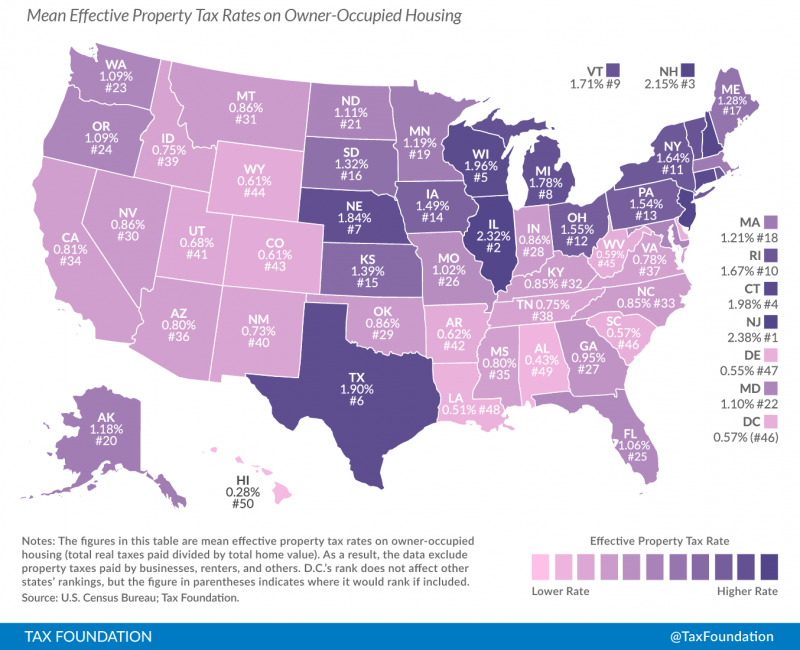

How Do Hawaii Tax Rates Compare To Other States Hawaii Real Estate

Sales Tax By State 2023 Wisevoter

7 25 Sales Tax Chart Printable Printable Word Searches

7 25 Sales Tax Chart Printable Printable Word Searches

Hawaii Sales Tax Rate Step By Step Business

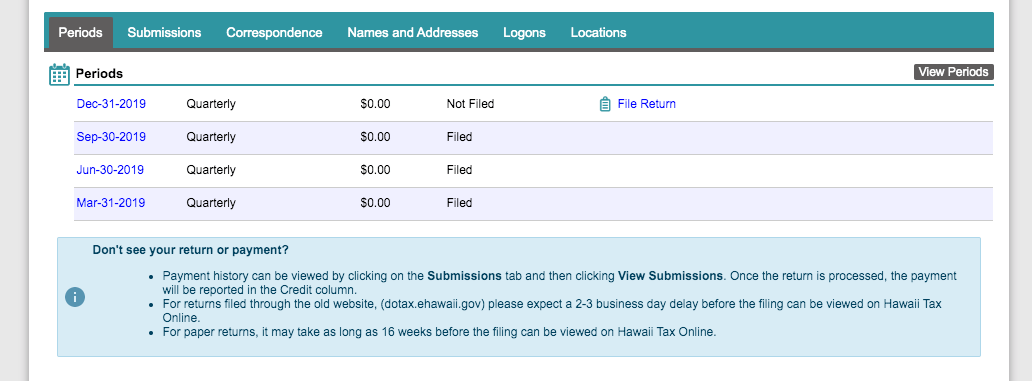

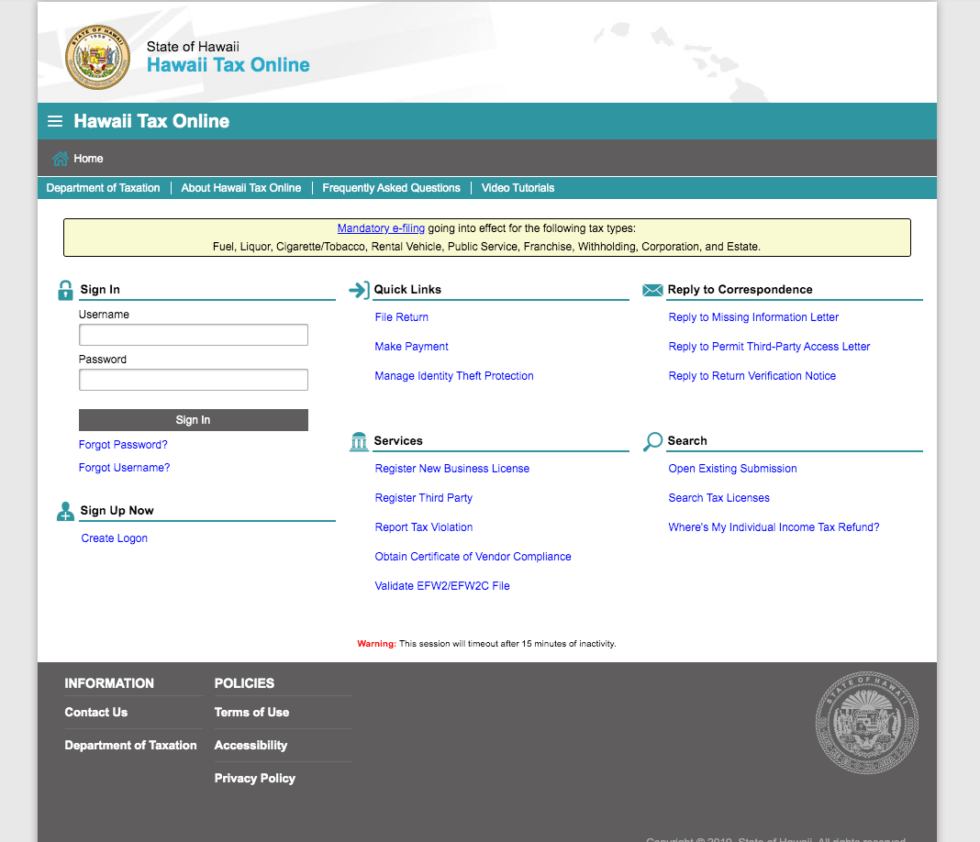

How To File And Pay Sales Tax In Hawaii TaxValet

How To File And Pay Sales Tax In Hawaii TaxValet

What Is The Sale Tax In Hawaii - While technically Hawaii does not have a sales tax there is a 4 percent general excise tax GET On top of the state tax rate there may be one or more local taxes as well as one or more special district taxes each of which can range between 0 percent and 5 percent