What Is The Tax Credit For Hybrid Vehicles For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids

You may qualify for a clean vehicle tax credit up to 7 500 if you buy a new qualified plug in electric vehicle or fuel cell electric vehicle New requirements effective April 18 If you take possession of a new clean vehicle on or after April 18 2023 it must meet critical mineral and battery component requirements to qualify for the credit Some Hybrids Are Eligible for the Revised 7 500 EV Tax Credit The 7 500 tax credit is an attractive incentive but is your hybrid vehicle you re eyeing even eligible See which EVs

What Is The Tax Credit For Hybrid Vehicles

What Is The Tax Credit For Hybrid Vehicles

https://www.pineapplemoney.com/img/Vehicles-That-Qualify-For-6000-Lb-Tax-Credit.jpg#header-image

Can I Get A Tax Credit For Buying A Used Hybrid Car Juiced Frenzy

https://i0.wp.com/juicedfrenzy.com/wp-content/uploads/2021/11/Depositphotos_186124840_S.jpg?w=1000&ssl=1

Tax Credit For Hybrid Cars

https://static1.topspeedimages.com/wordpress/wp-content/uploads/jpg/200601/tax-credit-for-hybri-6.jpg

The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the tax credit Beginning January 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 A federal hybrid car tax credit is available to consumers who buy plug in electric vehicles EVs in the United States According to the U S Department of Energy you can receive a tax credit of

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply

Download What Is The Tax Credit For Hybrid Vehicles

More picture related to What Is The Tax Credit For Hybrid Vehicles

It Just Got A Lot Easier To Get A 7 500 Tax Credit For Buying An EV

https://www.thecooldown.com/wp-content/uploads/2023/03/WXeB-gLf-YYifeLczQZHnsPc2zoidhRrVucmCLcQzrM.jpeg

All About Tax Credit For EV PHEV And Hybrid Cars CarBuzz

https://cdn.carbuzz.com/gallery-images/1600/954000/800/954828.jpg

Toyota s EV Tax Credit Cap Is Expected To Be Reached Soon Bloomberg

https://assets.bwbx.io/images/users/iqjWHBFdfxIU/iUf3ibQ9twUI/v0/-1x-1.jpg

Federal tax credits for hybrid cars and electric vehicles include specific EV vehicles that are qualified for a tax credit of up to 7 500 The initial cost of some of these vehicles might be what s holding you back but tax credits can make a big dent in the price of an electric or plug in hybrid car The five PHEVs that receive a 3750 credit are the BMW X5 xDrive 50e the Ford Escape PHEV the Jeep Grand Cherokee 4xe and Wrangler 4xe and the Lincoln Corsair Grand Touring Remember any plug

How EV PHEV and Hybrid Tax Credits Are Determined First off tax credit is determined by the type of electric vehicle and by the size of the battery Some plug in hybrid models Jan 1 2024 at 3 09pm ET By Patrick George A year ago nearly every new electric vehicle and plug in hybrid on the market qualified for a tax credit of up to 7 500 provided it was

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

https://www. cars.com /articles/heres-which-hybrids...

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids

https://www. irs.gov /credits-deductions/credits-for...

You may qualify for a clean vehicle tax credit up to 7 500 if you buy a new qualified plug in electric vehicle or fuel cell electric vehicle New requirements effective April 18 If you take possession of a new clean vehicle on or after April 18 2023 it must meet critical mineral and battery component requirements to qualify for the credit

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

U S Lawmakers Propose To Extend EV Tax Credit At A Cost Of 11 4

Used Car Dealer Near Federal Way WA Sunset Ford Of Sumner

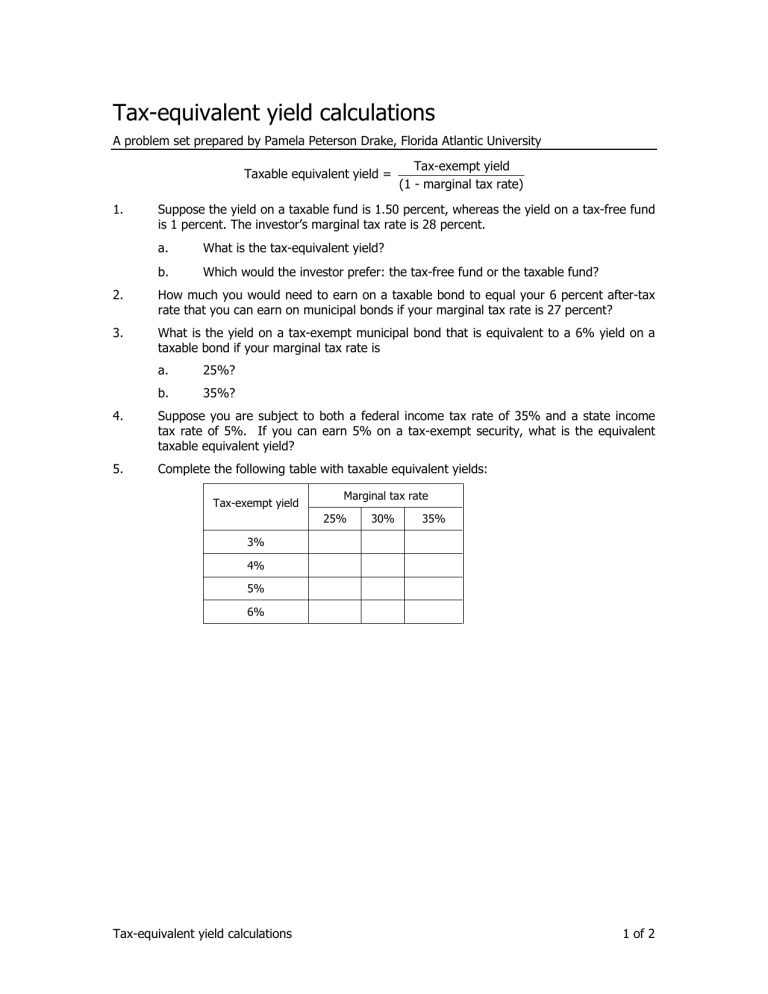

Tax equivalent Yield Calculations It

Federal Rebates For Hybrid Cars 2023 Carrebate

Federal Rebates For Hybrid Cars 2023 Carrebate

Has Which Discovered Its Best scoring Hybrid Car Which News

Federal Rebate On Hybrid Cars 2023 Carrebate

Tesla Receives A Boost As All Model 3 Variants Are Eligible For 7 500

What Is The Tax Credit For Hybrid Vehicles - Any all electric vehicle EV plug in electric vehicle PHEV and fuel cell electric vehicle FCV purchased new in 2023 or later may be eligible for a federal income tax credit of either 3 750