Where Do Taxable Payments Go In Tax Return As part of the taxable payments reporting system TPRS many businesses lodge a Taxable payments annual report TPAR to report payments made to

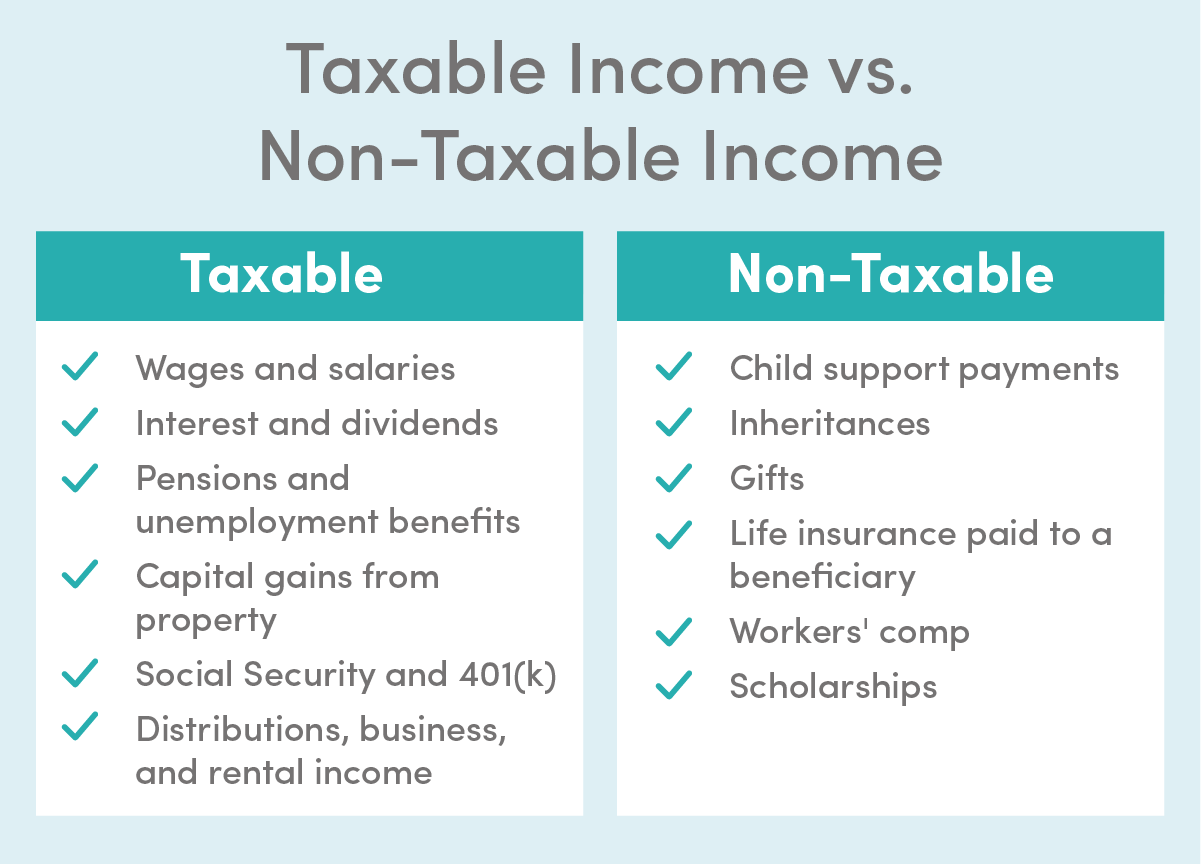

Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but is not taxable Taxable income can include payments you receive from Employment Wages and employee benefits included on Form W 2 Self employment or side jobs

Where Do Taxable Payments Go In Tax Return

Where Do Taxable Payments Go In Tax Return

https://www.taxgirl.com/wp-content/uploads/2021/01/Screen-Shot-2021-01-10-at-3.09.05-PM.png

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

How To Calculate Tax On Salary Wholesale Deals Save 40 Jlcatj gob mx

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/15150753/Apple-Effective-Tax-Rate.jpg

MyTax 2022 Taxable payments annual report How to report your payments and grants reported on a Taxable payments annual report using myTax In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject

Updated May 27 2021 Reviewed by Charlene Rhinehart Taxes appear in some form in all three of the major financial statements the balance sheet the income statement and the cash flow R40 Filing Online Where do I declare redundancy or severance payments Article ID 2273 Last updated 29 Mar 2022 This article will complete an

Download Where Do Taxable Payments Go In Tax Return

More picture related to Where Do Taxable Payments Go In Tax Return

What Income Is Subject To The 3 8 Medicare Tax

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Payment Agreement How To Set Up A Payment Plan With The IRS Marca

https://phantom-marca.unidadeditorial.es/fa8dca0f613b5b2703e6297386515270/resize/1320/f/jpg/assets/multimedia/imagenes/2022/09/17/16634245499228.jpg

What Is Pre Tax Commuter Benefit

http://www.remotefinancialplanner.com/wp-content/uploads/2017/02/word-image-3.png

Unless your last Self Assessment tax bill was less than 1 000 or you ve already paid more than 80 of all the tax you owe you ll be asked to make payments on account Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year It can be described broadly as adjusted gross income AGI minus allowable

You must still pay income tax on incentive payments and other types of Box 3 income just not Social Security or Medicare taxes The amount you enter on your Shows substitute payments in lieu of dividends or tax exempt interest received by your broker on your behalf as a result of a loan of your securities Report on

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

https://blog.navitmoney.com/wp-content/uploads/2020/07/what-is-taxable-income-1400x1125.png

Taxable Income Calculator infographics Income Business Finance Mo

https://i.pinimg.com/474x/84/7e/aa/847eaa6116f324a24a2efa028218c362--personal-finance-investing.jpg

https://www.ato.gov.au/.../taxable-payments-reporting-and-contractors

As part of the taxable payments reporting system TPRS many businesses lodge a Taxable payments annual report TPAR to report payments made to

https://www.irs.gov/businesses/small-businesses...

Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but is not taxable

Calculate My Income Tax SuellenGiorgio

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Here s Where Your Federal Income Tax Dollars Go NBC News

:max_bytes(150000):strip_icc()/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg)

How Much Money Can A Business Make Before Paying Taxes Leia Aqui How

Taxable Payments Reporting

Estimated Quarterly Payments To The IRS What Are They Do I Have To

Estimated Quarterly Payments To The IRS What Are They Do I Have To

Ask The Tax Whiz How To Compute Income Tax Under The New Income Tax

How To Request Your Federal Income Tax Refund Tax Rates

Taxable Income Formula Financepal

Where Do Taxable Payments Go In Tax Return - In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject