Where Is Refund Amount On Tax Return Verkko 1 tammik 2024 nbsp 0183 32 Tax refunds individual taxpayers If you have paid too much tax in withholding or prepayments we refund the excess back to you when the tax year is over Refunds are paid to taxpayers on different dates depending on when their tax assessment process is completed You can see the date and amount of your refund

Verkko 6 kes 228 k 2019 nbsp 0183 32 Intuit Alumni You should see your refund amount when you login to your TurboTax Online in the top left hand corner If you don t please follow the steps below to verify the amount listed on your tax return Verkko 1 tammik 2024 nbsp 0183 32 The tax refund is already on its way to the bank where you can cash the money order If you do not cash the money order in 28 days the bank returns the uncashed amount to the Tax Administration The

Where Is Refund Amount On Tax Return

Where Is Refund Amount On Tax Return

https://savingtoinvest.com/wp-content/uploads/2022/02/image-14.png?is-pending-load=1

ITR Refund Status How To Check Income Tax Refund Status The Economic

https://img.etimg.com/photo/msid-86750817/tax-refund-1.jpg

11 How To Check My State Refund Status Trending Hutomo

https://i2.wp.com/images.ctfassets.net/ifu905unnj2g/1zITcbI6WTwwhYkzrV0MSr/5a215aad2a09fdf03c52d0d9c4ab6a1e/image_4.png

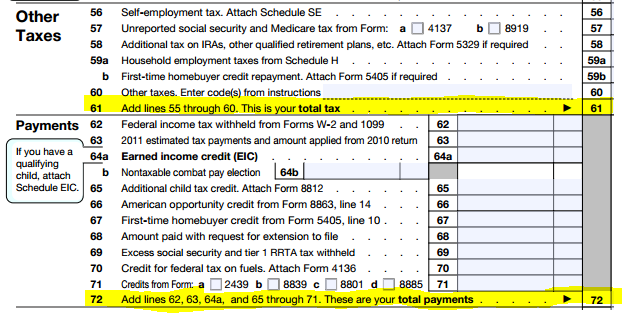

Verkko 4 p 228 iv 228 228 sitten nbsp 0183 32 Get information about tax refunds and track the status of your e file or paper tax return You can check the status of your 2023 income tax refund 24 hours after e filing Please allow 3 or 4 days after e filing your 2021 and 2022 tax year returns Verkko 3 kes 228 k 2019 nbsp 0183 32 If you filed a Form 1040SS the Refund Amount is shown on Line 13a Additionally be certain you are choosing the correct filing status If you filed a Form 1040 the Filing Status is shown on the top of the form

Verkko 5 kes 228 k 2019 nbsp 0183 32 My Fed refund is over 21 days My return was accepted the same day it was filed The track my refund link requires I provide my exact refund but I don t have that number handy I am traveling and can t access it Is there any other way I can check my status or get the amount number from turbotax I have been using turbotax for Verkko 4 tammik 2024 nbsp 0183 32 To use Where s My Refund you need to provide your Social Security number or individual taxpayer ID number ITIN filing status and exact whole dollar amount of your expected refund Prior year refund information Where s My Refund will display the refund status of the tax year you choose

Download Where Is Refund Amount On Tax Return

More picture related to Where Is Refund Amount On Tax Return

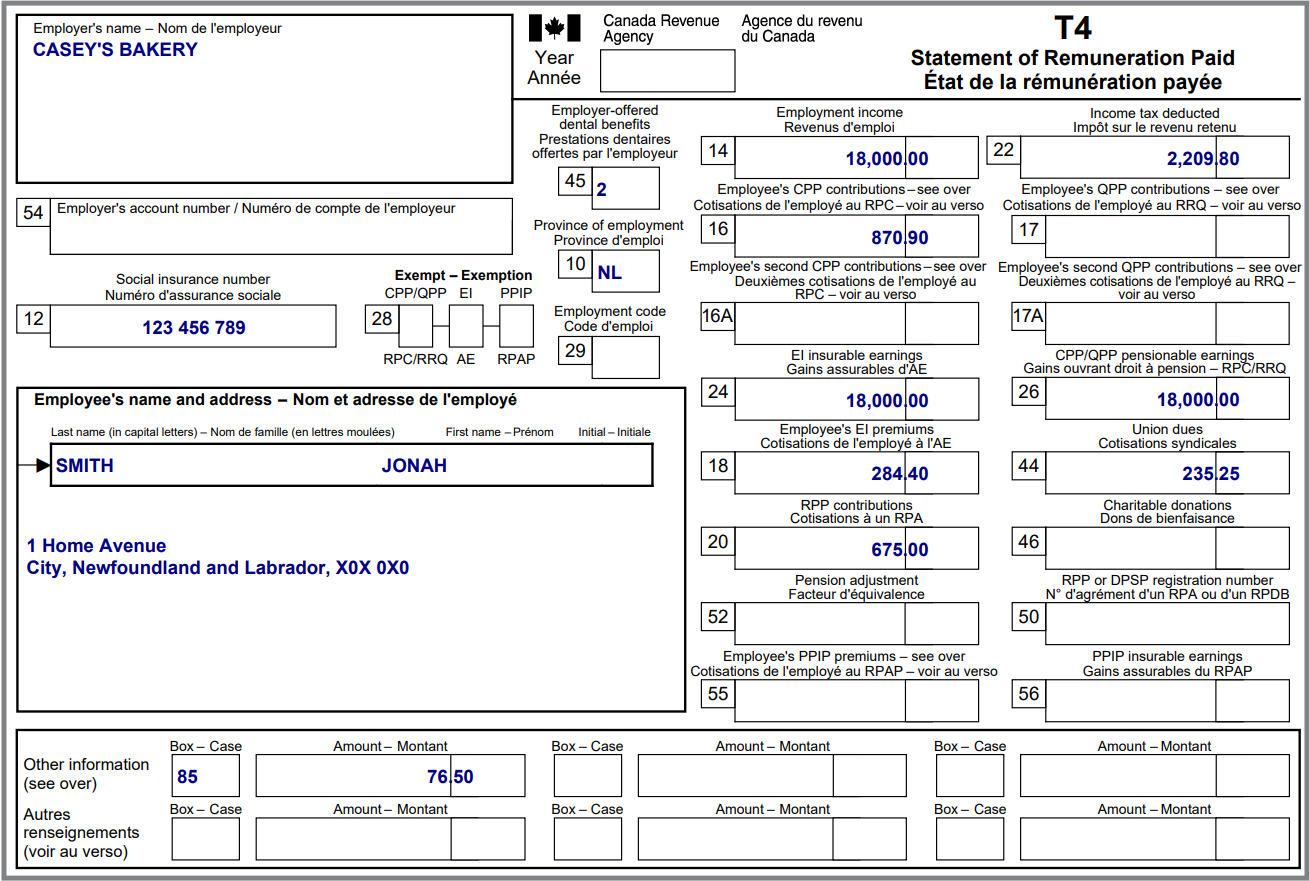

Exercise Calculate A Refund Or A Balance Owing Learn About Your

https://www.canada.ca/content/dam/cra-arc/serv-info/tax/individuals/edu-prgms/mdls-xrcss/jonah-t4-en.png

-d4c7.jpg)

This Map Shows The Average Tax Refund In Every State

https://cdn.howmuch.net/articles/tax-refund-by-state-(1)-d4c7.jpg

3 Reasons You Shouldn t Receive A Tax Refund Next Year

https://s.yimg.com/ny/api/res/1.2/JIoLoNr_QJe3C1icuE0MAg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTM2MA--/https://media.zenfs.com/en/gobankingrates_644/b7a1d2b2c529af141deffd558b1cb65b

Verkko 26 huhtik 2023 nbsp 0183 32 Rocky Mengle You can easily check your refund status with the IRS s quot Where s My Refund quot portal Although the average tax refund is lower this year compared to last it is about 2 878 as Verkko Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable Because tax rules change from year to year your tax refund might change even if your salary and deductions don t change In other words you might get different results for the 2023 tax year than you did for other

Verkko 9 maalisk 2023 nbsp 0183 32 Your tax return amount is in general based on line 24 total tax owed and line 33 total tax paid Subtract line 24 from line 33 If the amount on line 33 is larger than the amount on line 24 that s what you overpaid In theory you should get this amount back as a refund Enter this overpayment on line 34 Verkko 25 toukok 2022 nbsp 0183 32 Using Where s My Refund taxpayers can start checking the status of their refund within 24 hours after e filing a tax year 2021 return Three or four days after e filing a tax year 2019 or 2020 return Four weeks after mailing a return

My Refund Illinois State Comptroller

https://myrefund.illinoiscomptroller.gov/assets/img/tax-return-graphic-2023.jpg

Why Wait For Your Tax Refund Get It Sooner By Cutting Out The IRS

http://o.aolcdn.com/dims-shared/dims3/GLOB/crop/4745x2605+21+561/resize/604x327!/format/jpg/quality/85/http://o.aolcdn.com/hss/storage/adam/1384f924728ace9e7a2aa85ac6a136ff/BGX923.jpg

https://www.vero.fi/en/individuals/payments/refunds

Verkko 1 tammik 2024 nbsp 0183 32 Tax refunds individual taxpayers If you have paid too much tax in withholding or prepayments we refund the excess back to you when the tax year is over Refunds are paid to taxpayers on different dates depending on when their tax assessment process is completed You can see the date and amount of your refund

https://ttlc.intuit.com/community/after-you-file/discussion/how-do-i...

Verkko 6 kes 228 k 2019 nbsp 0183 32 Intuit Alumni You should see your refund amount when you login to your TurboTax Online in the top left hand corner If you don t please follow the steps below to verify the amount listed on your tax return

Why Do I Have The PATH Message On Where s My Refund

My Refund Illinois State Comptroller

How To Find Out If You Owe Irs Informationwave17

How To Calculate Your Federal Income Tax Refund Tax Rates

Check Refund Status Browserguide

Understanding Your Forms W 2 Wage Tax Statement

Understanding Your Forms W 2 Wage Tax Statement

Cool Info About How To Check On My State Refund Delaybeat

What Is Line 15000 Tax Return formerly Line 150 In Canada

Tax Refund Stamp Business Concept Refund On Tax Stock Vector

Where Is Refund Amount On Tax Return - Verkko 18 helmik 2022 nbsp 0183 32 Your filing status Your exact refund amount You will need this information to use the first two refund status tools below Use one of these IRS refund status tools to check on the status of your return and refund Where s My Refund IRS2Go mobile app