Which Europe Country Has The Highest Tax Refund How do 2024 VAT rates by country compare Explore 2024 VAT rates in Europe including EU VAT rates data See value added tax rates in Europe

Every business along the value chain receives a tax credit for the VAT already paid The end consumer does not making it a tax on final consumption The EU 33 rowsCountry of Purchase VAT Standard Rate Minimum in Local Currency Austria

Which Europe Country Has The Highest Tax Refund

Which Europe Country Has The Highest Tax Refund

https://img1.daumcdn.net/thumb/R1280x0.fjpg/?fname=http://t1.daumcdn.net/brunch/service/user/8pLF/image/cRrOI-dmFVfYOeYSGi-dDhSYe_M.jpg

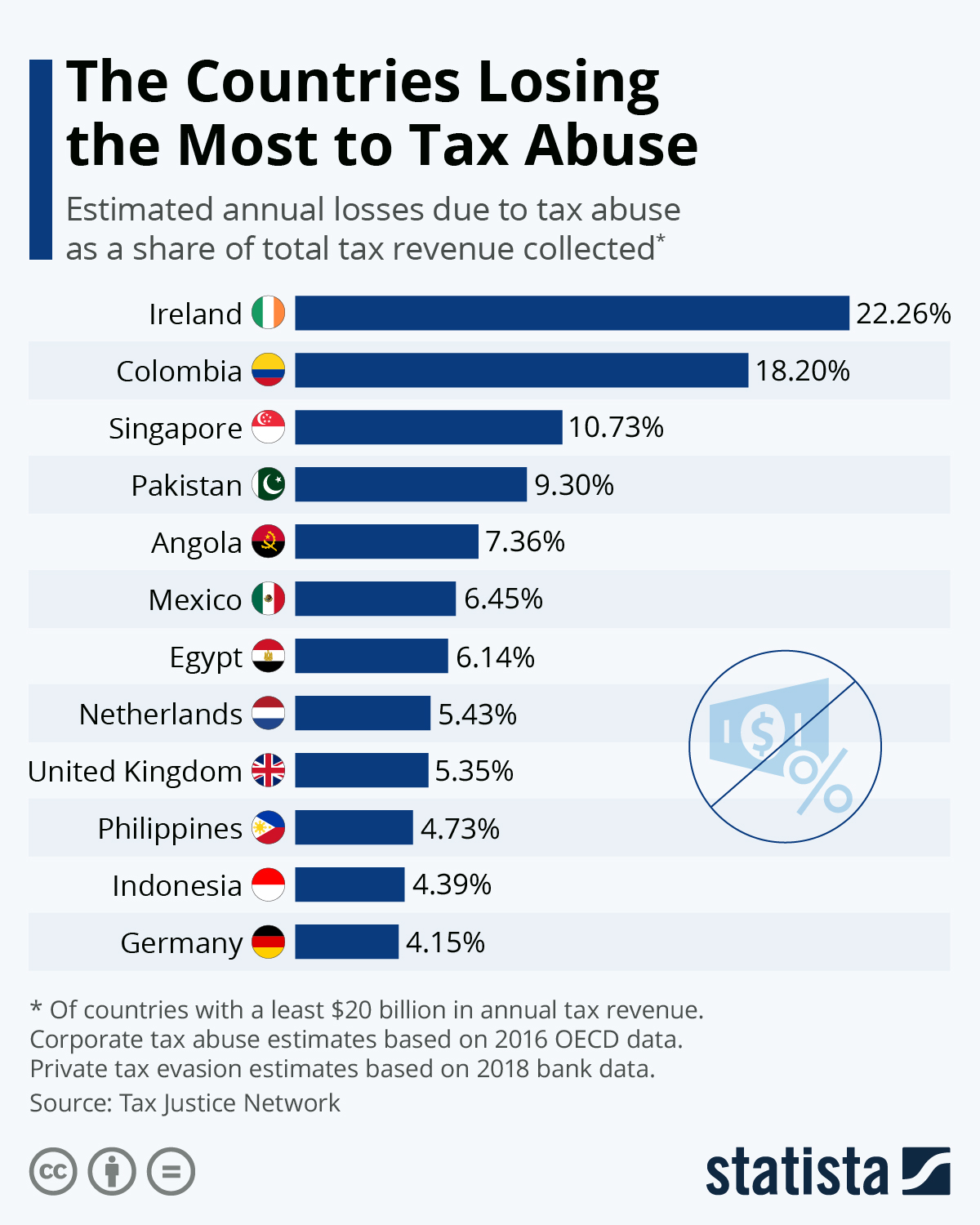

Chart The Countries Losing The Most To Tax Abuse Statista

http://cdn.statcdn.com/Infographic/images/normal/23563.jpeg

Which States Have The Highest And Lowest Income Tax

https://datawrapper.dwcdn.net/a2s2o/full.png

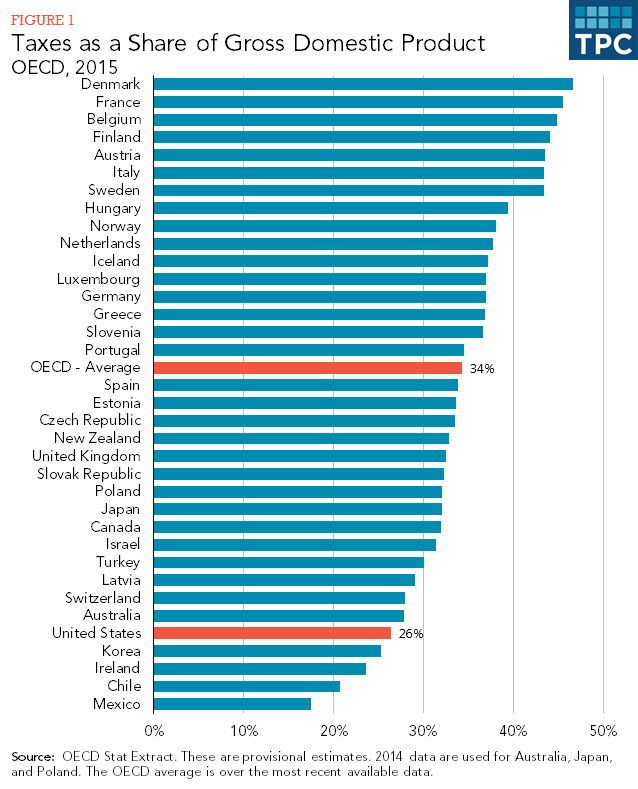

47 rowsDenmark Finland France Germany Italy Netherlands Portugal Spain United Kingdom See also References Sources External links Tax rates in Europe This is a If you have questions on VAT refund rules applicable in a particular EU country contact national tax authorities For questions on customs arrangements at a particular border

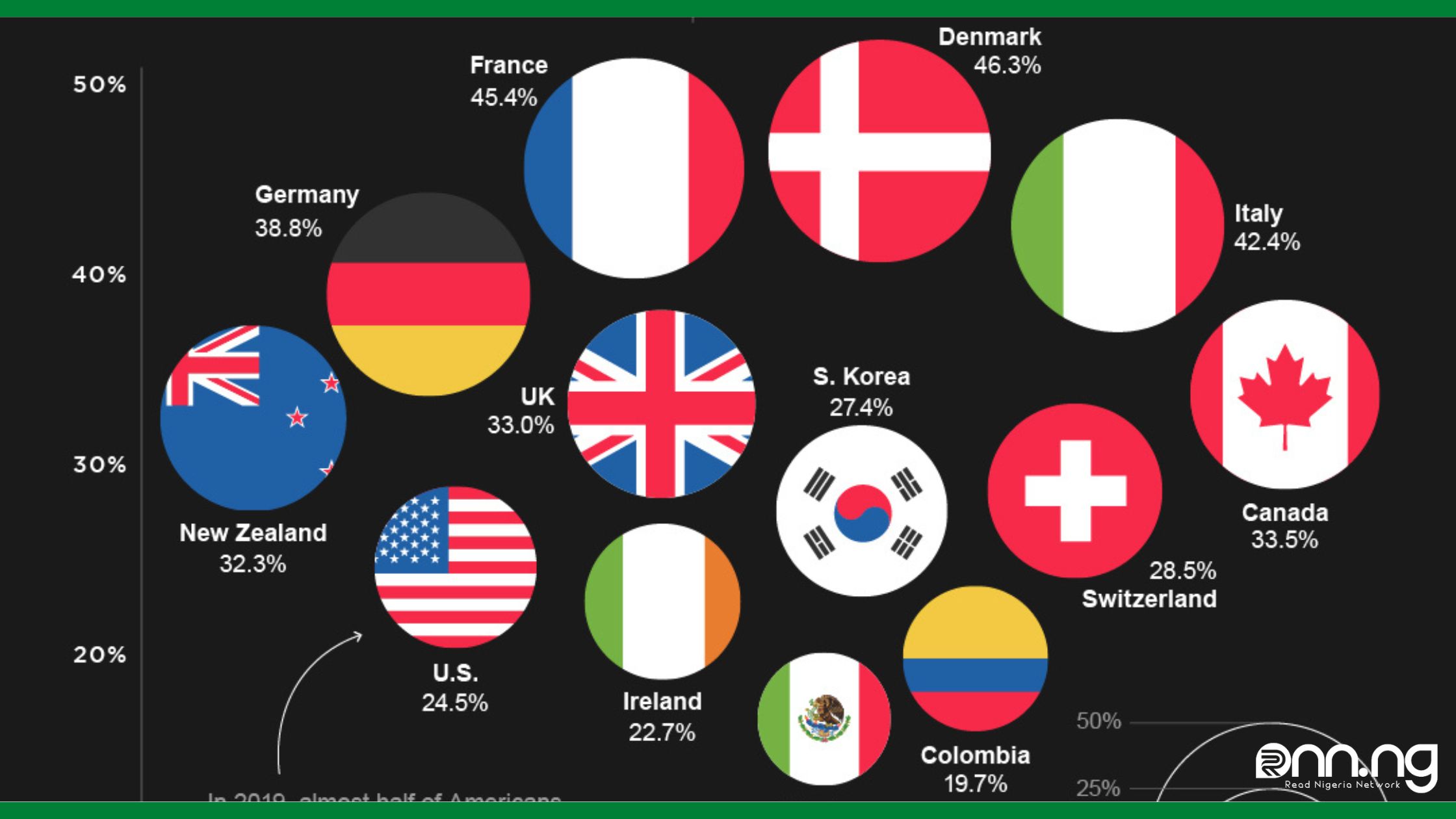

Goods in European countries contain VAT value added tax This tax is automatically added to your shopping and can be as much as 20 25 of the net price However if you re shopping abroad and take Sweden and Finland both have figures of around 44 Europe s biggest economies also return high tax revenues as a percentage of GDP generally 40 or more with the exception of the

Download Which Europe Country Has The Highest Tax Refund

More picture related to Which Europe Country Has The Highest Tax Refund

Which Country Has The Highest Taxes YouTube

https://i.ytimg.com/vi/obKVIXfDoh4/maxresdefault.jpg

Top 10 Countries With The Highest Tax Rate

https://rnn.ng/wp-content/uploads/2022/12/Countries-With-The-Highest-Tax-Rates.jpg

Which Country Has The Highest Taxes SavingAdvice Blog

https://www.savingadvice.com/wp-content/uploads/2017/10/Which-country-has-the-highest-tax-rates-1.png

VAT Chart EU This chart outlines examples of common business expenses eligible for VAT refunds to companies established in the European Union VAT Chart Non EU EU country specific information Country specific VAT guides Vademecums limitations on the right to deduct VAT e g restaurant costs entertainment activities cars fuel VAT

There are 11 countries that do not charge VAT They include Bermuda Cayman Islands Gibraltar Guernsey Channel Islands Hong Kong Kuwait Libya Macau Qatar and According to the information provided Hungary has the highest VAT refund at 27 This means that tourists who make purchases in Hungary can receive a refund

Highest Taxed Countries 2023 Wisevoter

https://wisevoter.com/wp-content/uploads/2022/11/Highest-Taxed-Countries.jpg

WEF 19 Countries With The Highest Tax Rates In The World Business

http://static3.businessinsider.com/image/55e55801dd089586178b462d-1200/19-spain-582-though-it-comes-in-at-no-19-spain-is-only-third-of-the-five-large-european-countries--two-other-sneak-in-ahead-with-higher-rates-for-businesses.jpg

https://taxfoundation.org/data/all/eu/value-added...

How do 2024 VAT rates by country compare Explore 2024 VAT rates in Europe including EU VAT rates data See value added tax rates in Europe

https://taxfoundation.org/data/all/eu/value-added...

Every business along the value chain receives a tax credit for the VAT already paid The end consumer does not making it a tax on final consumption The EU

Which Countries Tax Their Citizens The Most World Economic Forum

Highest Taxed Countries 2023 Wisevoter

Europe Search Marketing Country Information

Graph Of The Week World s Highest Tax Rates

Denmark Is The Highest Taxed Nation In The World Tax Walls

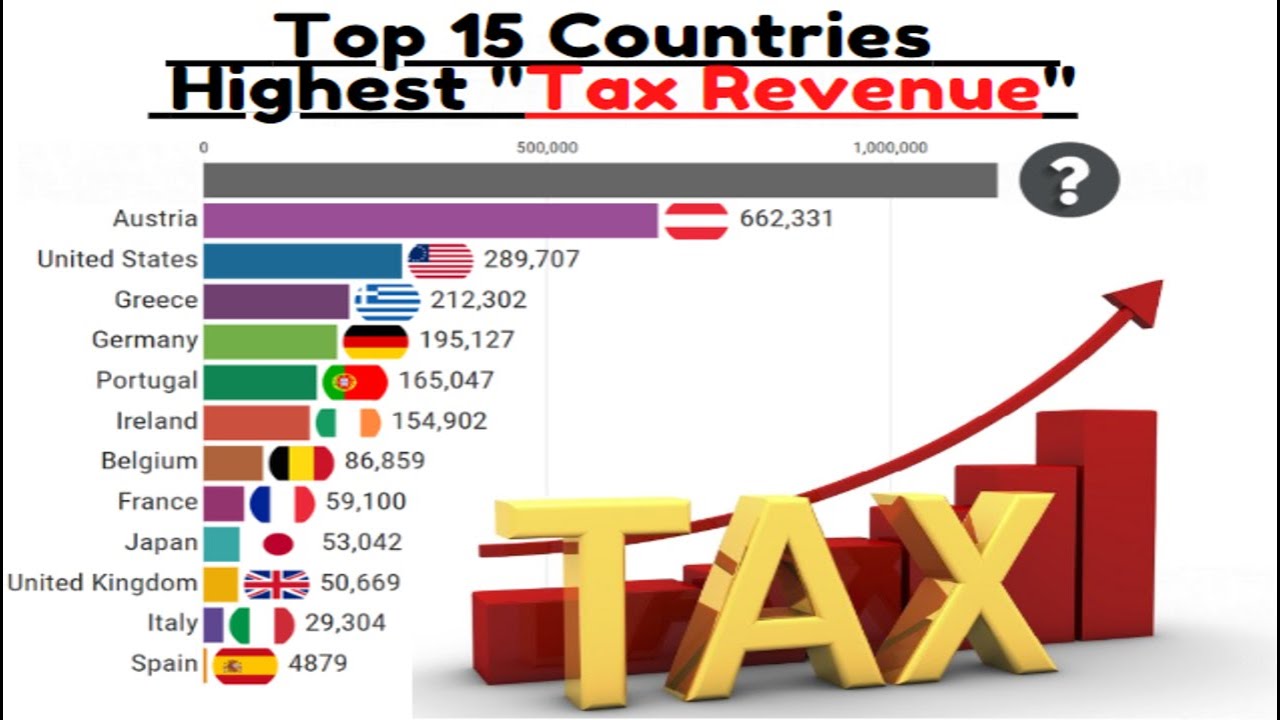

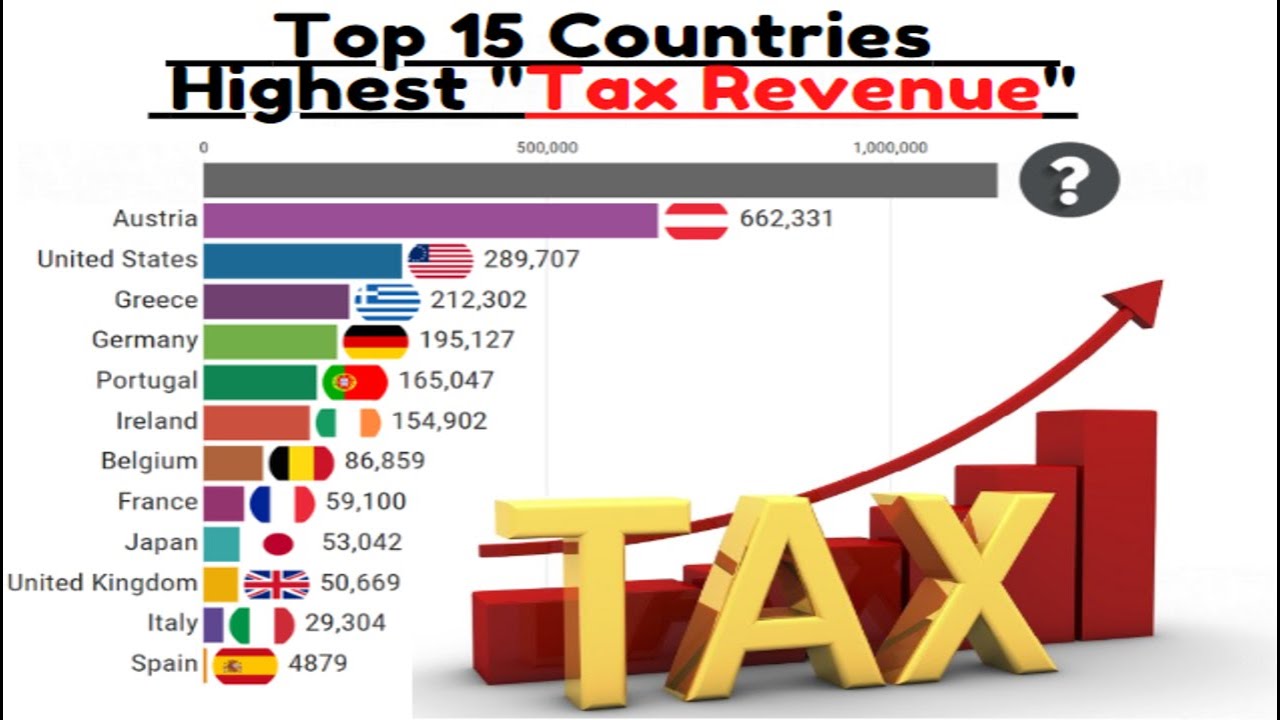

Top 15 Countries By Highest Tax Revenue 1965 2019 YouTube

Top 15 Countries By Highest Tax Revenue 1965 2019 YouTube

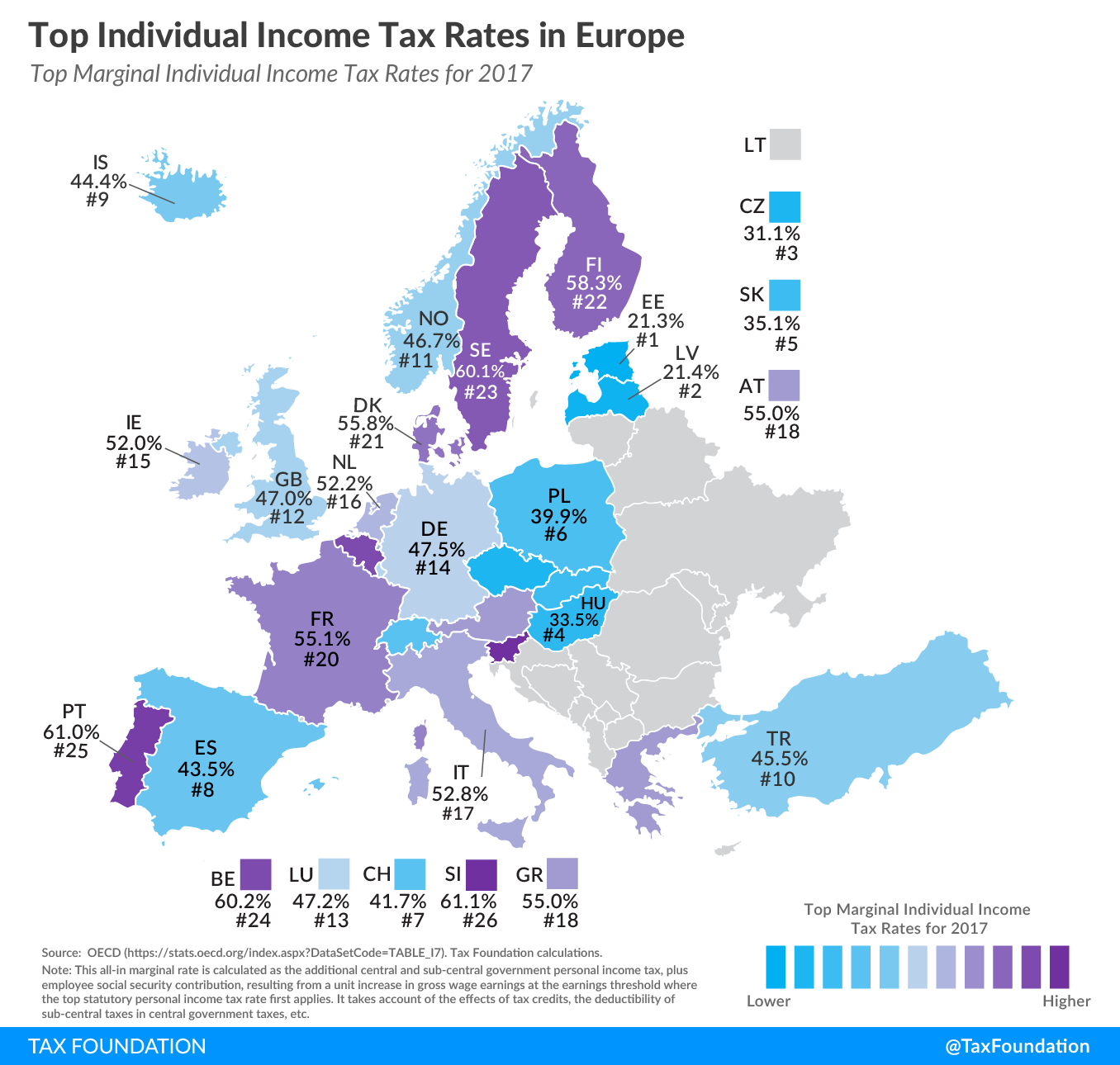

Top Individual Income Tax Rates In Europe Tax Foundation

Europe Personal Income Tax Rates Birojs BBP

Where Will You Pay The Most In Corporate Tax

Which Europe Country Has The Highest Tax Refund - At the moment the lowest VAT rate in Europe is 17 in Luxembourg while the highest is 27 in Hungary Do take note that the above rates may change and you