Who Is Eligible For Tax Return Uk Most residents of the UK are required to file a Self Assessment tax return if any of the following are true You earn at least 100 000 in

HMRC says you will need to file a return if you were self employed as a sole trader and earned more than 1 000 The same is true if you earned more than 100 000 Last updated 4 Jan 2024 Most people in the UK do not need to file a tax return because any taxable income they have is taxed through a system called PAYE paye as you earn However there are a few situations

Who Is Eligible For Tax Return Uk

Who Is Eligible For Tax Return Uk

https://www.peninsulagrouplimited.com/wp-content/uploads/2016/01/Tax-Return.jpg

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Who Is Eligible For VA Benefits The 2 Critical Factors Revealed

https://vaclaimsinsider.com/wp-content/uploads/2022/04/Who-is-Eligible-for-VA-Benefits--2048x1365.jpg

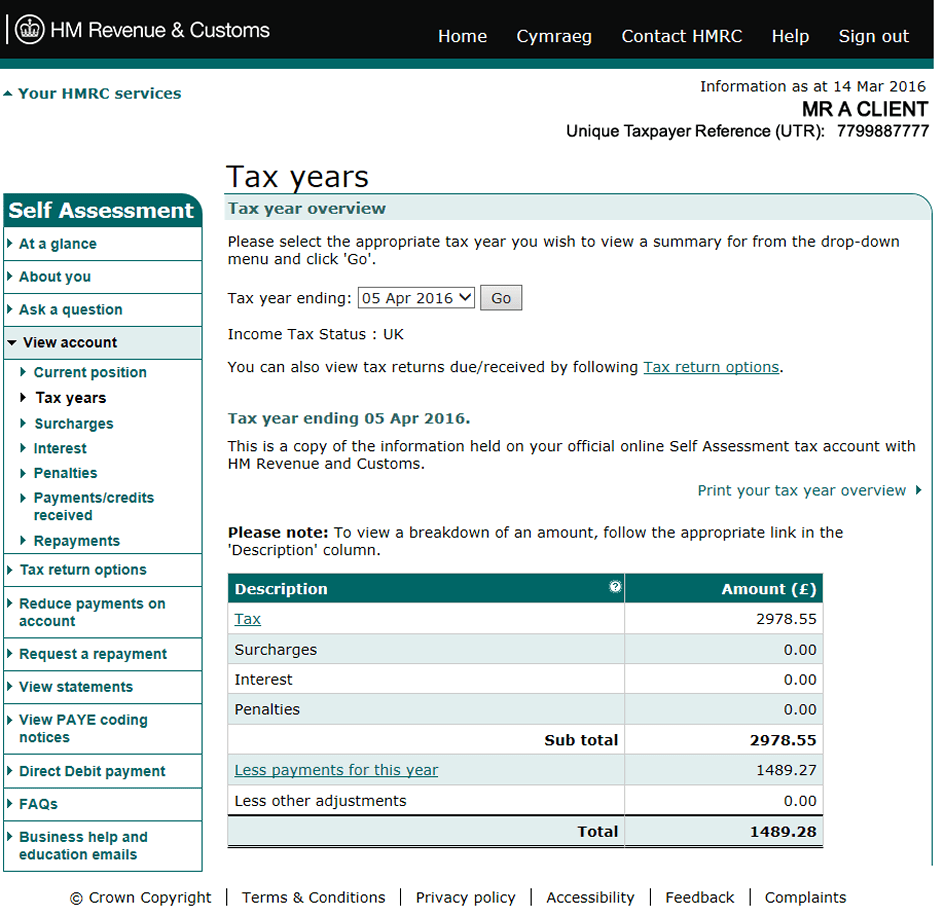

UK resident individuals eligible for the remittance basis of taxation include the following Non UK domiciled individuals who are under 18 years of age and have no Help with self assessment What is a self assessment tax return A self assessment tax return is an online or paper form that has to be submitted to HMRC every year by those who owe tax on income

It is necessary to complete self employment pages known as SA103 in addition to the basic tax return SA100 If annual turnover is less than 85 000 2022 23 the short pages can be completed SA103S rather Around 3 8 million people are yet to file their self assessment tax return with HMRC The deadline is 31 January 2024 and if you miss it you face a fine But it s not

Download Who Is Eligible For Tax Return Uk

More picture related to Who Is Eligible For Tax Return Uk

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

How To Print Your Tax Calculations Better co uk formerly Trussle

https://images.ctfassets.net/bed00l8ra6lf/1c8O9gTiS0yPCj2IORQRha/83df0441e65fdafc9ed02bc52c484409/7._FC_tyoprintyourtaxyo.png

How To Choose Between The New And Old Income Tax Regimes Chandan

https://images.moneycontrol.com/static-mcnews/2022/02/New-vs-old-tax-regime-Make-a-wise-choice-R.jpg

Once you ve filed your 2022 23 return you can amend it online anytime from 72 hours after you ve filed it until 31 January 2025 5 Pay your tax bill on time Be The tax relief is available on contributions up to 100 of your annual earnings i e if you earn 30 000 a year you can get tax relief on up to 30 000 paid into your pension in a single tax year However from April

A tax consultant understands all rules of taxes in the UK everything about the expat tax aware and can also help you complete and submit the UK tax return UK tax obligations The British tax system HM Revenue and Customs HMRC is responsible for administering and collecting taxes in the UK Tax receipts for the UK totaled approximately 714 8

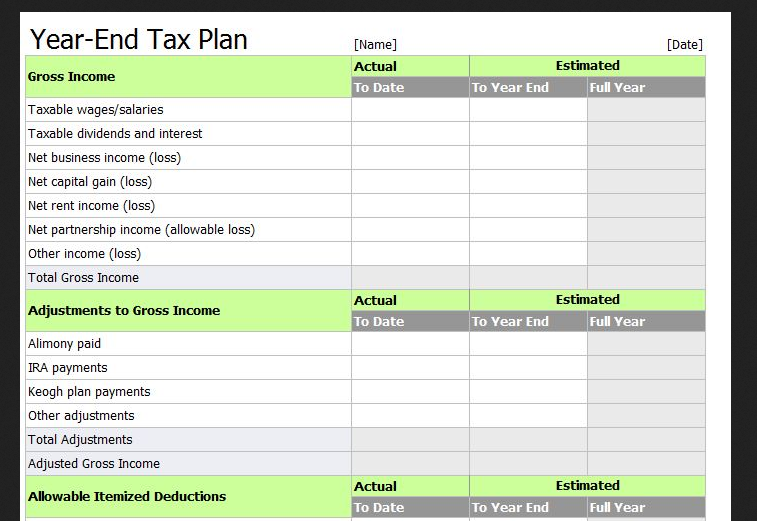

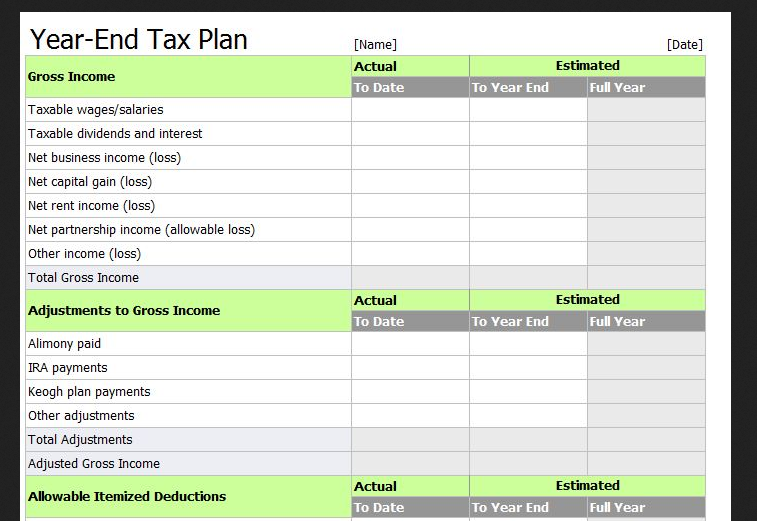

Tax Return Spreadsheet Template Uk Db excel

https://db-excel.com/wp-content/uploads/2017/03/tax-return-spreadsheet-template-uk.png

UK Taxes Preparing Self assessment Tax Returns That Are Due To Be

https://media-exp1.licdn.com/dms/image/D4D12AQFSTbsrLgjueA/article-cover_image-shrink_720_1280/0/1665820627601?e=2147483647&v=beta&t=Klm9Wu27FzupoY39aU1rEz3gSmdcp8FT2AhDAT1ow74

https://www.greenbacktaxservices.com/…

Most residents of the UK are required to file a Self Assessment tax return if any of the following are true You earn at least 100 000 in

https://www.theguardian.com/money/2024/jan/13/self...

HMRC says you will need to file a return if you were self employed as a sole trader and earned more than 1 000 The same is true if you earned more than 100 000

Your Tax Refund Is The Key To Homeownership

Tax Return Spreadsheet Template Uk Db excel

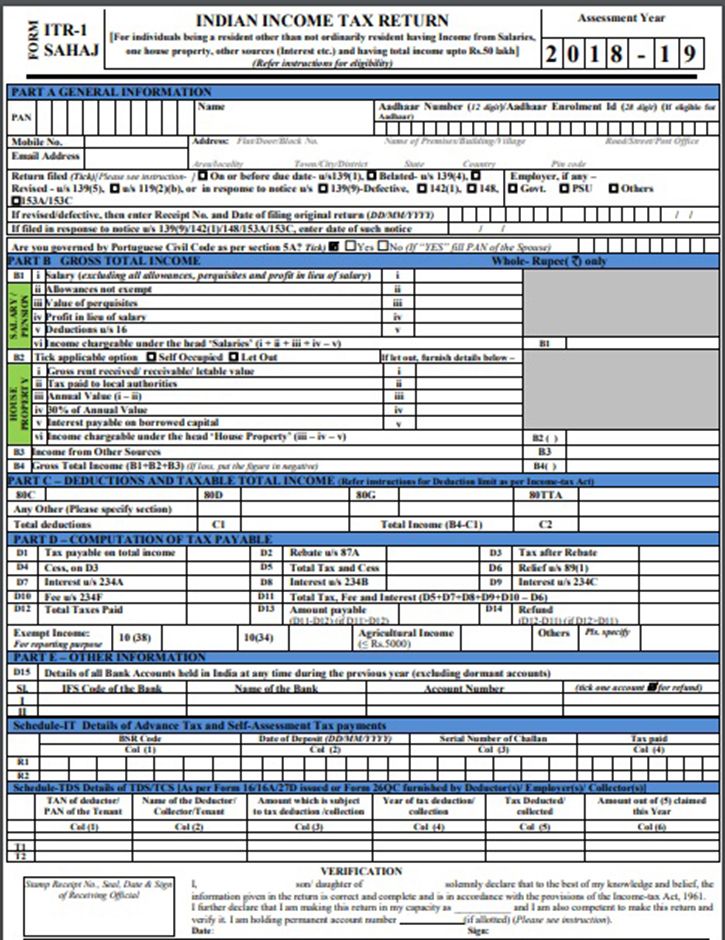

Income Tax Return

100 OFF US Income Tax Preparation IRS Tutorial Bar

Final Senator Domeniu Annual Tax Return Form ndeaproape Porter Secol

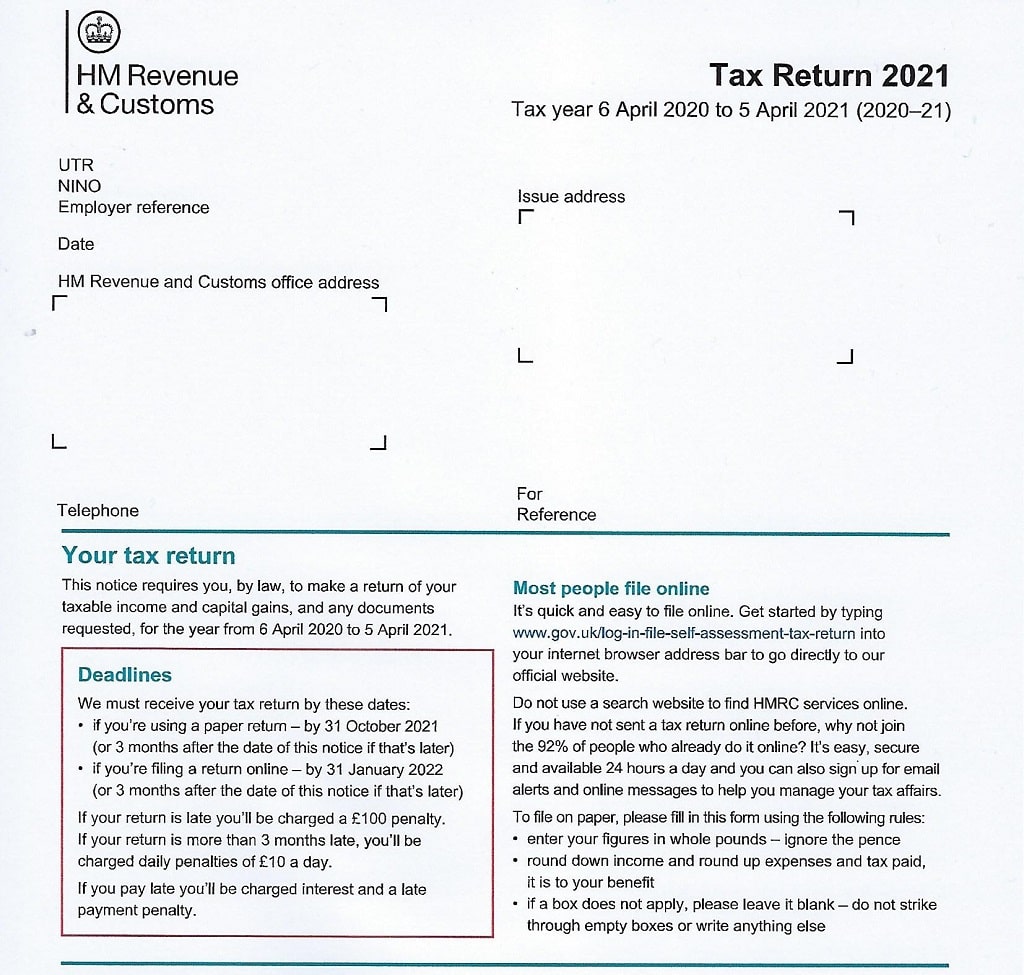

Tax Return Uk Date 2021 TAXIRIN

Tax Return Uk Date 2021 TAXIRIN

Who Is Eligible For Sales Tax Exemptions TaxJar

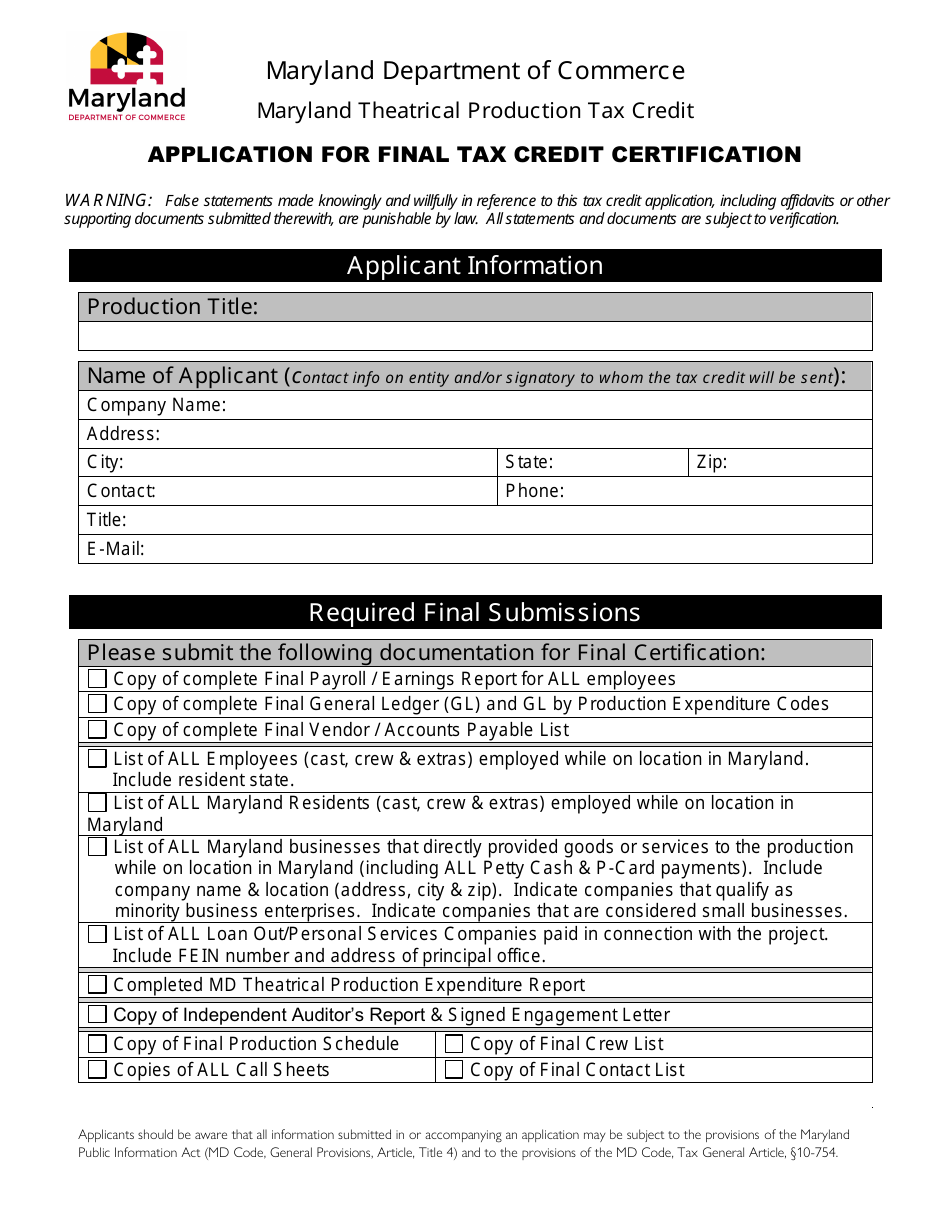

Maryland Application For Final Tax Credit Certification Maryland

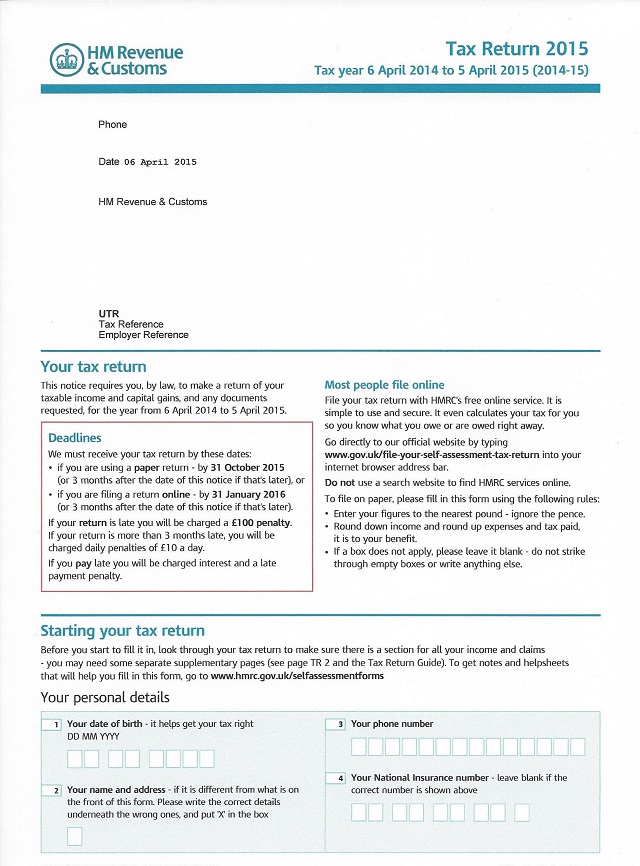

2015 Tax Returns Accountant In Surrey Taxhelp uk

Who Is Eligible For Tax Return Uk - UK resident individuals eligible for the remittance basis of taxation include the following Non UK domiciled individuals who are under 18 years of age and have no