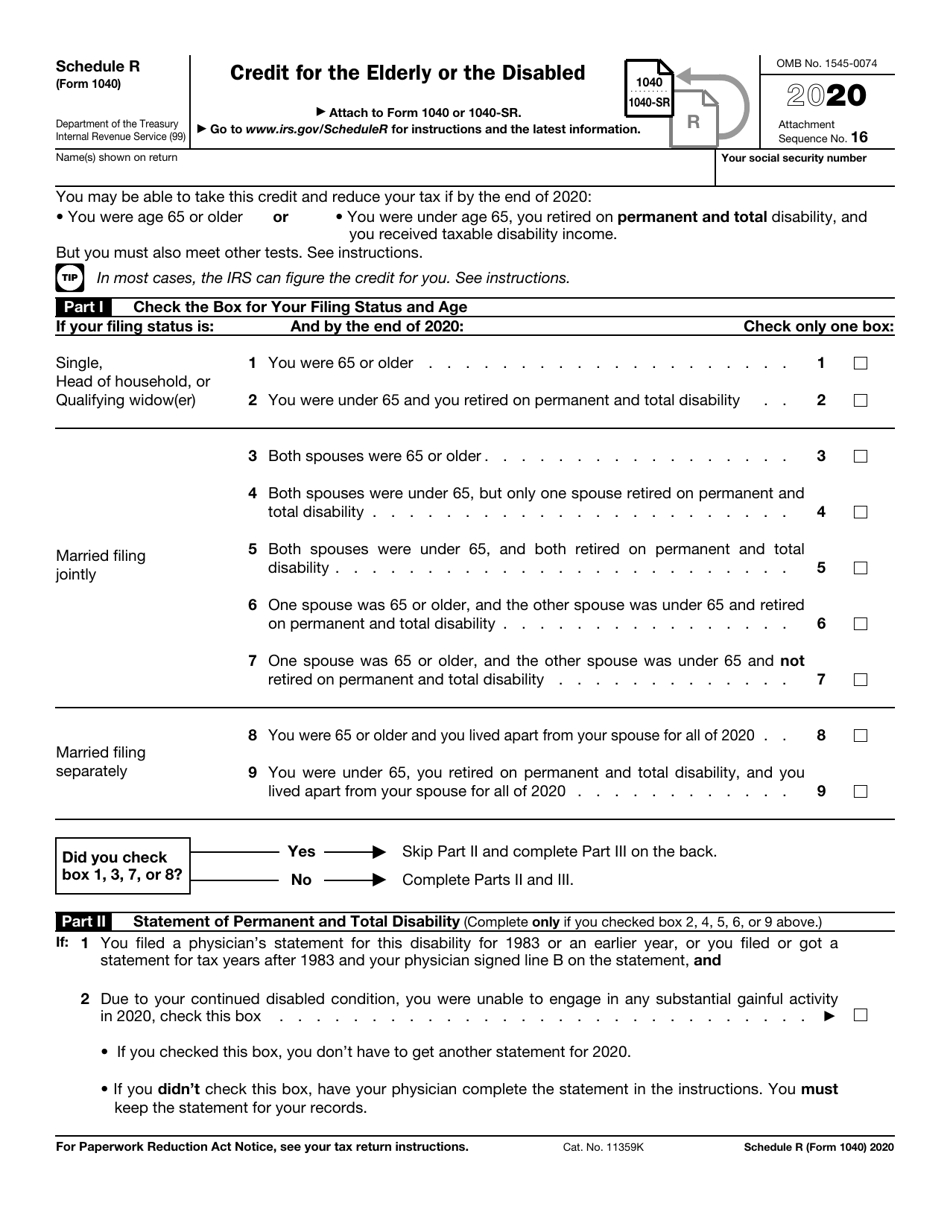

Who Qualifies For Indiana Unified Tax Credit For The Elderly You may be able to claim the unified tax credit for the elderly if you or your spouse meet the following requirements You and or your spouse are age 65 or older by the end of the tax year

The Unified Tax Credit for the Elderly is available to individuals age 65 or over with taxable income of less than 10 000 If your income on Line E is less than the amounts on the chart Seniors may be entitled to the Unified tax credit for the elderly Most can claim this credit by filing their taxes on Form IT 40 or Form IT 40 PNR Low income seniors may be eligible to file the

Who Qualifies For Indiana Unified Tax Credit For The Elderly

Who Qualifies For Indiana Unified Tax Credit For The Elderly

https://imageio.forbes.com/specials-images/imageserve/637e82a05e5b4ed6725883aa/0x0.jpg?format=jpg&width=1200

FinancialFridays Seniors Tax Credits Part 1 United Way Of Bruce Grey

https://unitedwayofbrucegrey.com/wp-content/uploads/2022/03/275750249_10159719719897970_6754699348310005992_n-1024x1024.jpg

California Earned Income Tax Credit CalEITC

https://res.cloudinary.com/yansusanto/image/upload/v1622380808/CA.png

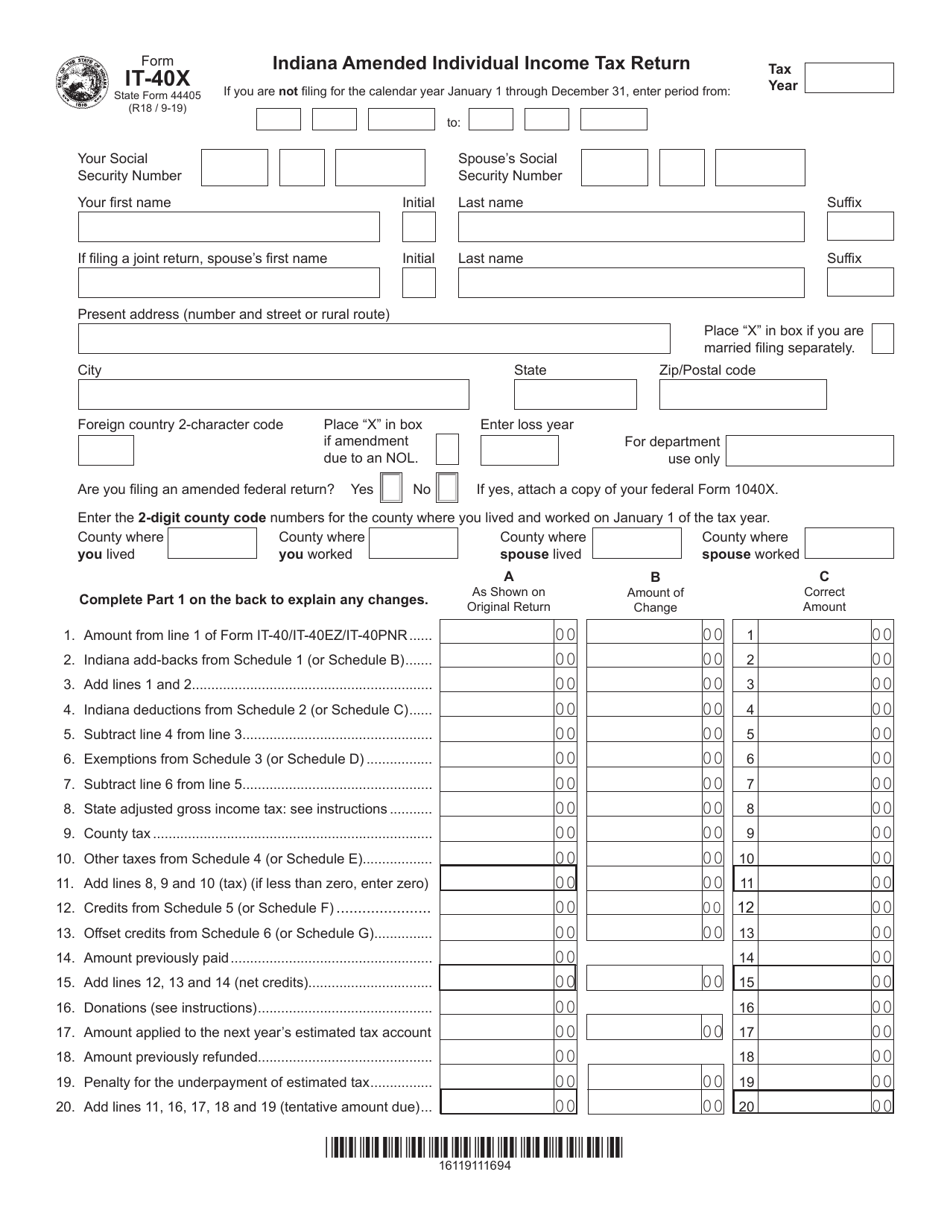

Below is a list of credits that are available to you on your Indiana return Unified Tax Credit for the Elderly You may qualify for this credit if you and you spouse meet ALL of the following You Indiana residents may be eligible for the Unified Tax Credit for the Elderly if they are 65 years old and have an adjusted gross income of less than 10 000 Military veterans

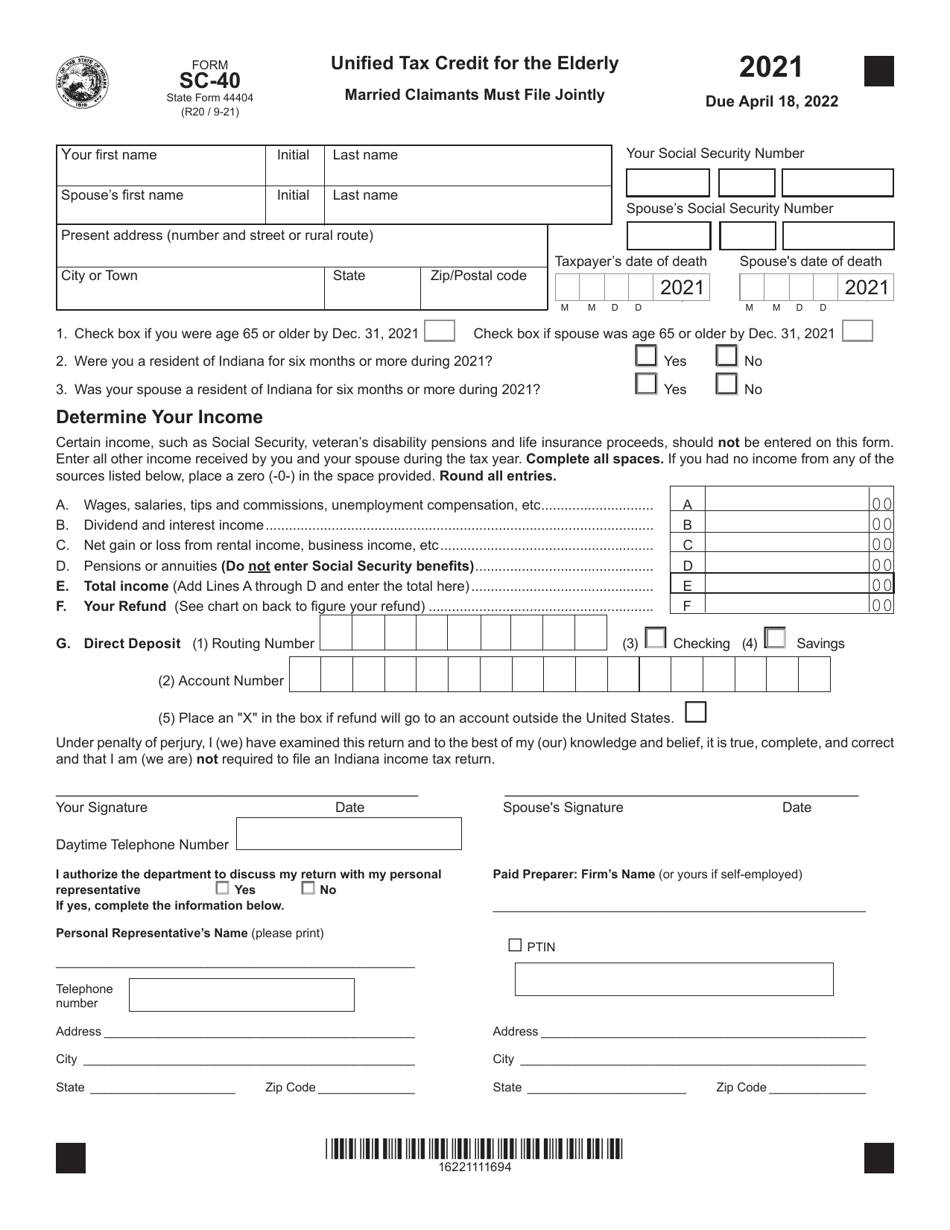

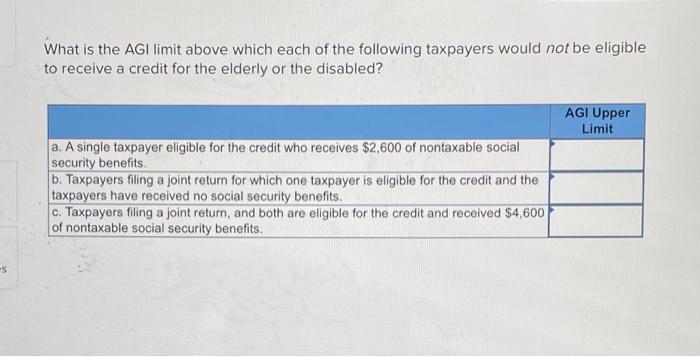

Form SC 40 is the Unified Tax Credit for the Elderly form You may be able to claim the unified tax credit for the elderly if you or your spouse meet all the following requirements The State of Indiana provides an income tax credit of up to 100 for an individual or 140 for a couple to elderly Hoosiers under the Unified Tax Credit for the Elderly This credit is

Download Who Qualifies For Indiana Unified Tax Credit For The Elderly

More picture related to Who Qualifies For Indiana Unified Tax Credit For The Elderly

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png)

Revised Form 4506t 7 17 Fillable Printable Forms Free Online

https://www.investopedia.com/thmb/jNRTz_5ciVp1RfBmoR2GJTt_kGI=/1084x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-06at5.10.12PM-c0c2d61973a947dc9623440dc43b4f61.png

Seniors may be entitled to the Unified tax credit for the elderly Most can claim this credit by filing their taxes on Form IT 40 or Form IT 40 PNR Low income seniors may be a The credit provided by this section shall be known as the unified tax credit for the elderly b As used in this section unless the context clearly indicates otherwise

Download or print the 2024 Indiana Unified Tax Credit for the Elderly 2024 and other income tax forms from the Indiana Department of Revenue Seniors may be entitled to the Unified tax credit for the elderly Most can claim this credit by filing taxes on Form IT 40 or Form IT 40 PNR Low income seniors may be eligible to

Unified Estate And Gift Tax Credit 2020 Kazuko Deaton

https://www.youngmoorelaw.com/wp-content/uploads/2021/01/2021-with-outline2-shutterstock_1844565196.jpg

3Days GST Registration Consultancy Service Aadhar Card ID 2848955650173

https://5.imimg.com/data5/SELLER/Default/2022/12/VI/ZH/KA/43048104/gst-registration-consultancy-service-1000x1000.png

https://www.in.gov › ... › filing-my-taxes › tax-credits

You may be able to claim the unified tax credit for the elderly if you or your spouse meet the following requirements You and or your spouse are age 65 or older by the end of the tax year

https://www.taxformfinder.org › indiana

The Unified Tax Credit for the Elderly is available to individuals age 65 or over with taxable income of less than 10 000 If your income on Line E is less than the amounts on the chart

FAQ WA Tax Credit

Unified Estate And Gift Tax Credit 2020 Kazuko Deaton

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

Form SC 40 State Form 44404 Download Fillable PDF Or Fill Online

Annotated Bibliography Student s Name Due Date Annotated Bibliography

Irs Printable Forms

Irs Printable Forms

What Is Medicaid Eligibility Income Limits For 2021 Medicaid Nerd

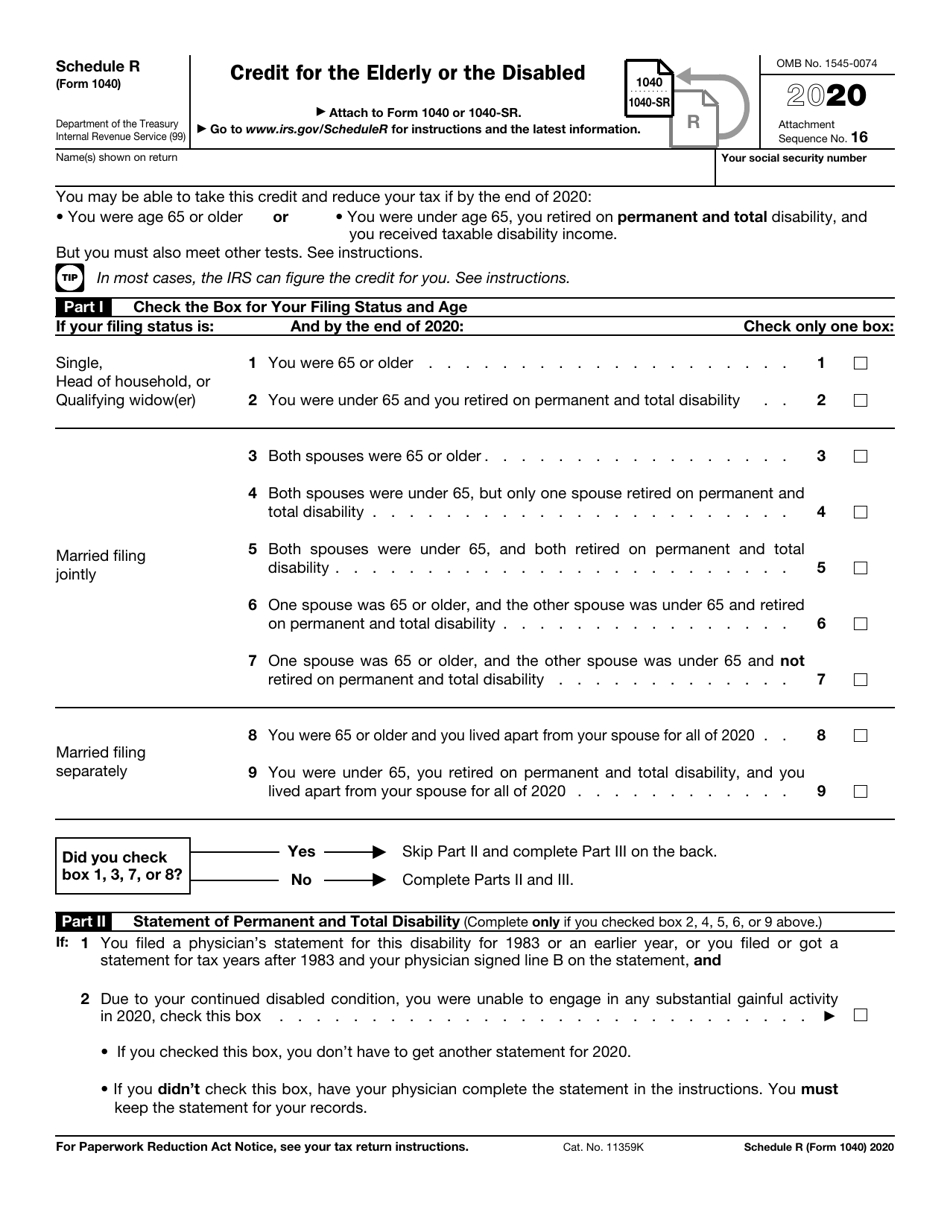

Solved What Is The AGI Limit Above Which Each Of The Chegg

Indiana Fillable Tax Forms Printable Forms Free Online

Who Qualifies For Indiana Unified Tax Credit For The Elderly - Indiana residents may be eligible for the Unified Tax Credit for the Elderly if they are 65 years old and have an adjusted gross income of less than 10 000 Military veterans