Withholding Tax In Spain If your company pays the earned income of a non resident worker in Spain you will be obliged to pay the non resident withholding tax by means of a Form 216 Thus the percentage that would apply to

Withholding tax rates On dividends paid to non resident companies 19 percent applies from 2016 onwards unless reduced by double tax treaties DTTs Withholding taxes In Spain withholding taxes apply in a number of cases This means that the person making a payment must withhold a percentage of that payment to pay it

Withholding Tax In Spain

Withholding Tax In Spain

https://i.pinimg.com/originals/a1/d2/8b/a1d28b093ee63891ad562a26b9653818.jpg

Which Are The Taxes You Need To Pay In Spain As An Expat YouTube

https://i.ytimg.com/vi/Rf9yVZPdfgM/maxresdefault.jpg

Taxes In Spain Frequently Asked Questions Expats Magazine

https://expatsmagazine.org/wp-content/uploads/2021/03/spanish-renta-tax.jpg

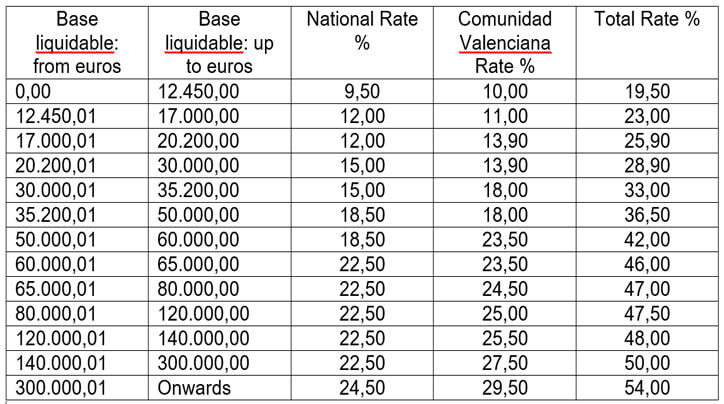

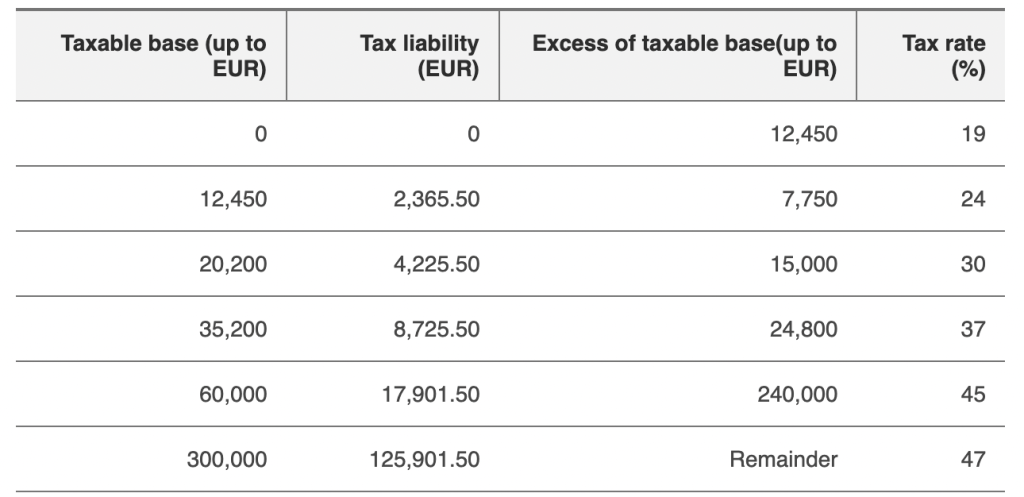

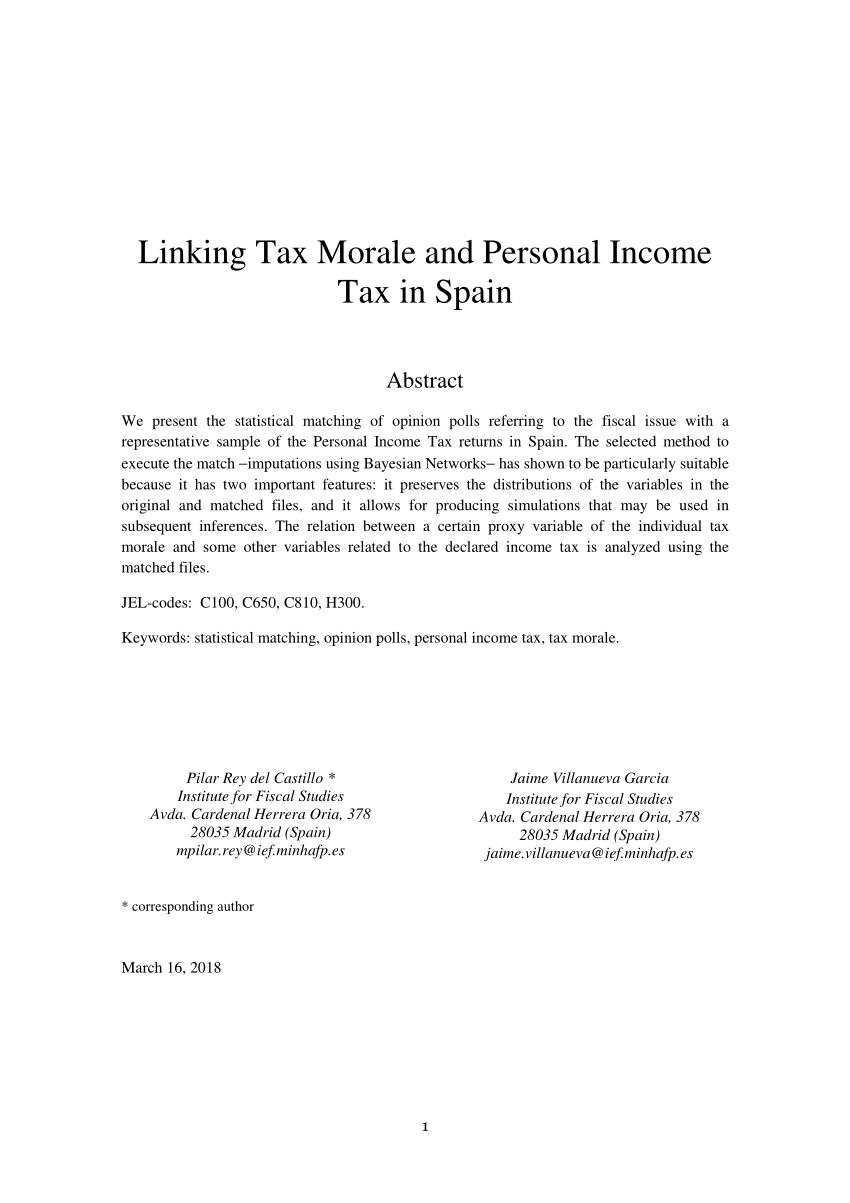

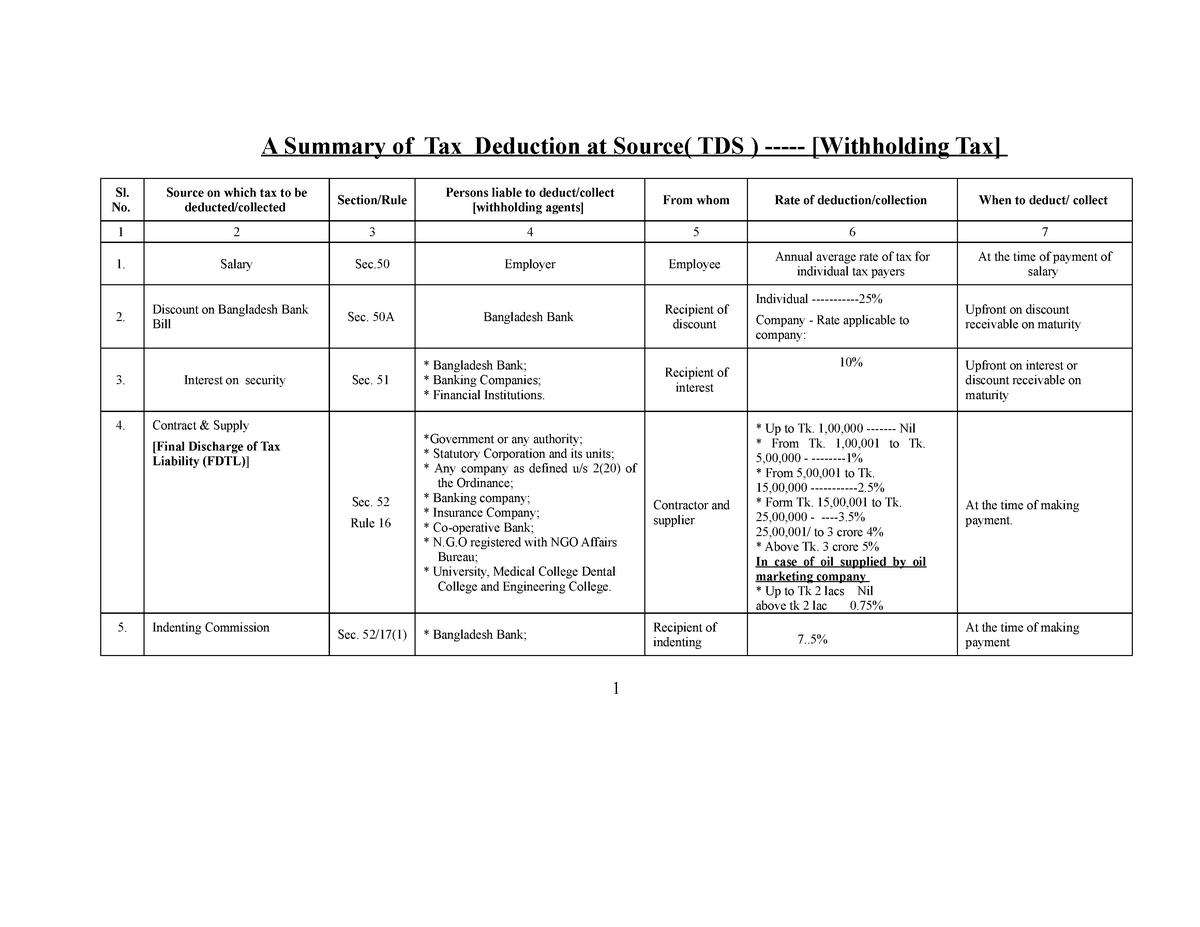

Spain imposes a withholding tax on dividends interest and royalties paid to non resident companies The withholding tax rates vary from 5 to 35 depending on the type of 4 0 Withholding taxes 4 1 Dividends 4 2 Interest 4 3 Royalties 4 4 Branch remittance tax 4 5 Wage tax social security contributions 4 6 Other withholding taxes 5 0

The tax rate for rental income earned by non resident individuals is generally 24 percent Non residents may also be subject to a withholding tax on certain General rule for determining the withholding tax base Income exempt from the obligation to withhold tax at source Deductible withholdings Retention of the purchaser of a

Download Withholding Tax In Spain

More picture related to Withholding Tax In Spain

Tax Return 2018 Holiday Rentals Income Tax In Spain

https://d1ez3020z2uu9b.cloudfront.net/imagecache/blog-photos/14239_Fill_800_800.jpg

It Is Necessary To Be Prepared For This Property Taxes In Spain Home

https://homesenator.com/wp-content/uploads/2022/01/deemed-property-tax-2-1400x933-1.jpg

Taxes In Spain The Complete Guide Spain Explained

https://blog.abacoadvisers.com/wp-content/uploads/2019/09/taxes-in-spain-1-1.jpg

Withholding Tax 21 21 00 Euros Total to be paid 100 00 Euros The amount of 100 00 Euros will be paid to the supplier of the service and 21 00 Euros Withholding Tax should be paid directly The Withholding Tax Rate in Spain stands at 19 percent Withholding Tax Rate in Spain averaged 19 00 percent from 2022 until 2024 reaching an all time high of 19 00 percent

It s important to note that while dividends distributed by the ETVE to non resident shareholders are generally not subject to withholding tax in Spain there is an The so known Retenciones with holding tax in Spain How much must be deposited and where Are these retentions progressive These and many other doubts are the ones

Tax Return 2018 Holiday Rentals Income Tax In Spain

https://sh-assets.holidu.com/imagecache/blog-photos/2686_Fill_800_800.jpg

Are You A British National And Struggling With Your Taxes In Spain

https://spainlifeexclusive.com/wp-content/uploads/2021/08/uk-tax-refund-struggling-taxes-spain-income-tax.jpg

https://www. tas-consultoria.com /blog-en/…

If your company pays the earned income of a non resident worker in Spain you will be obliged to pay the non resident withholding tax by means of a Form 216 Thus the percentage that would apply to

https:// kpmg.com /xx/en/home/insights/2018/07/...

Withholding tax rates On dividends paid to non resident companies 19 percent applies from 2016 onwards unless reduced by double tax treaties DTTs

NEW LIMITS TO PRESENT ANNUAL INCOME TAX RETURN IN SPAIN EBF Consulting

Tax Return 2018 Holiday Rentals Income Tax In Spain

How To Navigate Your Tax Return In Spain As An Expat Dirwo

Expat Taxes In Spain 2023 Non Resident Tax Rates Spain

Guide To Crypto Taxes In Spain TokenTax

PDF Linking Tax Morale And Personal Income Tax In Spain

PDF Linking Tax Morale And Personal Income Tax In Spain

Withholding Tax Invoice Template Invoice Maker

How To File Back Taxes Yourself Wealth Chatroom Navigateur

Withholding Tax A Summary Of Tax Deduction At Source TDS

Withholding Tax In Spain - Spain imposes a withholding tax on dividends interest and royalties paid to non resident companies The withholding tax rates vary from 5 to 35 depending on the type of