30 Rebate On Rental Income The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30

Individuals owning a residential property that generates rental income or is self occupied are eligible to claim deductions under Section 24 Types of deductions Let out house If you are earning a rental income from house property then you can claim certain deductions in the new tax regime under income tax laws So for

30 Rebate On Rental Income

30 Rebate On Rental Income

https://customstoday.media/wp-content/uploads/2016/04/Faisalabad-Excise-collects-Rs-925m-as-property-tax.jpg

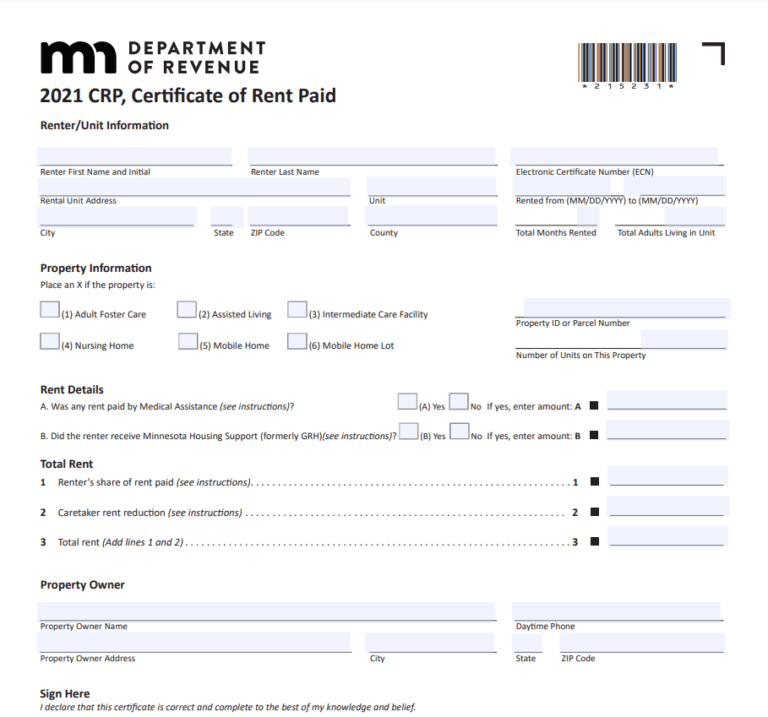

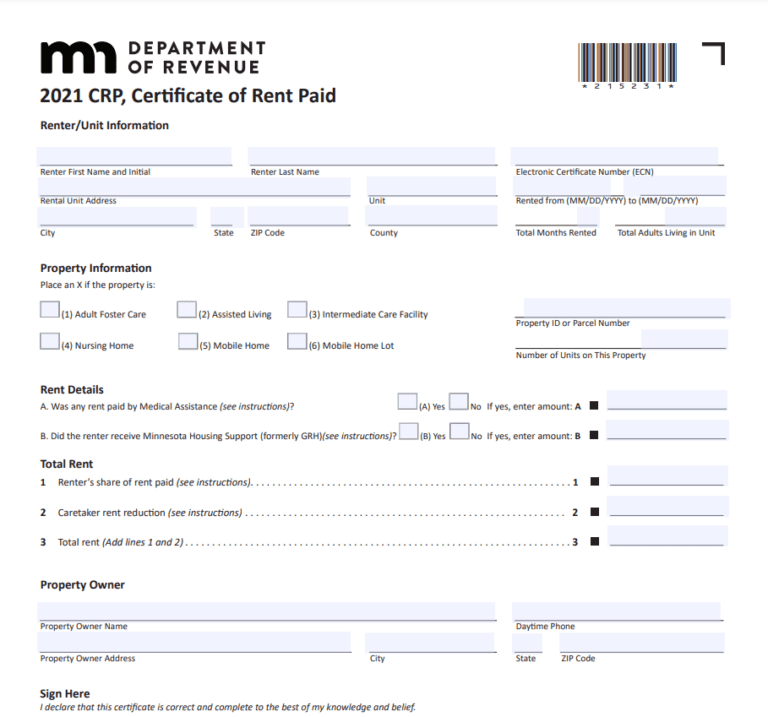

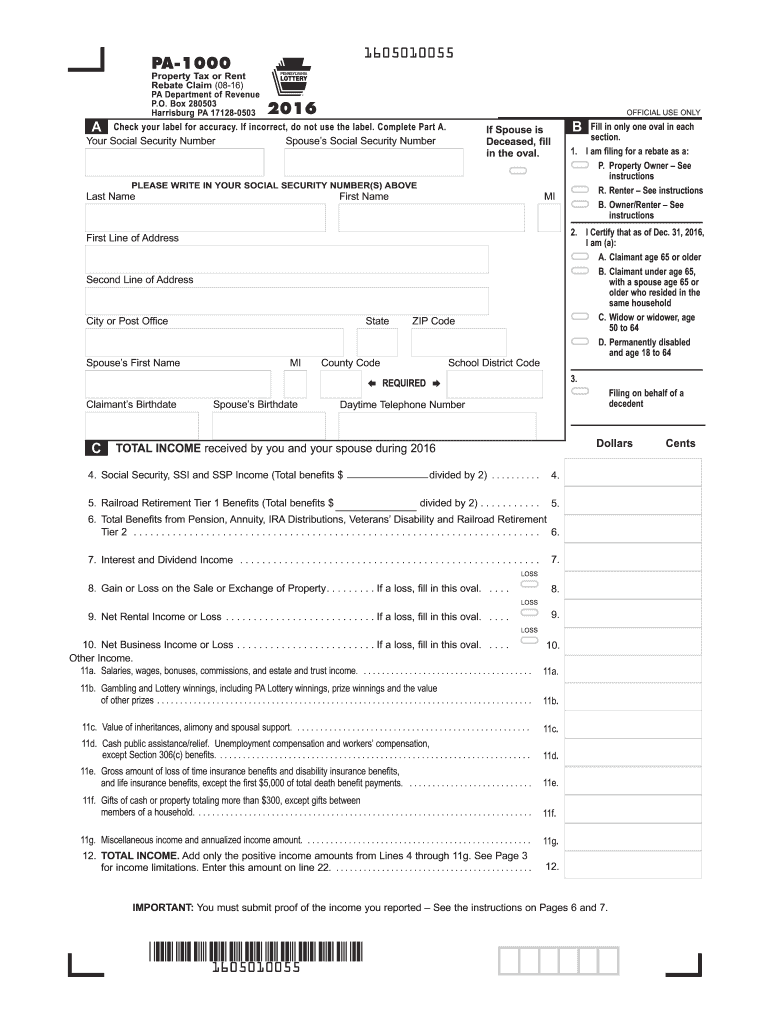

Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/How-To-Fill-Out-Rent-Rebate-Form-768x717.png

Renters Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

The 30 income rule where you spend no more than 30 of your income on rent has been a long standing guideline in the renting world said real estate As per Section 24A of the Income Tax Act a taxpayer is entitled to a 30 percent standard deduction from the rental income to cover expenses like

Rental income is taxable under Income from house property of Section 22 of the Income Tax Act This also provides exemptions on rental income As per the section You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of

Download 30 Rebate On Rental Income

More picture related to 30 Rebate On Rental Income

Home Buyer Rebates 2 5 Cash Back Of Total Purchase Price

https://www.texashomes2percentrebate.com/wp-content/uploads/2015/04/Texas_2_percent_Seller_Rebate_Program1.jpg

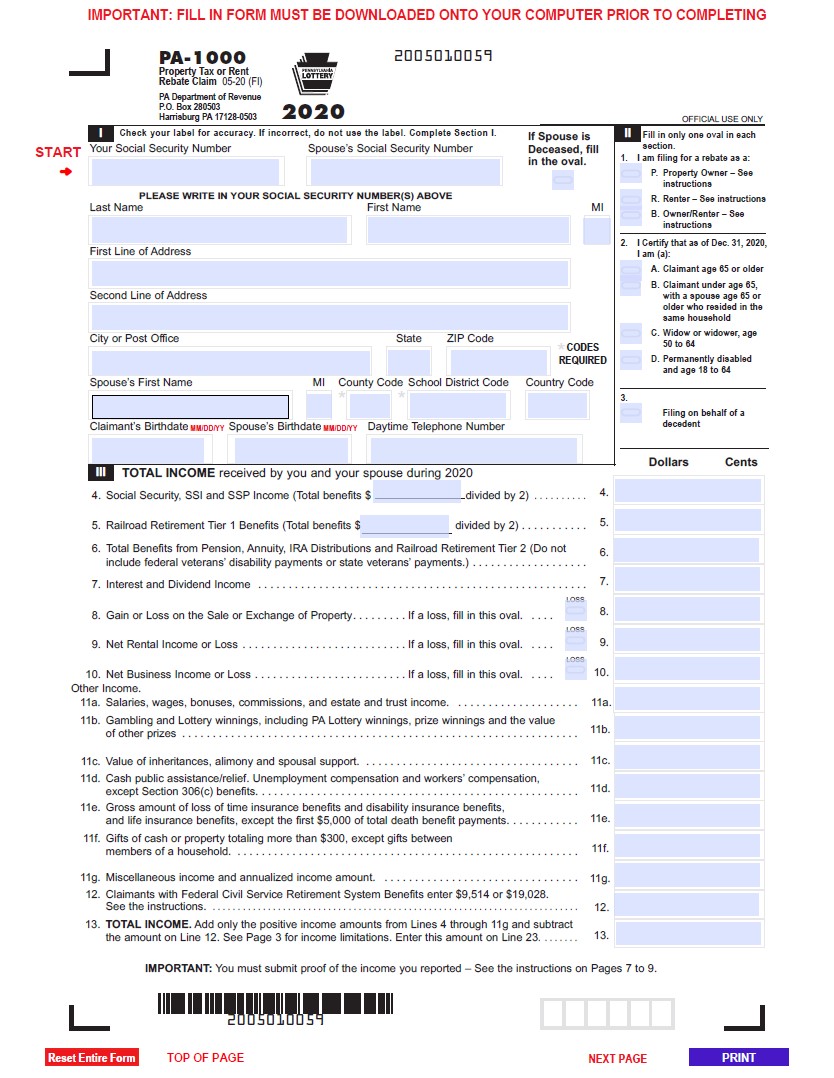

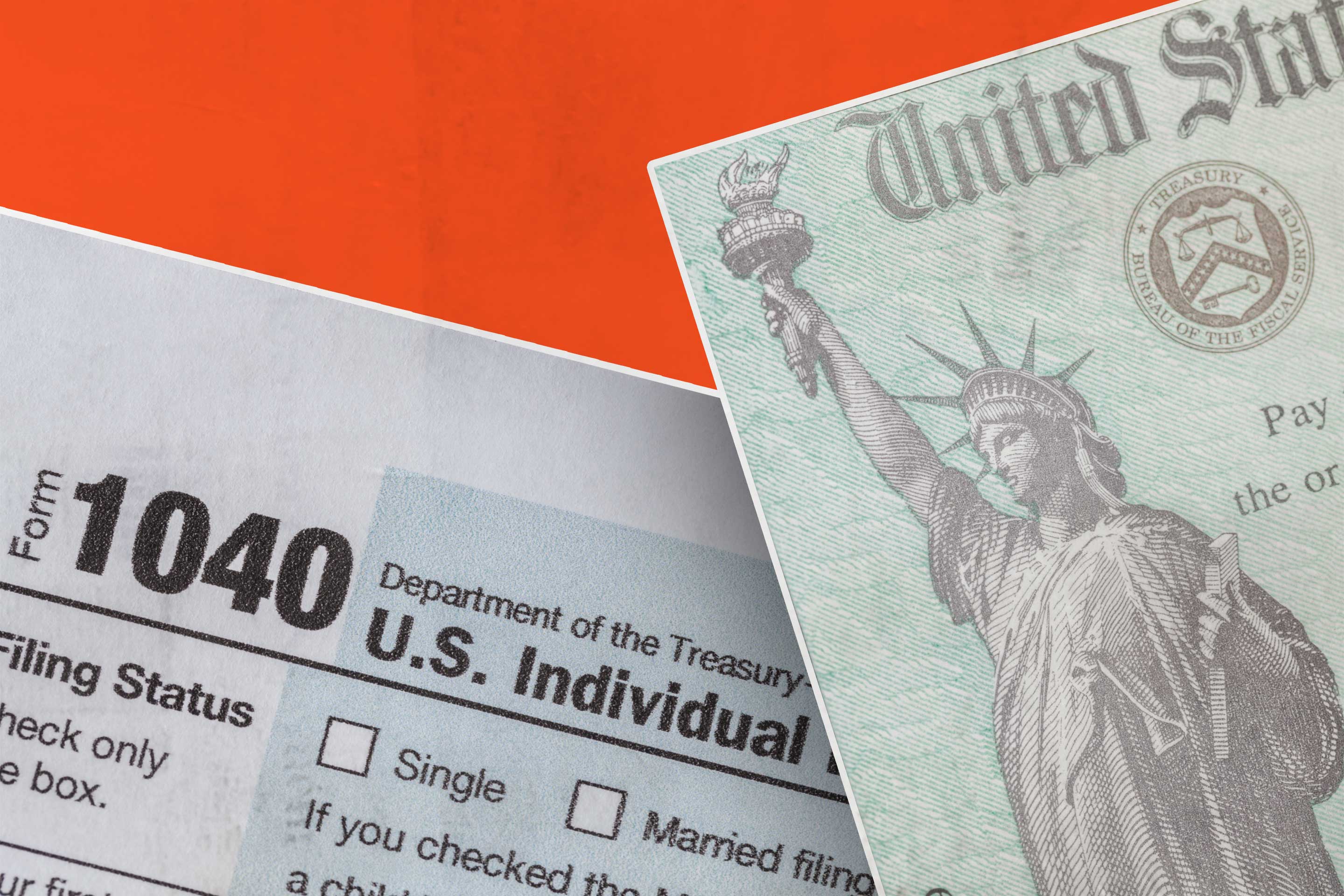

Pa Rental Rebate Status Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PA-Rent-Rebate-Form-2021.jpg

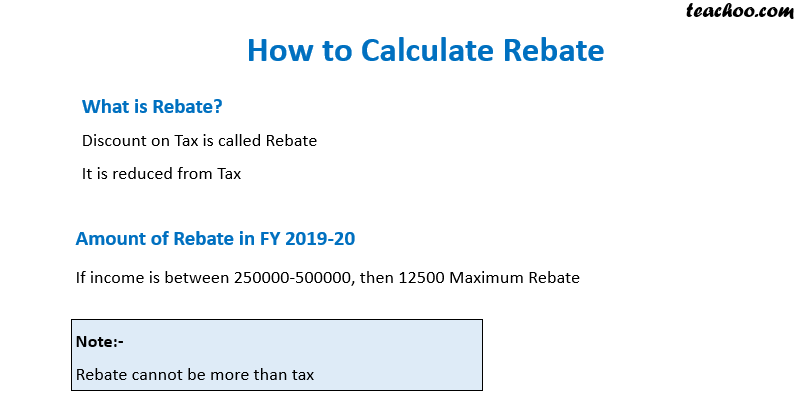

Section 87A Income Tax Rebate

https://taxguru.in/wp-content/uploads/2018/07/Tax-rebate.jpg

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may E tax subject to a maximum of Rs 12 500 In the new tax regime the rebate is increased to Rs 25 000 or 100 percent of income tax where the otal income does not exceed

Yes you can claim an income tax exemption on both the house rent allowance HRA and repayment of the home loan If you are living in a house on rent Reduce 30 of NAV towards standard deduction 30 on NAV is allowed as a deduction from the NAV under Section 24 of the Income Tax Act No other expenses such as

Rent Decreases During Rent Roll Settlement Rent Roll Angels

https://rentrollangels.com.au/wp-content/uploads/2020/04/tierra-mallorca-JXI2Ap8dTNc-unsplash-scaled.jpg

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

https://www.vero.fi/en/individuals/property/rental_income

The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30

https://cleartax.in/s/deductions-under-section24...

Individuals owning a residential property that generates rental income or is self occupied are eligible to claim deductions under Section 24 Types of deductions

Alliance Tax Experts Many Homes Owned Here How To File Your Income

Rent Decreases During Rent Roll Settlement Rent Roll Angels

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Form For Renters Rebate RentersRebate

Rental Income Tax Benefits Available For Landlords Chandan Agarwal

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax

Property Tax Or Rent Rebate Claim PA 1000 FormsPublications Fill Out

Income Tax Rebate Under Section 87A

Printable Rebate Form For Old Style Beer Printable Forms Free Online

30 Rebate On Rental Income - The tax relief that landlords of residential properties get for finance costs is being restricted to the basic rate of Income Tax This is being phased in from 6 April