529 Plan Georgia Tax Deductible Web Contributions up to 4 000 per year per beneficiary are eligible for a Georgia state income tax deduction for those filing a single return and 8 000 per year per beneficiary for

Web In fact the Georgia state tax benefits for 529 plans just got better The state tax deduction has been increased from 2 000 to 4 000 per year per beneficiary for single taxpayers Web Georgia taxpayers may be eligible for a Georgia income tax deduction on contributions made to a Path2College 529 Plan up to 8 000 per year per beneficiary for joint filers or

529 Plan Georgia Tax Deductible

529 Plan Georgia Tax Deductible

https://www.goodearthplants.com/wp-content/uploads/2019/04/money-tree-geralt-Pixabay-2380158_1920-1.jpg

Do 529 Plans Outperform Savings Accounts

https://wiserinvestor.com/wp-content/uploads/2022/11/Copy-of-Website-Image-Blog-8.jpg

Are 529 Plans Tax Deductible In New Jersey Simon Quick Advisors

https://static.twentyoverten.com/5dd43b58fe95cc60688ef1e8/ZSL2kRyDUT/Financial-Planning-1.jpg

Web 20 M 228 rz 2023 nbsp 0183 32 For contributions made to a Path2College 529 Plan account by April 18 2023 Georgia taxpayers may be eligible for a state income tax deduction up to 8 000 Web Path2College 529 Plan offers compelling income tax benefits Georgia taxpayers filing jointly can deduct up to 8 000 per year per beneficiary in the Path2College 529 Plan

Web 9 Dez 2021 nbsp 0183 32 Your investments in a Path2College account grows free of both federal and Georgia state income taxes The state also offers a sizable tax deduction for residents Web Contributions made to the Path2College 529 Plan by April 15 are eligible for a Georgia income tax deduction for the previous year Limitations apply See disclosure booklet

Download 529 Plan Georgia Tax Deductible

More picture related to 529 Plan Georgia Tax Deductible

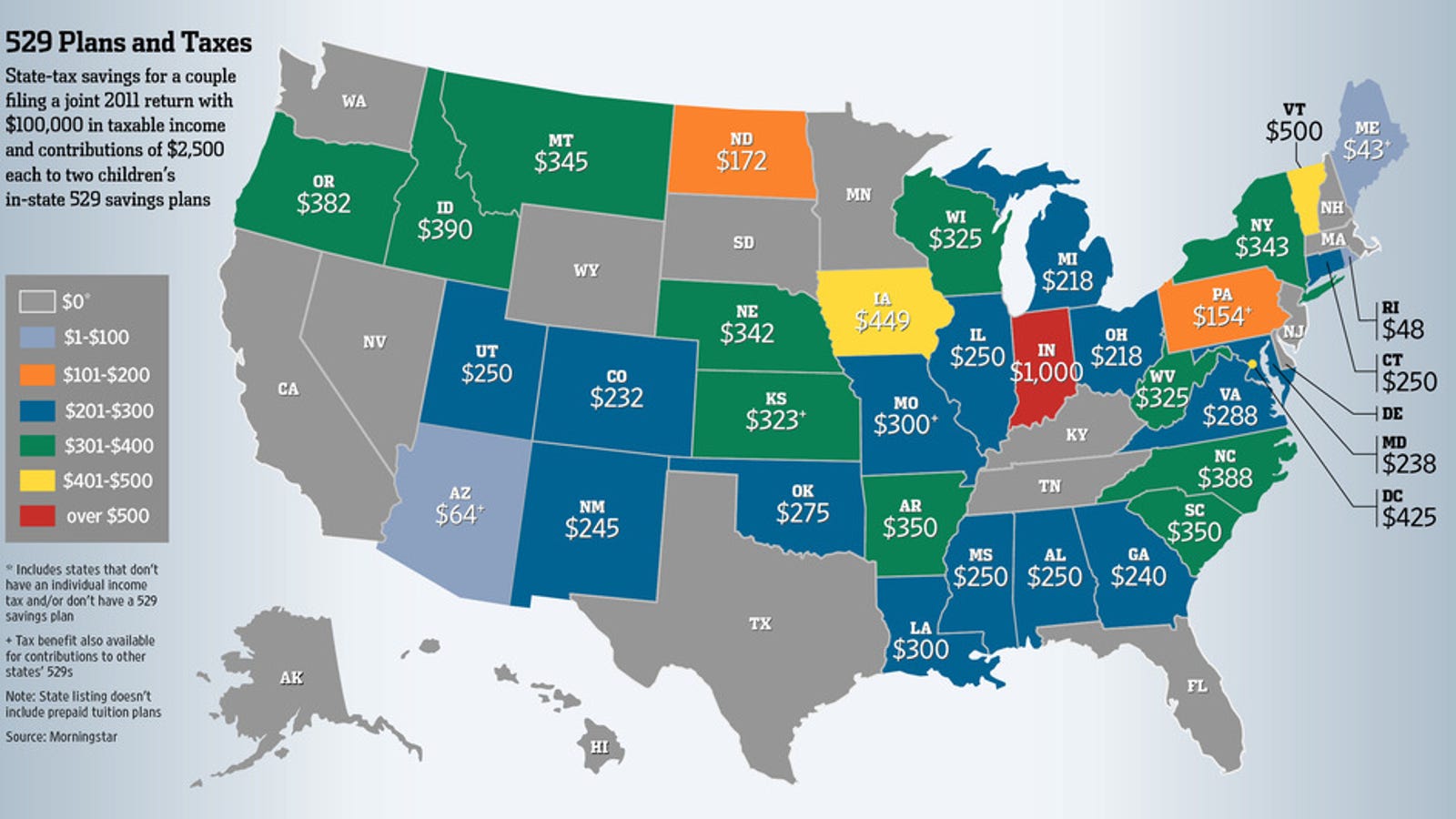

The Tax Benefits Of College 529 Savings Plans Compared By State

https://i.kinja-img.com/gawker-media/image/upload/s--1ZmmFPnG--/c_fill,fl_progressive,g_center,h_900,q_80,w_1600/1005722794300725574.jpg

529 College Savings Plan

http://babydickey.com/wp-content/uploads/2011/03/Untitled1-1024x296.jpg

Is The NC 529 Plan Tax Deductible CFNC

https://www.cfnc.org/media/sjshnqm0/fafsa-tax-forms.jpg

Web The Department of Revenue does not administer Georgia s Section 529 Plan Information about the Plan can be obtained at www path2college529 or by calling 877 424 Web Tax Benefits of Georgia s 529 Plan Starting with tax year 2020 married Georgia taxpayers who file jointly and invest in the Path2College 529 Plan can deduct up to 8 000 from their state taxable income per account

Web 4 Juni 2020 nbsp 0183 32 Tax deductions reduce a filer s overall tax liability to reward them for responsible financial choices Two examples of deductions are income reductions for families with dependents and those paying Web 7 Feb 2023 nbsp 0183 32 529 contributions are tax deductible on the state level in some states They are not tax deductible on the federal level But if you re saving for college you ll want to

Copy Of GA 529 Plan Blog Wiser Wealth Management

https://wiserinvestor.com/wp-content/uploads/2021/04/Copy-of-GA-529-Plan-Blog.png

Your Separation Agreement Impacts Whether Spousal Support Payments Are

https://sharifflaw.com/wp-content/uploads/2023/11/post-1.jpeg

https://ost.georgia.gov/georgias-529-college-savings

Web Contributions up to 4 000 per year per beneficiary are eligible for a Georgia state income tax deduction for those filing a single return and 8 000 per year per beneficiary for

https://www.frazierdeeter.com/insights/georgia-doubles-deduction-for-

Web In fact the Georgia state tax benefits for 529 plans just got better The state tax deduction has been increased from 2 000 to 4 000 per year per beneficiary for single taxpayers

Saving For College 529 Plan How To Plan

Copy Of GA 529 Plan Blog Wiser Wealth Management

Dortha Grimes

Is Oregon 529 College Savings Plan Tax Deductible EverythingCollege info

If 529 Plans Get Taxed Here s Another Tax free Option

529 Plan Tax Deductible College Savings Plans

529 Plan Tax Deductible College Savings Plans

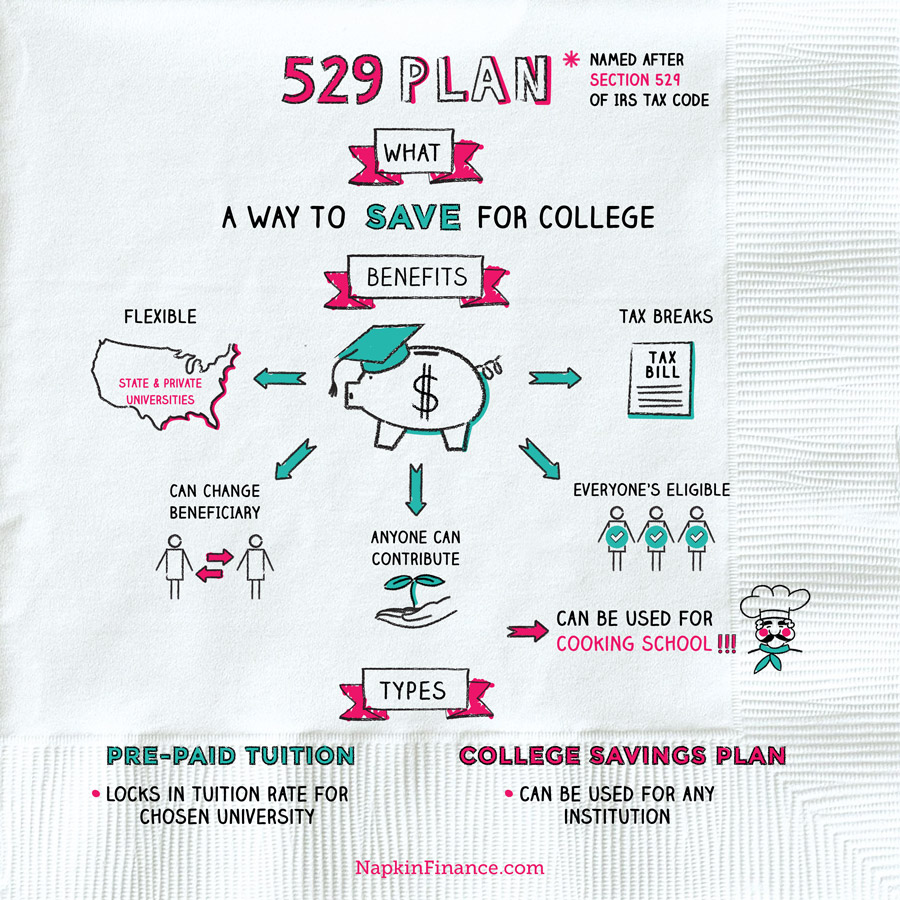

529 Plan Napkin Finance

Reliable Tax Richmond VA

The Complete Guide To Virginia 529 Plans For 2024

529 Plan Georgia Tax Deductible - Web 9 Dez 2021 nbsp 0183 32 Your investments in a Path2College account grows free of both federal and Georgia state income taxes The state also offers a sizable tax deduction for residents