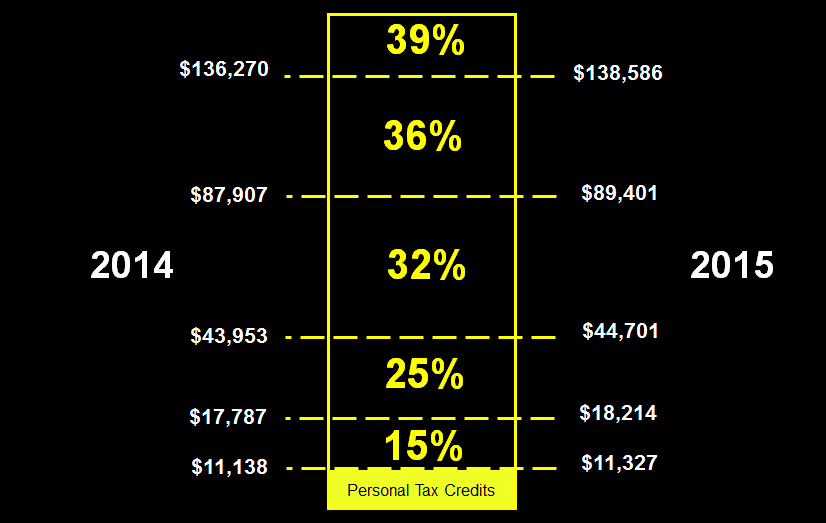

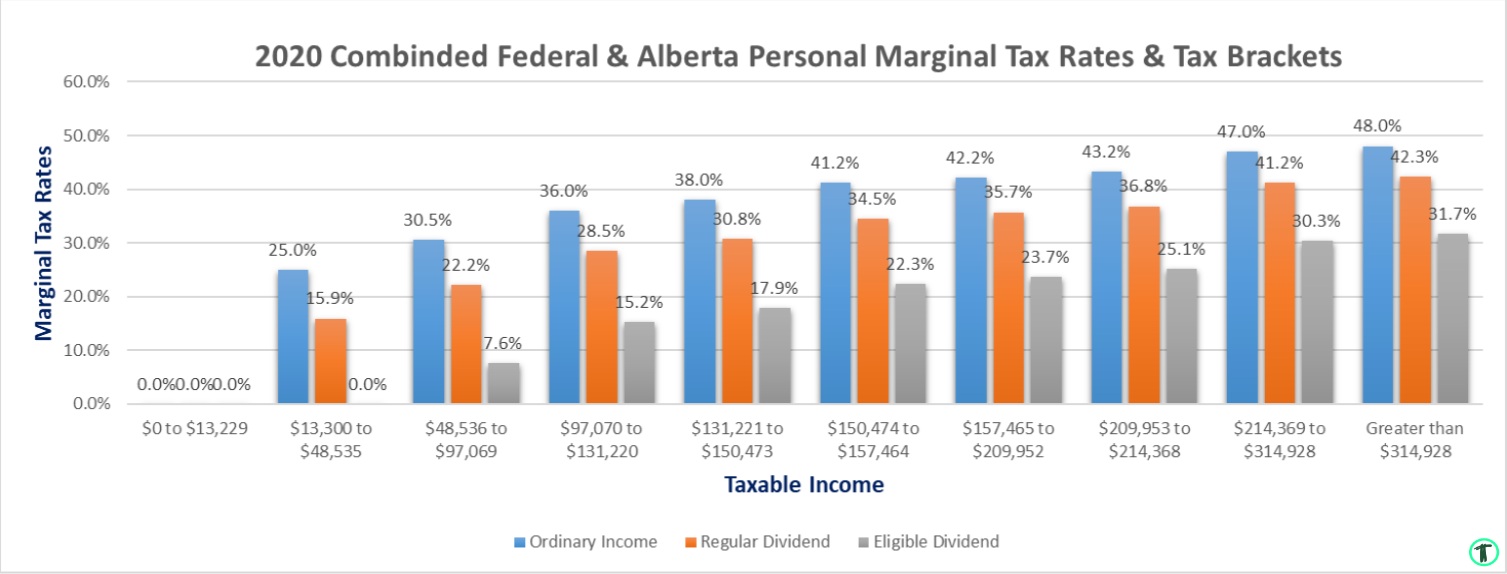

Alberta Income Tax Rate 14 rowsFind the current and future marginal tax rates and tax brackets for Alberta

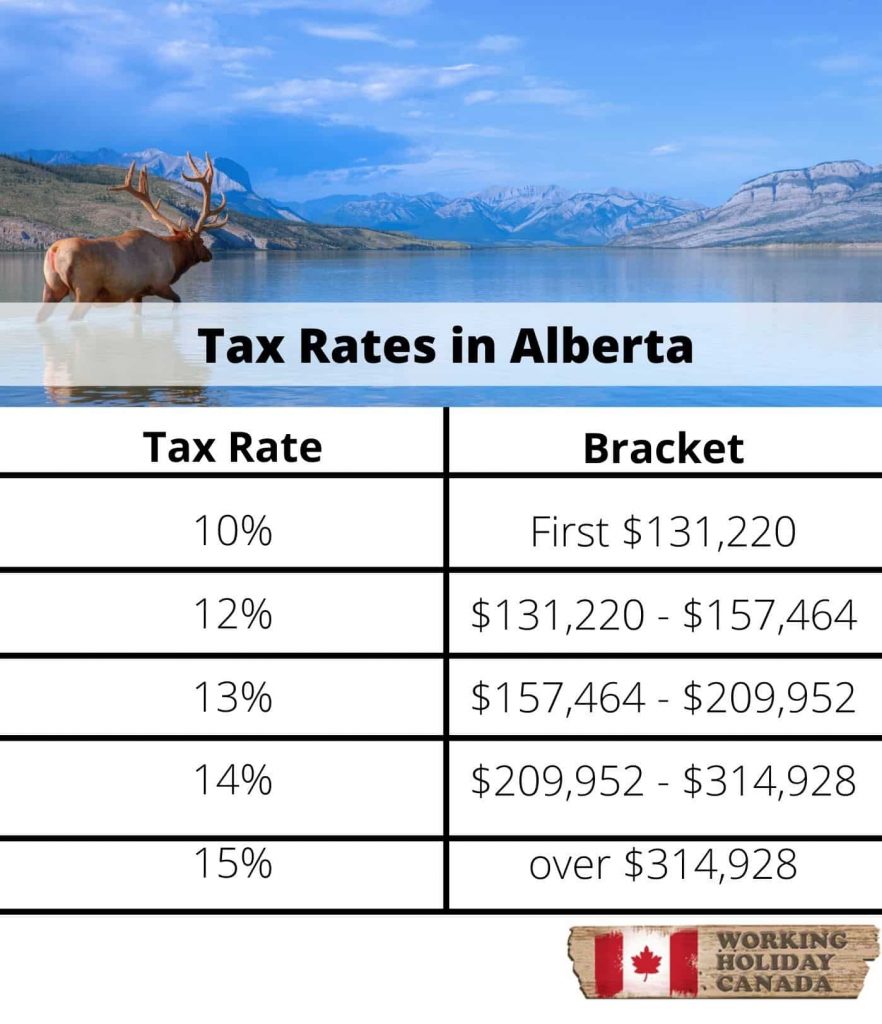

The tax rates in Alberta range from 10 to 15 of income and the combined federal and provincial tax rate is between 25 and 48 Alberta s marginal tax rate increases as To calculate your Alberta net income use the Alberta income tax calculator which are typically easy tools to use You ll be asked to enter your gross salary and your net

Alberta Income Tax Rate

Alberta Income Tax Rate

https://www.savvynewcanadians.com/wp-content/uploads/2020/09/alberta-and-federal-marginal-tax-brackets-and-rates-1536x722.jpg

New Income Tax Rates In Alberta

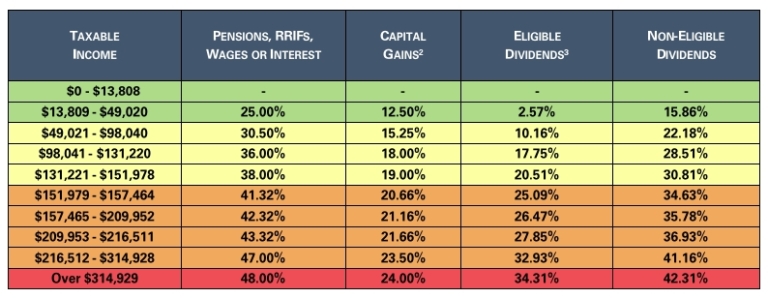

http://retirehappy.ca/wp-content/uploads/AB_Marginal_Tax_2014-2015.png

Alberta Income Tax Rates For 2021 Alitis Investment Counsel

https://www.alitis.ca/wp-content/uploads/2019/01/2021-Alberta-Tax-Rates-768x298.jpg

Federal Personal Income Tax Rates Brackets 2022 Review Alberta s 2022 federal and provincial personal income tax rates and determine your tax bracket and marginal tax rate The federal basic personal amount comprises two elements the base amount 13 521 for 2023 and an additional amount 1 479 for 2023 The additional

The Federal tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 1 024 a 2 4 increase On August 31 2022 Premier Jason Kenney announced that indexation of the personal Taxable income Alberta Marginal rate on 1 The tax rates reflect budget proposals and news releases to January 15 2022 Where the tax is determined under

Download Alberta Income Tax Rate

More picture related to Alberta Income Tax Rate

The Most Updated Alberta Income Tax Calculator From Wefin

https://wefin.ca/wp-content/uploads/2023/01/alberta-income-tax-calculator-1-1024x1536.jpg

What Are The Income Tax Brackets In Alberta TAXW

https://www.investopedia.com/thmb/ipeomve2vOe_OFD-h9yg3SJFU8g=/582x327/smart/filters:no_upscale()/42_am-5bfd7c9846e0fb0051b8eed8

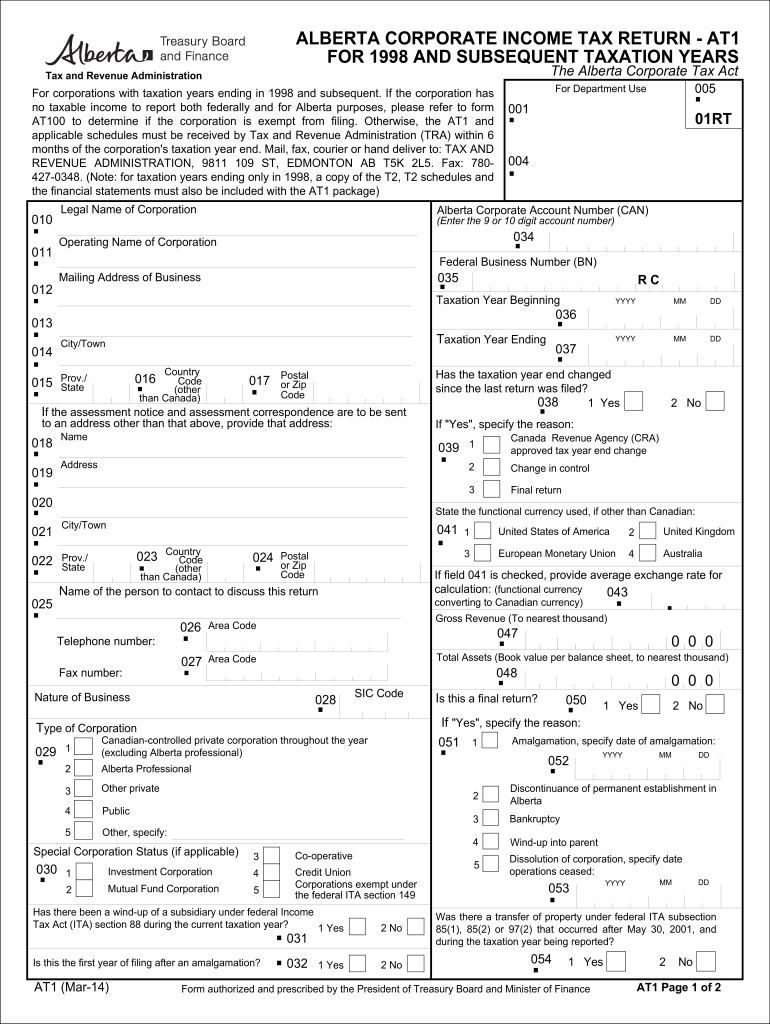

Alberta Corporate Income Tax Return At1 Fill Out And Sign Printable

https://www.signnow.com/preview/6/962/6962761/large.png

The tax rates in Alberta range from 10 to 15 of income and the combined federal and provincial tax rate is between 25 and 48 Key Takeaways New for 2023 The personal income levels used to calculate your Alberta tax have changed The amounts for most provincial non refundable tax credits have changed

Alberta Income Tax Calculator 2022 2023 This Page Was Last Updated April 14 2023 WOWA Trusted and Transparent Estimate your 2022 2023 total income taxes with The Income tax rates and personal allowances in Alberta are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below

Jason Kenney Says UCP Would Cut Alberta s Corporate Tax Rate To 8 The

https://i.cbc.ca/1.5042107.1551724633!/fileImage/httpImage/image.jpg_gen/derivatives/original_780/alberta-corporate-tax-rate-history.jpg

The Basics Of Tax In Canada Workingholidayincanada

https://workingholidayincanada.com/wp-content/uploads/2020/02/Alberta-min-882x1024.jpg

https://www. taxtips.ca /taxrates/ab.htm

14 rowsFind the current and future marginal tax rates and tax brackets for Alberta

https:// turbotax.intuit.ca /tax-resources/alberta-income-tax-calculator.jsp

The tax rates in Alberta range from 10 to 15 of income and the combined federal and provincial tax rate is between 25 and 48 Alberta s marginal tax rate increases as

Marginal Tax Rates For Each Canadian Province Kalfa Law Firm

Jason Kenney Says UCP Would Cut Alberta s Corporate Tax Rate To 8 The

The Basics Of Tax In Canada WorkingHolidayinCanada

2020 Combined Federal Alberta Tax Rates For Personal And Corporate

Canadian Provincial Taxes Canada Province Tax Rates GST PST HST

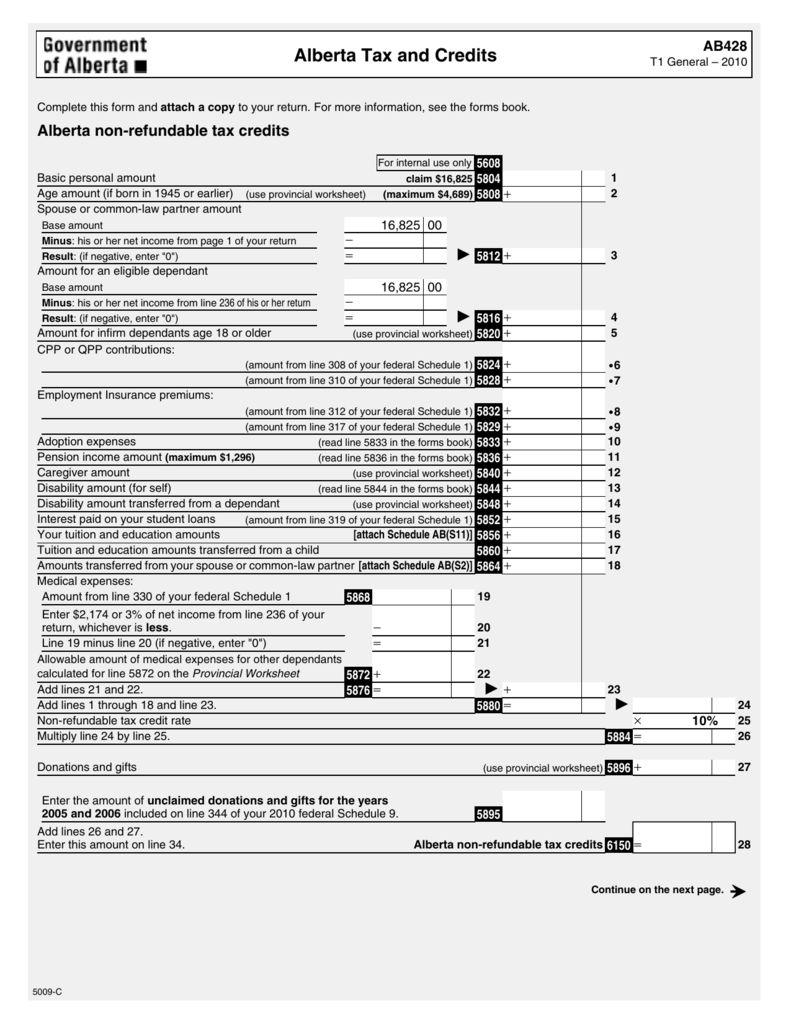

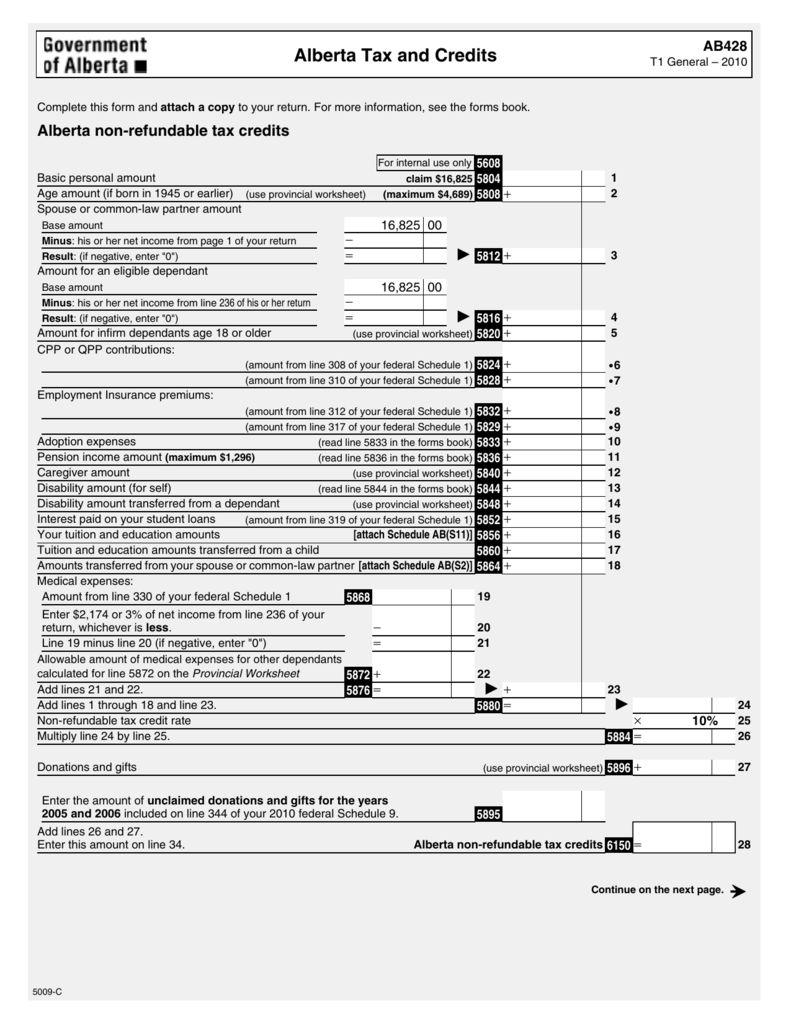

Alberta Tax And Credits

Alberta Tax And Credits

A Modest Proposal Alberta Needs Income And Corporate Tax Reform

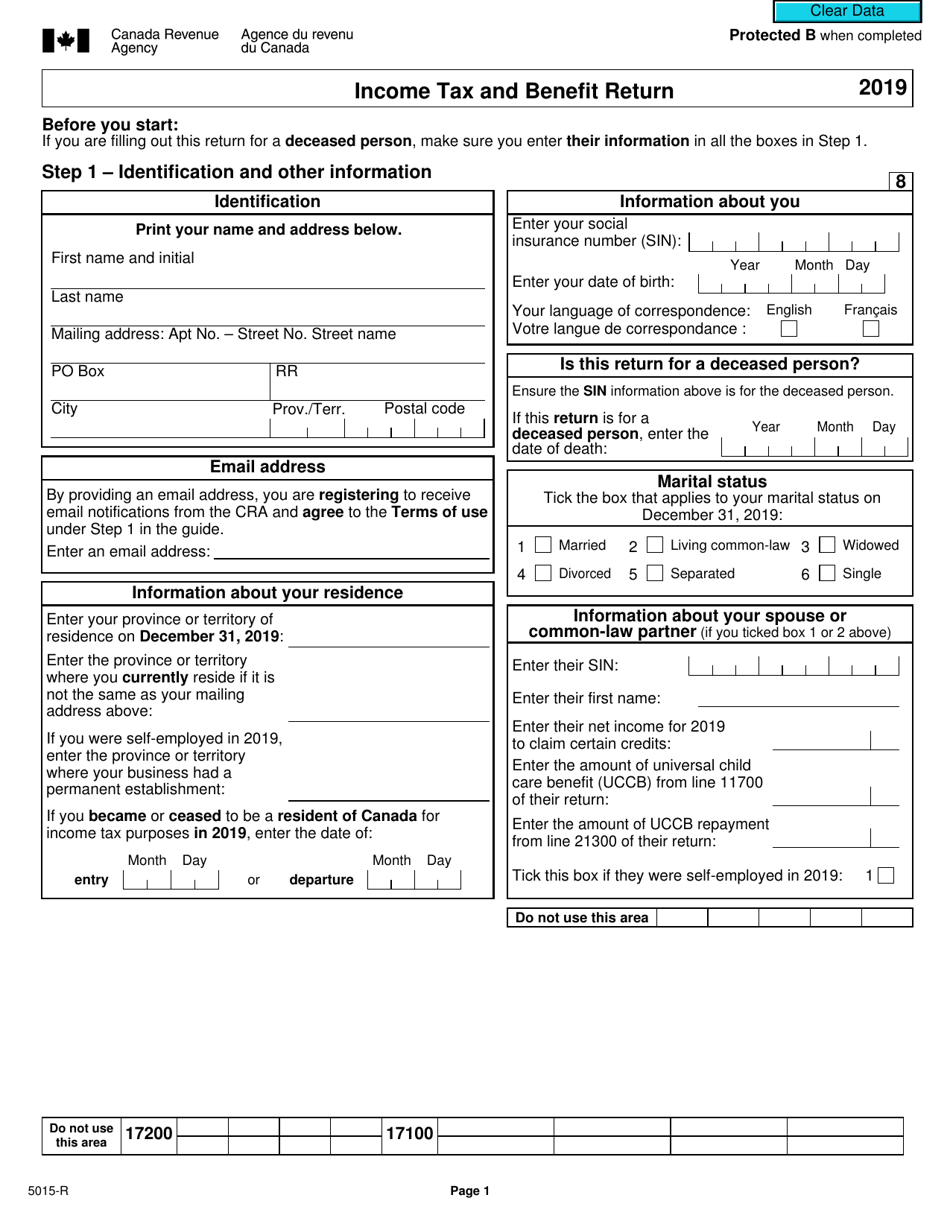

Form 5015 R Download Fillable PDF Or Fill Online Income Tax And Benefit

Alberta Affordability Payment Taxable

Alberta Income Tax Rate - Taxable income Alberta Marginal rate on 1 The tax rates reflect budget proposals and news releases to January 15 2022 Where the tax is determined under