California State Tax Credits For Energy Efficiency In 2022 the Inflation Reduction Act revitalized two aging tax credits the solar tax credit and the energy efficiency home improvement tax credit and turned them into the most prominent federal incentives for 2024

The California Energy Commission announced that the first of two Inflation Reduction Act IRA funded programs is accepting applications Rebates for energy efficiency Tax Provision Description Provides a tax credit for energy efficiency improvements of residential homes Period of Availability 2022 2032 Tax Mechanism Consumer tax credit

California State Tax Credits For Energy Efficiency

California State Tax Credits For Energy Efficiency

https://info.siteselectiongroup.com/hubfs/Images/Blog-Resize/Capital-01.jpeg#keepProtocol

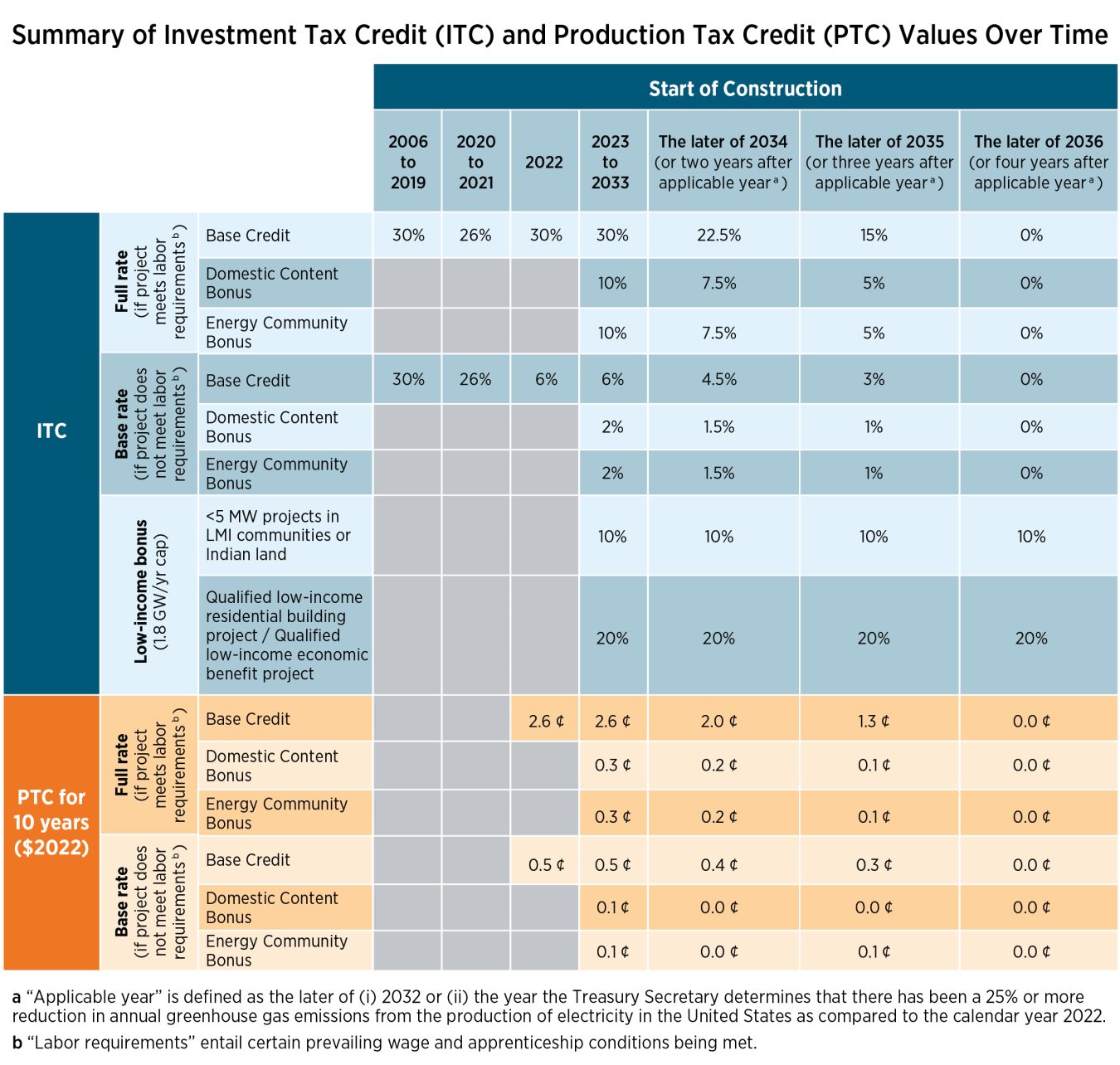

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

You can get a loan with zero fees or closing costs to pay for energy efficient improvements in your home Loans are available to both renters and homeowners A broad range of credit scores and home types are eligible for Tax credits for residential energy efficiency and clean energy projects were extended and expanded through the IRA The U S Department of Energy has a publication on Federal

To ensure you qualify for a Home Energy Rebate wait until your state launches its program before starting your project Other federal options for assistance include tax credits and the Inflation Reduction Act IRA Tax Credits The Inflation Reduction Act IRA is the most significant investment in climate and clean energy in U S history More than half of the new

Download California State Tax Credits For Energy Efficiency

More picture related to California State Tax Credits For Energy Efficiency

Get The Power Of Tax Credits For Your Businesses

https://imageio.forbes.com/specials-images/imageserve/6382a9dd088a90f846f35930/0x0.jpg?format=jpg&crop=3207,3207,x0,y0,safe&width=1200

Equipment Tax Credits For Primary Residences About ENERGY STAR

https://www.energystar.gov/sites/default/files/TaxCredit_Residential.png

Tax Credits For Energy Efficient Home Improvements Kiplinger

https://cdn.mos.cms.futurecdn.net/jL8hKibD7YHkjQxA6muNGM-1920-80.jpg

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through Consumers can find financial incentives and assistance for energy efficient and renewable energy products and improvements in the form of rebates tax credits or financing programs Visit the following sections to search for incentives in

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent The Energy Savings Assistance ESA program is designed to help you conserve energy and save money Income qualified customers including renters may be eligible to receive energy

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Colorado Tax Credits For Alternative fuel Vehicles Head To Senate

http://media.bizj.us/view/img/209831/bloombergphotochevroletvolt*1200.jpg

https://www.cleanenergyconnection.org/…

In 2022 the Inflation Reduction Act revitalized two aging tax credits the solar tax credit and the energy efficiency home improvement tax credit and turned them into the most prominent federal incentives for 2024

https://www.energy.ca.gov/news/2024-10/new...

The California Energy Commission announced that the first of two Inflation Reduction Act IRA funded programs is accepting applications Rebates for energy efficiency

Tax Credits For Giving Ozarks Food Harvest

Federal Solar Tax Credit What It Is How To Claim It For 2024

Extended Tax Credits For Energy Efficient Windows Efficient Windows

Tax Credits For Paid Sick And Paid Family And Medical Leave Questions

State Tax Credits And Incentives Updates To Know Scott M Aber CPA PC

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg)

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg)

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

When Are Tax Credits Ending How To Apply For Universal Credit

PDF States Tax Credits For Company Financed Research

Tax Credits Save You More Than Deductions Here Are The Best Ones

California State Tax Credits For Energy Efficiency - You can claim either the Energy Efficient Home Improvement Credit or the Residential Clean Energy Credit for the year when you make qualifying improvements Homeowners who