Car Loan Tax Deduction In reality car loan payments and lease payments are usually not fully tax deductible This article will explain exactly why using three different scenarios We ll explore how much of your monthly car payment you can write off with a financed personal vehicle a financed company car and a leased vehicle Contents

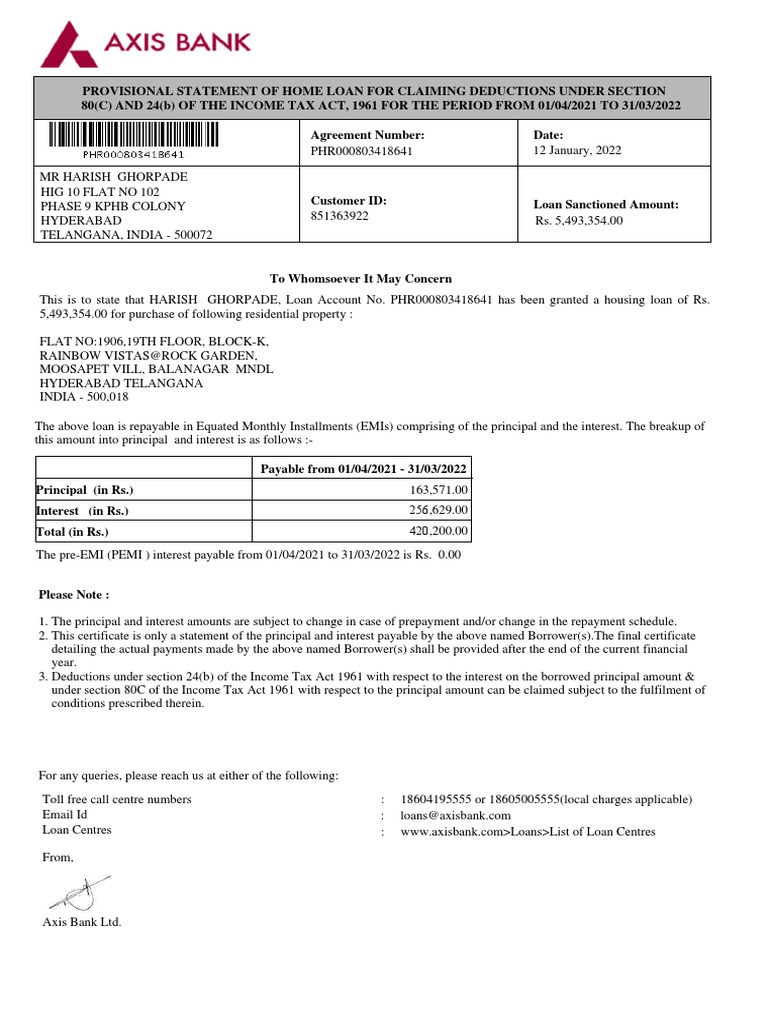

The loan amount will be deducted from your tax refund reducing the refund amount paid directly to you Tax returns may be e filed without applying for this loan Fees for other optional products or product features may apply Interest paid on a loan to purchase a car for personal use Credit card and installment interest incurred for personal expenses Points if you re a seller service charges credit investigation fees and interest relating to tax exempt income such as interest to purchase or carry tax exempt securities Mortgage interest deduction

Car Loan Tax Deduction

Car Loan Tax Deduction

https://life.futuregenerali.in/media/vyedfzjg/home-vs-tax.jpg

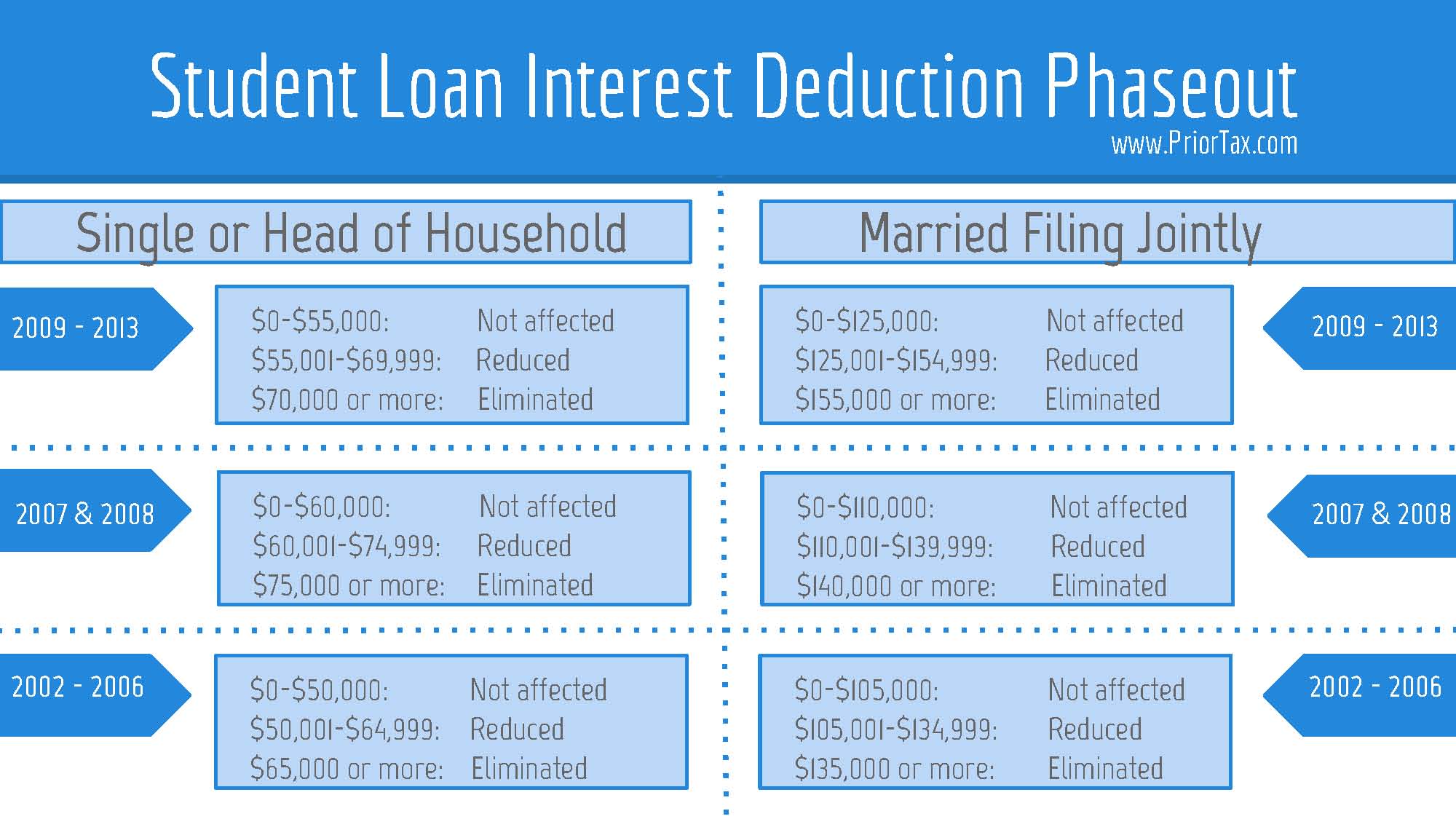

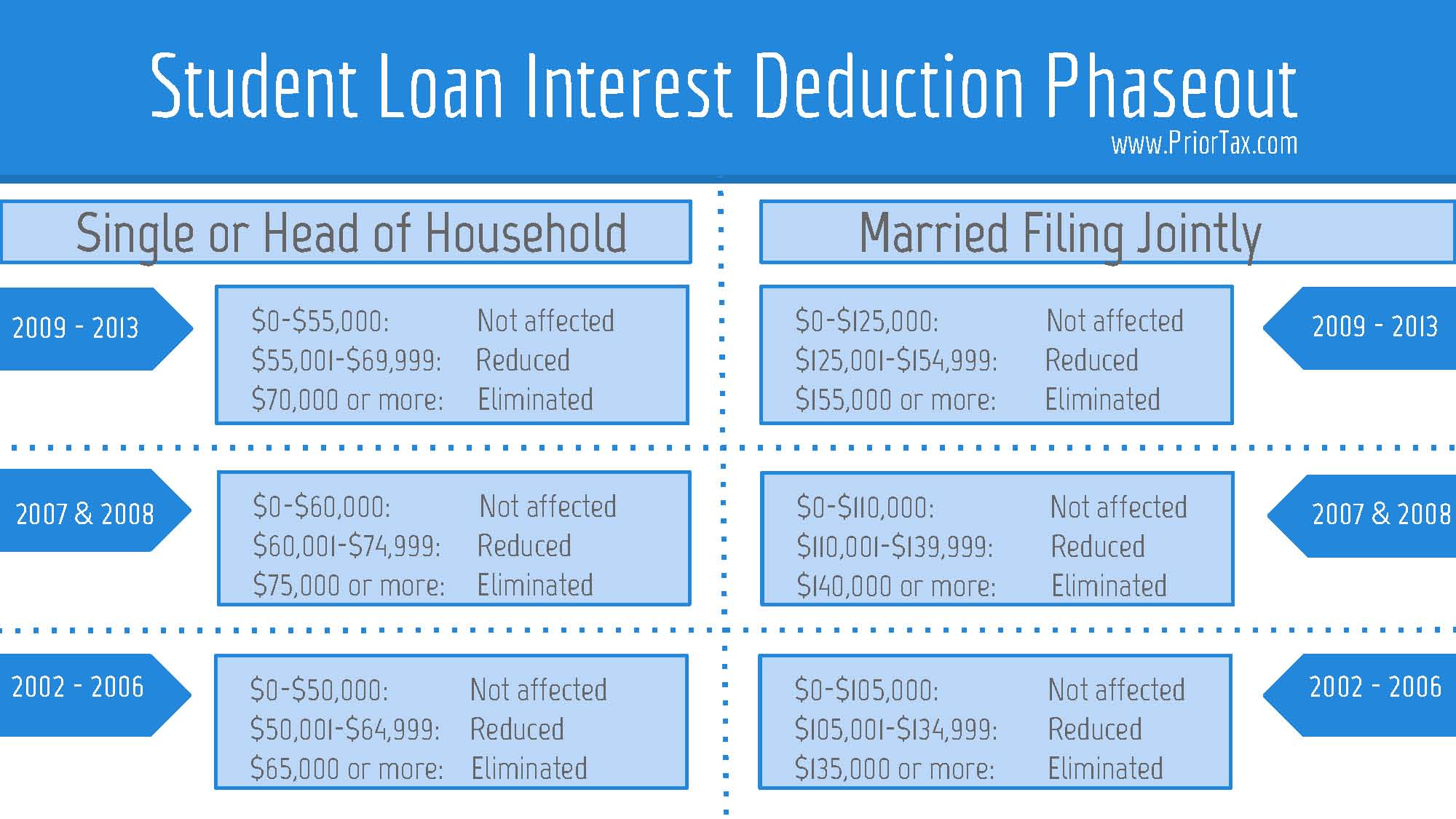

Is Student Loan Interest Tax Deductible RapidTax

http://blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-20131.jpg

Is Your Business Loan Tax Deductible

https://img.caminofinancial.com/wp-content/uploads/2019/12/07172627/Tax-deduction-1024x683.jpg

If your taxable income from the business is 30 lakhs for the year then 8 8 lakhs which is 12 of 10 lakhs can be deducted from your annual income while paying tax Hence for that year you will only have to pay tax for 21 2 lakhs What is Section 80EEB Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to purchase an electric car However certain restrictions and conditions concerning the loan issuer and the electric vehicle must be followed in order to claim the 80EEB deduction

You can deduct the interest paid on an auto loan as a business expense using one of two methods the expense method or the standard mileage deduction when you file your taxes But writing off car loan interest as a business expense isn t as easy as just deciding you want to start itemizing your tax return when you file Last updated 1 August 2023 Print or Download On this page Types of vehicles Expenses you can claim Separate private from business use Car limit Watch For a summary of this content in poster format see Motor vehicle expenses PDF 761KB Types of vehicles

Download Car Loan Tax Deduction

More picture related to Car Loan Tax Deduction

How To Know If You Qualify For A Student Loan Tax Deduction

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2021/03/0/0/Credible-tax-deductions-iStock-thumbnail-172162220.jpg?ve=1&tl=1

Tax Offset V Tax Deduction What s The Difference Sherlock Wealth

https://sherlockwealth.com/wp-content/uploads/2022/05/Tax-offset-v-tax-deduction-.jpg

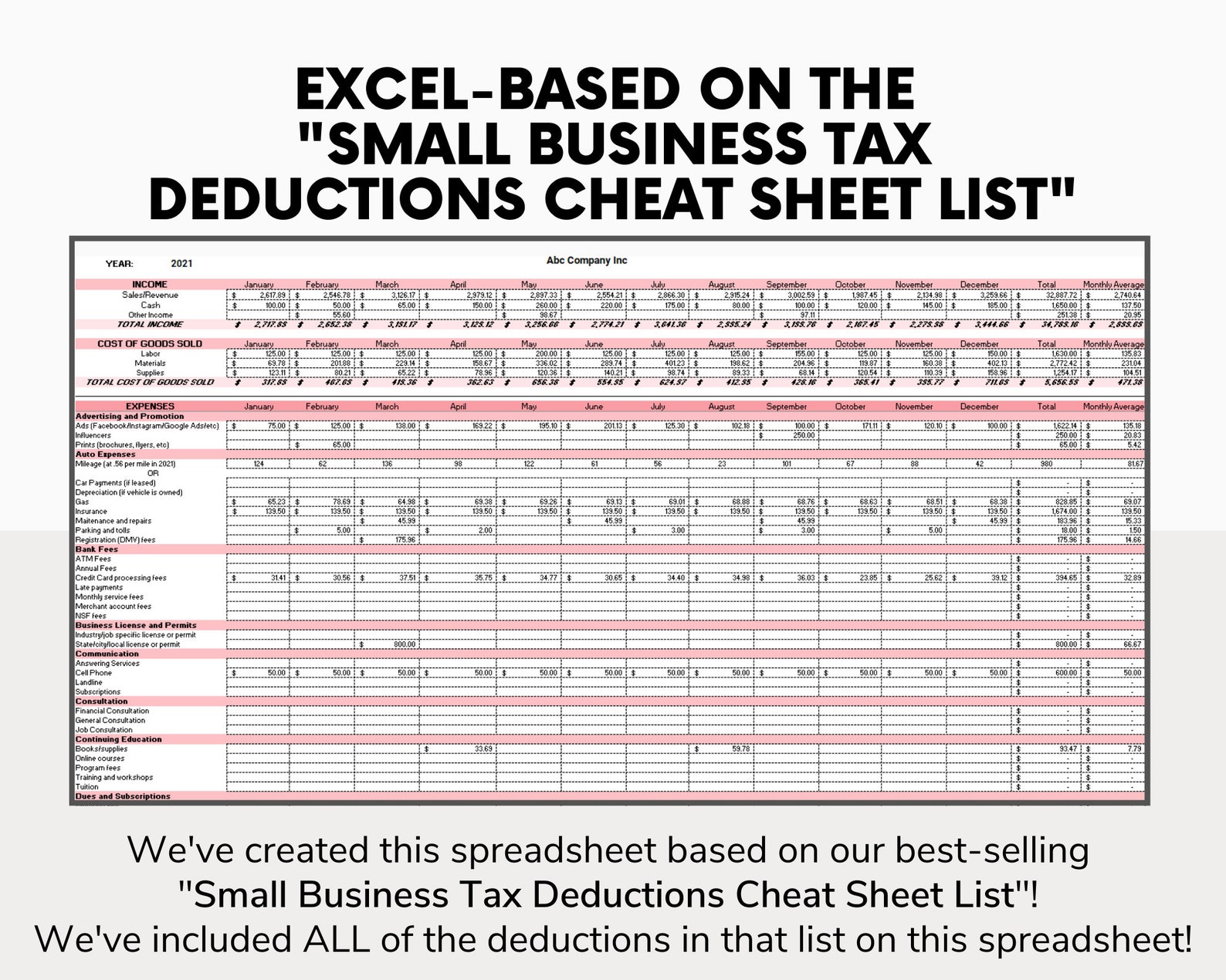

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1588xN.5462529921_cvyy.jpg

Key Takeaways Interest paid on personal loans car loans and credit cards is generally not tax deductible However you may be able to claim interest you ve paid when you file your Key Takeaways A deduction is an expense that can be subtracted from taxable income to reduce the amount owed Most taxpayers who take the standard deduction only need to file Form 1040

[desc-10] [desc-11]

Tax Deduction On Payment To Release Bumi Lot Sep 01 2022 Johor

https://cdn1.npcdn.net/image/16620138369d75eb5efaa5abfbaf75663b336ff632.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

HOME LOAN INTEREST CERTIFICATE For FY 2021 22 PDF Loans Interest

https://imgv2-2-f.scribdassets.com/img/document/553973286/original/542bfb7a7c/1661356692?v=1

https://www.keepertax.com/posts/can-i-write-off-my-car-payment

In reality car loan payments and lease payments are usually not fully tax deductible This article will explain exactly why using three different scenarios We ll explore how much of your monthly car payment you can write off with a financed personal vehicle a financed company car and a leased vehicle Contents

https://www.hrblock.com/.../deducting-car-loan-interest

The loan amount will be deducted from your tax refund reducing the refund amount paid directly to you Tax returns may be e filed without applying for this loan Fees for other optional products or product features may apply

Bill C19 Is The Largest Ever Tax Deduction Oaken Equipment

Tax Deduction On Payment To Release Bumi Lot Sep 01 2022 Johor

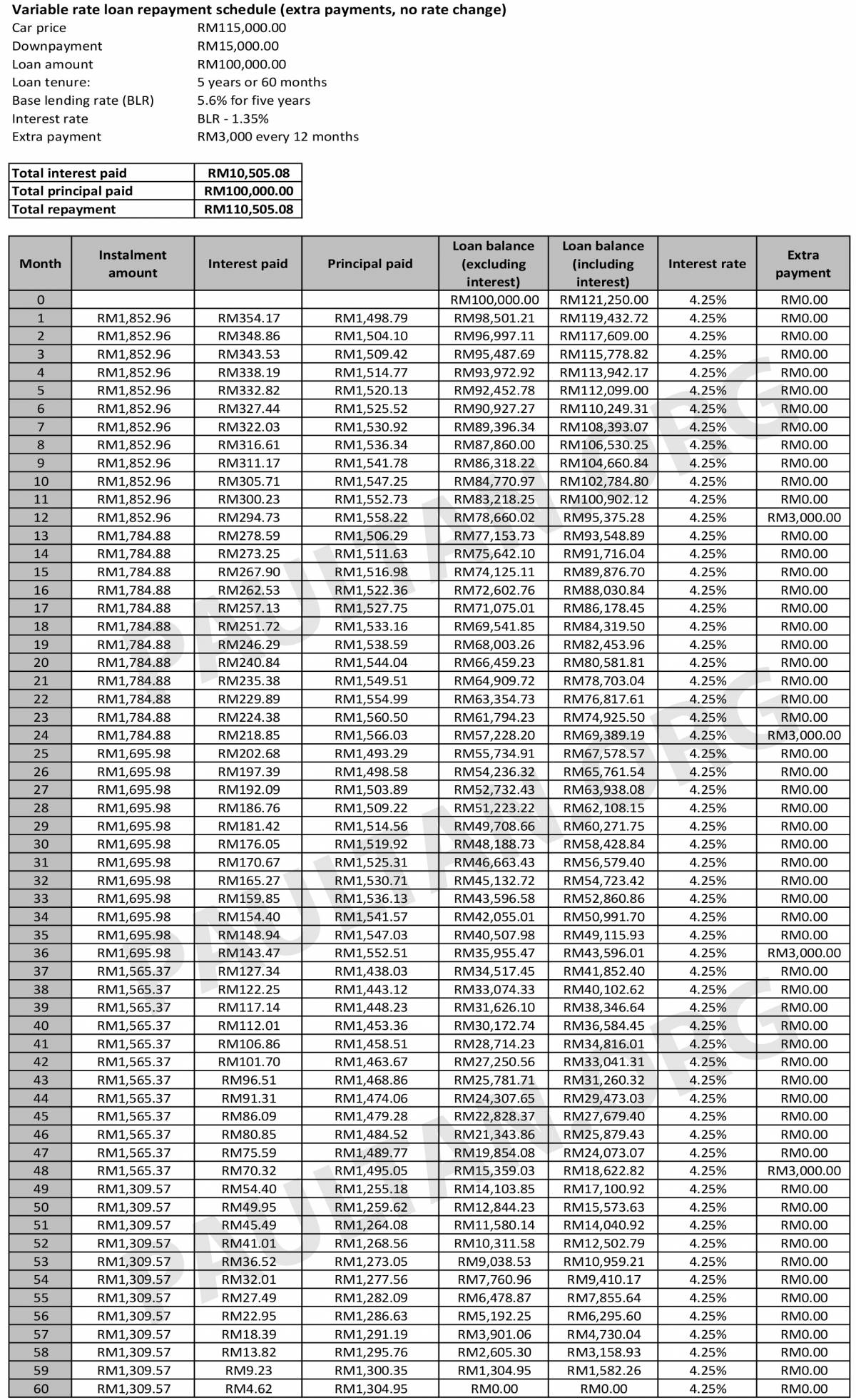

Car Loan V1 100k Example xlsx Paul Tan s Automotive News

Mortgage Interest Tax Deduction 2020 Calculator GrantNivirah

Home Loan Tax Deduction Home Sweet Home Modern Livingroom

Printable Auto Loan Application Printable Application

Printable Auto Loan Application Printable Application

What Will My Tax Deduction Savings Look Like The Motley Fool

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Tax Deductions On Home Loan ComparePolicy

Car Loan Tax Deduction - If your taxable income from the business is 30 lakhs for the year then 8 8 lakhs which is 12 of 10 lakhs can be deducted from your annual income while paying tax Hence for that year you will only have to pay tax for 21 2 lakhs